Portfolio Update

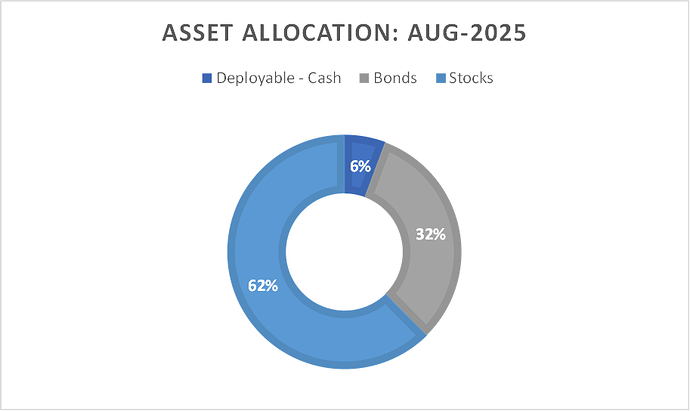

Asset allocation

For the first time in last 2-years equity allocation crossed 60%, a jump from 49% in May -2024. Rise in equity allocation is reflection of portfolio performance in last 15 months and deployment of cash/REIT money to equity in dips.

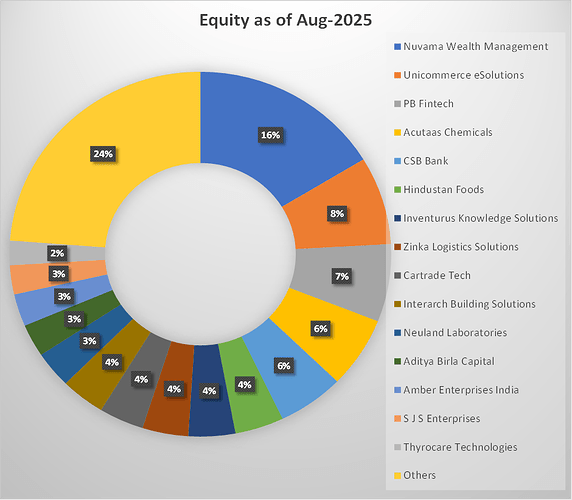

Equity Portfolio:

2025, has been a totally unstable year, instability started from 2nd half of 2024. Mindset is different, I feel I am away from my investment philosophy.

What I like, - I like to concentrate in few positions (12-15) along with some upcoming/R&D bets (6-8).

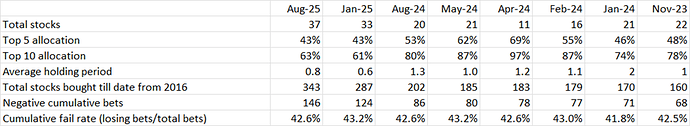

What I am doing: Given the market texture/height I have now few “scared bets” (low growth reasonable valuations – CSB Bank, Kalamandir, South Indian Bank, Tamiland Mercantile Bank), few “fomo bets” (CDMO bucket – Neuland, Cohance, Piramal, BlueJet, OneSource) and few “need to be there bets” (AMCs, exchanges). Overall result is 37 positions, I think highest in the last 5-years.

For 8 years (2016 to Mid of 2024) my cumulative buys were 185 stocks, however, in last 15 months (June-2024 to Aug-2025), I have bought 168 stocks. Insane activity.

Material new entries (>3%) since my last update are: Unicommerce, CSB Bank, and Inventurus Knowledge.

Unicommerce – a Saas company, a proxy to India’s e-commerce and quick commerce as it provides warehouse management services to these companies. Unicommerce also acquired shipway which is into courier/delivery services.

Unicommerce has not grown at all for last few quarters. So my thesis has not played out so far. However, valuations are reasonable at 40PE on FY26 cash earnings. Growth is most important ingredient; I shall wait for next couple of quarters to see if revenue growth at least comes to double digits and hope margin continues to improve.

CSB Bank: Good base loan book with 45% gold loan and most of other loan book is also secured. It has been growing its loan book at 20%+ while maintaining reasonable NPA <2%. Loan book growth from FY27 is likely to pick up to 30% as its IT system implementation allows it to scale retail book and deposits too. At 1.5x P/B with 20% capital ratio, seems reasonable bet.

Inventurus Knowledge: A healthcare tech company with 30% margins, growing at 16-18%. Its platform has widest feature of doing 16 chores which a physician/clinic needs to do. Revenue growth may accelerate to 20% from FY27 owing to ramp up of new clients, pruning of existing clients completes in two quarters. High return metrics (30%+ ROE). Company’s services are highly integrated to its customers, which results in high stickiness, cross selling opportunities. Company earns based on outcome of its customers. IKS improves customer’s profitability by 8-9% post the payment to IKS (almost equal to their ebitda margins pre-IKS). This results in win-win for both client and the company,

Disclaimer: I am not a financial advisor and nor a SEBI registered Analyst. The content shared here is only for learning purpose. All the names mentioned here are for example purpose. I may buy more, exit or partly sell the stock/bonds without any prior intimation . I work for an investment advisory firm. My portfolio is not a recommendation for anyone. Some of these stocks might be in clients portfolio as well so please be aware of vested interest.