Hi @mayank_raghuwanshi Strides has guided for 20-22% margins. While OneSource will be demerged and get listed, we shall get about 1/3 value in that form. So excluding OneSource, Stride’s market cap will be ~8k crore. I expect Strides excluding OneSource to report 400 crores of profits. Hence, Strides is available at 20PE FY25 post demerger (whenever that happens).

After I bought stock has already runup 15-18% in a very short time. My conviction on Pharma and Chemicals is not that strong so I may not rampup or exit anytime.

Sir do you think mapmyindia is going to face any problems in it’s existing or potential business opportunities because of the alleged stealing of its map solutions by ola?

@HarshVijay competition is always a concern. I feel Ola or any other map company can be a competition if they can create large user base. A large user base shall help improving map, keep real time updates etc.

As of now, MMI seems to have edge owing to its inroads to OEMs. Ola being an OEM itself may not be able to garner auto OEMs as it always creates doubts for another auto OEM.

Ola has mass scaled only two wheelers. So two wheeler may be the area where MMI faces a threat. However, as per my understanding this might be small business for them.

Nevertheless, Ola can be a bigger threat in consumer and enterprise if they have good products. Their two wheeler fleet can result in good data and its likely they garner some delivery related areas (amazon, zomato etc.).

Definitely an area to keep an eye. MMI is there for decades now so it may not be cake walk for Ola either.

Risks are to be managed with allocation and opportune profit takings.

Sir can you please share your latest portfolio… Its always interesting to read about your stocks…

Sir can you please share your latest portfolio… Its always interesting to read about your stocks…

Yes sir, Please do share your portfolio and your buying price. It would be very interesting to read

Can you mention the company

Sir waiting to see your current portfolio and assist allocation.

I wish everyone a very happy new year. Thanks a lot for showing interest in my portfolio.

Its been difficult to provide updates when mind (read: investing philosophy) is not stable. I was afraid of heights particularly in light of valuations of some of my holdings (PB Fintech is over 70x FY27 earnings), and earnings (or guidance) disappointments (Mapmyindia, Rategain, Restaurants brands, Star Health etc.).

The fear of losing money and lack of opportunities based on my traditional methods led me to try something else. I was trying to keep my loses limited. So best form of investing during heights (and to keep loses limited) is trading (please note that I am not trying to define trading). Trading with stop losses. However, I did not know how to do it. I went through few training/discussion videos (publicly available) from the chartist @_chartitude (on twitter). It was more of availability bias as he is common to few fundamental investors/channels (SOIC, Ishmohit) I follow. I heard/saw his couple of youtube videos and liked his approach. Why I liked – in trading sizing and stop loss is difficult to determine. He gives a wonderful formula of stop loss interlinked with sizing (position) in a way to keep overall loss limited to 1% of portfolio per position. I liked, I tried and I was successful to a certain extent with almost double digit returns in 2-3 months (Sep to Nov). However, I did not pursue this approach further as I did not want to mess with my traditional approach which has been successful for past several years.

(Note: Apologies in advance to chartist@chartitude in case in any way I unknowingly mis-represented or narrowed your philosophy)

However, still I turned short-term oriented. I did lot of buying and selling based on my judgement of expensiveness, earnings visibility etc. Fear of heights – not having control on emotions, market movements driving my decisions. Hardly a man to learn from. However, not all is bad: I shall and have paid good amount of taxes.

So I feel like shutting down everything (related to market) and come back fresh after 6 to 9 months. Nevertheless, one thing I have learnt since my investing journey from 2010 is that you should “Never get out of markets fully”.

Portfolio Update:

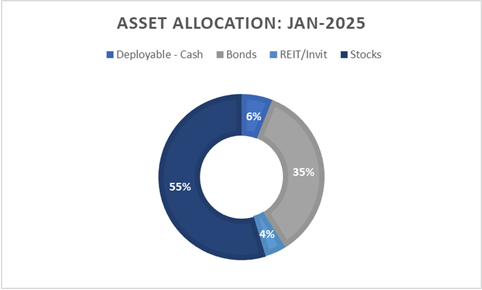

Asset allocation:

REIT/Invit has made entry in the portfolio due to lack of deployable opportunities in equity. However, I consider REIT/Invit and 4% cash a total of 10% assets ready to be deployed in equity if there are opportunities available. The past few days of correction has made few stocks attractive for me to enter.

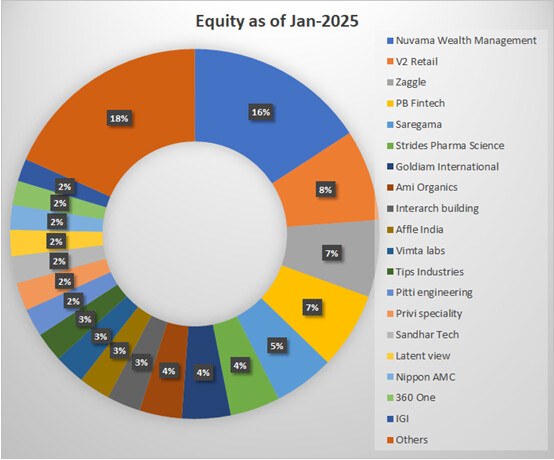

Equity allocation

has come down from 57% in last update to 55% now. Mainly due to some exits and trims. However, given the increased size of my portfolio I am looking to increase my target equity allocation to over 60% now, provided some opportunities come along.

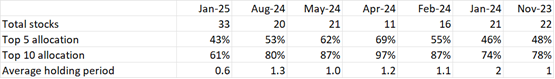

The portfolio is bit of a zoo right now. I would like to trim the number of stocks to 20-25 in 1st phase (next 3-4 months) and may be get it below 20 (best case scenario) in medium term.

My largest sectoral allocation, capital markets related stocks, continue to deliver well. Underlying earnings momentum seems very strong with huge number of IPOs, growing asset and wealth management AUMs, operating leverage benefits and relatively okayish valuations. All these stocks are trading below 30x FY26 earnings and earning growth is likely to be in 18-30% range. So still available in the range of 1-2PEG. Off course there will be 1 or 2 quarter where there is decline or flatness in the profits. However, I note these stocks are already 10% off in recent market fall.

New entries: V2 retail, Vimta labs, Strides Pharma, Goldiam International, Ethos, Timex, Deep Industries, Garware Hitech, LT foods, ADF foods, Amber enterprises, IGI

Exits: Rategain, Heritage foods, Medi assist, EFC , Restaurant Brands, Finopay, Udater services

Trims: PB Fintech, MapmyInidia, Zaggle (though started ramping up recently)

Re-entries: 360 One, Nippon AMC, Ami Organics

Bought and sold during quarter or reverse: An exchange, a broker, Sandhar (sold and bought again),

So in summary there was lot of activity. It will not make sense to justify all the actions of unstable mind (investing philosophy).

However, few thoughts where I was somewhat clear or now I am clear:

PB Fintech: continues to be highly valued hence I continue to trim it, from 11% of portfolio it has now come down to 6%. This is an awesome franchisee, its very difficult to judge how much PE should be given. My initial thesis was PE range of 50-70 on 1200-1500 cr of earnings in FY27. So it is already 70PE on FY27 earnings. However, cant completely exit a company which shall continue to grow topline in 30%+ range and still at single digit market share of overall premium and dominant share of 90%+ in online. Recently some funds (Helios) have started talking about this company and I am sure they are not here for a very short-term.

Zaggle: growing revenue at 50%+ rate and management is guiding margin improvement. I have studied global companies and they are very large. In the quarter I had started trimming due to lack of my confidence on the company. Management comes on TV too much. However, recently I noted Helios fund entered the stock. I feel somewhat positive and started ramping it up. I feel it continues to remain attractive for the growth it has.

V2 retail: outstanding SSSG in 30% ranges. Store additions is in 15-20% range, even if SSSG comes down to low double digits it can grow in 20-25% range for foreseeable period. Valuations are difficult to judge though. V-mart has 500 stores and V2 has ~170 stores so I think there is good headroom available for growth.

LGD players: Many youngsters are now buying LGDs for fast fashion and affordability reasons. Hence, looking to play this trend through B2B player like Goldiam and certifiers (IGI). Tracking IGI closely I will ramp up only if company reports 15-20% growth with valuations remaining in line.

Strides Pharma: Post OneSource, Strides Pharma market cap is ~6K crores. Company is likely to grow revenues in 10-12% range and likely to do a profit of 400-500 crores in FY26. Management is guiding to be debt free by FY27/28. All this means, earnings growth may be in 30-40% range for next 3 to 4 years. Stock is available at 12-14 PE currently. Unless I am missing something completely.

Music: A mixed bag with a correction in Tips and Saregama is doing reasonably well. Saregama may not do much for next 3-4 quarters as earnings will be suppressed with content investment. However, non-linear growth may start from FY27, driven by steady content investment and hopefully paid subscription picks up. Seeing trend that lots of young/teens are paying for subscription, particularly with Spotify 59rs starter pack. Why this trend: youngsters like to share their playlists and that’s not possible if you are not paid subscriber. If Youtube monetizes shorts then it will be huge upside for Saregama (though not baked into my thesis yet).

Vimta: A unique company. I was tracking the company for many years but was lost on stereotyping (Hyderabad based). What attracted me this time was they are planning to get into EMS/Semicon testing as well. Anyways last quarter margins shot up due to sale of their diagnostics business. Such inherent high margin business with reasonable growth was a good bet at <800.

Note: many of these stocks have run up fast. My thesis was as of date of my first buying for new entries (like V2 retail, Goldiam and Vimta). Juice left now may be not appropriate for follow on investors. Also as always I may sell anytime without informing/updating anyone.

I have added few luxury retailers as starting positions. Their growth in October was very strong. These are bit seasonal in nature so I don’t want to misjudge a seasonal strong quarter with extrapolation.

Disclaimer: I am not a financial advisor and nor a SEBI registered Analyst. The content shared here is only for learning purpose. All the names mentioned here are for example purpose. I may buy more, exit or partly sell the stock/bonds without any prior intimation . I work for an investment advisory firm. My portfolio is not a recommendation for anyone. Some of these stocks might be in clients portfolio as well so please be aware of vested interest.

What was the reason to exit heritage foods sir? As I’m thinking to take the position in it, I see it’s reasonably valued at this price.

Since you exited star health have you studied Niva bupa too or you are not optimistic on health insurance now

Sir whats your exit thesis in SJS enterprise ? Is it any technical exit or fundamental thesis change ?

What was the reason to exit Rategain sir?

sir, what is your xirr in last ten years?

Sir!!, It’s been a while, You have posted your current portfolio. Please do that, it would be very helpful for all of us.

hello sir, I want to take your some time on RATEGAIN want to know your rational behind selling Rategain. what i understand it is because of valuation and growth slowdown. if i was right what are your thoughts on Rategain after this recent correction. thanks for your time.

Sir can u please share ur latest portfolio

@joinjp2003

Hello Sir, I’m new to the ValuePickr forum. I noted that you sold your stake in PB Fintech, however I have been researching this company a bit…One of the few fintechs that I really like for their ability to scale. The competition is certainly increasing and that should be looked at as good news I think :-). Large market opportunities attract competition and they should be welcomed. Management keeps saying that any new insurance provider who wants to sell digitally must follow a model similar to what PB Fintech is doing currently, they seem to know what they are doing per their results. TrustPilot is also reporting by and large positive reviews… Their profitability is going up significantly. I am wondering if you are still following this company and your thoughts.

I’m thinking - that as the Indian population matures and grows families, earnings, they are going to need more insurance, wealth management, health care etc. over the next 15 years. So Policy Bazaar if it can keep the current model going has a very long runway and first mover advantage. lots of good brand recall… It is also taking steps to more fully build out its portfolio so it can do cross selling. The leverage is going to be fantastic if they can pull it off… The thing I like about PB is - when I want to buy insurance I want a comparison & search engine that lays out the choices, and helps me decide…I like good deals. I think of PB like an Agoda or Expedia. There is value in the model and it can scale, as other engines in the middle have shown. As you rightly said, it is a pull model… however they are likely to build in more businesses that they can then cross sell with.. starting with PaisaBazaar..

However competition is also increasing and getting ready with their own offerings -

JioFinance - in association with Allianz will most likely enter with its own product. Likely to be price competitive. deep pockets. Now this is the other finance company I would like to look into… their BlackRock Aladdin partnership is very interesting.

Bima Sugam - is supposedly launching very soon and thought to be an ONDC style disruptor backed by IRDAI and claims to be “independent”, Bima will provide very similar function as what PolicyBazaar currently provides. This one is going to be very disruptive to PB if they have a good UI and sales support. LinkedIn shows they have between 201-500 people, most recently hiring a CyberSecurity head.

BajajFinance - their alliance with Allianz is kaput, now they will probably go it alone but they have deep pockets and already have an established network, with opportunities to cross sell

InsuranceDekho - similar to PB but much smaller. Per a 2024 report online did business of 750 crore or so and turned a 85 cr profit… Hopefully we’ll see an IPO from them as well.

Go Digit Insurance - different model but still the same business, big focus on tier2,3 towns and cities.

Acko and others as well… However again note that its a massive market and predicted to grow fast.

As far as valuation goes, if you see the basic PE and other ratios that would be beside the point.. with their current profits, valuation is at the lowest PE ratio since they listed and still in the 200x range :-) … this is a company which one should believe in and hold for the long term i.e > 5 years to see the full benefit which is a very significant increase in profits is possible… as the full flywheel effect comes into view…Management is founder led and qualified, deeply experienced team. If you trust they can find a way to still make the model work, pivot the business appropriately and find ways to sell…Can the business sell - so far the answer is a Yes…

Your thoughts ?

-ViewFar

Hi @viewfar. Very nicely summarised. I continue to hold pb fintech with about 7% weight. It continues to grow well. My estimate is pb will do 3k crore profit by fy30. Such stocks are difficult to enter but if you have it you don’t sell.