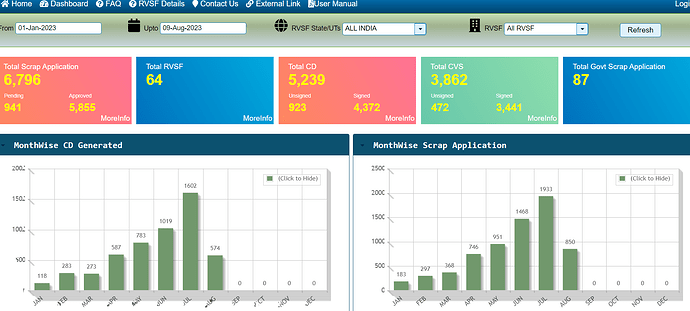

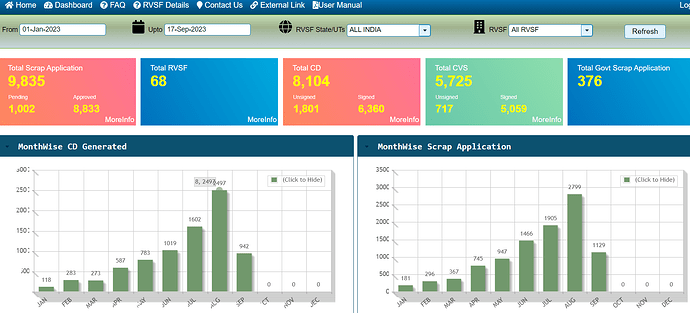

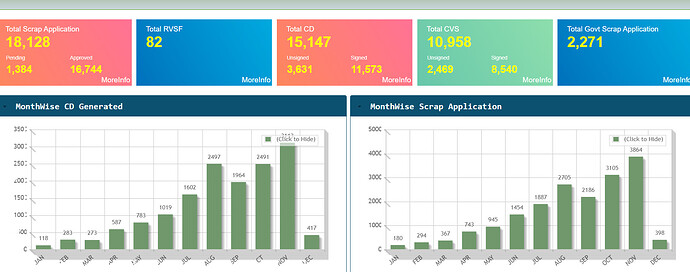

ELV Vehicles growth rate is more than 50% on month to month basis and seems to be getting Good traction.

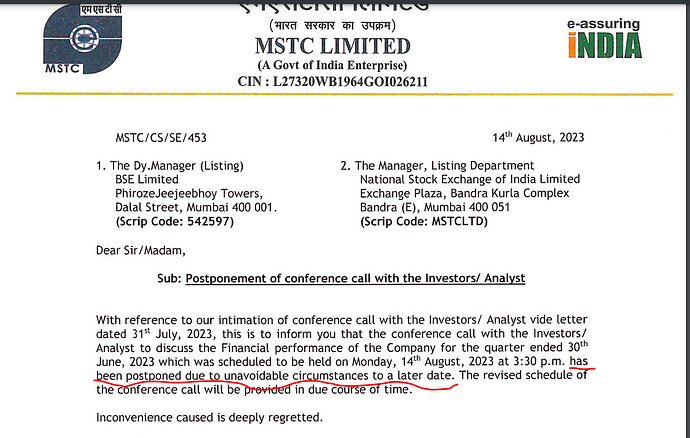

-: Order dated: 07/08/2023:-*

In the present case, the Appellant has been disputing the claim of the Respondent Bank on various grounds. The proceedings before the D.R.T. was questioned on the ground of territorial jurisdiction,

and also on the ground that the claim under the agreement between the Appellant and the Respondent could not be strictly construed as a ‘debt’ coming within the purview of the RDDB & FI Act.

The Appellant had challenged the claim of the Respondent before the civil court at Alipore. After having raised all these contentions in challenging the claim of the Respondent, it cannot be said that the mere mentioning of the claim in the balance sheets as liability would amount to an unambiguous, unequivocal or clear admission on the part of the Appellant. The notes accompanying the statements of account has to be read together with the description of the liability highlighted in the balance sheets. When the fact regarding the pendency of litigation before the D.R.T. and the Alipore court is

explained in the note attached to the balance sheets, it can definitely be not stated that the admission is unequivocal. There is no such admission in the pleadings of the Appellant. The mentioning of the

liability in the balance sheet with a rider that there is litigation pending between the Appellant and the Respondent would clarify that it is not a clear admission on the part of the Appellant. An admission can

always be explained by the party making it. In the present case, the explanation follows the purported admission. The explanation for the alleged admission in the balance sheets comes in the form of a notes attached to it. The intention for incorporating a provision to grant a decree on admission is to hasten the disposal of matters where is is no possibility of a contest arising in view of the admission. I n the instant case, the parties have been litigating for more than a decade now. Under the circumstances, I find that the Ld. Presiding Officer was not justified in admitting the recitals in the balance sheets as unequivocal admission of liability on the part of the Appellant to grant a decree on

admission. The impugned order cannot, therefore, be sustained and requires to be set aside.

Resultantly, the appeal is allowed in the impugned order of the D.R.T. dated 16/09/2017 is set aside and I.A. No. 302 of 2017 on the files of the D.R.T. is dismissed. The D.R.T. is directed to dispose of the O.A.(Original Application) as expeditiously as possible keeping in view the fact that it is more than a decade old.

DRAT Order Dtd 07.08.2023.pdf (571.4 KB)

Based on the above Judicial Pronouncement, it is highly probable that liability of Rs.221 crores in the books should be written back and considered as Income. Further the cash outflow of Rs.90 cr as an Appeal deposit should also be came back (cash inflow) to the company.

Eagerly waiting for the MSTC Management comments to the Shareholders ![]()

Steel Scrap Potential and MSTC Role

A tonne of steel scrap can save 1.1 tonne of iron ore, 630 kilogram of coking coal and 55 kg of limestone. The use of steel scrap in both major manufacturing routes (BF-BOF & DRI-EAF/IF) can substantially lower the carbon emission in the process. The Steel Scrap Recycling Policy mentions the role of steel scraps in reducing greenhouse gas emissions by 58 per cent.

In the Steel Scrap Recycling Policy 2019, the Ministry of Steel stated that as of 2019, the current supply of steel scrap is 25 million tonnes from the domestic market and 7 MT from imports. The aim of the scrap policy is to be able to harness this 7 MT from the domestic market itself to reduce dependence on imports. This would make India’s steel markets less vulnerable to global events in the sector.

The policy mentions opening 70 scrap processing centres with 300 collection and dismantling centres to fill up the gap of 7 MT. India also aims to generate steel production of about 255 MT by 2030 (according to the National Steel Policy 2017).

By that time, it is estimated that the demand for steel scrap may rise up to 70-80 MT. To meet this, India may require up to 700 scrap processing centres (shredders) that shall be fed by 2800-3000 collection and dismantling centres spread all over the country.

Potential of Steel scrap Market and MSTC share in the same (Estimation)

| Year | 2023 | 2030 | |

|---|---|---|---|

| Steel Scrap | 32 | 80 | in Millions |

| Rate | ₹ 20,000 | ₹ 30,000 | Per MT |

| Scrap Value | ₹ 64,000 | ₹ 2,40,000 | in Crores |

| MSTC Market Share % | 10% | 25% | Estimated |

| MSTC Market Share | ₹ 6,080 | ₹ 60,000 | in Crores |

| MSTC Commission% | 3% | 3% | Estimated |

| MSTC Commission | ₹ 167 | ₹ 1,800 | in Crores |

I. Case Reference

Case Citation : (2023) ibclaw.in 45 DRAT

Case Name : MSTC Ltd. Vs. Standard Chartered Bank

Appeal No. : Appeal No. 10/2023

Judgment Date : 07-Aug-23

Court/Bench : DRAT Mumbai

Present for Appellant(s) :

Mr Gaurav Joshi Senior Counsel along with Mr Rohit Gupta, Ms

Anamika Singh and Ms Nashrin Shaikh, Advocate for Appellant

Present for Respondent(s) :

Mr Dinyar Madon Senior Counsel along with Mr Tushad Cooper

Senior Counsel, Ms Radhika Gupta and Ms Rashika Bajpai, i/b M/s

Khaitan & Co., Advocate for Respondent Bank

Chairperson : Mr. Justice Ashok Menon

II. Brief about the decision

Facts of the case

The Appellant (MSTC Ltd.) impugns the order passed by the DRT-I, Mumbai directing the

Appellant/Defendant to pay an amount of Rs. 222,51,00,000/-to the Applicant Bank within 30

days exercising jurisdiction under Rule 12 clause (5) of the Debts Recovery Tribunal

(Procedure) Rules, 1994 allegedly being the admitted liability shown in the balance sheet of

the Defendant company. The Appellant is aggrieved and hence the appeal.

The Respondent Standard Chartered Bank (SCB) is the Applicant in the aforesaid O.A. which

was filed for recovery of Rs. 191,03,54,070.96 allegedly due and payable by the Defendant as

on 06/03/2012 together with interest thereon at the rate of 12.25% per annum with effect

from 07/03/2012 till realisation.

The Respondent contended that in the Annual Report pertaining to the financial year

2011-2012, Defendant had admitted its liability towards the Applicant to the tune of Rs.

186,03,00,000/-and has further shown a sum of Rs. 5,05,00,000/-as contingent liability

pending the outcome of the legal proceedings. It is further alleged that in the annual report of

the Defendant company pertaining to the financial year 2012-2013, a sum of Rs.

203,70,00,000/- has been shown as its liability towards the Applicant and also mentions a

contingent liability of Rs. 13,85,00,000/. Similarly, the annual reports of the Defendant

company for the year 2013-2014 show the liability towards the Applicant as Rs.

245,74,00,000/-and the contingent liability is shown as Rs. 22,70,00,000/-. Likewise, the

annual reports of the Defendant company pertaining to the financial years 2014-2015 and

2015-2016 mention a sum of Rs. 222,51,00,000/-as liability the contention of the

Defendant/Appellant to this application for judgment on admission is that the application was

filed at a belated stage when the O.A. was due for a final hearing after adducing of evidence.

An interlocutory application of this nature at this stage of the proceedings is not maintainable

particularly when there is a serious dispute with regard to the facts and maintainability of the

O.A. itself. It is pointed out that there is, in fact, a categorical denial to the claim of the

Applicant SCB in the balance sheets sought to be relied upon for the purpose of admission.

Decision of the DRAT

For the statement in the balance sheet to be accepted as admission, it has to be clear,

unambiguous and unequivocal. Admission, undoubtedly is the best form of evidence but where

a party relies on the admission of the opposite side as evidence, it is essential that the whole

admission must be taken into consideration. Any explanation or rider to that admission cannot

be ignored.

In the present case, the Appellant had challenged the claim of the Respondent before the civil

court at Alipore. After having raised all these contentions in challenging the claim of the

Respondent, it cannot be said that the mere mentioning of the claim in the balance sheets as

liability would amount to an unambiguous, unequivocal or clear admission on the part of the

Appellant. The notes accompanying the statements of account has to be read together with

the description of the liability highlighted in the balance sheets.

When the fact regarding the pendency of litigation before the D.R.T. and the Alipore court is

explained in the note attached to the balance sheets, it can definitely be not stated that the

admission is unequivocal. There is no such admission in the pleadings of the Appellant. The

mentioning of the liability in the balance sheet with a rider that there is litigation pending

between the Appellant and the Respondent would clarify that it is not a clear admission on

the part of the Appellant. An admission can always be explained by the party making it.

In the present case, the explanation follows the purported admission. The explanation for the

alleged admission in the balance sheets comes in the form of a notes attached to it. The

intention for incorporating a provision to grant a decree on admission is to hasten the disposal

of matters where is is no possibility of a contest arising in view of the admission. In the instant

case, the parties have been litigating for more than a decade now. Under the circumstances, I

find that the Ld. Presiding Officer was not justified in admitting the recitals in the balance

sheets as unequivocal admission of liability on the part of the Appellant to grant a decree on

admission. The impugned order cannot, therefore, be sustained and requires to be set aside.

Resultantly, the appeal is allowed in the impugned order of the D.R.T. dated 16/09/2017 is set

aside and I.A. No. 302 of 2017 on the files of the D.R.T. is dismissed. The D.R.T. is directed to

dispose of the O.A. as expeditiously as possible keeping in view the fact that it is more than a

decade old.(p17-18)

Hi,

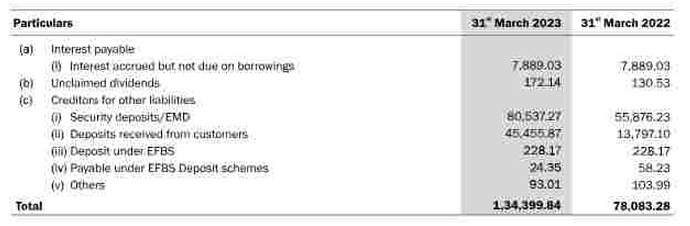

I think we should consider the other liability items as well in the balance sheet as the company has to pay for them and they are significant:

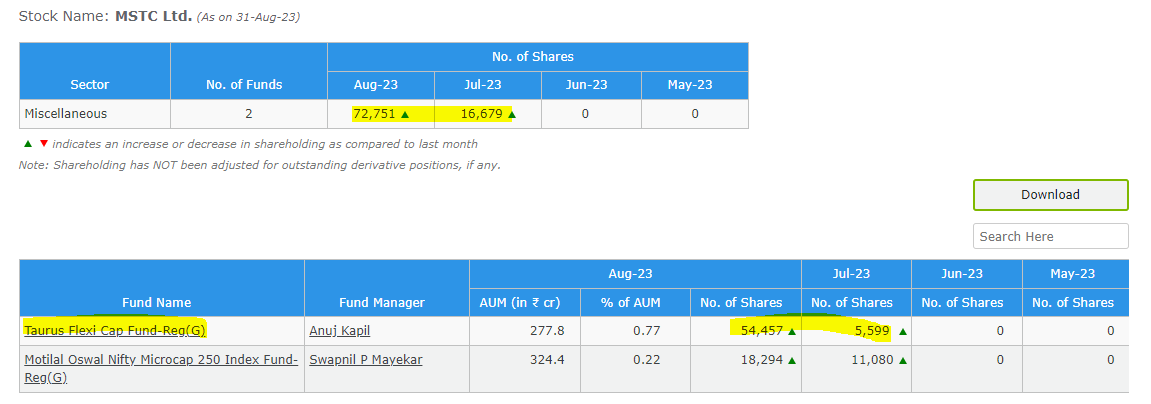

Can you share the source of this image?

Two more services launched by MSTC

Check this blog by Prof. Sanjay Bakshi on MSTC

Hope you find it useful.

dr.vikas

https://www.business-standard.com/industry/auto/fame-iii-india-to-replace-800k-diesel-buses-with-electric-over-7-years-123122900244_1.html

The JV with Mahindra was facing challenges as mentioned in concall due to slow implementation by state governments with the upcoming policy on fame 3 and also scrapping of old diesel vehicles MSTC can exploit this opportunity,

Hello Pranshinv,

Where do you get this data ?

The transition to a million EV buses over the next decade means a lot of existing buses will be scrapped. The article has some numbers.

Million electric bus plan nears gates of PMO | Mint(PMO,aware%20of%20the%20matter%20said.

Discl.: Invested

https://aws.steelmint.com/indias-elv-recycling-facilities-to-open-up-new-scrap-supply-horizon-425259

India: Number of registered vehicle scrapping facilities rise over 50% in last 6-7 months

—

by

- Applications for new units increase rapidly

- 43 facilities currently operational

- Scrap generation from ELVs to reach over 5 mnt by FY’24-25

Morning Brief: The government launched the National Vehicle Scrappage Policy in August 2021, and it officially came into effect in August 2022. The policy is aimed at phasing out unfit, polluting vehicles, and promote a circular economy. It also aims at boosting vehicle sales: vehicles older than 20 years (passenger) or 15 years (commercial) must pass fitness and emissions tests, or else they will lose registration and will be recommended for scrapping.

With the government starting to accept applications from entities interested in establishing scrap recycling facilities, the scrappage policy is taking a definite shape, as it allows interested parties to actively participate in the development and operation of recycling facilities dedicated to end-of-life vehicles (ELVs).

Policy incentives/overview

- Scrap value for the old vehicle given by the scrapping centre to be 4-6% of the ex-showroom price of a new vehicle.

- Concession on motor vehicle tax of up to 25% for non-transport vehicles and up to 15% for transport vehicles.

- Registration fees to be waived for purchase of new vehicle against the certificate of deposit (CD).

- Auto OEMs have been advised to provide 5% discount on the purchase of a new vehicle against the certificate of deposit.

Operational recycling facilities

As per data available with SteelMint, a total of 86 applications for Registered Vehicle Scrapping Facilities (RVSFs) have been approved by the government till date, with 43 facilities already operational, while the remaining are scheduled to commence soon.

The Indian ELV industry is slowly becoming a formal, automated and mechanised sector with the entry of auto OEMs/steel mills-supported recycling units. Currently, there are two OEM-backed facilities operational in the country:

- Mahindra CERO, a joint venture of Mahindra Accelo and MSTC. The current recycling capacity of this facility is around 50,000 vehicles per year with units located in Delhi, Pune and Chennai. The company is planning to expand capacity to over 600,000 units in 25 different cities by 2025.

- Maruti Suzuki Toyotsu India is a JV of Maruti Suzuki and Toyota Tsusho Group. Currently, it has a capacity to recycle about 25,000 vehicles per year. It has its unit based in Noida, UP.

- This apart, Tata Motors has signed a memorandum of understanding (MoU) with the Maharashtra government to build a facility with recycling capacity of 35,000 vehicles per year. It has also planned to enter an MoU with the Gujarat government to build a recycling facility with an annual capacity of 36,000 vehicles.

State-wise facilities

The majority of the applications received indicate a keen interest from firms in the western districts of Uttar Pradesh, Haryana, etc. In UP, around 42 applications were received, constituting approximately 50% of the total applications throughout the country. To see the complete list of state wise vehicle recycling facilities, Click her

Surge in vehicle scrappage applications

As per data from the Ministry of Road Transport & Highways (MoRTH), in 2022 (from August to December), a total of 372 applications were received for vehicle scrappage. Out of these, 354 were accepted.

However, the landscape changed significantly in 2023. Last year, a staggering 20,821 applications were received. Remarkably, 19,398 of these were promptly approved, reflecting the dynamic growth in vehicle scrapping activities.

Outlook on scrap generation from ELVs

The policy is estimated to cover 51 lakh light motor vehicles (LMVs) that are above 20 years of age and another 34 lakh LMVs above 15 years of age.

In 2021, India generated about 26.5 mnt of ferrous scrap domestically, of which 30% was from end-of-life vehicles which stood at around 8 mnt.

Delhi is the hub of ELV scrap recycling in India, contributing around 1.5-1.6 mnt. Other key centres are Bangalore (0.3-0.4 mnt), and Mumbai (0.3-0.5 mnt). Cities like Kolkata, Chandigarh, Pune Chennai, Meerut etc account for a combined 0.67 mnt of total ELV scrap generation in the country.

Automobile, railways, shipbuilding, hard stocks etc. are the main sources of end-of-life vehicles. Railways generate about 3.5-4 mnt, auto about 3-3.4 mnt and shipbuilding about 1 mnt.

As per estimates, India’s ferrous scrap generation from ELVs will touch 5.30 mnt by FY’24-25 and 7.30 mnt by FY’29-30. Estimated volumes in FY’23 will be around 4.60 mnt.

The data includes scrap generation from 2- and 3-wheelers, passenger cars, commercial passenger vehicles, and commercial goods vehicles. This data is estimated considering the average vehicle life of 15 years and average steel consumption in the automobile sector.

It is estimated that ELV recycling will cover up to 30% of domestic post-consumer scrap generation by 2030.

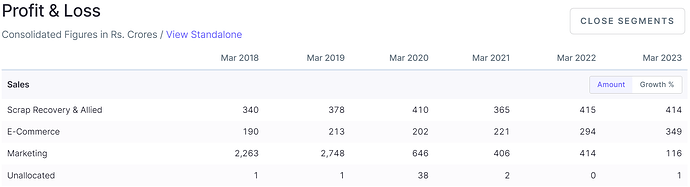

Maybe a very simplistic question - What exactly is the “marketing” business of MSTC? - Marketing of the items or Rev through ads in the platform ?

Thanks in advance

Marketing Department, MSTC Limited is mainly engaged in the business, inter alia, of industrial/other raw materials, project equipment etc. on account of and for interested customer(s) who come to avail of the facilities, expertise and market acquaintance of MSTC, acquired over the years in the trade afore stated. MSTC’s business activities include procurement of industrial/other raw materials, project equipment etc. on Facilitator mode which is to be mutually agreed between MSTC and the interested customers. The said procurement is against 110% BG margin.

Revenue of Marketing Division for the last five years is given below:

(₹ in million)

Year

Amount in ₹ million

2020-21

4062.61

2019-20

6463.57

2018-19

27482.79

2017-18

22627.50

2016-17

13261.00

SCHEME OF PROCUREMENT UNDER 110% BG BACKED BUSINESS MODEL

- Only limited company can avail the facility of procurement of raw materials, equipments and other items for their business purpose;

- The value of procurement shall be covered by irrevocable Bank Guarantee (BG) issued by any Scheduled Commercial Bank and strictly as per MSTC format. The value of BG must be for 110% of the procurement value;

- The BG shall be treated as valid on receipt of SFMS message from MSTC designated banker and on confirmation of BG;

- Application can be sent in the link given below;

- Application to mention clearly the quantum of fund as well as the utilization purpose

- Following documents are to be attached with the application by new customers:-

- Memorandum and Articles of Association

- Audited Annual Accounts for last 3 completed financial years

- Brief report on the Organization’s Activities

- Details of Directors

- Details of items to be procured through MSTC

- Income Tax PAN

- GST Registration Certificate

- Valid Bank limit Sanction Letters

- Letter from the Director of the company giving details of:-

1. Whether there is any case initiated against the party under Section 138 of the NI Act or any other criminal proceedings is pending against the party;

2. Whether any court case (civil or criminal) is pending between the party and any Public Sector Undertaking/Government Department, if so details thereof;The certified hard copies will be asked for whenever required; - On successful processing of application a non refundable processing fees of Rs. 5,000/- (Rs. 1000/- for MSME &Agri-sector customers) plus GST will be payable prior to signing of agreement;

- The agreement shall at MSTC’s standard format. The same will be shared on successful processing of application;

- Charges for availing this raw material procurement facility are as under:

- Service charge - 0.10% plus applicable GST per month of credit;

- Interest - 10.45% per annum for the current financial year i.e. 2021-22. The rate is subject to revision every year;

- Initial credit period is for maximum 180 days. The same can be further extended for another 180 days subject to payment of due charges on account of service charges and interest of the past period. However such extension is at sole discretion of MSTC;

Individual proposal value should not be less than Rs. 50 lacs. For MSME & Agri-sector customers the individual proposal value should not be less than Rs. 10 Lacs.

Hi all,

First of all, thank you to the group, some of the information shared have been useful to my research.

For my own journal, I did a write-up so sharing here (link (Transfer - Dropbox)) with you incase helpful. All the best.

Sarfraz