Hi All,

I am a management professional with 20 years of experience in the telecommunications industry.

About my investing journey :

Since 2016 , I developed an interest in investing .As most of the aspiring investors of this generation, I chanced upon Warren Buffet, read his letters to shareholders ,his biographies by Roger Lowenstein and Alice Schroder and read almost everything on and recommended by Warren. One thing lead to another and discovered Charlie Munger (Must say was enamored by his concepts on Lattice work of Mental models, Poor Charlies Almanack , Psychology of human misjudgment etc), Ben Graham, Howard Marks etc etc . For a long period of time my phones Wallpaper was Charlie Munger surrounded by Books sitting comfortably in his arm chair and reading profusely. That was and is my idea of financial independence. ![]()

Another great influence was professor Sanjay Bakshi . I devoured almost everything written and spoken by the venerated prof.

This period from 2016 till 2020 was a period of intense reading and I read almost every investing author worth his salt during this period.

But my investments was performing badly as most of the fun was derived from bookish knowledge and didn’t bother to do the spade work of investment research.

Then in 2020 when covid struck, I had some extra spare time and chanced upon VP forum and Screener.in. In VP forum I was awe struck by some dynamic and passionate investors and that helped me to figure out the “wheat from the chaff " (Journey is still on , still its more chaff and some wheat ![]() ).

).

I keep going back to the investment journey of the stalwarts in VP like Ayush Mittal, Dr. Hitesh Patel, Abhishek Basumallick, Donald to keep me motivated when the chips are down.

My personal portfolio after 3-4 years of losses also made some descent gains in the Covid rebound and subsequent bull run (Although I am sure luck and rising tide that takes everything high with it had a major role to play).

I am presently employed in a telecom company , but this is not what I want to do for the rest of my life. I thoroughly enjoy the process of investing and love to spend my day reading and thinking.

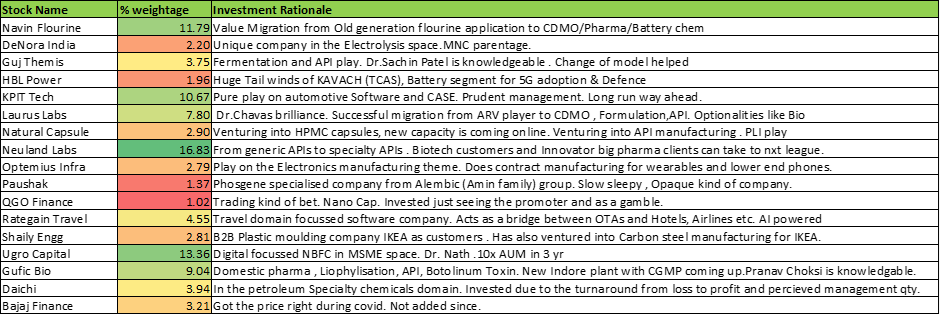

Sharing my portfolio here with a brief description of the investment thesis on each of the companies.

I will also use this space to upload interesting bits of information and things that I have learned / come across on and off.

Hope to get feedback from fellow investors.

P.S: The portfolio weightages are lopsided due to runup and drawdown of certain scrips. I am still poor in selling | portfolio balancing along with many other things ![]() . The basic premise or question that I keep asking is whether the businesses can double in 3 years from these levels/ purchase prices which ever is higher (26% CAGR). If I believe so I give it a long rope.

. The basic premise or question that I keep asking is whether the businesses can double in 3 years from these levels/ purchase prices which ever is higher (26% CAGR). If I believe so I give it a long rope.