Meghmani Expansion Plans:

Disclaimer: Mostly this calculation is based on management commentary and some of it is our assumption. Invested.

Meghmani Expansion Plans:

Disclaimer: Mostly this calculation is based on management commentary and some of it is our assumption. Invested.

My holding of meghmani orgenic suddenly disappeared. Why?

Its getting demerged into 2 entities if I am not wrong Agro and chemical businesses.So you must get allocations accordingly of 2 companies with changed names.

Yes. Same no. of shares of Meghmani Organochem as shares held of Meghmani Organics and 94 shares of Meghmani Finechem for every 1000 shares of Meghmani Organics.

@DevPatel Have you received any confirmation on meghmani. My father holds 75 shares of meghmani, it still showing in demat account. There seems no communication on email.

Do we need minimum 94-100 shares to get finechem?

Any assistance will be helpful

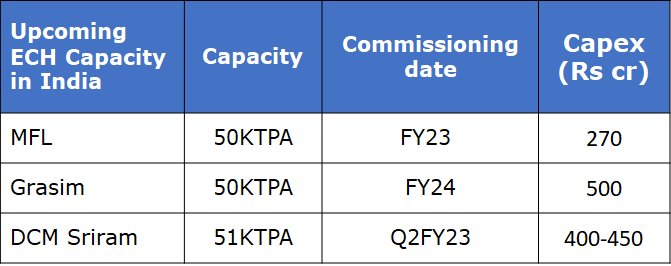

Meghmani Finechem is doing the ECH capacity at almost 50% lower capex than it’s peers and also commissioning it’s capacity one year ahead of the schedule. Big advantage.

Source: Be the last man standing...

See the latest recording of the analyst meet here GIA Stocks

Hi , Can any one please tell when the new shares will be listed and start trading on exchange again. Is there any date announced

When Meghmani Organics stopped trading, its market cap was about 3500 cr. Whats the expected marketcap of the two new cos, Meghmani Organochem and Meghmani Finechem??

Curious about the usual time it takes for demerged entities’ shares to list? Been some time now wrt Meghmani.

Isn’t it a little unusual for the demerged entities to take so long to get re-list? I’m wondering if they’ve run into trouble with SEBI or exchanges which actually have to issue the circular for trading?

Hi,

Wanted to clarify some confusion regarding financials of the demerged Meghmani Finechem. The financials reported for MFL on thr presentation are : -

However, in latest presentation of Meghmani Organics, the financials of pigments business are reported as : -

Huge difference in Revenues and margins esp. FY’21(Is it a re-listing dress up ![]() ) Or what’s the link that I’m missing. Can someone invested frm pre demerger clarify this?

) Or what’s the link that I’m missing. Can someone invested frm pre demerger clarify this?

@Rakesh_Arora , others - would like to know ur thoughts regarding this.

Disclosure : - not invested. Studying it as a spin-off play after coming across the idea in special situations thread.

I think you got confused. MFL is into Chlor Alkali segment. Pigments and Agrochem went with MOL.

Meghmani Finchem Investor Presentation(This has chlor alkali and planning to enter higher derivatives)

Meghmani Organochem (Changed back to Meghmani Organics) Investor Presentation (This is combination of Pigments and Agrochemicals)

@shardhr you can verify you numbers from above presentation

@Rakesh_Arora :- Thanks for clarifying. The confusion is resolved now.

@Shawn_Lopes :- Yes, I referred those docs nd latest co. presentations. Bt it seems chemistry and chemical industry is out of my Circle of Competence( and way too out  )

)

Disclosure :- Same as above

Listing of Equity Shares of Meghmani Organics Limited.

http://meghmani.com/wp-content/uploads/2021/08/mol-listing.pdf

What prices do you anticipate foe the 2 companies ?

Why did Meghmani Organics list below its price when it moved out of trading.

Also the results have been good…more than double for both the demerged entities…so I am expecting both the stocks to move in circuits for at least next 5-7 days.

Amazing Revenue CAGR targets FY 2024. Seems possible with Agrochemical capex plan & clear disclosures on expected revenue from capex.

http://meghmani.com/wp-content/uploads/2021/08/Q-1-FY-22-Investor-Presentation.pdf

After studying concall and result of Meghmani organics in details, I found following major points which I want to share with fellow VPians:

Disc: Invested, Biased