(post withdrawn by author, will be automatically deleted in 24 hours unless flagged)

@satya61229, I guess u posted in the wrong thread. This thread is for Meghmani organics nor Mangalam Organics

Thanks. I was wondering why they have flagged it as promotional. You have saved me.

Hi All,

I’m new to investing. I’m going through the quarterly presentations of Meghmani. I observed a discrepancy in numbers ( like Q1 FY16 & Q1 FY17 has different numbers for Q1 FY16) . can some one help me in getting the correct numbers. (Quarterly Numbers) - { segment wise - sales, ebitda, volume etc.}

There has been accounting changes from changes by adopting Ind-As. The later ones would be of Ind-as and earlier one would be the accounting according to previous standards.

Credit rating upgrade by CRISIL

In the Annual report 2018-19 , it is not clear whether the MFL pay 109.8 Crores or 211 Crores in the form of OCRPS. (Page 145, note 44) . Can anyone please help in understanding this . they have mentioned it as 210.9 crores OCRPS , Rs. 109.8 Cr

accdd29e-de8f-43bc-9264-2a3f382779e2.pdf (761.8 KB)

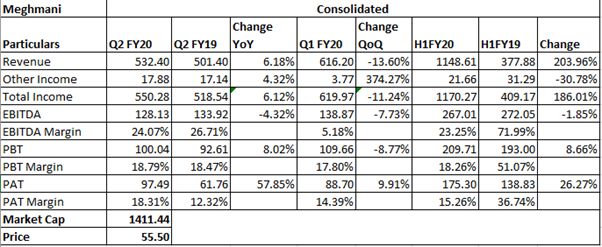

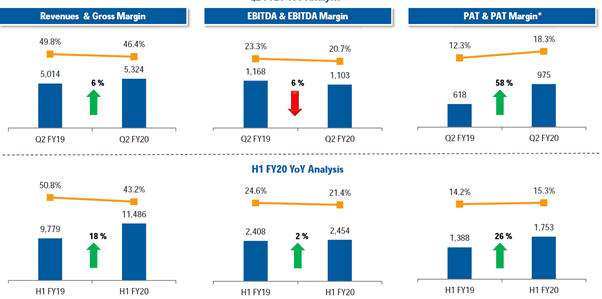

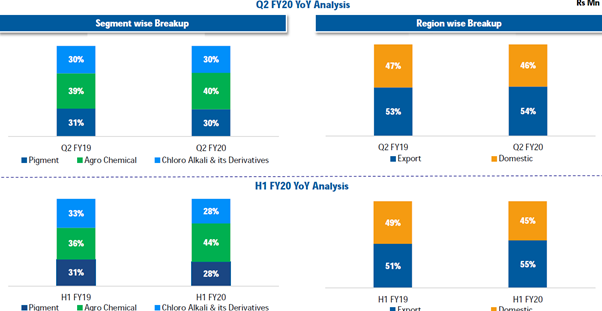

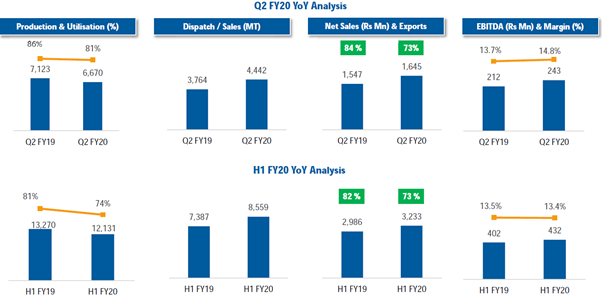

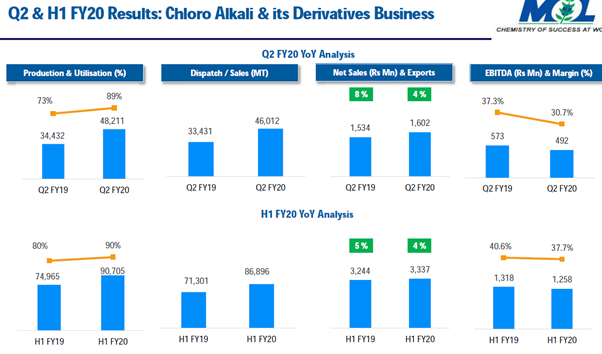

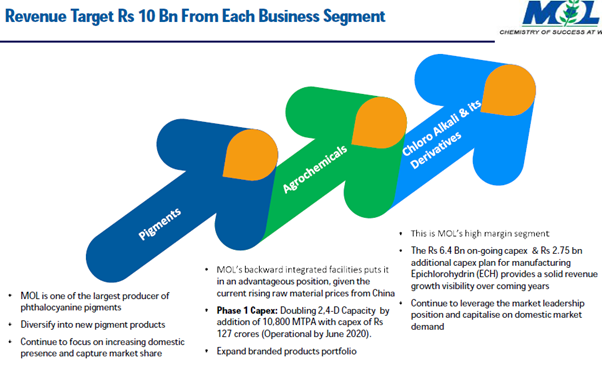

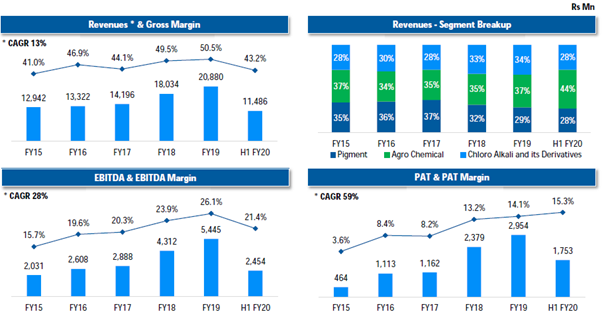

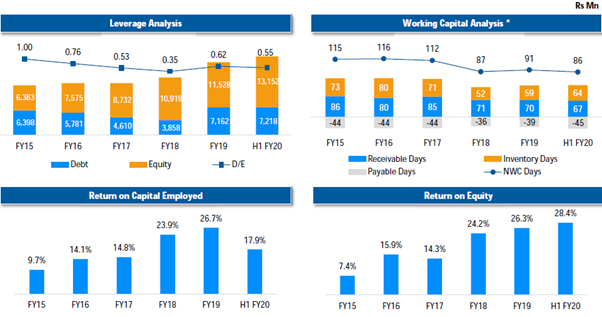

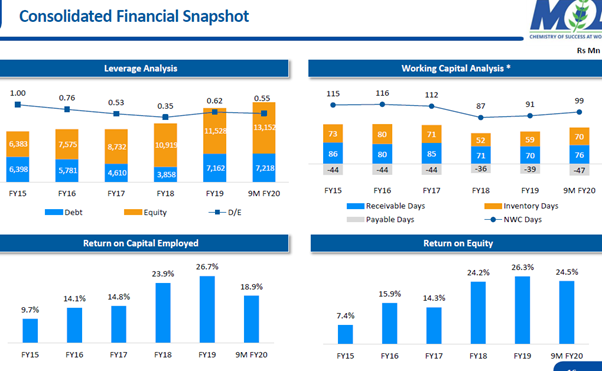

Q2 FY20 Result Presentation:

Q2 FY20 Results!

Disc: Invested

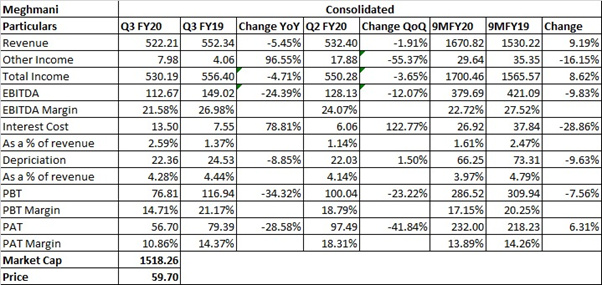

Results out-

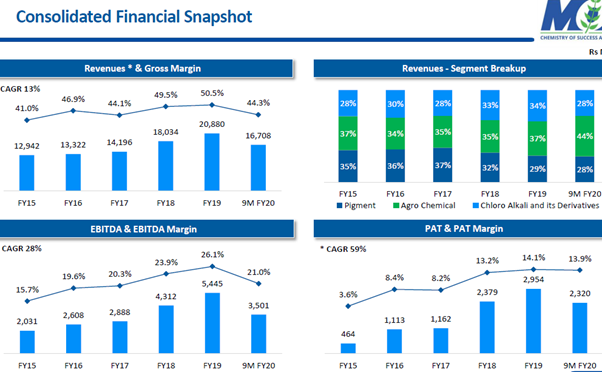

Revenue Decline - 5.45% YoY

Pat decline - 28% YoY

0694f5a2-3724-4afb-8839-c3c1bb825059.pdf (654.3 KB)

Also Company has announce to demerge it pigments and agrochem business so as to list them separately for value unlocking - Managemnet view.

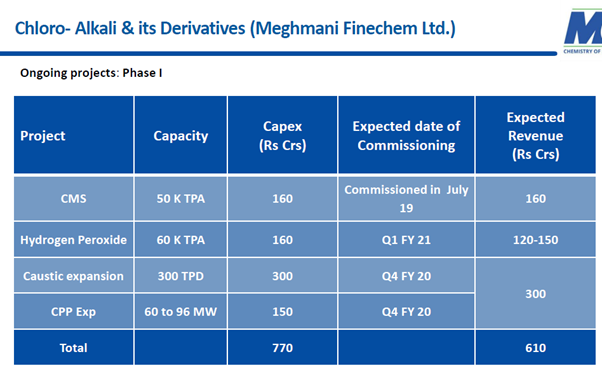

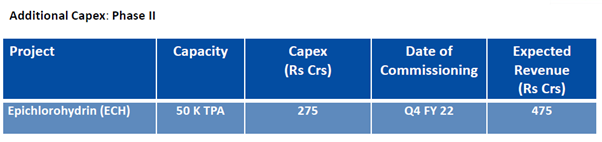

And also amalgamate Meghmani with Meghmani Finchem Ltd(FCL)

6d44479a-047d-4527-8622-d395b2f5d42b.pdf (374.1 KB)

Views invited.

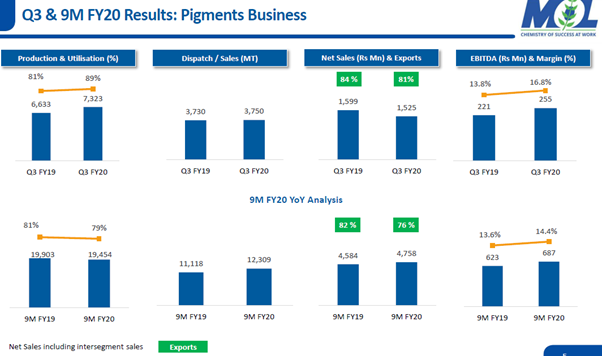

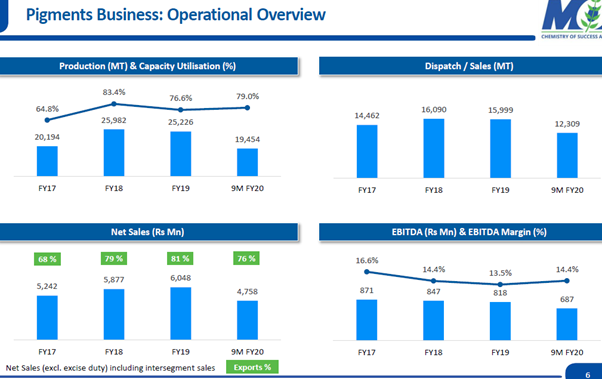

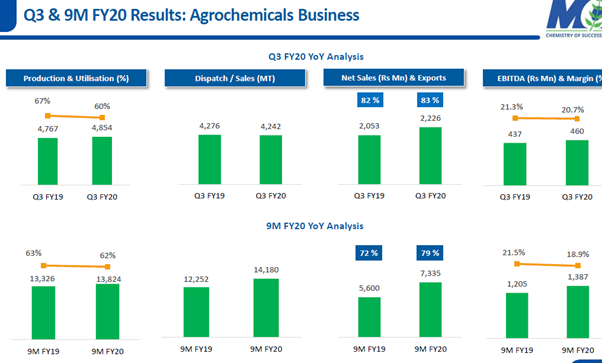

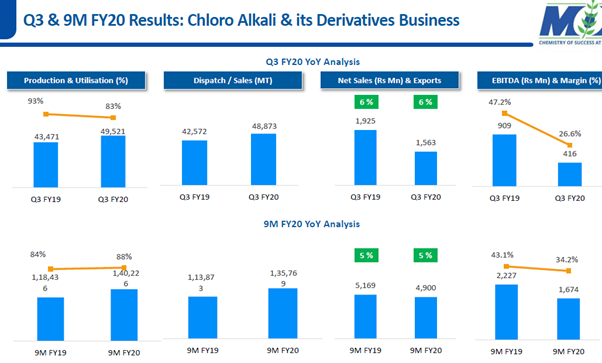

Meghmani Q3 Results!

Q3 FY20 IP:

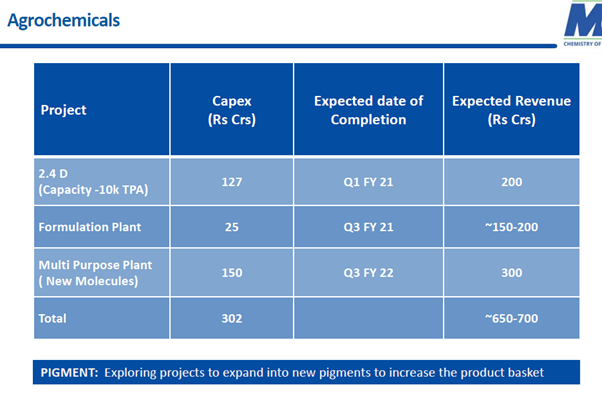

Future Plans:

Has any one estimated/calculated the impact or benefit of amalgamation and merger?

Is is good for the shareholders?

CRISIL has upgraded its ratings on the bank facilities of Meghmani Organics Limited (MOL; part of the Meghmani Group) to ‘CRISIL AA-/Stable/CRISIL A1+’ from ‘CRISIL A+/Positive/CRISIL A1’.

Meghmani does this every 2-3 years

Last time company bought promoters’ shares at an extremely unfavourable terms to rest of the shareholders. It was covered by all analysts on twitter as daylight robbery

secondly their stocks catch fire every 2-3 years so they can write off as one of expense

This time their stock is stolen, probably were empty boxes

It’s all covered here if you read this thread

so the management is a ‘chor machaye shor’ types and one should stay away from it !

This is going to impact Meghmani Organics further.

3 to 4 weak quarters expected