@Mohit_baid but I don’t think Megatherm is going be a strong beneficiary of steel capex, most players are going to build capacities using BOF route rather than EAFs because there isn’t much steel scrap available. Also as I said, the market for induction furnace itself is very small so room for growth is very little.

Disclosure - I’m invested already but was looking to significantly increase position size and researching before doing that.

1 Like

With CO2 emissions going up… what is the alternative to steel production without coal? Is induction the only option?

Q4FY24

YoY

Revenue +18%

Net profit +87%

HoH

Revenue +8%

Net profit +55%

Expected better revenue growth but the bump in Profits/OPM made up for it.

https://nsearchives.nseindia.com/corporate/FINANCIALRESULTS202324_28052024132456.pdf

Hey can you enlighten us by describing TAM and opportunity size of this electrical induction melting / heating furnance !! any listed player? competitors ?

1 Like

That $85M is supposed to be by how much the industry will grow by I think, not the entire market size

WIth Kacholia entering, business scalability is proven in emerging Steel and ancillary scenario.

3 Likes

megatherm biz update q1fy25.pdf (3.3 MB)

new update -

- entered into renewable and industrial transformers

- order book of 393 cr.

3 new upcoming launch on 22nd august

5 Likes

Will this drive be beneficial for players like Megatherm ?

1 Like

Yes, it should benefit companies in this domain.

My Takeaways on Furnace Industry

-

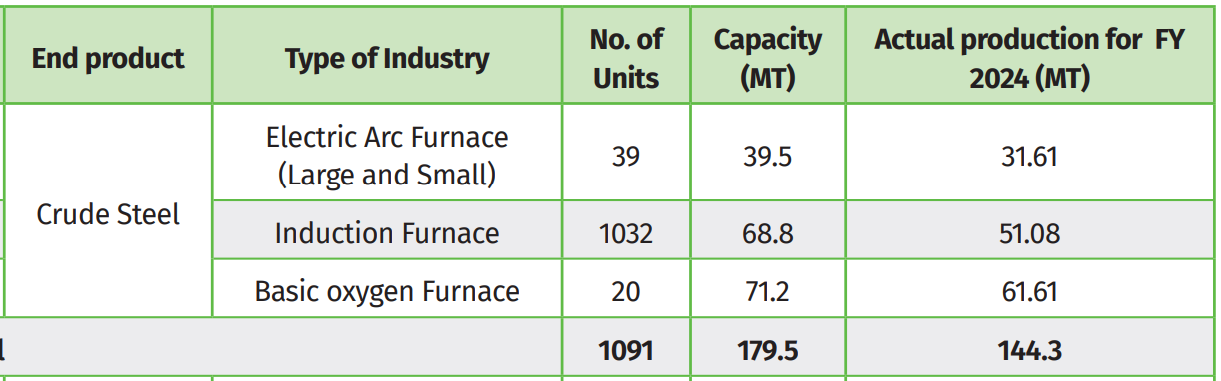

Typically, the hot metal is converted into steel through the basic oxygen furnace (BOF) route, while DRI (direct reduced iron) is converted to steel in an electric arc furnace (EAF) and an induction furnace (IF).

-

The larger integrated steel plants (ISPs) typically use the BF-BOF and DRI-EAF pathways, whereas smaller plants use the coal-based DRI-IF pathway.

-

A higher growth of 8% and 12% was observed in (Electric arc furnace) EAF and induction furnace (IF) routes of steelmaking compared to 7% for the BOF route.

-

Green hydrogen can be used in blast furnaces and gas-based shaft furnaces as a substitute for fossil fuels since it has significantly lower breakeven cost than coal & natural gas. Tata Steel has demonstrated hydrogen injection in blast furnaces while JSW is planning for hydrogen injection in shaft furnaces.

-

Despite lower breakeven cost than coal & natural gas it very unlikely to substitute due major challenges such as high capex required for modifying the furnaces, lack of a fully developed ecosystem and availability of green hydrogen.

-

There are around 1032 Electric Induction Furnace (EIF) units in India with a total installed capacity of 68.8 Mt. The production through the EIF units is 50.4 Mt registered a capacity utilisation of 73% and contributed to 35% of crude steel production in India.

- Continuous technological developments and the availability of bigger-size furnaces enabled EIFs to contribute to steelmaking in India. The furnace capacity ranges from 8 tonne to 60 tonne.

Potential Problem or this an opportunity?

IF mainly uses scrap or a mix of scrap which consist 40-60% scrap material

Extremely low consumption of scrap totalling 33.36 Mt in FY24

All this round me back to the question, Is there really a significantly market size for Megatherm Induction Ltd? (Critics/opinions are appreciated)

Disclosure : Not invested, My understand may be about the business is very little

2 Likes

Your understanding is exactly correct. I got IPO allotment in the company but wanted to research more for increasing the position size. I had a talk with their IR team, and they’re targeting 500cr revenue by 2030 I think.

The reason they’re expanding into transformers and other markets is bcz the size of Furnace market isn’t large. Most steel companies use BOF method bcz the quality produced is better. More importantly the entire steel industry is undergoing a CAPEX right now, which means this is the best time for the company but still most expansion is happening through BOF route. Tata Steel tried to get a plant in UK switch to EAFs but they’re facing huge protests.

Overall, I think the promoters are really honest and diligent so if they figure something out by cracking new product lines, that could be great. But the total market size of the business is extremely small. Infact, total size for EAFs is around 700cr out of which megatherm takes around 160cr, electrotherm takes 200cr and a few other players occupy the market and there isn’t much scope for expansion/growth.

7 Likes

Megatherm Induction update H1FY25:

Product line:

- Capital goods/machineries : Induction melting furnace, Induction billet heater, Hardening & heating equipment , transformers(distribution,generation,IDT, solar etc)

- Steel sector OEMs : Ladle refining furnace, EAF, CCM, Rail hardening machine, Fume extraction systems etc.

Revenue from segments:

- W.r.t FY24 turnover ,

Forging & foundry = 50 cr. 60-70 = spare OEM parts, transformers(currently)=35 cr.(post Unit-II production, immediate rev possibility=150 cr)

- Remaining 130-160 cr. is from steel OEM machines.

Customer concentration :

- Top 10 customers= 110-115 cr.(35% approx. of FY24 rev)

- Top 2-3 customers= 70 cr approx.

Competitions :

- Inductotherm ( monopoly in heating and hardening equipments in steel sector-not competing currently)

- Electrotherm.

Margin is going to be improved due to new backward integration of CRGO sheet metal processing for captive consumption in induction segment.(9% is the margin target)

Induction melting & induction Heating products brings highest revenue.

Highest margin profile in transformer is IDT(Induction Duty Transformer) that goes into renewable sector also.

New transformer facility to have 30MVA upto 50MVA transformer type production. Total investment made for Rs. 25 cr. to realise additional 200+ cr. of revenue from the Unit-II facility in transformer segment. Possible production from March 2025 after certification in January 2025.

Transfomer enquiry clients :

- Adani green

- Jindal renewable

- Reliance

- Tata power renewable

- Renew

- Gensol engg.

- Avaada group etc

Remarks ;

-

Sluggishness in steel sector helps co. because steel manufacturers wants to cut costs by renewing or installing cost efficient systems like induction machineries etc.

-

Despite Rs. 30 cr capex (greenfield+ backward integration of CRGO sheets) Rev up by 0.7%(flat) and PAT up by 22% compared to H1FY24.

-

Due to OEM products in steel sector , co. posses some pricing power for it’s products. Sales spare parts brings high margin revenue.

-

Recent email enquiry with CS told us about the unit - I production capacity will increase after the entire transformer production move to Unit-II facility.

-

Regarding PCB(Printed Circuit Board ) query to the CS , here is their reply - "In reply to your query, we would like to affirm that yes, we are manufacturing it. Rapid prototyping machine has been bought to speed up R&D work."

Disc : invested. ( Not SEBI registered )

7 Likes

Was trying to calculate future mcap, based on concall guidance of 500cr revenue, seems its on a good value buy.

Disclosure: not invested. Tracking. Might take position in future based on execution capabilities

FRESH ORDERS

Company has confirmed receipt of following bulk orders which are to be executed in FY26.

RUNGTA MINES GROUP (approx. INR 25 crore)

SHYAM METALICS AND ENERGY GROUP (approx. INR 26 crore)

CHANDAN STEEL LIMITED (approx. INR 12 crore

Disc: Invested & tracking closely

1 Like

I have invested in a Transformers manufacturing company for some time now and am convinced there is enough space for multiple entrants and that the industry tailwinds are here to stay for at least a few years.

Appreciate the management for a fullscale diversification as soon as they sensed a saturation point in furnaces.

2 Likes