How much should MCX fall now…Is there any calculation possible which gives impact on share price of say 250 cr which they would spend in next 2 quarters, assuming they will transition this time in next 2 Quarters…

As mentioned a few posts earlier, value of any company is the present value of all free cash flows the company generates in its entire lifetime. Temporary short term events like this dont really matter so much for the intrinsic value of the company. Before the software extension, company was trading at around 8000 cr M.Cap. If you think that MCX will be able to get the new software up and running in the next 2 quarters, the total hit to cash flows incrementally from here on out is about 220 cr or about ~3% of the total MCap. In the meanwhile the stock is already down about 10%, so market is pricing in further slippages in timelines.

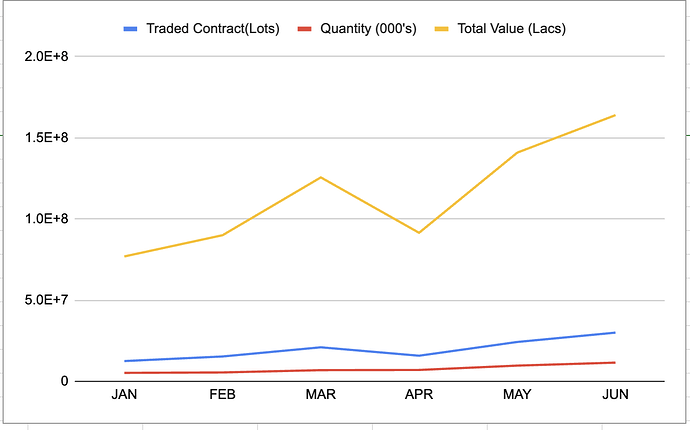

The more important data point in my opinion remains the daily traded volumes on the exchange which hit a new record high in June month. Core company performance except for the software transition issue remains very very healthy. In my opinion, Events like these seperate the short term traders from the investors.

Disclosure: Invested and biased.

Is there a possibility that the solution by TCS never becomes stable? Can MCX buy 63 Moons?

Income tax portal was not by TCS but Infosys

How incompetent does the management have to be not to have a delay penalty on the service provider?

Especially when the service, or product being developed is the backbone of your business and your existing backbone is on an expiration date. What incentive does TCS have, even to deliver the product on time?

Where can one see June’s or monthly numbers?

You can find daily volumes from the MCX website:

Based on rumours I have heard, there are multiple allegations that existing player, some existing brokers and some employees of the exchange are trying to create maximum roadblock in transition to new system. Rumours include story of missing requirements shared by exchange employees, some brokers not participating fully in mock tests or deliberately entering wrong data, selective leaking of internal conversations on twitter, sending bug report to regulators to create pressure etc. etc. etc.

Please note these are all rumours I have heard and I do not have any proofs to substantiate it. So do not blindly believe it as truth.

Only conclusion I was able to draw from it was that when such complex migrations are involved, story is not always simple or straight forward - multiple players with their own vested agenda will try to bake their bread in the entire episode. As a retail investor we should not simply assume that such migrations will happen as per committed time. Guess many of us learnt it the hard way

P.S: If this post violates any of the forum guidelines, please let me know. I will immediately delete it.

There is huge gain in March which again comes down in April. How do we know that May/June numbers are not temporary…

Any insights from latest results and investor calls…to me it sounded like the same.

Got this from UBS article on MCX - “Recently, the company informed that it has resolved trading procedure issues, completed the final code freeze, and resumed daily mock trading on the new platform starting from September 1. MCX aims to finish the transition by the end of September 2023 and anticipates no issues with introducing contracts for January 2024.”

Not sure where did the company made this statement…may be in an ivestor’s call?

There is a circular on the MCX website https://www.mcxindia.com/docs/default-source/circulars/english/2023/september/circular-624-2023a3e7e34757fb64e3bdfdff00007acb35.pdf?sfvrsn=ad1c8791_0

“Members may note that exchange proposes to Go Live on the new system tentatively by end

of September 2023, subject to necessary compliances and approvals. A separate circular will

be issued for actual Go-live date with the new commodity derivatives platform.”

finally, MCX is going live with the new platform

There have been a few developments regd the New trading platform in past few days. Even though there are questions on technical qualification and approval from SEBI technical board. The Co will hopefully overcome this one issues in next 3 months. This would save the Co from excessive software charges and that should improve operating metrics.

From My rough calculation I estimate the net profit to be ~380 cr for FY25 and a ICICI report estimates the profit to be ~425cr. So, if we assume trades at P/E of 35x (CDSL and CAMS trade at 40x, for lower growth rates) the market cap would be 14000 cr (currently 10400 cr). That would be 35% returna in next 18 months or 22% CAGR.

Higher p/e multiple, continued revenue of 30% and possible dividend would be added benefit.

Dowside risks include any further challenges in deployment of the new trading platform and any regulatory changes.

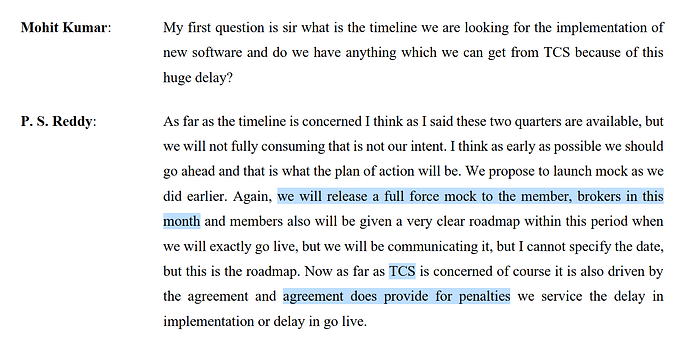

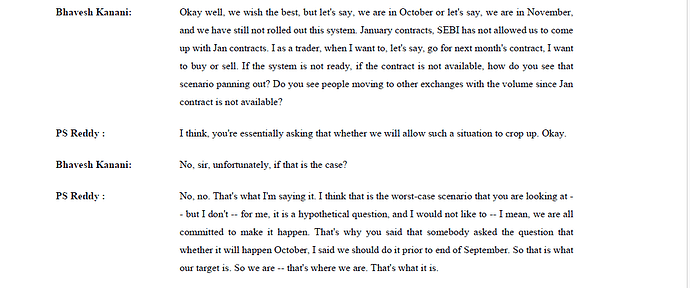

If I may add an additional risk, please refer to the transcripts of the 1Q analyst call and subsequent IIFL organised call on Aug 3. SEBI has refused to permit January contracts. My interpretation is that

this effectively means that if the transition drags on, hedgers will be unable to hedge January future contracts on MCX (and would therefore look at alternate options - e.g. NSE). This is a big risk as this is one way liquidity can move to another exchange. See below the extract (and the management refusing to provide a view on how they will tackle this saying it is a worst case scenario)

What would have helped is if the management had clarified how serious the current ‘technical issue’ raised in courts is. Fingers crossed it is a minor hiccup. Not sure if anyone else has a more detailed overview on what the risk of the current court case is?

Disc: Invested with a full position so likely to be biased

Even if they werent able to offer contracts from January onwards for a period of 2-3 months, even then the probability of liquidity moving to another platform is small. Main reason is that all contracts on the futures side (except energy) are compulsorily deliverable. That means that there is a vast warehouse network that underpins the digital trading. NSE or another exchange wont be able to replicate that quickly. If they cant do that, then buying compulsorily deliverable contracts becomes extremely risky (even if you have no intention of taking delivery). See what happened to oil futures contracts in USA in March 2020 when it was impossible to take delivery. Most likely, SEBI is arm twisting and will reverse their stance and allow MCX to launch new contracts in a worst case scenario.

In any case, options isnt a threat since NSE isnt even allowed to launch most contracts since they dont meet the 1000 cr minimum ADT criteria.

Disc: Invested

SEBI technical advisory recommended that MCX may go live with new platform.

Relief to the Co.

Link Here