good set of number management is very bullish for future growth. yesterday concall was worth listening.

management is experting improvement in ebidta margin from net quater.

growth in CDMO is quite good. i am holding it for 2-3 year till then their new capacity are live and running.

moving in a right direction. debt reduction is going on and management is moving the business in right direction.

tailwind continued, overall sector is posting good numbers.

dis: invested

(i am holding these stocks, please share your thought)

Really liking how your portfolio companies are all firing at the same time when it comes to earnings. What are your exit criteria for portfolio companies?

I use both technical and fundamental while entry and exit. When I find my holding are in good momentum and their value is not very on extreme i just hold on it.if valuation is not reasonable it start trimming it but slow until momentum is their. On portfolio level I need both fundamental and technical with valuation on my side. But in the end market is supreme.

| S.NO | STOCK | REVENUE GROWTH | EPS GROWTH |

|---|---|---|---|

| 1 | GARWARE HI TECH | 56% | 127% |

| 2 | KRSNAA | 22% | 89% |

| 3 | NUVAMA | 43% | 74% |

| 4 | SENCO | 27% | 40% |

| 5 | SUPRIYA LIFE SCIENCE | 19% | 93% |

| 6 | ORIENTAL A | 4% | 555% |

| 7 | LAURAS LAB | 0% | -46% |

| 8 | NEULAND LABS | -26% | -63% |

| 9 | THYROCARE TECH | 20% | 46% |

| 10 | PRIVI SPECILITY | 17% | 46% |

| 11 | DEEPAK FERTILIZER | 13% | 250% |

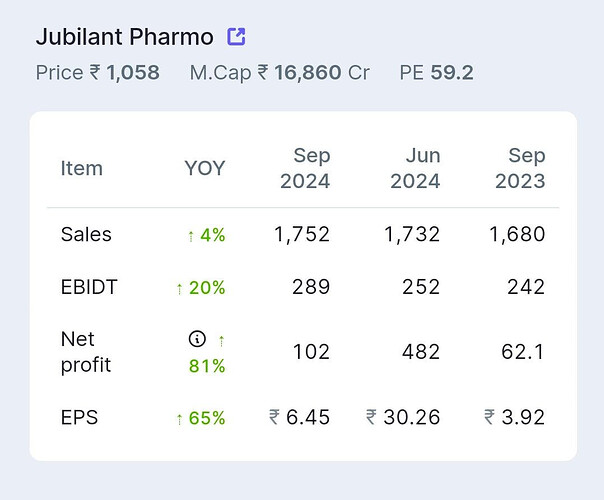

| 12 | JUBLANT PHARMOVA | 4% | 65% |

| 13 | Edelweiss Financial Services | 31% | 44% |

| AVERAGE | 18% | 102% |

On portfolio level earnings are quite good, currently portfolio is 5.5% down it is performing well against nifty ,where nifty is 10% down.

| COMPANY | PERCENTAGE |

|---|---|

| AWFIS | 4.1 |

| DEEPAK FERTILIZER | 7.1 |

| EDELWEISS | 4.8 |

| GARWARE HI TECH | 16.3 |

| JUBILANT PHARMOVA | 7.1 |

| KRSNAA | 5.9 |

| LAURAS LAB | 4.6 |

| NUVAMA | 10.8 |

| ORIENTAL AROMATIC | 3.6 |

| PRIVI | 6.5 |

| SENCO | 10.7 |

| SOLARA | 4.1 |

| SUPRIYA | 8.9 |

| THYROCARE | 5.6 |

| TOTAL | 100 |

Recently make some changes sold Neuland to buy Solara and add Awfis ,

Solara- It look likes management is moving in a right direction due to past performance valuation is also cheap.

Neuland - sold due to valuation getting better opportunity.

Awfis - expecting good growth, cash flow are good and enough for future growth.2-3 years are looking good for the company.

Do look at Pn gadgil, i had almost similar allocation to Senco but to me it seems like Png with such high growth looks reasonably valued & incremental chnage is much more in Png .Now with the entry of Png Rerating of Senco looks difficult at parlance with their growth.

Current portfolio status

| COMPANY | ALLOCATION |

|---|---|

| APOLLO PIPE | 2.4 |

| AWFIS | 6.7 |

| DEEPAK FERTILIZER | 5.2 |

| EDELWEISS | 5.8 |

| GARWARE HI TECH | 16.9 |

| HIKAL | 3.2 |

| JUBILANT PHARMOVA | 5.5 |

| KRSNAA | 5.8 |

| LAURAS LAB | 5 |

| NUVAMA | 6.1 |

| PRIVI | 6.7 |

| SENCO | 11.2 |

| SHEELA FORM | 4.5 |

| SHIVALIK RASAYAN | 4.2 |

| DMCC | 2 |

| THYROCARE | 5.5 |

| SOLARA | 3.2 |

| TOTAL | 100 |

I made some changes in my portfolio

#Sold Supriya

#trimmed Nuvama

#Added Dmcc

#Added Shivalik

#Added Hikal

#Added Apollo pipe

#Added sheela form

1.Sold Supriya due to peak margins, peak utilisation. Moreover I got better opportunities in other pharma stocks where earnings seems depressed right now. In pharma I am going with a basket approach where I added Lauras, jubilant pharmova, Hikal and solara.

2.Nuvama - Trimmed this stock due to my portfolio allocation constraints and because their profits from capital market business are almost contributing 60%+ which may become cyclical going forward.

3.Adding Dmcc and Shivalik rasyan as their management seems to be moving in right direction. In both these companies operating leverage can start playing, also I am thinking in terms of 3-4 years perspective. technicals starting to improve as well.

4.Apollo pipe - Pipes industry is going through the rough cycle, however in this tough time Apollo managed to have good working capital cycle and cash flows. Management is guiding for better growth and improvement in ebidta margin. I am adding it slowly as it seems like technicals are not agreeing with fundamental theory.

5.Sheela form- Same as pipes, mattress industry is also facing headwinds. My thesis on this is management, I like their acquisition strategy, they acquired Kurlon and Furlenco in downturn. Management is guiding for a 14-15% volume growth and improvement in Ebidta margins.

DISCLOSER: INVESTED

CURRENT PORTFOLIO STATUS

| NSE CODE | ALLOCATION |

|---|---|

| APOLLOPIPE | 5.45% |

| AWFIS | 7.69% |

| DMCC | 2.34% |

| EDELWEISS | 6.01% |

| HIKAL | 6.06% |

| JUBLPHARMA | 6.40% |

| KRSNAA | 6.99% |

| LAURUSLABS | 7.56% |

| ORIENTBELL | 3.71% |

| PRAJIND | 3.21% |

| PRIVISCL | 7.45% |

| RATEGAIN | 2.86% |

| SAMHI | 5.50% |

| SENCO | 6.83% |

| SFL | 5.76% |

| SHIVALIK | 6.44% |

| SOLARA | 2.69% |

| THYROCARE | 7.06% |

| TOTAL | 100.00% |

| Made some changes | |

| Sold Garware hi tech,Nuvama,deepak fertilizer. | |

| Added Samhi,Praj ind,Rate gain. |

I am making some changes in my process as short term tax is very pain full. Trying to hold companies with longer term view. all the changes which I want to make almost complete.Current portfolio is down about 20 percent which is normal because my whole portfolio is in small

And I want to stay in small caps and very happy to average my portfolio holding if they went down.

Dis:Invested and Biased

| COMPANY | ALLOCATION |

|---|---|

| APOLLOPIPE | 5.92% |

| AWFIS | 7.57% |

| DMCC | 2.61% |

| EDELWEISS | 5.49% |

| HIKAL | 7.83% |

| JUBLPHARMA | 5.95% |

| KRSNAA | 6.94% |

| LAURUSLABS | 8.49% |

| ORIENTBELL | 3.16% |

| PRAJIND | 4.06% |

| PRIVISCL | 8.27% |

| RATEGAIN | 2.32% |

| SAMHI | 5.07% |

| SENCO | 3.96% |

| SFL | 5.83% |

| SHIVALIK | 6.25% |

| SOLARA | 3.52% |

| THYROCARE | 6.78% |

| TOTAL | 100.00% |

Their is no chance in Portfolio Stocks in last 2 week added 17-18 percent lum sum in same stocks, added more money to the stocks which are showing strength in the portfolio.

| SECTOR | ALLOCATION |

|---|---|

| CO-WORKING | 7.57% |

| HOTEL | 5.07% |

| CHEMICAL | 17.12% |

| PHARMA | 25.78% |

| DIAGNOSTIC | 13.72% |

| TECH | 2.32% |

| BUILDING MATERIAL | 9.08% |

| GOLD RETAIL | 3.96% |

| MATTRESS | 5.83% |

| ENGINEERING | 4.06% |

| FINANCIAL | 5.49% |

| TOTAL | 100.00% |

Pharma and chemical are the areas where I am most bullish on, I am bullish on Banking and Finance to but because of personal reason i did not invest in finance stocks.

My expectation with Apollo pipe. Taking 20% revenue for next 3 year and ebidta margin went back to 12%.

| APOLLO PIPE | ||||||||

|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| Revenue | 518 | 784 | 915 | 931 | 1117 | 1340 | 1608 | 1930 |

| Ebidta margin | 14% | 12% | 8% | 10% | 9% | 10% | 11% | 12% |

| Ebidta | 72.52 | 94.08 | 73.2 | 93.1 | 100.53 | 134 | 176.88 | 231.6 |

| Other income | 8 | 3 | 2 | 4 | 3 | 4 | 4 | 4 |

| Interest | 5 | 4 | 9 | 6 | 9 | 9 | 10 | 10 |

| deprecition | 18 | 26 | 28 | 30 | 36 | 38 | 40 | 45 |

| PBT | 57.52 | 67.08 | 38.2 | 61.1 | 58.53 | 91 | 130.88 | 180.6 |

| TAX | 27% | 26% | 27% | 34% | 28% | 28% | 28% | 28% |

| Net profit | 42 | 50 | 28 | 40 | 42 | 65.52 | 94 | 130 |

| CURRENT MCAP | 1800 | |

|---|---|---|

| EXIT PE FY28 | EX.MCAP | CAGR |

| 20 | 2600 | 13% |

| 25 | 3250 | 21.70% |

| 30 | 3900 | 29.40% |

Pointers on what all opportunities and risk this investment could hold-

Thesis points-

- Financial risk profile remains strong, having robust capital structure and healthy debt coverage ratio. Also, over the medium term, APL plans to fund its ongoing capital expenditure through equity/ internal accrual only.(If industry remains in headwind due to their balance sheet they can survive.

- They have establish strong distribution network. This extensive network ensures product availability and enhances brand presence in both organized and unorganized markets.

- Company is transitioning from a North India-focused company to a pan-India player, allowing them to tap into new markets and diversify their revenue streams. The establishment of manufacturing facilities across various regions enhances proximity to consuming markets, which is critical for success in the piping industry.

- Company has a strong brand value, therefore while expanding into other regions, there won’t be much difficulty for products acceptance.

- They are focusing on increase in share of value added products, hence higher margins.

- Acquisition with KML-

- Apollo will gains access to KML’s extensive distribution network, Allowing them to penetrate these markets more effectively and expand their geographical footprint.

- Previously KML offered diverse range of high quality products, this will complement Apollo’s existing product lines, enabling the company to cater to a broader customer base and meet diverse market needs.

- Also Kisan Mouldings had established strong brand equity among key stakeholders, including farmers, builders, and architects. Integrating this brand with Apollo’s reputation for quality can enhance customer loyalty and drive sales growth.

Antithesis points-

- Susceptibility to fluctuations in raw material prices. The price of PVC resin are volatile as well as change in regional demand supply dynamics.

- Intense competitive pressure because of low product differentiation and high price sensitivity.

- Aggressive discounting by large players.

- Faces competition from both large players as well as unorganised segment.

This is my expectation please dont go for it.

Dis. Invested and biased

AWFIS

Thesis points-

- Managed aggregation model-

- Instead of leasing properties like rivals, awfis partners with property owners making them business collaborators.

- This asset-light model reduces capital expenditure, mitigates financial risk for both the company and property owners during economic downturns or occupancy fluctuations.

- Awfis has expanded rapidly across India, including tear 2 cities. Tier 2 cities are experienceing rapid growth with demand surging at a 25% cagr, providing awfis with a first-mover advantage.

- They provide Tailored solutions for enterprises and SMEs, awfis has developed offerings specifically designed for SMEs and larger corporations. By addressing the unique needs of these segments, awfis has broadenned its client base beyond startups and freelancers.

- They have leveraged technology to enhance user experience and operational efficiency, features like touch free smart scans, geo-tagged attendance management, and desk booking through their app has streamlined workspace utilisation and improved client satisfaction.

- They maintain a low debt to equity ratio and superior return ratios contributing to its financial stability.

Anti thesis -

- Though the company is moving to the asset-light MA model, AWFIS is still required to incur a significant amount towards fit-outs and the same have been funded by cash accruals and investor funding till June 2023.

- The real estate sector in India is cyclical and volatile, resulting in high fluctuations in cash inflows because of volatility in realisations.

- The number of operators has grown rapidly, with major players like WeWork and IWG expanding aggressively, alongside numerous local and niche providers.

My expectation with AWFIS

| Awfis | ||||||||

|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| Revenue | 178 | 257 | 545 | 849 | 1296 | 1750 | 2275 | 2730 |

| Ebidta margin | 30% | 27% | 29% | 29% | 32% | 32% | 34% | 34% |

| Ebidta | 53.4 | 69.39 | 158.05 | 246.21 | 414.72 | 560 | 773.5 | 928.2 |

| Other income | 38 | 22 | 19 | 25 | 67 | 26 | 26 | 26 |

| Interest | 47 | 49 | 73 | 93 | 125 | 156 | 187 | 224 |

| deprecition | 87 | 98 | 150 | 196 | 264 | 314 | 364 | 400 |

| PBT | -42.6 | -55.61 | -45.95 | -17.79 | 92.72 | 116 | 248.5 | 330.2 |

| TAX | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net profit | -42.6 | -55.61 | -45.95 | -17.79 | 92.72 | 116 | 248.5 | 330.2 |

| CURRENT MCAP | 4766 | |

|---|---|---|

| EXIT PE FY28 | EX.MCAP | CAGR |

| 25 | 8255 | 20% |

| 30 | 9906 | 27.62% |

| 35 | 11557 | 34.35% |

Dis. Invested and biased

My Investment rational in DMCC:

The company has a strong R&D focus, supporting innovation.

They leveraged R&D investments to compete with Chinese companies- focusing on product differentiation, targeting niche markets, offer products that met precise international standards, developing high-margin specialty chemicals tailored to specific customer needs, aligning with global market trends and diversifying its product portfolio.

They offers nearly a century of chemical manufacturing experience.

Based on various conference calls and the history of this company, management displays several notable qualities-

They have shown the ability to pivot their business model,

They seem R&D focused and adaptable, also continuing to invest in process development.

They believes in shareholders long-term value creation.(Taking short-term pain for long-term gain)

Conservative management, no over optimism or pessimism

Very low attrition in the company even during bad times.

The balance sheet is in good condition.

On experting the number it is very difficult but if thing went good for DMCC

It can went for 20% ebida margin in 3 year experting 2 time asset turn and some 40-50 cr capex their revenue can touch 600 cr of sales.

| Ex.Fy2028 | |

|---|---|

| Revenue | 600 |

| Ebidta margin | 20% |

| Ebidta | 120 |

| Other income | 10 |

| Interest | 12 |

| deprecition | 18 |

| PBT | 100 |

| TAX | 28 |

| Net profit | 72 |

| CURRENT MCAP | 643 | |

|---|---|---|

| EXIT PE FY28 | EX MCAP FY 28 | CAGR |

| 20 | 1440 | 30% |

| 25 | 1800 | 40.94% |

| 30 | 2160 | 49.77% |

Number are looking crazy so please dont fall for it as their are many risk which can change all of these expectation, but for me the down side was limited and upside can suprise.

Dis. Invested