Manpasand Beverages and Parle Products to jointly distribute their brands in Western markets now

http://equitybulls.com/admin/news2006/news_det.asp?id=227346

Not directly relevant. But provides an overview of fruit drink market.

I came across the below analysis today regarding Manpasand.

https://2point2capital.com/blog/index.php/a2016/12/06/the-curious-case-of-manpasand-beverages/

Is anyone worried regarding the corporate governance standard of Manpasand? I have a 15% portfolio allocation and hence want to confirm that my thesis still stand strong.

Only point that troubled me is very low salary to management personnel.

Regarding other points as high equity dilution, I actually consider this as a strength for a fast growing company to have zero debt.

Fact that both Pepsi and Parle recognizing the threat posed by Manpasand validates that Manpasand capturing their market share is real.

For this, the company is not only doubling its capacity but also ramping up its distribution network. On the back of this, by 2020, Manpasand expects to process five times the quantity of pulp at 12,000 tonnes per annum to produce more varieties of vegetables and fruit juices

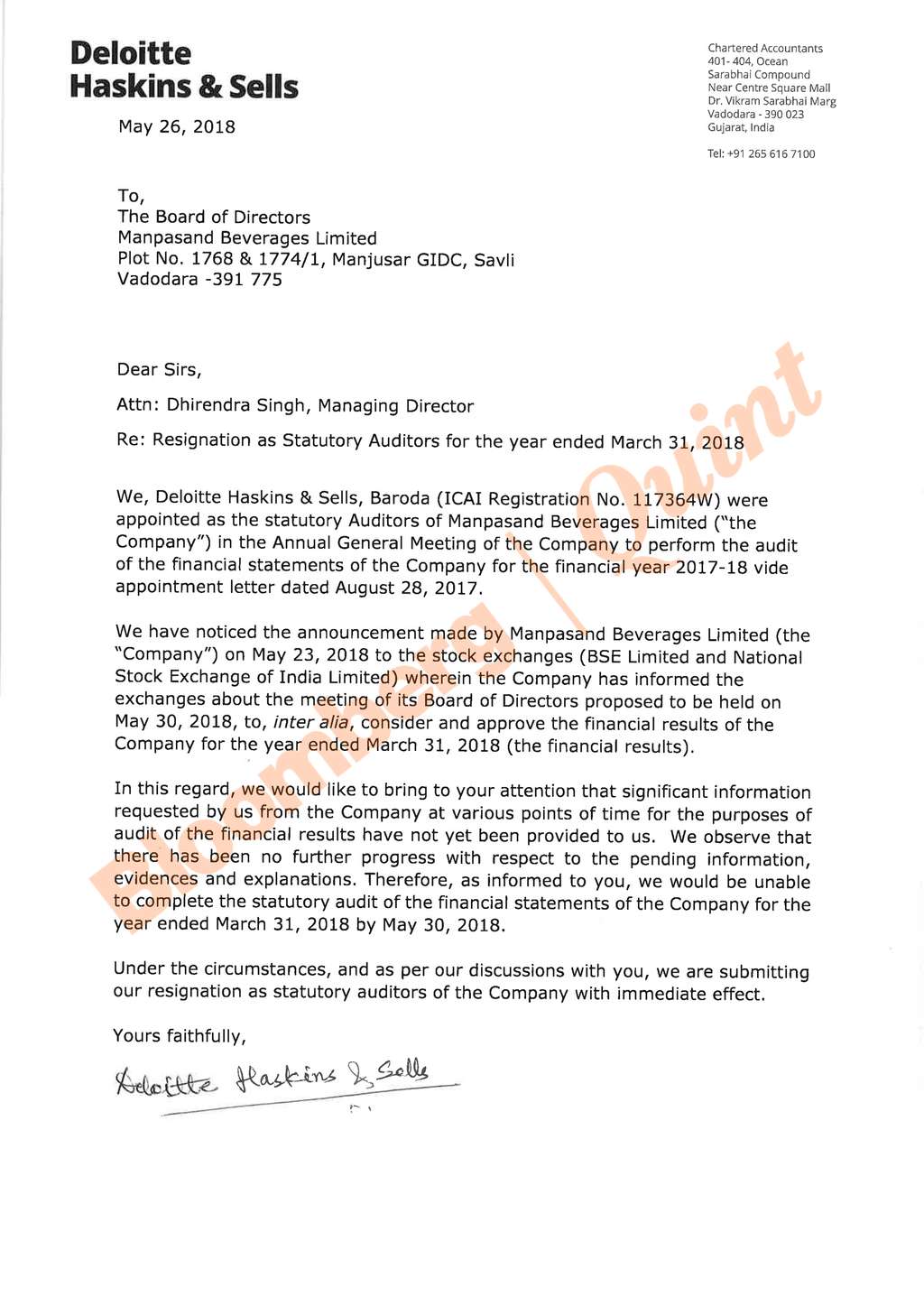

Deloitte has resigned as auditors of d company just 4 days before declaration of the results. Is this a red flag ?

It is a clear red flag and I am going to stay away from such company but huge holdings of Motilal oswal only surprised me.

Mehra Goel is the new chartered accountants who also audited Bhushan steel, jay Bharat, MTNL, Shyam Telecom etc. some well known names and some spectacular failures as well. Very disappointing sucha thing happens a few days before AGM. May try to reduce today.

In their letter to the exchanges, the company had categorically said that the resignation had no correlation to the financial results announcement. Well, it looks like that wasn’t the case.

Near-term future at least on the stock market looks very bleak now. Shareholders may find it very difficult to exit as well.

This stock is widely owned by institutions. Between promoters and institutions, it is owned 97% and is just 3% owned by retail shareholders. It is currently a zero debt company which should Have real assets to back its book value. So I think there will be a floor where it can hold from further downside. Probably another 20 to 40% downside. But it still turned out to be a huge wealth destroyer and probably will not command such high valuations anytime in the near future.

Just 10 months ago, Motilal Oswal had initiated coverage with a target price of around Rs. 900.

Despite the army of highly educated analysts and bulging research budgets, institutions often aren’t able to detect misdoings at companies. We, as retail investors, have a much lesser chance of discovering misdoings.

It’s almost always wrong to mirror the stock picks of leading institutions.

It pays to be circumspect.

Better safe than sorry

On a ligher note, even Deloitt would have surprised to see its Signature !!!

They are now going the use this signature as their new logo !!!

Great efforts by letter designer.

Are you meaning that the letter is fake? Bloomberg Quint is a reputed Group and generally that is how an audit firm will sign off which will also include the signature of audit partner

You’re right, it is sketchy. Generally the lead partner signs in his capacity as the partner of the audit firm. Deloitte Haskins & Sells cannot sign a document. Will be interesting to read the contents of the letter it shot off to the Companies board, ICAI and the new auditor as they’re required under various legislations.

“Deloitte has been auditor of Manpasand Beverages Limited for 8 long years, and we have been

providing all required information as and when required by them. While there could have

been some delays but we have never denied sharing any information with them ever.”