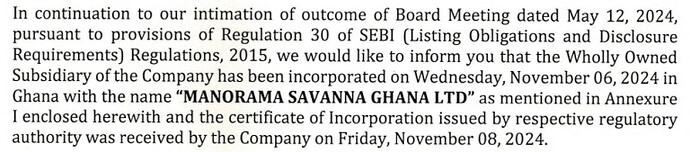

One More Subsidiary in GHana

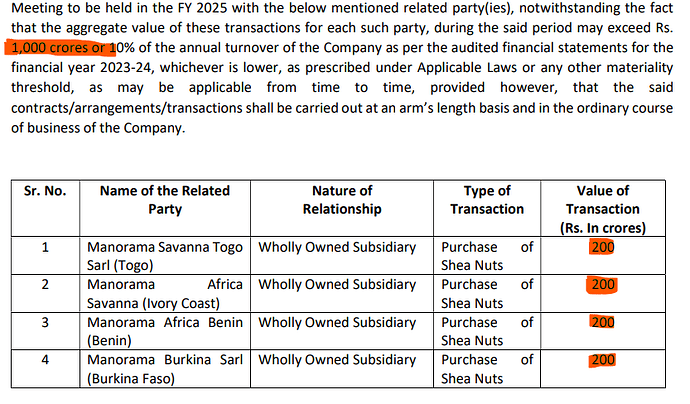

Seems Procurement going to be 1000+ Cr in Near Future

200*5 Subsidiary(Ghana is not mentioned in Notice) + Domestic Procurement

How much of it will be saleable could be the question.

Does anyone has readymade(extracted) data for 500 cr of annual sales how much procurement they did ?

it will give us idea.

Is the company not conducting a Concall for Q2 results? I thought with Q1 results, they started the practice of conducting quarterly Concalls.

Doing concall is not compulsory. They may do it once a yr or twice a year / every quarter.

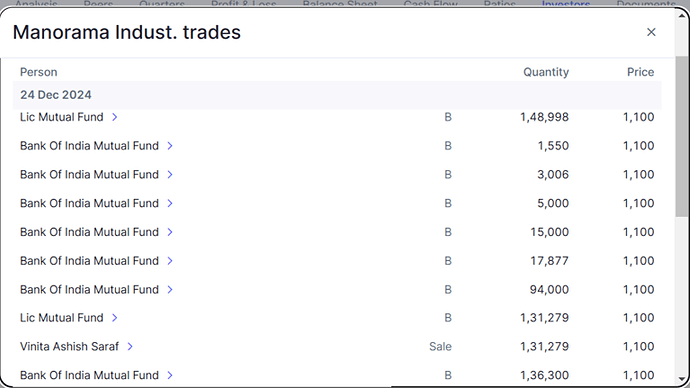

Sale of shares by promoter group.

Three fund houses (Bank of India Mutual Fund, LIC MF & Birla Sunlife Mutual Fund) have entered into the stock; via the sale of shares.

All rounder performance by the Company

https://www.bseindia.com/xml-data/corpfiling/AttachLive/25292413-b204-4ff2-a718-60440fb6ee99.pdf

Finance Cost seems too high.

After Company received IND “A-” from IND “BBB+”

it shall come down

Adding some views by a friend

Company can do 40crs + pat in Q4FY25

Which is equal to fy24 PAT

And I feel next year company can do more than 200crs pat

And new capex announcement is come

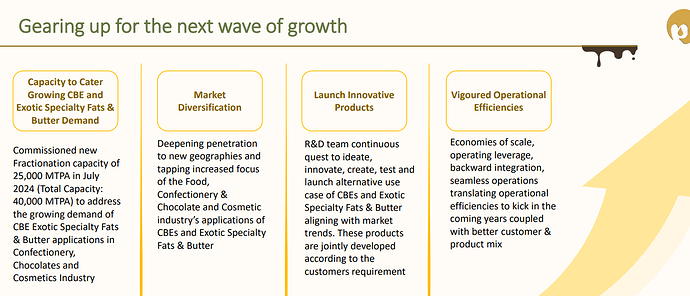

Currently they are 40000 mtpa

Next year they can added more 20000 mtpa

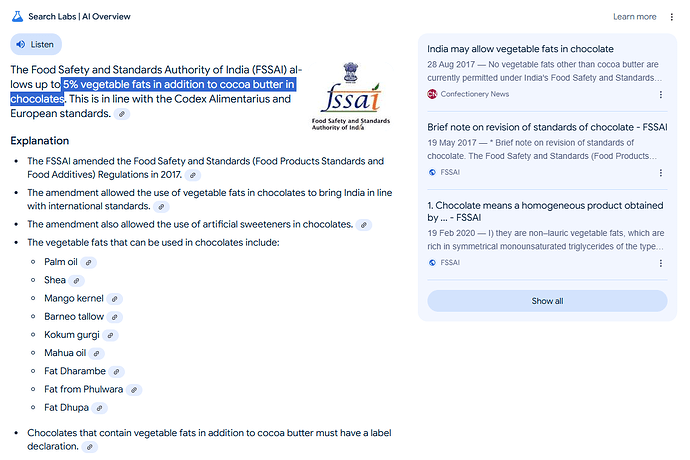

If coco butter price go up more then clients prefer more CEBA

But max can be only 12.5% mix in India

Also they are increasing value chain

Which can be seen in margins number

For remaining 20000 mtpa no need of land

Post 20000 company can buy land

FY26E

I feel 250-300 crs sales every 3 months

PAT can be 200crs

PE can be anything

Because currently Roce is looking not so great which will be very big post q4

Also soon company will be free cash flow postive

No need of external cash for growth

Africa business is same as indian business

Raw material cost is going down so GP margin is increasing

Asset turns will increase soon