Agree on the management part.

The 10-year example is undoubtedly an extreme case and is not intended to be seen as a virtue. If the fundamentals are neither convincing now nor expected to improve in the future, holding on to hope serves no purpose.

I don’t see selling above 200 is very good decision. Let wait for MFI sector to take uptrend, that will be the best time to sell. Any news from bain capital in meanwhile will prove cherry on top.

Disclaimer: buying from 89 levels and will remain invested till the cycle turns.

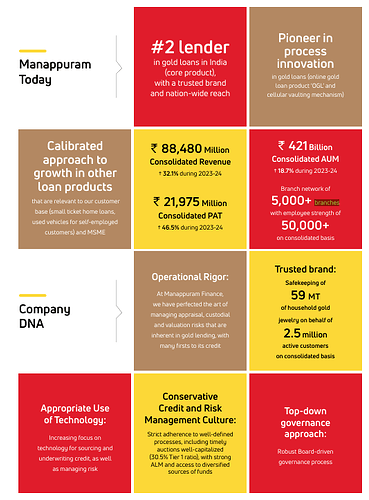

@thakurvi thanks for your inputs. At my end Manappuram has become almost 33% of portfolio ![]() due to consistent buying in last 5 years at all levels - partially because of its relative cheap valuation - partially because of knowing the fact that lending against gold is one of the safest mode of lending (other than pure Housing Finance).

due to consistent buying in last 5 years at all levels - partially because of its relative cheap valuation - partially because of knowing the fact that lending against gold is one of the safest mode of lending (other than pure Housing Finance).

However, now want to diversify in other such companies as well - where there is growth in industry as well as promoters have fire in belly to grow business either themselves or through high caliber operating professionals.

For Sure, a new promoter like Bain Capital or some other business house (like IIFL, Aditya Birla Capital etc. buying out VP Nandkumar) will be a main reason to stay invested in Manappuram for years to come.

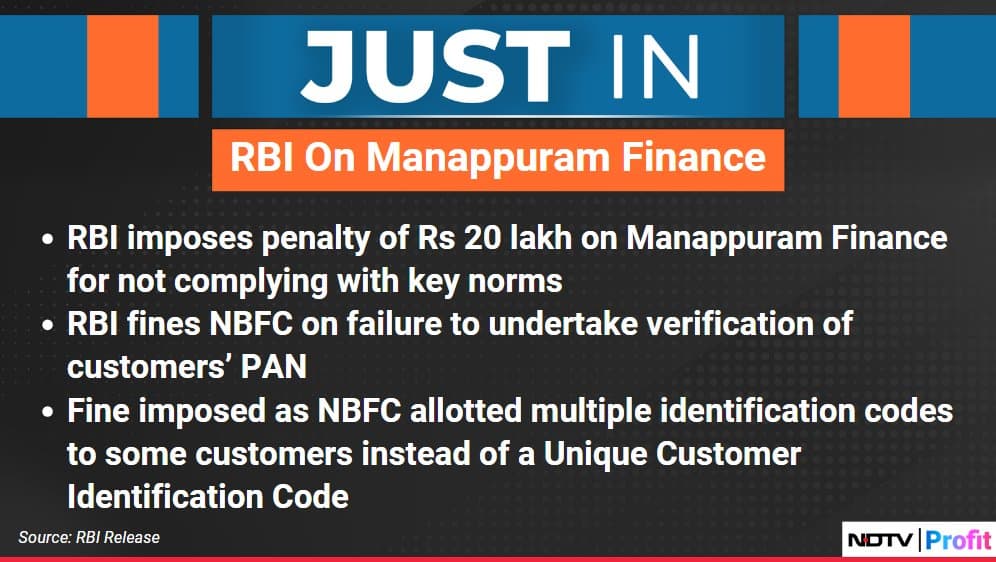

such failure on customer verification and lose system of customer database management is matter of concern, Customer data is very critical resource for any company, since there are multiple codes for single customer, how they will leverage the data. this shows lack of management risk management and strategic thinking.

This is a common problem in almost every financial institution, most of them would be old customers, its more prevalent in the industry then you may think (even in SBI, PSB etc, probably in big 4 banks too)

yes I agree, but pan verification gaps and getting fined by RBI is big, they are not able to resolved this till now and Navi is fast to resolve. (they are big and big organization need more time to resolve). I had multiple accounts in HDFC in 2009 and bank mapped them and i had to close one.

Anil singhvi bullish target 375 rs

Lets see how long it can trade at such throw away and cheap valuations

Muthoot P/B 3.5 vs Manappuram 1.3

Muthoot PE 21. Vs Manappuram 7

both growing at almost same rate

- hopefully soon ashirwad will be out of ban which

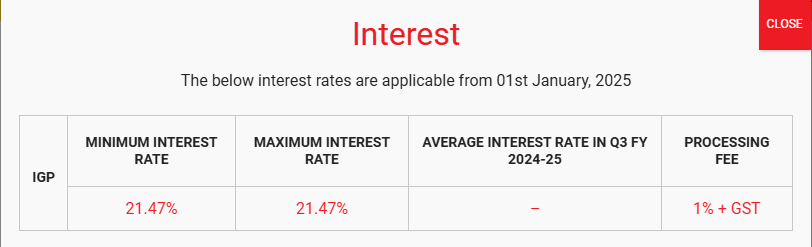

https://asirvadmicrofinance.co.in/micro-finance/

Asirvad has updated ROI, PF, Pre-payment charges etc. at their website.

Think such price they not even offering to Gold loan customer(s) in Manappuram.

Think within Jan 2025 - RBI Ban must be removed for subsequent lending.

I think if your hold period is 2-3 years from now, then manappuram is good bet to take. Once MFI sector recovers, promoter will defintely go for market listing and with gold prices surging, it can be win win situation for manappuram. Any news from Bain capital can give boost to its market capatalization. Till then it is roller coaster ride with severe ups and down.

What I learn today is investing is also about probabilities and probabilities can happen or not happen. It is 50-50 case.

What is my take: Let see how far I can enjoy the drive with manappuram. Valuation is on our side. I am buying from 89 levels and bought till 160 levels. Average cost lies between that. Holding for 2 years in this journey with full of uncertainity.

Growth is never a concern in the lending business as long as risks are effectively managed. In the gold loan segment, risks are minimal, and Manappuram’s portfolio is heavily focused there. Currently, with Asirvad offering very low rates, we can expect substantial growth, but it’s crucial to focus on profitability. The growth potential remains vast. This year has seen significant clean-up in the gold loan sector and NBFCs under the RBI’s stricter regulations, creating a more level playing field. These are interesting times ahead, in my view.

Removal of supervisory restrictions: Arohan Financial Services Limited,

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=59452

Another positive hope for Ban to be lifted from Asirvad soon.

On Dec 02, Ban was removed from Navi.

On Jan 03, Ban has been removed from Arohan.

Huge positive for Manappuram

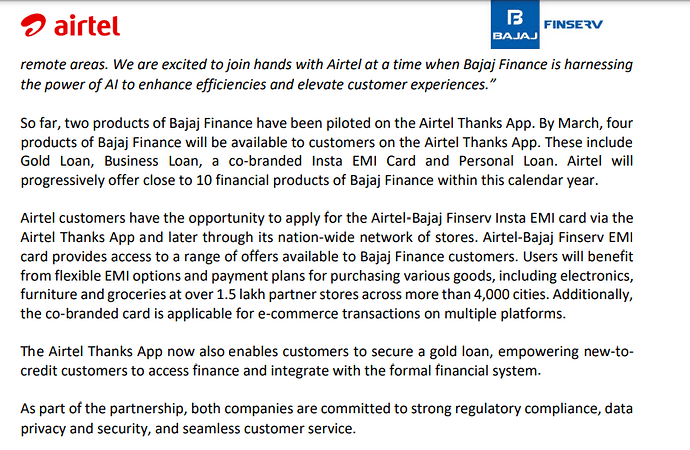

Bajaj Finance tied up with Airtel to offer Gold Loan (among many other products).

Assuming the scale & seriousness with which Bajaj Finance operates, and Airtel’s desperation to get a pie of Finance sector (since JIO via JIO finance is already into this sector) - any thoughts how it can impact gold loan lender like Manappuram in medium to long term.

In my view, the scale could be easy through digital lending for airtel customers. but it is going to be interesting how do they check the quality of the gold? or How do they store it? Is it applicable only for gold stored in bajaj finance branch, the digital lending is option?

Manappuram Finance Limited currently has 5000+ branches and expanding. I’m not sure about the competitors, but #2 lender in gold loans (as per the AR 2024)

Bajaj Finance intends to be amongst the top 3 players in gold loan & MFI segment.

As of now present in approx. 4250 locations, and aspire to add 1000 more locations in next 3-4 years.

No doubt, in gold loan, secure safekeeping of borrower’s pledged gold would be the most challenging task for a lender … but in case Bajaj Finance has kept Gold loan as a segment to grow … they will get possible solution to overcome such challenge.

If that happens, will Manappuram growth would be impacted … will be a key data point to monitor.

| • | The sector demonstrates strong growth potential but faces certain challenges. | |

|---|---|---|

| • | Regulatory scrutiny from the Reserve Bank of India (RBI) | |

| • | These regulations may temporarily slow growth in the short term. | |

| • | However, they are expected to enhance the industry’s long-term stability and transparency. | |

| • | Let’s see which competitor emerges as the leader, though it’s likely that all players will gain some market share. |

Manappuram has the advantage of cheap valuations

- Case has been booked against seven microfinance companies

- Aashirvaad Micro Finance (Manappuram Finance Limited)

- Sathya Micro Capital Finance Limited

- Unity Small Finance

- Suryodaya Finance

- IIFL Samastha Finance Limited

- L&T Financial Services, and

- BSS Micro Finance Limited (Kotak Mahindra Bank)

Source: Case against 7 microfinance firms over woman’s suicide | Latest News India - Hindustan Times

This is broader trend of governments now getting actively involved in regulating activities of MFI’s.

Looks like the pain in MFI is only going to get worse.

It’s scary that 7 different institutions have given out loans to the same individual makes you wonder what sort of due diligence they are doing despite claiming to stick to prudential norms