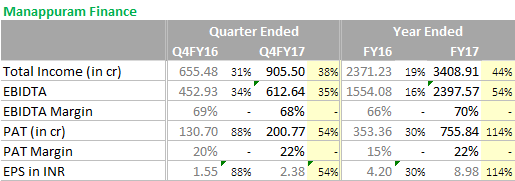

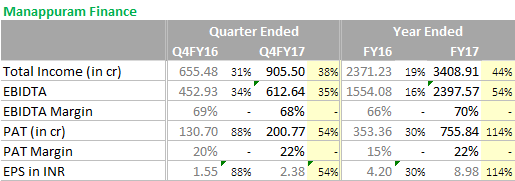

Prima facie numbers look good,

However asset quality deteriorated a lot on the MFI Book,

Prima facie numbers look good,

However asset quality deteriorated a lot on the MFI Book,

However, diversified Microfinance is loss making in Q4 (-151.7% Q-o-Q). Not sure does management is capable to turn around, as they have limited understanding of that business. GNPA 4.66%!.

Q4 net profit at 207 Cr - growth of 67% YOY on a great year. Yearly profits up to 727 Cr

http://www.bseindia.com/corporates/anndet_new.aspx?newsid=1a353124-1986-4ffc-8287-801cbecaaf58

Q4 results and presentation http://www.manappuram.com/investors/quarterly-results.html

Observation is correct, but i believe it should be seen in larger perspective of on annual basis.

industry situation due to demonetisation was being disrupted and hence reading in between the lines for one odd quarter may mislead. having said so, important will be to be alert for current quarter Q1 trend to really confirm Q4 being one off to ignore.

I saw it. If you compare with other Microfinance companies who released Q4 results, these incumbents have recovered well in Q4 with some growth. Hence, need to view critically Mana Fin Management’s competency, which is deep red. As microfiance biz need different strategy…

One critical question with Manappuram’s business strategy going forward is how viable this gold loan product’s going to be in the years to come. I mean, what’s stopping banks from winning away a sizeable market share from gold loan nbfc’s. In the Q4 investor presentation, Manappuram has done a great job comparing their product with that of banks. But the interest rate differential is just too high to sustain. It’s quite a low hanging fruit for banks to exploit. Online gold facililty where you deposit gold at any branch and avail of loan 24x7 is not a technological innovation by any means.

Also, the general argument that people may not have a bank a/c but would most definitely have some gold doesn’t hold merit. Manappuram is disbursing 60% of incremental gold loans directly into bank accounts. So their target customer base is definitely not the unbanked!

Management commentary too is focussed on the size of the non-gold portfolio.

Views and thoughts invited!

I think what separates any NBFC from banking channel is the reach, penetration and focus. It includes micro finance, transport finance, gold loan or simply home loans. Banks have been doing this for years but they are also doing a ton of other things and somehow NBFC’s have made hay where banks overlooked.

Another point is a large bank would’ve rigid policies and documentation process while Mannappuram/ Muthroot provide that personal touch at local level that a borrower might be looking for.

That argument can be made for why can’t banks do any NBFC can do. For one, Banks do come under different rules and guidelines compared to NBFC. A simple example, we have a HMCL dealership - NBFCs can advertise 0% interest but Banks can not due to some RBI rules/guidelines.

NBFCs provide greater penetration, they have more relaxed policies, they focus on getting more smaller customers and are focused on the loan business.

Does anyone idea or asked during con-call -

Consolidated Assets (Fixed+Other) de-growth -7.9%, while income from Operations increased by 43% (Y-o-Y). How management able to do it? OR Is I am missing anything?

Thanks.

As I m banking professional, i know that though we offer lowest interest rate, our loan to value s still lower than nbfc such as manappuram, muthoot etc…, Those customers who need more money , have no other option than nbfc . Therefore, set of people still depends on it only.

Business hours of psu banks are 10am to 3.30 pm. So customers can pledge their gold ornaments during this hours only. In case of NBFC, customers may pledge their jewels , even at 8 pm i think so.

Nothing. But banks tried that in the past and it didn’t work for them as they are not geared for making small ticket loans. They are looking for multi-crore wholesale loans. Banks with wider reach have assets that are about 100 times assets of gold loan companies. even if they take entire business away from gold loan companies it will only add about 1% to their loan book.

Gold loan is practically micro finance with adequate security and that’s why it has best of both worlds. Any financial institution will die for the combination of very high yield and low NPA since gold is the most liquid assets. The key question of execution is more or less settled. The quick turnaround, flexibility in packaging loans and low cost operations compared with banks is not the only advantage. IMO, there are few issues to be settled for which some cooling period is required. Volatility will always be there in this biz and past corp governance transgressions would need to be forgotten. Only thing it needs is time to settle all negative notions and domestic investors to come back.

Disc: Invested

Manappuram share price is undervalued (Price Vs Value) though it has good business model, strong management, decent growth, good results. What could be reason from Mr. Market? If the stock is undervalued for so long we may need to re-think!

Disc: Invested during demon. If i find better opportunity, i will switch lanes for long-term

One of the reasons stock is undervalued (I think) is Mutual Funds are staying away from gold loan companies. Manappuram is owned by very few MFs, the market is reaching new highs on backs of SIP revolution.

yes but till howlong is the question growth will have to be rewarded patience willbe tested…

“NIRMAL BANG” Came up with their report after Q4 results and they are not seeing much growth in FY18 as PAT/EPS numbers are almost same as FY17. Not really sure about their theory behind such low projections.

Disc : Invested

Typical nonsense from brokerages. They invent numbers to arrive at ‘acceptable/marketable’ TP else how would they explain price behaviour. They say 10% growth in gold loan AUM, strong growth in MFI, home loan and CV loan. Cost to AUM to fall to 5% but asset quality to deteriorate and hence cut in estimates. The assumption regarding asset quality is very subjective.

Another brokerage (Edelweiss) downgrade their growth estimates, but better than what Nirmal Bang suggested

Not to read these reports for price targets, but to know their opinion about what these experts think about business performance and then monitor the key concern areas, highlighted in reports, yourself going forward .

Helps to learn the industry.