Laurus is already close to $5 billion mcap. One should be cautious on its future prospects as Biologics is a game that even biocon is finding tough

Laurus market cap is 3.25 bn.

Will delete this post tnrw

I was reading about Neogen. Doesnt it look over priced at 112 Price to earnings and 20 Price to Book along with excessive debt? It would take a long time to come to a buying range. There is always a dilemma in my mind when buying. Which businesses to buy? Both Neogen and Laurus looks good. Laurus looks cheaper with respect to earnings plus it is not as leveraged as Neogen.

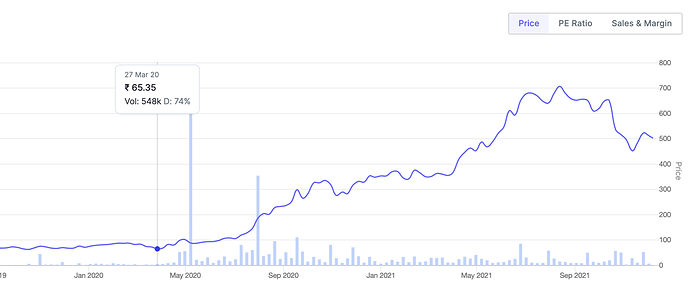

I just entering laurus couple of weeks back. Considering Laurus the runup from sub 100 levels, I guess I might be buying on the higher side. I still like the Laurus business which @Malkd is confident about but I am not sure whether I should buy more.

I like the passion with which you write about your favourite businesses. It is pleasant when reading about how you develop conviction for your investments. You are able to treat your investments well as your own business. I strongly presume you would like your investments to yield better than your own business. I will keep coming back for your thought regarding your convictions.

How do you see this risk in Vaibhav Global? While the business model of the company seems quite moated, the jewellery segment in India has had its fair share of crooked promoters. The subsidiaries in BVI through which most of the sales are routed scare me; how did you get comfort around that?

@visanty

My business is a debt free, high margin, cash in advance, low risk business that i can grow with increased involvement, efficiency and hard work. I don’t see the point in putting more money here than i currently do so i work with low costs and grow with additional time spent and work done by me.

With my PF companies I don’t have any direct involvement and the only contribution I can make is adding money when I’ve got cash available through my main business to increase my PF size and hence increase future returns.

So with business my growth is equal to higher efficiency/involvement and hard work… and with my PF growth is via initial study and a little bit of tracking and patience… So while I want both to grow they both grow in different manners. I do expect a good yield long term though

Clubbing VG under the other shady jewellery businesses isn’t fair tbh(and is branching out away from jewellery too). As long as I don’t feel like I’m being cheated(and keeping track every quarter has given me no reason to feel cheated by the management) I’m fine with my investment here.

I was a bit worried regards the Myanmar issue but then VG actually came out and addressed it directly which was refreshing to see and I nearly doubled my holdings post that at what to considered cheap valuations. They’ve been good to shareholders regards consistent dividend too and that combined with their balance sheets shows me the money does exist and isn’t being diverted into nefarious means. It’s now one of the largest holdings I own as far as cost is concerned ie laurus and deepak are a lot higher due to their huge runups but VG has a lot of capital in it and I’m sitting on a 15 percent loss(I don’t expect to see much of a return here for the next few years but I’m still quietly confident) . I have done my study and If I wasn’t confident I wouldn’t have so much at risk so il let my allocation do the talking here

@Malkd are you still tracking saksoft or done with it?

Do you think their logistics and fin-tech verticals are really worth looking?

Hey @Shikhar_Seth … i was intrigued by saksoft at the beginning of last year if i remember correctly since it looked juicy both fundamentally and technically and after a few interesting concalls. Had narrowed it down to 3 companies ie saksoft, expleo and intellect design arena. Rather than split my investment i put all my IT company money into Intellect design arena and haven’t really looked at saksoft since. Had posted my notes in the saksoft thread and haven’t really followed up or looked at them since so i dont have anything new to add. It seemed a risky punt even at the low 300s when I was studying it ie before it rose 3x … i cant see too much having changed since then since the time period has been less than a year (except for the risk reward becoming even more unfavorable since it’s now in the high 900s)

thanks @Malkd for the prompt response.

I saw your past thread,definitely saksoft looks fine on books and their business verticals looks interesting.

Don’t know much about valuations, how it seems risky or undervalued.

I am pretty impressed with the acquisitions they made and partner with UI path, but need to read more about management and how they good they are with implementation

also can you let me know are you tracking innovana thinklabs? In case yes, it will be great to listen your few cents on it

It’s been a while since I’ve posted an update here. Mainly because nothing has changed as such. Not sold a single share of anything yet… and I haven’t really bought anything for a while now since I’ve been working on building a safety net to cover my business via wintwealth, itc and fds as mentioned last year. Considering results of most of my companies are out(and there seem to be a lot of controversial results within those too) I’m just posting a few thoughts on those

Laurus labs: Somehow the panic here reaches unreal levels mid quarter almost every quarter with everyone posting their bearish long term views. With laurus i have one rule… wait for chava to speak. The results have been obviously poor… and the threat to their core business is there for everyone to see… but all that goes to the wayside when chava clears everything in his interviews and concalls. I agree with him totally wherein the company will be a totally different one a few years from now with a change in product mix by then and I’m happy to stick around until then(that being said I’m going to be a bit more cautious about comments now on in since i got a bit blindsided by how chava totally ignored telling us about how stocking lead to those few crazy good quarters)

Deepak I’m very happy with… few quarters of pressure is nothing here. The long term story with this company and the chemical sector is still one of the best in the market imo.

Financials like ugro and idfc(i own both idfc first and idfc) have outperformed and i see a few headwinds but I’m happy with the optionalities here long term.

Intellect design arena keeps chugging along beautifully and the target of 70% SAAS is well on

track… though lumpiness (and bearish projections when this does occur) is expected in the short to medium term. Reits are almost back to pre COVID levels regards their business… and I’m well chuffed with my huge embassy reit allocation at all time low levels since the storm seems weathered. Itc is back at buying range so i can treat it like an FD again.

The only company I’m disappointed in is vaibhav global. That being said i still love the business model so even though management seems to have higher expectations than they should have(and so did i) I’m still happy to own it. Nice dividend, safe and honest management and low risk business model … though I’m expecting a few years of pressure here until Germany capex done. Won’t be adding any more here… though i won’t be selling yet either(another 8 quarters away at the minimum from making that decision)

Overall, I’m happy. Maybe I’m a bit pigheaded and stubborn regarding my investments but I’m pretty sure theyll be worth it in the long run. I havent really studied new companies since i don’t find the risk reward in my favor currently in the stock market. Plus there’s nothing more annoying than studying a company only to not invest in it and regret later(I’m still annoyed about kpit and racl and a couple others since I’d done the hard work of researching them near their all time lows lol). Probably still around 4 months away from building my safety net so i won’t really be researching new companies or buying more shares until then and I’m not really bothered about whether the sensex falls to below 50k or goes above 70k or if my PF outperforms the nifty 50 in the medium term(spoiler alert: i have underperformed the nifty 50 for months now lol) which is the best mindset possible for me to handle this volatility since now I’m pretty sure Il have the patience to withstand a few years and let compounding take its course…

That’s about it from me… cheers to anyone who still reads my posts considering how infrequent they now are

Hi Can you share yr thoughts oN IDA and Xelp after so much run up. Have they come into buying range . I have read IDA presentation abt SaaS and there Core function in SaaS. Very impressive.

I am not sure of promoter quality of IDA And Xelp. For Xelp hardly anything available on net .

I have invested at Expleo sub 500 as a value buy , MNC stock available at less than 10 PE with unique business model. It has run up well.

Pls guide.

Thanks

Did something very rare today ie i started investing in a new company again… After a loooong break. Took a relatively safe, but big bet on Strides Pharma. It just checks every box for me as a value /safe investor. It is in my favourite sector ie Pharma so i am able to track it easily. It is available at around 1x Sales presently with the stelis optionality in the near to medium future too giving a fairly good margin of safety. The concall was a joy to attend and things finally look like they will turn a corner. I have been tracking this company for a year now… earlier it was way too overpriced for me. Then it got cheaper but they were in the midst of a beating both in business and technically. Now it’s a perfect price point and on the verge of a turnaround too. The risk reward here is perfect for me. The other 2 businesses I am very close to investing and i find the risk reward in an investors favor are Edelweiss and amaraja batteries. Again, both are not market favourites… but they offer a good margin of safety and with patience one one’s side they could be good bets long term too. I have nt yet made my move on these last two companies though(something just doesn’t sit right with Edelweiss for me regards rashesh’s guidance vs actuality and i need to clear that before I make my decision)

Disc: not a sebi advisor.

Hi @Malkd

These are following I noticed,

- High Debt Equity ratio along with poor Return of equity.

- Promoter holding is very low.

- Low Price/Sales but high PE

Can you elucidate on why is this stock so interesting other than the sales growth in business and turning around.

Regards

@visanty

When investing in value bets there are issues i agree… and these issues are why a business is available for cheap. It’s all about looking in further and seeing if these issues will be non issues in a few years

Debt will reduce as operating leverage kicks in. Promoters have just put in cash at 485 per share showing their intent to reduce debt (and also helps with the low ownership problem with their skin in the game through this). Whatever route they go with via stelis should help in this too… plus they have cash from arrotex on the way. PE is high because they currently dont have much to show in terms of earnings. As costs go down (freight, inventory will normalise over next few quarters) and operating leverage kicks in their profits will increase and the PE won’t look high anymore.

Overall at 1x sales I’m willing to take the risk especially since i have long timelines when owning a company so i can give them time to breathe and change things. Strides will be a different company a year from today and i don’t see much downside risk anymore post the concall which is something I’ve been patiently waiting almost a year for.

Good to read your threads again, Malcom!

Before reading below, a disclosure: I am guilty of not listening/reading Q3FY22 ConCall. Below is a result of quick Financials glance, and skim through of VP thread.

As per you, what kind of valuation would you (or market) give for branded generics biz like Strides? Stelis is still a year away. IPO froth seems to be going away. It seems the management is inclined towards Demerger (and not IPO).

Currently, it’s available at price of sales of around 1. Looking at past earnings when the biz was profit positive, a quick calculation gives us a pe of ~20.

Also, management not releasing the investor presentation - how do you see that? (unless I missed it)

I’m perfectly happy with management communication tbh. That being said i give too much weight to good concalls  … i prefer a good professional concall and a CS that replies to emails vs anything else (and is one of the main reasons I don’t really like amararaja). Stelis is an optionality that I’m happy with either way… an IPO would help resolve their debt issue and a demerger gives me shares in a company I’d want to invest in anyway. I wouldn’t really valuate a branded generics company too high… but i definitely would value it at above 2x sales and hence why I feel i have a margin of safety here(also if things go to plan sales + profits will be a lot higher by this time next year). Tbh I was tempted to invest here due to the stelis optionality at 2 to 3 x sales last year but i held back and now I’m getting the same chance at 1x sales. There is huge value here…but again… it may take a year or two to materialise. I’m more excited about tracking the upcoming concalls and seeing the business come back on track than anything else tbh. Feels like a nice project to get into for the next few years

… i prefer a good professional concall and a CS that replies to emails vs anything else (and is one of the main reasons I don’t really like amararaja). Stelis is an optionality that I’m happy with either way… an IPO would help resolve their debt issue and a demerger gives me shares in a company I’d want to invest in anyway. I wouldn’t really valuate a branded generics company too high… but i definitely would value it at above 2x sales and hence why I feel i have a margin of safety here(also if things go to plan sales + profits will be a lot higher by this time next year). Tbh I was tempted to invest here due to the stelis optionality at 2 to 3 x sales last year but i held back and now I’m getting the same chance at 1x sales. There is huge value here…but again… it may take a year or two to materialise. I’m more excited about tracking the upcoming concalls and seeing the business come back on track than anything else tbh. Feels like a nice project to get into for the next few years

Same with Edelweiss. It’s a horrible investment on paper. And my stomach churns at the thought of having money in it. But i dont think I can ignore the thought of buying now at low 60s and seeing the business improve slowly every quarter + optionalities like the wealth business demerger play out etc over the next few years. Infact i pulled the trigger on Edelweiss a few minutes ago too(though with a smaller allocation vs stelis since i can only listen to a concall twice a year here… though the investor presentations are pretty detailed to read too). I see both as low risk long term bets that i will enjoy tracking and that i have the stomach to hold onto through an upcoming crash. They will take up about 4 percent of my wife’s and my portfolio combined too so they are high reward, low risk options for me that won’t hurt my wallet so much and will give me a good education in the workings of the stock market too if they fail miserably.

@Malkd What do you think about jubilant ing? I have read all i could about the company and the only red flag i have found is their laxity in environmental compliance… But now with their latest investor presentation they seem to be improving on the same now…If you were to invest now? What do you think about the company? Do you still hold your position as such or has anything caused you to change it?

Regards

Voldemort

@Voldemort

It’s still one of my highest allocations… Infact was lucky enough to build by majority position at around 240 which was the lowest it had ever reached and hence my MOS is through the roof and i can cushion most negatives so il be holding it for the long term and will let the business grow at its own pace. Infact i even added more recently during the rout around 530 or so. The environmental issues came up last year and then, i believe it was chins, who did a deep dive into it and i found the resolution satisfactory. Management’s steps now have reassured me even further.

@Tejas_Vora

I’m sorry for replying so late… i had studied expleo, xelp in 2020. Made a good profit but then i sold out and put all that money into IDA. Personally feel the management and the business quality of IDA is fantastic and in time it will bear fruits for both the owners and investors. I am a bit bitter about leaving expleo and seeing it run up since though especially since i had jumped on very early  … haven’t really looked at it since then so I dunno how it’s progressing now… same with xelp.

… haven’t really looked at it since then so I dunno how it’s progressing now… same with xelp.

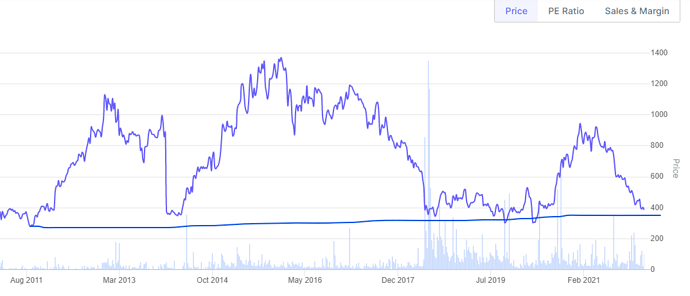

With your permission Malkd, Adding one more perspective. Company is available at the similar market cap as it was in 2011. Current valuation is almost 10 year low. That definitely provides the margin of safety given the revenue has increased to 1.5 times.

@Malkd - Did management provide any indications on turning EBITA positive; Is it going to be driven by increased revenue or cost optimization?