About

Incorporated in 1989, Lotus Chocolates

Ltd manufactures Chocolates, Cocoa

Products and other similar products[1]

Business Overview: [1]

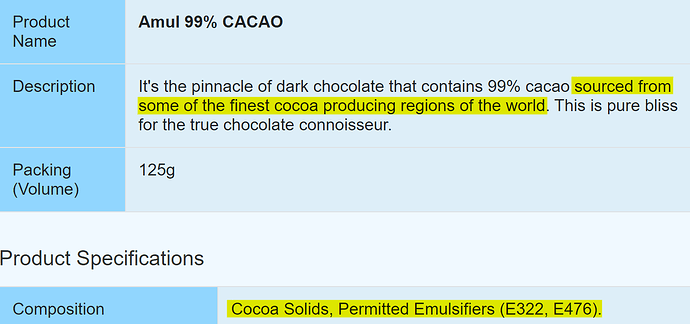

LCL is in the business of sourcing and processing cocoa beans to manufacture chocolates, cocoa products, and cocoa derivatives. Its products are supplied all over the world to chocolate makers and chocolate users, from local bakeries to multi-national companies, etc.

Product Profile: [1]

Chuckles, Supercar, Chco Drops, Choco Bars, Cocoa Powder, Choco Slab, Cocoa Butter, On and On, Hand filled chocolates, Chocolate liquor, also known as cocoa liquor and cocoa mass

Manufacturing Facility: [2][3]

The company has an ISO 9001-2008 and FSSC 22000:2010 (Food Safety Standard Certification by TUV NORD) certified manufacturing unit at Medak in Andhra Pradesh, where it processes cocoa beans into cocoa powder and

cocoa butter, and sells chocolates under the Lotus brand

Clientele: [3]

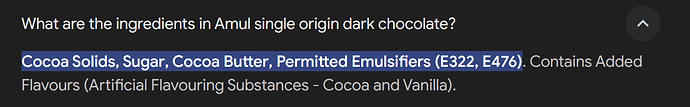

Amul, Mother Dairy Fruit & Vegetable Pvt Ltd, and Parle Products Pvt Ltd.

Loss: [4][5]

The company generated all its revenue from the sale of cocoa products but reported a loss in FY23

Acquisition: [3][6]

Reliance Consumer Products Ltd (a wholly owned subsidiary of Reliance Retail Ventures Ltd) acquired 51% stake and took control of the company from May 24th, 2023. RCPL made an open offer to their public shareholders, and on April 6th,2023, completed the acquisition of 130 equity shares of company under the open offer. RCPL has also acquired a 100% shareholding of Soubhagya Confectionary Pvt. Ltd for Rs. 18 crs.

Change of KMP: [7][8][9]

a) Mr. Sikander Aman Khullar resigned as Chief Executive

Officer and was replaced by Mr. Sandipan Ghosh on Jan 3rd, 2024

b) Mr. Vivekanand Narayan Prabhu resigned as Chief Financial Officer and was replaced by Mr. S Gautham on July 18, 2023

| Narration | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | Trailing | Best Case | Worst Case |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales | 60.78 | 65.40 | 66.47 | 56.92 | 65.69 | 69.89 | 47.87 | 86.97 | 62.72 | 144.06 | 243.76 | 330.89 | 168.59 |

| Expenses | 59.86 | 62.65 | 65.04 | 54.22 | 63.75 | 68.32 | 45.48 | 80.66 | 68.47 | 144.85 | 232.45 | 315.54 | 164.97 |

| Operating Profit | 0.92 | 2.75 | 1.43 | 2.70 | 1.94 | 1.57 | 2.39 | 6.31 | -5.75 | -0.79 | 11.31 | 15.35 | 3.62 |

| Other Income | 0.59 | 0.19 | 0.13 | 0.02 | 0.07 | 0.05 | 0.11 | 0.23 | -0.69 | 1.08 | 0.99 | - | - |

| Depreciation | 0.73 | 0.77 | 0.80 | 0.80 | 0.65 | 0.65 | 0.62 | 0.22 | 0.17 | 0.38 | 0.38 | 0.38 | 0.38 |

| Interest | 0.07 | 0.91 | 1.22 | 0.66 | 0.15 | 0.20 | 0.20 | 0.31 | 0.32 | 0.79 | 1.24 | 1.24 | 1.24 |

| Profit before tax | 0.71 | 1.26 | -0.46 | 1.26 | 1.21 | 0.77 | 1.68 | 6.01 | -6.93 | -0.88 | 10.68 | 13.73 | 2.00 |

| Tax | - | - | - | 0.33 | -0.12 | -0.11 | -0.09 | - | 0.02 | -0.46 | 1.03 | 10% | 10% |

| Net profit | 0.71 | 1.26 | -0.46 | 0.93 | 1.33 | 0.88 | 1.77 | 6.01 | -6.96 | -0.42 | 9.66 | 12.41 | 1.81 |

| EPS | 0.55 | 0.98 | -0.36 | 0.73 | 1.04 | 0.69 | 1.38 | 4.70 | -5.44 | -0.33 | 7.52 | 9.66 | 1.41 |

| Price to earning | 81.67 | 51.81 | -97.11 | 68.68 | 19.97 | 14.69 | 10.63 | 31.18 | -36.14 | -1,050.36 | 194.99 | 194.99 | 56.69 |

| Price | 45.30 | 51.00 | 34.90 | 49.90 | 20.75 | 10.10 | 14.70 | 146.40 | 196.50 | 344.65 | 1,467.00 | 1,884.35 | 79.85 |

| RATIOS: | |||||||||||||

| Dividend Payout | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |||

| OPM | 1.51% | 4.20% | 2.15% | 4.74% | 2.95% | 2.25% | 4.99% | 7.26% | 0.00% | 0.00% | 4.64% | ||

| TRENDS: | 10 YEARS | 7 YEARS | 5 YEARS | 3 YEARS | RECENT | BEST | WORST | ||||||

| Sales Growth | 10.06% | 11.68% | 17.01% | 44.38% | 129.69% | 129.69% | 10.06% | ||||||

| OPM | 2.75% | 2.79% | 2.50% | 2.15% | 4.64% | 4.64% | 2.15% | ||||||

| Price to Earning | 59.20 | 56.69 | 62.87 | 113.09 | 194.99 | 194.99 | 56.69 |

Risks -

- Intense Competition:

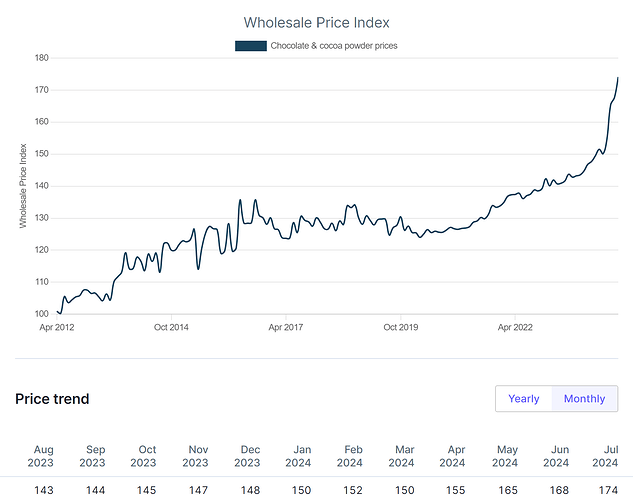

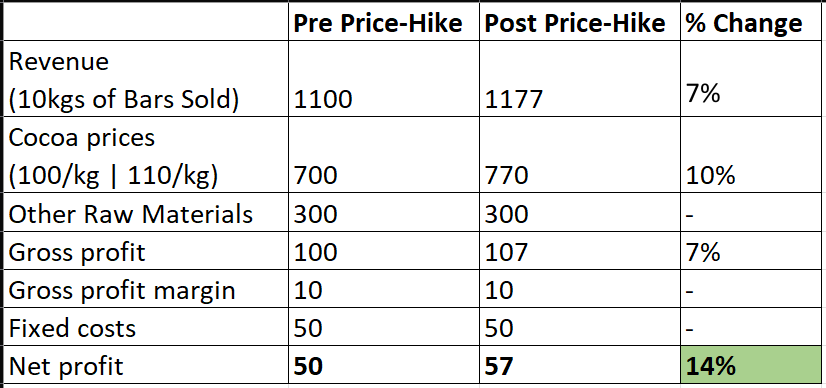

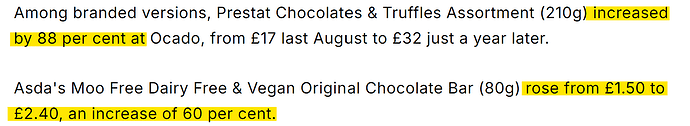

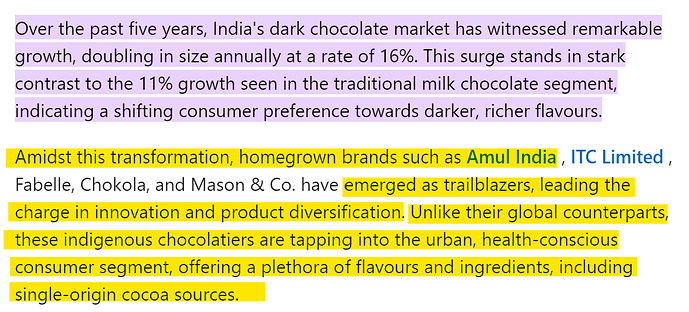

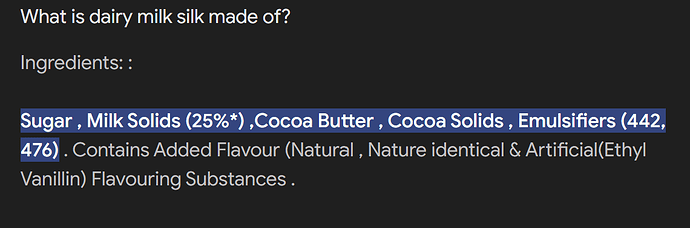

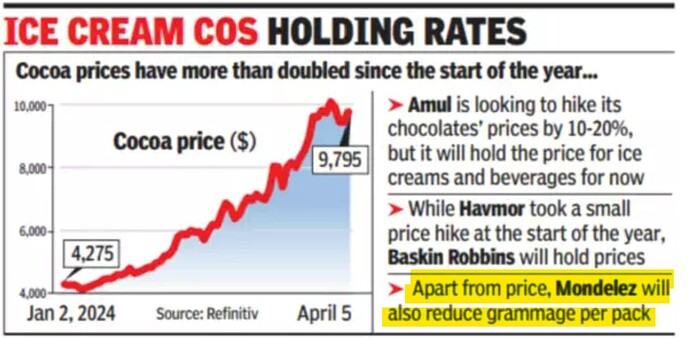

The Indian chocolate market is dominated by global giants like Cadbury, Nestlé, and Amul, which have greater financial resources, brand recognition, and distribution networks. - Raw Material Price Volatility:

Fluctuations in the prices of key ingredients like cocoa, sugar, and dairy products can impact profitability. If Lotus Chocolates cannot pass these cost increases on to consumers, margins could be affected. - Changing Consumer Preferences:

If consumer preferences shift towards healthier snacks or low-sugar products, and Lotus Chocolates is slow to adapt, it could lose market share. - Supply Chain Disruptions:

Any disruptions in the supply chain due to geopolitical events, transportation issues, or other unforeseen circumstances could affect the availability of raw materials or finished products. - Economic Slowdowns:

Economic downturns can reduce discretionary spending, and chocolate, being a non-essential item, might see a drop in demand during such periods.

Disclosure - Invested