At present ,small cap index is near all time high.

So , my return will definately come down to more sustainable level of around 15-18% over period of time .I will be happy if it it remains >15% XIRR

In the past 10 years, SENSEX has moved from 22K to 65K which is only 11.44% CAGR returns due to low GDP growth below 5.5 to 6%. (This is in spite of low base in 2014 due to tough economic situations after 2012).

Prior to that, between 2003-04 to 2013-14, SENSEX moved from about 5K to 22K/23K which was close to 16% CAGR with about > 8% GDP growth. This was the period when I started my investment journey.

Above figures are approximate but very close.

So, SENSEX growth has been relative to GDP Growth. It is approximately 2 Times GDP Growth.

Considering the fact that, GDP growth will remain mostly below 6% going forward, if individual investor can generate 15% to 16% returns those will be certainly good in my opinion.

With 15% CAGR you can still compound money at very good rate. Funds will double within 5 years or even in 4 years which is reasonable expectation.

Mutual Funds might beat this but with relatively higher risk. Hence Risk adjusted returns need to be seen.

It is also possible to generate these returns in Large Caps with moderate exposure to Mid Caps, if investor follows value investing approach.

These are few observations from my journey.

are you saying that mutual funds will beat individual investors and will give more than 15% or it will beat double the GDP returns? and how do u think, mutual funds will stand out vis a vis individual investors?

My perspective is that, with value investing approach, an Investor can generate better returns than SENSEX.

During 2003-04 to 2014, based on Large cap - Mid Cap, my journey shows that returns were close to 18%+ though I was not tracking the returns accurately. This is based on my gut feel as my portfolio was small and I was unable to track due to heavy workload.

After that, My returns have dropped to about 15%-16% CAGR from 2014 to 2024 (we are almost there).

From my journey, it is evident that, since GDP growth is muted in the past 10 years, my returns have also dropped. My portfolio was tilted towards Mid Cap-Small Cap more but still returns are less.

My portfolio till 2013 was purely large cap but still returns were high. You can see TCS, L&T, TechM, HDFC Bank share journey in that period which I was holding.

As per my view, an Investor is better placed to generate better Risk adjusted returns.

I may be wrong because Mirae Asset Large Cap fund has generated better returns in the past 10 years as well.

Mostly an Investor who wants to understand various businesses can continue investing in stocks directly else MF route is better. SENSEX might generate even lesser returns (May be below 11%) since it is heavily tilted towards only few stocks. (Again, I may be proved wrong here. Also, I do not invest in many companies which are part of SENSEX as their corporate governance is nothing to speak about!!).

What i understand

In very long run, say over 10-20 yrs,

Sensex @11-12% cagr return

Large cap@10-12% cagr

@mutual fund@12-14%(10-16%)

Warren buffet@20% cagr return

So, if we have15-17% kind return, i think it is best.

What Peter lynch says

“I have heard people say they would be satisfied with 25-30% cagr return.

At that rate they would soon own half the country along with japanese and the bass brothers.In certain yrs you will make 30% but there will be other yrs when you will make 2% or perhaps lose 20%”

=What if one expect huge return?

That will make person greedy and he/ she may take irrational decisions .So never expect unlealistic profit in short

=One should expect minimum 14 to 15% CAGR return after 3 to 5 yrs of investment.

=After 3 to 5 yrs, if you dont get 14 to 15%cagr ,invest in index fund or well managed mf

My 3 year CAGR as per Value research is 16.4% and 1 year CAGR is 21.4%. I have Large cap around 57% midcap 34% and remaining small cap

Both make sense, so for you only criteria to sell is when fundamental are deteriorated.

Idea of investing is to make money by investing in good companies, so when do you sell the stock ?

Many investors are assuming that, Index funds can generate 12% returns in next 20 years looks very optimistic to me.

As per my understanding GDP growth of even 6% looks difficult with almost 12% + population unemployed as of now. This is also based on official data. Actual data is different as per my discussions with various people. Business models will be disrupted making even more people loosing jobs.

With below 6% GDP growth over next 20 years, even generating 11% is not very easy for SENSEX.

Individual investors who invest in good companies (with good corporate governance) will fetch superior returns. Curated stock portfolios will generate Alpha in my opinion going forward.

I may be wrong in my analysis, as things may change over next few years. if GDP growth bounces back above 10%, then things will look completely different.

Cut the weeds, not the flowers.

Mohnish Pabrai says “Rakesh Jhunjhunwala has this persona of a guy who sits in front of three screens, talking to people all the time and all this activity is going on. But then in his portfolio, Titan doesn’t get touched for decades. Lupin doesn’t get touched. The crown jewels don’t get played with,” Mohnish said, the admiration clearly evident in his tone.

If you are in the happy position of the ownership of a tremendous business, the tremendous runway you only need to be right once or twice in a lifetime. And it would cover a lot of sins.

GDP growth rate reported is real growth. The nominal GDP growth rate of India is about 10 to 12% which is about the same as expected broad market passive equity return.

This logic implies that, when Indian GDP Growth rate was almost 8% to 9% during 2003-2013, Nominal GDP rate was about 16% to 18%.

Probably that’s the reason why SENSEX CAGR was about 16% during that period.

Probably it is good idea to understand the lessons learnt at that time and use those in next 20 years.

Earnings of equity market must grow slower than GDP because the growth of existing enterprises contributes only part of GDP growth. The role of entrepreneurial capitalism, the creation of new enterprises, is a key driver of GDP growth, and it does not contribute to the growth in earnings and dividends of existing enterprises.

During the 20th century, growth in US stock prices and dividends was 2% less than underlying macroeconomic growth.

Source: William Bernstein and Rober Arnott, “Earnings Growth: The 2% dilution”, Financial Analysts Journal, 2003.

The total return of the market (broad market index like nifty 500) is comprised of dividend & divided growth in a long time frame. The best assumption to make to calculate future return is dividend rate at 1.5 to 2% and for dividend growth rate 2 to 3% less than the nominal GDP growth rate of India.

Equity market earnings grow slower than GDP due to entrepreneurial capitalism driving GDP growth, not existing enterprises. Historical data suggests a 2% lag in US stock prices and dividends compared to macroeconomic growth. For future returns, consider a dividend rate of 1.5-2% and dividend growth 2-3% less than India’s nominal GDP growth. Source: William Bernstein and Rober Arnott, “Earnings Growth: The 2% dilution”, Financial Analysts Journal, 2003.

I will take a deep dive into the reasons for higher economic growth (>8%) during 2003-2013 and use those lessons for my study and analysis.

Since I have a positive outlook about world economy, this study will help me.

As an investor, positive outlook about the world economy is always good.

Since this is deviating from the main topic discussed in this post, I would not add more comments here.

But we forget one thing here. Most Small Cap and Mid Cap Promoters take anywhere between 1-5% of Revenues/Profits as Consulting fees in addition to salaries. In some cases its 10% of profits. Look at the Marans of SunTV.

They also have other indirect sources of taking money out legally thorugh related party transactions. So all this needs to be considered.

My point was more towards concentration of networth of promoters, not much related with related party transactions or commission or salary of promoters.

No I got it, I was corresponding to that only. They can be concentrated because they have all these other sources of earning income. Something which they control and transfer from Net Income which belongs to all shareholders.

I think this is a very interesting thread. Just giving out my two cents as somebody who is relatively new to the markets (2 years) on a few of the topics that were touched here.

On the idea of holding stocks for the long term:

I think one of the crucial insights you can gleam from successful investors is their understanding that there are cycles in which the economy transfers resources to its various constituent industries. There are companies within each industry that can turn out to be the most efficient and therefore the ones that get the better valuations, but there is no structural story as such.

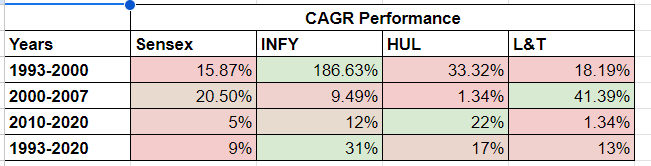

I’ll try to explain this idea by quoting Kenneth Andrade sir’s example of three industries that have been called structural sometime in their journey, or are still considered to be structural. These industries are FMCG, IT and Infrastructure. We’ll take the most capital efficient companies in these industries. And try to visualise the performance of these industries across three decades.

This chart demonstrates that while in the long run, you would have made money buying either of these three businesses because of their leadership and their capital efficient nature, you could have made much more had you been a little more cognizant of these cycles. This is the kind of outperformance retail investors are aiming to achieve on their small capital. And this is what we should aim to do.

Once we have the ambition set out, lets try to deduce what’s the pattern with this outperformance.

In this chart, if you see the outperformance of L&T in 2000 phase, it happened because of two things, one that the P/E of the company was at 8 times at the start of the cycle and two that the demand scenario for infrastructure increased tremendously over this period, taking it to 60 P/E by the end of the cycle.

HUL at the start of its benign cycle had a lower P/E than it does now, but more importantly, its period of outperformance was what economists have called the lost decade for Indian Growth. India didn’t grow as rapidly and so for businesses that were the largest in the country and were growing at higher than GDP, investors were willing to pay a higher P/E. This pushed the valuations of the company further.

So how can somebody predict these cycles? You can’t. And the only satisfactory answer I’ve gotten after hearing people like Kenneth Andrade is that you can’t predict the cycles but you can be more cognisant of patterns in the previous cycles, so you understand them well. But more importantly you can judge which are the companies that have the balance sheet and cash flow strength to capture the growth when it comes. The better question to ask is not which cycle is next, but which companies are generating a higher return on capital or are deploying lower capital, paying off their debt and managing to get higher cashflows whenever their parent sector is out of favour.

This will give you more time to really build conviction in a business and also wouldn’t be as time consuming as running after the latest stock on twitter while struggling in your professional commitments.

I think a good way of looking at it is in continuous cycles of what will do better one year down the road from here, instead of sitting on your laurels at any point.

I think two of the companies - Infy and LT in your examples grew tremendously during the periods you mentioned because of two bubbles we saw in recent times. Dot com bubble between 1995 and 2000 and real estate / infrastructure bubble of 2004-2007.

Once these bubbles bursted in late 1999/2000 for dot com and 2007 for real estate, which also led to many companies exited the market (Unitech, GTL limited, Visualsoft etc.), there was a lull period and negative sentiments for these sectors in general due to which even good companies like Infy and LT suffered for many years.

Thank you for the reply @abhikjha

I think that is precisely the point of understanding cycles better. Had you invested in INFY in the 1990s and L&T in 2000-07, you would have taken advantage of the multiple rerating these companies enjoyed. But had you gotten in at the wrong time, you would have suffered.

Over a long term, the returns of all these companies beat the index, but most of the returns for INFY were made in 1993-2000, and those for L&T were made in 2000-2007. This is where the outperformance will come from for an individual investor.