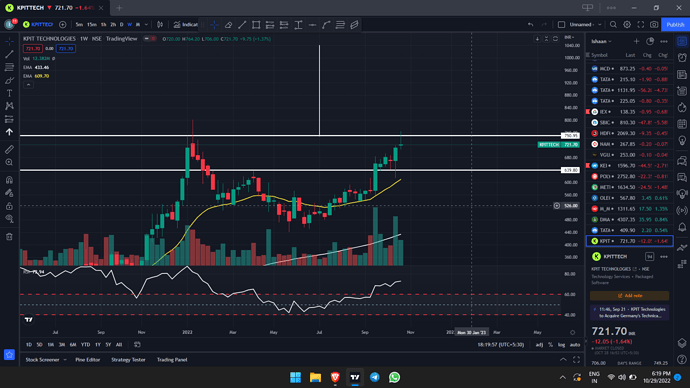

This forum is for fundamental analysis but having so many people already discussing about how good the company is and it’s growth prospects for years to come, the charts are also showing the same picture in the short term. It seems, KPIT is forming a Rounding Bottom Pattern on a weekly time frame. The volumes in the bottoming period show consolidation and recent upturn is facilitated by huge delivery volumes and green candles. Now it has reached it’s previous highs of 750 and we can see some consolidation here as well.

The targets after the breakout comes at around 1000 but even being a bit conservative we can safely assume the stock to reach 850-900 levels in the short term. Ofc this will only happen if it crosses and sustains the 750 levels with decent enough volumes. The RSI is also above 60 which is showing the buying momentum might continue.

Not an investment advice. Just a study and for reference. Pls do not make any investment decisions based on my post.