Very low OPM and ROCE . There is no pricing power… is there any moat around the business … can anyone tell us

After holding for 3 years , exited at loss Very disappointing set up

Kingfa AGM FY 22 Notes

- Volume growth is very bright. Foray into new Auto OEMs, new age industries (both EV 4 &2 wheelers), consumer durables, a dedicated team in place for the same.

- Plans to foray into Mining industry as well.

- Exports to improve to South East Asia, Gulf and Africa.

- PPE contribution currently less than 10%, but will become significant in overall revenues.

- Raw material increase price passing on: Quarterly, half yearly price passing on has already been in place.

- On quarterly concalls: currently quarterly powerpoints are being shared. Mgmt doesn't seem to have intentions for quarterly concalls.

- Cost of raw material is ~90% of sales, majority of this is coming from the parent company in China. Mgmt guided that this situation is not going to change, which will keep resulting in foreign exchange outgo. FE outgo could be balanced by FE inflow due to exports.

Mgmt conclusion:

- Focus for the last two years was on localization of production--> now almost all parts can be produced in-house.

- Strategy is to make India is global hub for exports.

- More focus will be on PPE and consumer durables.

bhai did u ask about why there is no hedging policy for kingfa? why there were forex losses and still no hedging policy

Company was answering bare minimum as far as the questions on Forex are considered.

Absolutely mindblowing numbers, Also its peer D-dev plastik posted super numbers… would the trend continue?

Kingfa AGM FY 23 Notes

Management commentary

-

Factory is running in full steam with a total incorporation of 17 lines including the ones for development activities in the field of next gen polymer compounds.

-

New laboratory inaugurated. High end laboratory in Chakan has been now commenced which will help with the right first time in development. This will soon be accredited, so that all OEMs and Tier 1 suppliers can use it for their needs. This lab is expected to reduce the lead time of development of new compounds and also to reduce the time for transfer of technology from China HQ to India.

-

Going forward, all engineering plastics will be made and sourced in India which will eliminate the delays in shipping, logistics (from China HQ) and optimize the inventory levels.

-

Prospects of India becoming an export hub is on the cards and will help improve capacity utilization levels, volume and margins.

-

Traditional Industries have other own limitations in terms of their margins. It is the new age industries such as EVs, office automation and solar which will help improve margins and presents bright future for kingfa india in coming years. Approvals for new products have been received, special to mention is regarding the approvals of fire retardant compounds.

Q&A

- Capacity Utilization

Capacity 1.4 lakh tonn/annum across 17 lines. Utilization is around 70%. There is nothing like 100% capacity utilization possible because of the product mix and change over associated with it almost on a daily basis. Management is working to improve efficiency of the existing lines. No separate capacity for engineering plastics existing. Set-up is such that any product can be manufactured on any line.

Expansion: will and can keep adding new lines on need basis

Volume offtake ranking: Passenger vehicle–> 2W → commercial.

- EVs

EV are same as existing ones: Lot of requirement for flame retardant material for 2W and 4W have been development, lot around battery packs and associated components. Approvals for 2 more products is awaited. Presence with Ola EVs is significant and there from day 1, also have presence with other 2W OEMs. Company keep adding products on a regular basis. Volume with ola is 13kg/vehicle.

- Auto, Non-Auto Share

Auto and non-auto share: Air conditioner, washing machine and other white goods. 72% auto and 28% non-auto. 10% years ago it was 95% auto. Continue to improve non-auto share. Ideal is to reach at 60% to 40%.

Non-Auto

Home appliances, construction is the latest addition.

- Market Share

Market share can’t be calculated because of too many players in India including unorganized.

- Dividends

In the sub-sequent meeting(s), board might consider interim or final dividend. Already asked finance to propose to the board. They said they are planning it from next year, cannot be delayed so much- highly likely of dividend from next year.

- India as export hub

Potential to become export to Europe and USA.

Currently exporting to Thailand and South Africa. In the future, sees potential to export to African countries as well.

- 30cr Forex loss

Couldn’t understand thier reponse in Chinglish. However, understood that this won’t be the magnitude of loss going forward as almost all eng plastics sourcing and production is done in India.

- 8Cr R&D Expenditure in FY23

This if for Test related equipment and for the lab. Feature of the lab: Analyze raw material, competitor product, testing performance of products.

- Health care products

Nitrile gloves. Mask with inhalation valve, mask with carbon coated fabric to reduce unpleasant odors such as paint etc.

Skipped answering questions on Quarterly concalls, 3 year vision.

- Closing remarks

Management sounded super bullish on India growth and capability. Spoken about increasing the management bandwidth to cater it. Products side try to minimize input from outside India.

When all other Tesla vendors shares are on upmove , no movement in this ? Any reason?

@prasad60 Which are Tesla vendors who are listed in India?

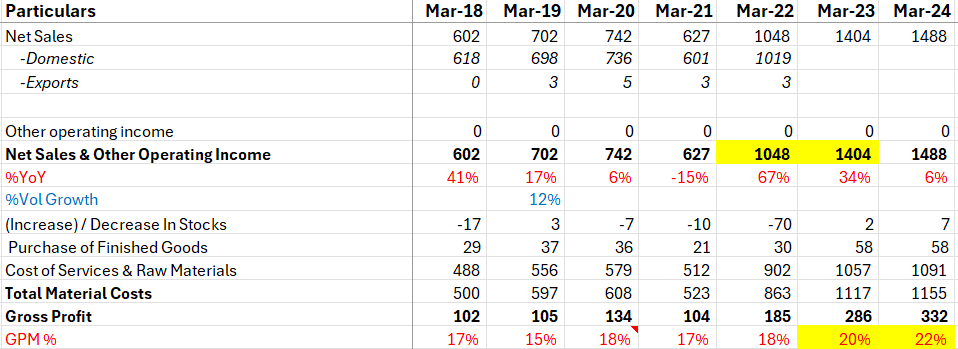

Was looking at this company, can someone explain how has the Gross margins been stable from FY’20 to FY’22 inspite of high volatility in RM (crude prices) during that time.

Is it because they source major RM from parent co. or they just pass on all the price increase?

And then later what caused the GM to increase in FY’23,24

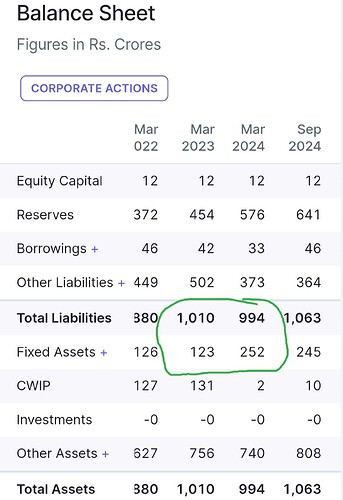

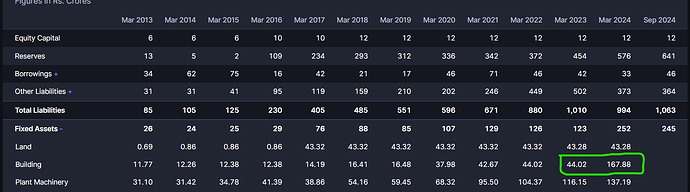

Can someone please explain the details of the capital expenditure done by the company in FY24.

There is no significant change in topline if we compare it to the capex done.

Was it simply a maintenance capex?

If you open the notes of fixed asset the building as increase and not the plant and machinery that’s why no growth in FY24

Why is the CFO/ pat conversion so terrible if we take data from fy13-fy24?