Greetings, fellow investors,

It’s been a while since I last shared an update on my small micro-cap portfolio, and I’m excited to provide you with the latest developments. Today, I want to discuss my revised investment thesis, adding new companies to my portfolio, and the growing focus on commodities, capital goods, and infrastructure.

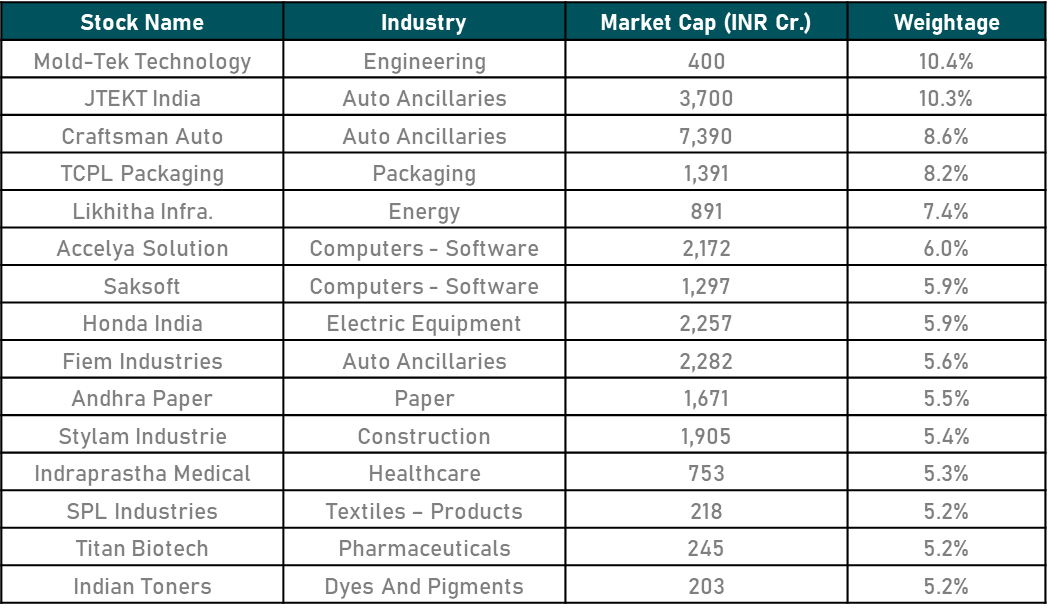

As the market landscape evolves, we must adapt and diversify our investments to capture emerging opportunities. With this in mind, I have made significant changes to my portfolio, retaining only two stocks from my previous update, Saksoft and Andhra Paper.

Commodities Outlook:

One of the key drivers of my investment thesis centres around the promising outlook for commodities. Global economic recovery, increased infrastructure spending, and rising demand from emerging markets are expected to bolster commodity prices. Commodity sectors such as metals, energy, and agricultural products offer attractive investment prospects.

Capital Goods and Infrastructure:

In conjunction with the commodities thesis, I believe capital goods and infrastructure sectors will play a pivotal role in driving economic growth. As governments worldwide ramp up infrastructure spending to stimulate economies, companies involved in construction, engineering, and capital goods manufacturing are likely to benefit. By adding exposure to these sectors, I aim to capture the potential upside from these developments.

With increasing market volatility, I believe diversification is crucial to manage risk effectively, especially in micro-cap investing. Each company was selected after careful analysis of its financials, growth potential, and alignment with my investment thesis.

It’s important to note that investing in small micro-cap stocks carries inherent risks, including volatility and liquidity concerns. Thorough research, staying updated on industry trends and regularly reviewing financial reports are essential for making informed investment decisions.

As always, I welcome your thoughts and insights. If you have any suggestions or recommendations for further research, especially within the commodities, capital goods, and infrastructure sectors, please feel free to share them. Together, we can navigate the ever-changing market and uncover hidden gems.

Disclaimer: The stocks mentioned in this post are for discussion purposes only and should not be considered investment advice. Please conduct thorough research or consult with a financial advisor before making any investment decisions.

| Stock Name |

Weight |

| Benares Hotels |

9.3% |

| Cochin Minerals |

7.9% |

| Andhra Paper |

7.6% |

| Cupid |

7.6% |

| Chamanlal Setia |

5.8% |

| Pricol Ltd |

5.2% |

| Axtel Industries |

5.1% |

| SKM Egg Products |

4.9% |

| Univastu India |

4.9% |

| Mangalam Seeds |

4.5% |

| Alufluoride |

4.5% |

| Revathi Equipments |

4.5% |

| Maan Aluminium |

4.5% |

| D P Wires Ltd |

4.4% |

| Shree Ganesh Remedies |

4.3% |

| Mazda Ltd. |

4.3% |

| Saksoft |

4.3% |

| Diamines & Chemicals |

4.2% |

| Beardsell Ltd |

2.1% |