So today we talk about the company name Jubilant Agri and Consumer Products Ltd (JACPL), part of the Jubilant Bhartia group.

Company Overview:

JACPL is a part of the Jubilant Bhartia group. It is in the business of performance polymers & chemicals and agri products for B2C & B2B.

- Performance Polymers & Chemicals: Synthetic latex (VP latex) and vinyl acetate polymers (PVA, ester gum) are used in industrial processes and consumer adhesives & wood finishes (brands like jivanjor and Charmwood).

- P&K Fertilisers: Primarily Single Super Phosphate (SSP) under the “Ramban” brand (contains ~16% P₂O₅ and 11% S). JACPL has two SSP plants (total 4.44 lakh TPA) serving North India.

- Agri-Nutrients: Micronutrients and specialty fertilizers (e.g. fortified SSP, zincated products) and plant growth regulators (e.g.Chlormequat for grain yield).

- Crop Protection Chemicals (minor): Select intermediates and formulation.

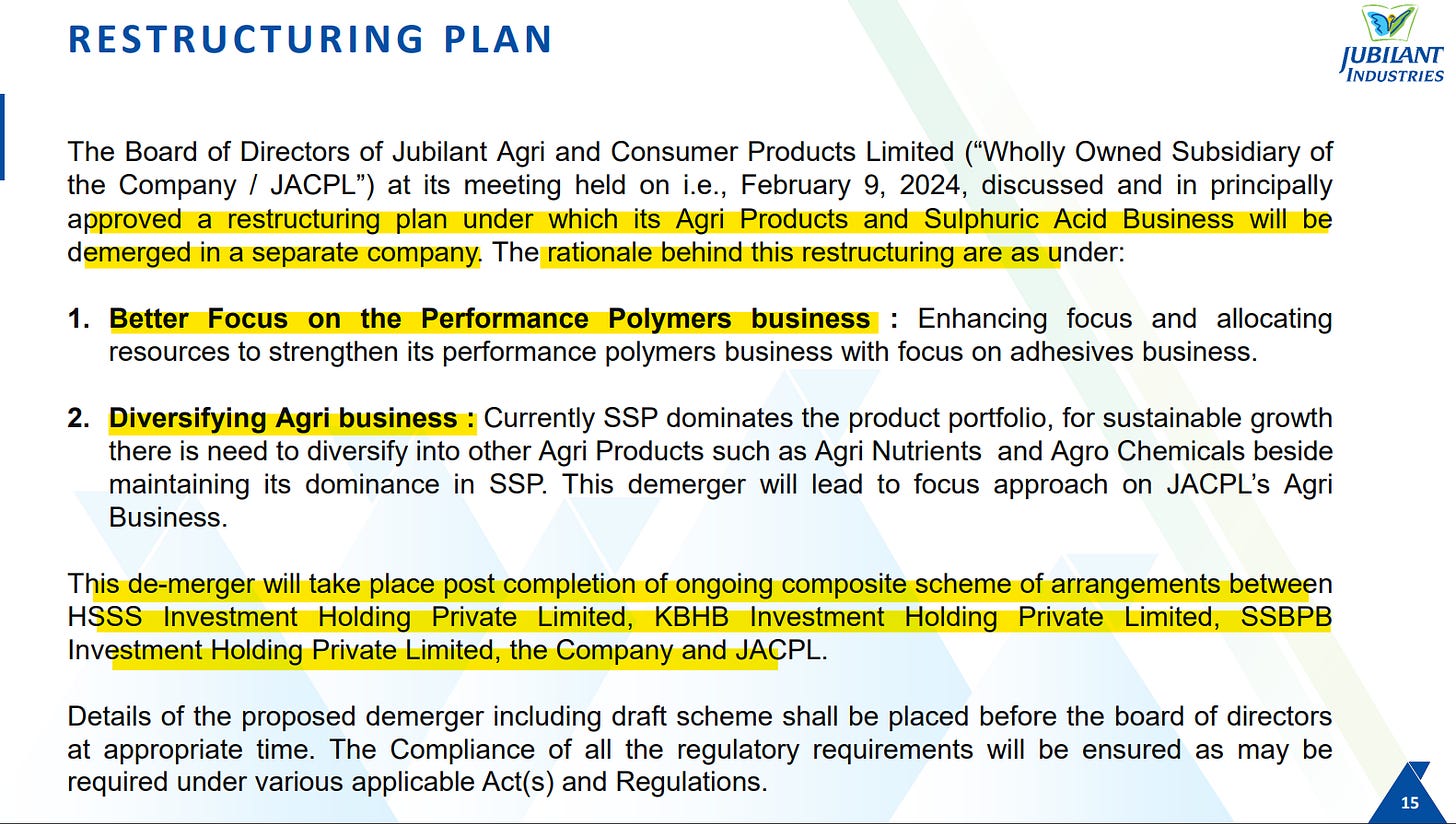

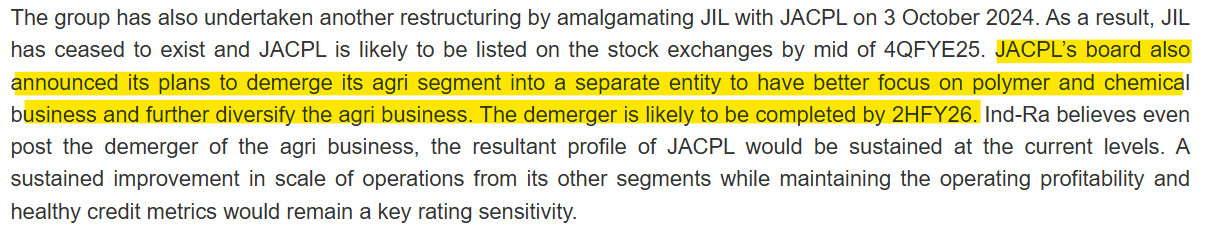

Demerger:

Previously a subsidiary of Jubilant Industries Ltd., the company’s agri and consumer products business was demerged in FY24 and transferred to JACPL through a slump sale, including consumer product sales, wholesale cash-and-carry trade, and leasing.

Product Categories:

a) Consumer Products:

Wood Working Adhesive, Wood Finishes, Maintenance Products

b) Performance Polymers:

Synthetic Latex, Food Polymer

c) Agri Products:

Crop Nutrition, Plant Growth Regulator

Brands:

a) Jivanjor

b) Vamicol

c) Vamipol

d) Polystic

e) Hero

f) Ultra Italia

g) Charmwood

h) Encord

i) Jubigum

j) Ramban

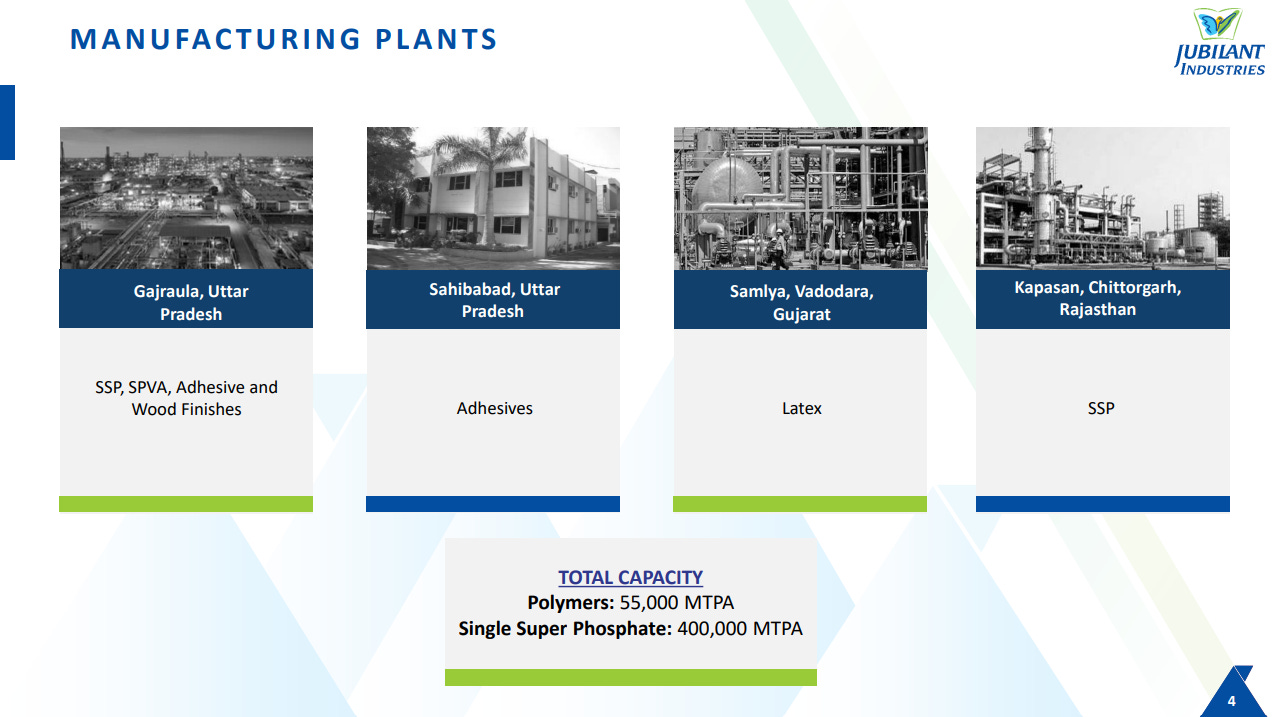

Production Facilities:

The company has 4 plants located in

Vadodara for Latex, Chittorgarh for SSP, Sahibabad for Adhesives, and Gajraula

for SSP, SPVA, Adhesive and Wood

Finishes. It has a total manufacturing

capacity of Polymers ~55,000 MTPA,

and Single Super Phosphate ~4 Lac MTPA

Distributors & Retailers:

Distributors ~800

Retailers ~20,000

Geographical Presence:

USA, Brazil, Mexico, China, Sweden, the Middle East, Russia, Israel, Spain, Germany, Belgium,

Luxembourg France, Korea, Vietnam, etc.

Geographical Revenue Split - FY24:

Export ~19%,

Domestic ~81%

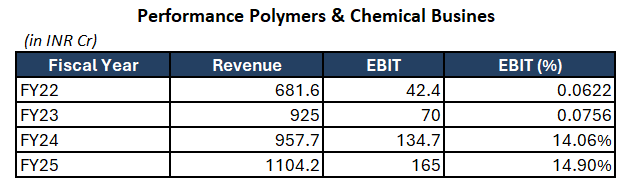

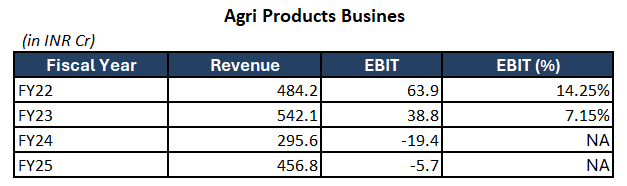

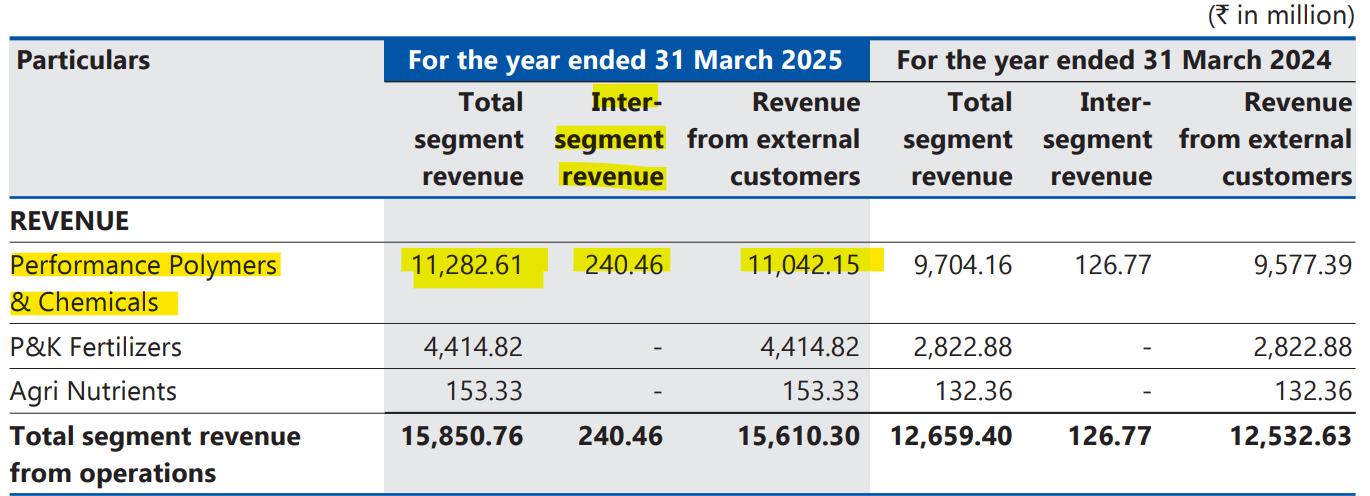

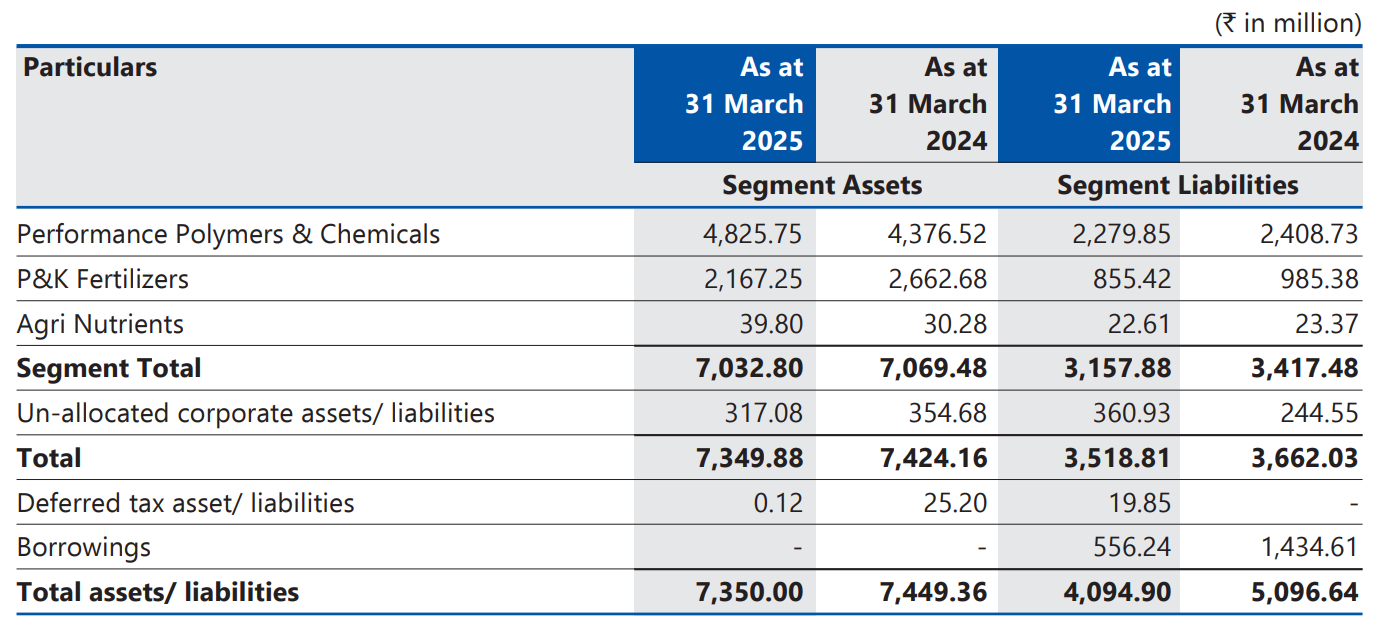

Segment Revenue:

Performance Polymers & Chemicals ~70%,

P&K Fertilizers ~29%,

Agri Nutrients ~1%

Business Model & Segment Analysis

-

Performance Polymers: JACPL makes Vinyl Pyridine (VP) latex and Polyvinyl Acetate (SPVA). VP-latex (branded Encord) is used in tyre-cord dipping and reinforcement; JACPL is India’s largest VP-latex producer and among the global top 2 SPVA and ester gum (brands Vamipol and Jubigum) are sold to chewing-gum and bubble-gum manufacturers. These B2B businesses have long-term contracts and high technical barriers (speciality grades); margins are moderate but stable.

-

Specialty & Performance Chemicals (Consumer Products): This includes woodworking adhesives, tile setters’ adhesives, construction chemicals and wood finishes (brands Jivanjor, Charmwood, Ultra Italia). These sell mostly in the retail channel. However, this segment is highly competitive and dominated by Pidilite (Fevicol). JACPL has a modest market share and competes on formulations, pricing and dealer network. Margins here are thinner due to competition and raw-material sensitivity.

-

P&K Fertilizers (SSP): JACPL’s SSP plants mix phosphoric rock with sulphuric acid (often its own captive acid) and additives (Ca, gypsum) to produce 16-19% P₂O₅ fertilizers. SSP is a bulk, regulated product with government-set prices and subsidies. The SSP business (brand Ramban) has healthy regional share in UP/Uttarakhand and benefits from scale (4.44 LTPA). However, profitability depends on subsidy policies and raw materials (rock phosphate, sulphur).

-

Agri-Nutrients: These are higher-margin specialty inputs – e.g. fortified SSP (with zinc, boron), zincated fertilizers, and plant growth regulators (e.g. VAM-C, chlormequat chloride to improve crop yield). They target niche crop segments and help diversify from commodity SSP. Customer stickiness is moderate (farmers value the unique benefits).

Each segment’s value chain is integrated: JACPL often produces its own intermediate inputs (e.g. sulphuric acid, organic solvents) to supply these businesses, which trims costs. Customers range from large industrial (tyre/cord manufacturers, gum makers) to agri-retailers and farmers. The distribution footprint is broad – chemicals are largely B2B, while fertilizers & adhesives use dealer networks.

Management & Governance

Prominent Bhartia family members chair the group (e.g. Shamit and Priyavrat Bhartia on the JACPL board). Key executives include Mohandeep Singh (CEO & Whole-time Director), appointed mid-2024 after serving with Jubilant and earlier, global roles at AkzoNobel/ABB. (Former CEO/MD Manu Ahuja – with decades of industry experience – passed away unexpectedly in Dec 2023.) The board has three independent directors and a couple of Bhartia scions, reflecting standard group governance.

Historically, the group has shored up capital when needed (e.g. equity infusion ~₹42cr during 2019–20)

. The promoters are seen as committed (timely support by the Jubilant Bhartia Group)

. Overall, governance follows established group norms; no major controversies are known.

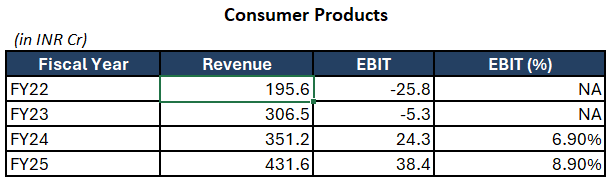

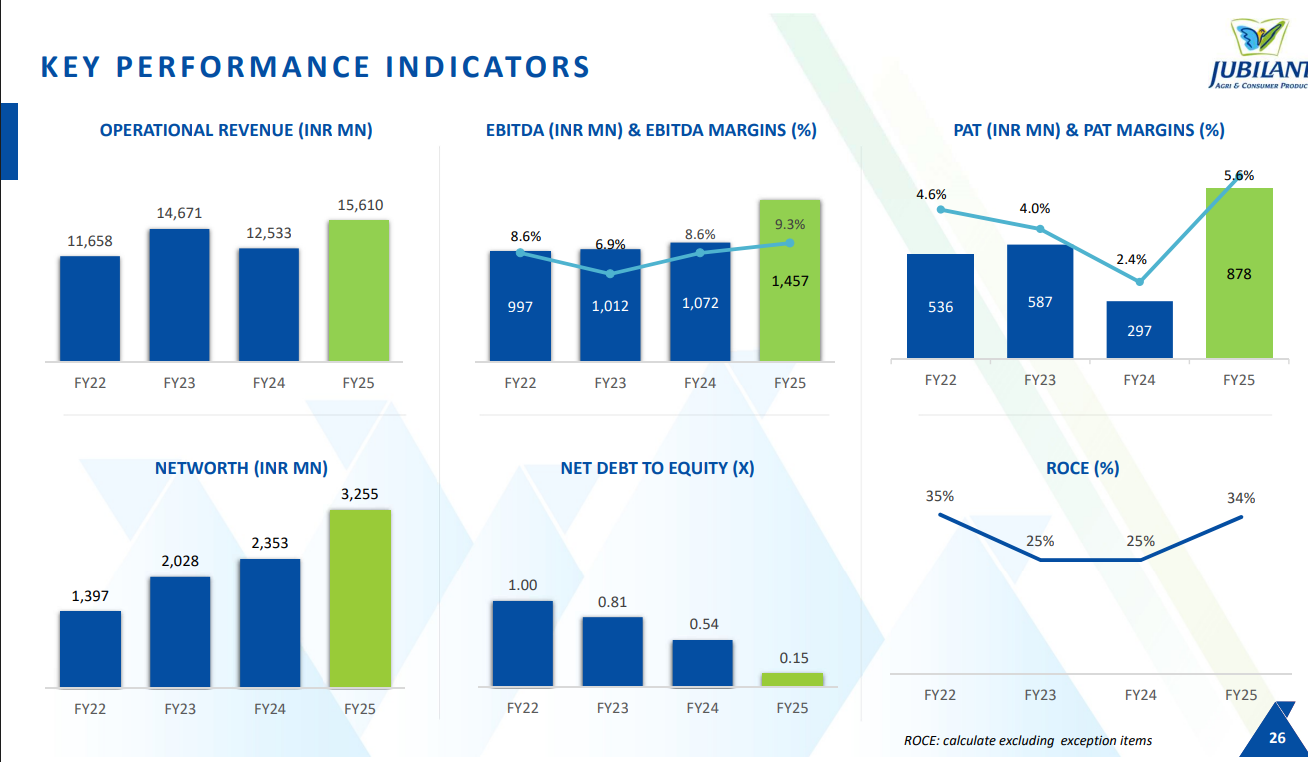

Financial Analysis (Last 5 Years)

-

Revenue: Grew from ₹621.8cr (FY21) to ₹1,541cr (FY25), a ~25% CAGR. Growth was lumpy: FY22 saw a jump (to ₹1,155cr) and FY23 ₹1,437cr, helped by volume gains and higher fertilizer subsidies. FY24 dipped to ₹1,226cr (partly due to project phasing and an unusual write-off), then FY25 recovered to ₹1,540cr (full-year contributions from all segments).

-

Profitability: Operating profit margin has been ~8–9% in recent years (improved from ~6–7% earlier). FY25 reported EBITDA ~₹146cr on ₹1,561cr sales, and PAT ₹88.2cr (EPS ~₹58.5)

screener.in. FY22/23 EBITDA was ~₹107–107cr; FY24 PAT was only ₹26.4cr (an exceptional INR33cr write-down occurred). Excluding that, underlying profitability is rising. -

Margins & Returns: Gross margins run mid-teens; net margin ~5.7% in FY25. Return ratios are healthy: ROCE ~32–33% and ROE ~31% (FY25), reflecting low equity base and improving profits. These are well above industry averages.

-

Leverage & Liquidity: Debt has fallen sharply. Gross borrowings went from ~₹162cr (Mar’24) to ~₹77cr (Mar’25). Correspondingly, Net Debt/EBITDA is low (<1x now). Interest cost fell from ₹20cr to ₹13cr/year. Cash flow generation has improved; JACPL’s free cash flow is turning positive. Promoters have de-risked the balance sheet via infusions, keeping Debt/EBITDA ~1.5x (FY22) down from 5.5x (FY19).

-

Working Capital: Historically high (GCAs ~120–140 days), due to fertilizer stockpiling. However, FY25 saw much leaner operations: receivable days ~67, inventory ~80 (down from 72 & 121 in FY24). The shift suggests faster inventory turnover (possibly digesting the excess SSP stock in FY24).

-

Capex: The company is investing in debottlenecking and expansions (e.g. SSP plant, upgrading adhesives lines). Fixed assets + CWIP grew (CWIP at ₹19cr in Mar’25). Capex is funded by cash flow; debt impact has been modest so far.

Summary: JACPL has seen strong topline growth and margin expansion in the past 3–4 years, alongside prudent financial management (deleveraging and cost control). Financial leverage is low and returns are high, indicating a solid financial profile.

Strengths and Weaknesses

Strengths:

-

Diversified Business Mix: Presence across unrelated industries – from agriculture to tyres to consumer goods – smooths revenue cycle.

-

Market Positions: #1 SSP brand in its key region (Ramban SSP, with 4.44 LTPA capacity)

and leading global supplier of SPVA (chewing-gum base). VP-latex is niche with few competitors. Diverse end-markets (farms, tyres, gum, wood) provide resilience. -

Economies of Scale: Large integrated plants (SSP, latex, PVA) give cost advantage. Captive raw materials (own sulphuric acid, etc.) lower input risks.

-

Financial Strength: High ROCE/ROE (30%+), healthy cash flows, very low net debt. Strong parent backing (Jubilant Bhartia) has ensured timely equity support.

-

Growth Tailwinds: FY22 saw an 87% revenue jump (₹665cr→₹1,166cr) due to volume and subsidy tailwinds. The company is well-placed to benefit when fertilizer consumption or polymer demand rises.

Weaknesses:

-

Competitive Consumer Segment: The adhesives/wood-finish business is intensely competitive (market leader Pidilite has ~70% share). JACPL’s products here command lower pricing power.

-

Regulated Fertilizer Business: SSP margins depend on government policy. Any subsidy cut or pricing change can quickly hit profits.The industry also faces payment delays, forcing working-capital borrowings.

-

Raw Material & Forex Risk: ~60% of costs are raw materials (rock phosphate, VAM, etc.). Price volatility (and INR volatility on imports) can compress margins, especially since consumer prices can’t always be raised.

-

Working-Capital Intensity: Fertilizer/seasonality drives large inventories (gross current assets ~4–5 months historically).This ties up cash and can surge borrowing when policy shifts.

-

Capex Demands: Maintaining and expanding facilities (new SSP capacities, chemical lines) is capital-intensive. Missteps or cost overruns could strain returns.

Risks and Mitigations

-

Macro Risks: Slowdowns in agriculture (monsoon failures) or construction auto (less tyre demand) could dent volumes. Rising interest rates and inflation could pressure costs. However, JACPL’s diversified mix (B2B industrial vs. farmer markets) partly hedges such cyclicality.

-

Sectoral/Business Risks:

Fertilizer policies: Any rollback of subsidies or introduction of duties on phosphates could hurt SSP margins. JACPL has mitigated this by moving into specialty fertilizers (fortified SSP, micronutrients) which are partly outside strict controls, and by maintaining high liquidity buffers.

Input inflation: JACPL owns backward units (e.g. acid plants) and long-term supply contracts to anchor input costs. In FY22 it even benefited from higher fertilizer subsidies, showing that policy upsides exist.

- Risk Mitigations: The company’s product diversity and exports (e.g. selling latex and acids abroad) reduce reliance on any single market. It also pursues backward-integration (making its own intermediates) to lower input import dependence. Most importantly, parent support provides a safety net: JBG’s track record of equity infusions and inter-corporate loans means JACPL can draw funds if needed. Recently, JACPL’s very low debt/ ample cash cushion imply it can weather short-term shocks.

Peer Comparison

| Company | Mkt Cap (₹ Cr) | Price/E (TTM) | ROE (%) | Key Segment Exposure |

|---|---|---|---|---|

| Jubilant Agri (JACPL) | 2,353screener.in | 26.6screener.in | 31.5screener.in | Fertilizers, polymers, adhesives |

| Pidilite Industries (PID) | 158,047screener.in | 75.5screener.in | 23.1screener.in | Consumer adhesives (Fevicol) |

| SRF Ltd | 84,807screener.in | 67.8screener.in | 10.4screener.in | Specialty chemicals (films) |

| UPL Ltd | 50,975screener.in | 47.1screener.in | 4.0screener.in | Agrochemicals / Crop protection |

| Coromandel Int. | 67,454screener.in | 37.6screener.in | 17.5screener.in | Fertilizers (Phosphatic) |

| Chambal Fert. & Chem. | 22,076screener.in | 13.4screener.in | 20.6screener.in | Fertilizers (Urea, NPK) |

| GNFC | 7,868screener.in | 13.2screener.in | 7.1screener.in | Fertilizers & chemicals |

Sources: Company filings and Screener (latest)screener.inscreener.inscreener.inscreener.inscreener.inscreener.inscreener.in.

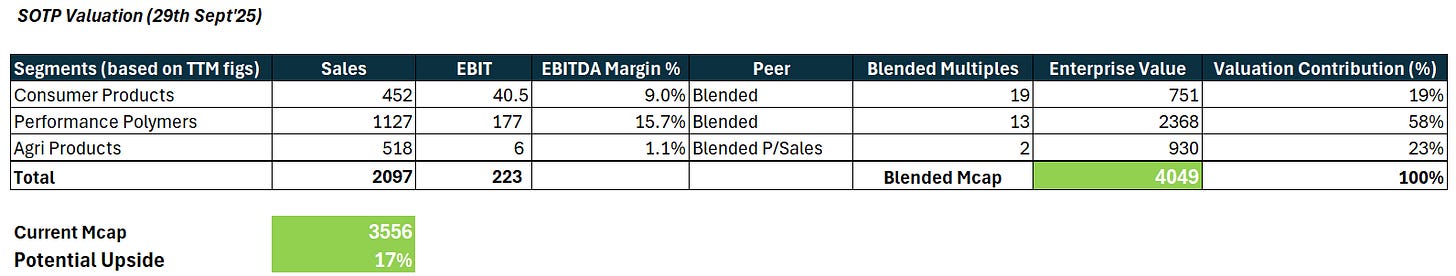

Valuation and Market Positioning

At ~₹1,560 (May’25), JACPL’s P/E is ~26–27× FY25 earnings. In absolute terms, that is a fair/low valuation for a company with >30% ROE. By comparison, Pidilite trades ~75× earnings; SRF ~68×. Coromandel (agri-inputs) trades ~38×. In effect, JACPL’s multiple is similar to mid-cycle fertilizer peers (Chambal/GNFC ~13×) despite its much higher return ratios.

Potential rerating triggers: Completion of the demerger/listing could unlock value as businesses are valued more appropriately. Continued EBITDA margin expansion (by cost control or shifting product mix) would boost earnings. Strong monsoon or higher crop prices could spur fertilizer demand, and recovery in industrial markets (tyres/construction) would lift polymer sales. Global expansion of its SPVA/latex business could also add optionality. Any substantial reduction in debt or a healthy dividend policy may make it more attractive to institutions.

In short, JACPL’s “hidden gem” case lies in its asset-light yet profitable business lines, strong promoters, and currently modest pricing. If the company sustains double‐digit growth (as CRISIL suggests) and maintains margins, its valuation gap to peers could narrow.

Conclusion – Opportunity vs. Risk

Opportunity: JACPL combines niche market leadership (globally in polymers, locally in SSP) with a diversified portfolio. Its financials have turned robust (high ROCE/ROE, low debt) after years of heavy capex. The promoter group’s credibility and support add a safety margin. In a stable agri demand environment and steady chemical markets, JACPL’s earnings should grow steadily. At current levels, investors get exposure to fertilizers and specialty chemicals at a reasonable multiple.

Risks: Key downsides include vulnerability to fertilizer subsidy shifts (a major profitability factor), raw material inflation (e.g. VAM, rock phosphate) that may compress margins, and tough competition in consumer adhesives. Execution of new expansions must be smooth. Macroeconomic weakness (currency depreciation, farm stress) could also hurt near-term performance.

Bottom line: Jubilant Agri & Consumer is a well-managed, diversified mid‐cap in the fertilizers/chemicals space. Its strengths (integrated business model, promotorial backing, improving returns) are balanced by commodity and regulatory exposures. A patient, long-term investor would watch for stable subsidy policies and sustained volume growth as catalysts to realize its hidden-gem potential.

Sources: Public filings, industry reports and ratings analysescrisil.comcrisil.comcrisil.comscreener.inscreener.inscreener.in, supplemented by Moneycontrol and Screener financial data.

I loved to hear your thoughts on this. it’s an opportunity for both of us to learn and grow. So share your insights and let’s have informative and friendly discussion about this company. I’m all ears.