About the company -

-

It got started in 1907, today business is in two vertical - (1) Material handling Equipment Manufacturing, (2) Engineered Product Vertical.

-

Material Handling Division (Rs 110 cr revenue run rate per annum) - Offers a range of equipment’s and systems, such as Pygmy, Pallet Trucks, Platform Trucks, Stacker, Reach Truck, Electric Forklift, Order picker, racking systems, etc. mainly used in the automotive, warehousing, logistic, etc. (Product ranges looked similar to the MHE division of Action Construction Equipment).

(Josts Engineering Co. Ltd. :: Material Handling)

-

Engineered Products (Rs 90-100 cr revenue run rate annually) - This vertical has a variety of product types - (1) Sound & Vibration measurement devices, (2) Measuring devices for nanoscale dimensions to help in scientific research purposes, (3) Transformer & Battery Testing Equipment, etc. (Josts Engineering Co. Ltd. :: Engineered Products)

-

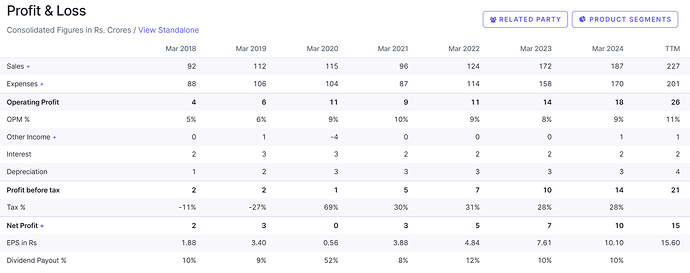

Financial Metrics - Over FY18-date, business has scaled from Rs 92cr revenue to Rs 227cr revenue scale, EBIDTA margins improving from 5% to 11%, mainly driven by operating leverage as GMs have been at ~40% across years on an average. TTM they are operating at EBIDTA of Rs 26cr, PAT of Rs 15cr (not much debt on BS), ROE profile of 20-25%.

- On the promoter side, there are two families who own - (1) Agarwal Family, also promoters of Agarwal Industries (Jai Prakash Agarwal is the common SH), (2) Jain Family (Vishal Jain, Shikha Jain, etc.). I don’t have much context on the quality of promoters. From the management side, Vishal Jain from promoter side is MD, and have respective CEOs of each verticals. Pls add more feedback about the promoters if someone has looked into the company or know about it.

Expansion plans -

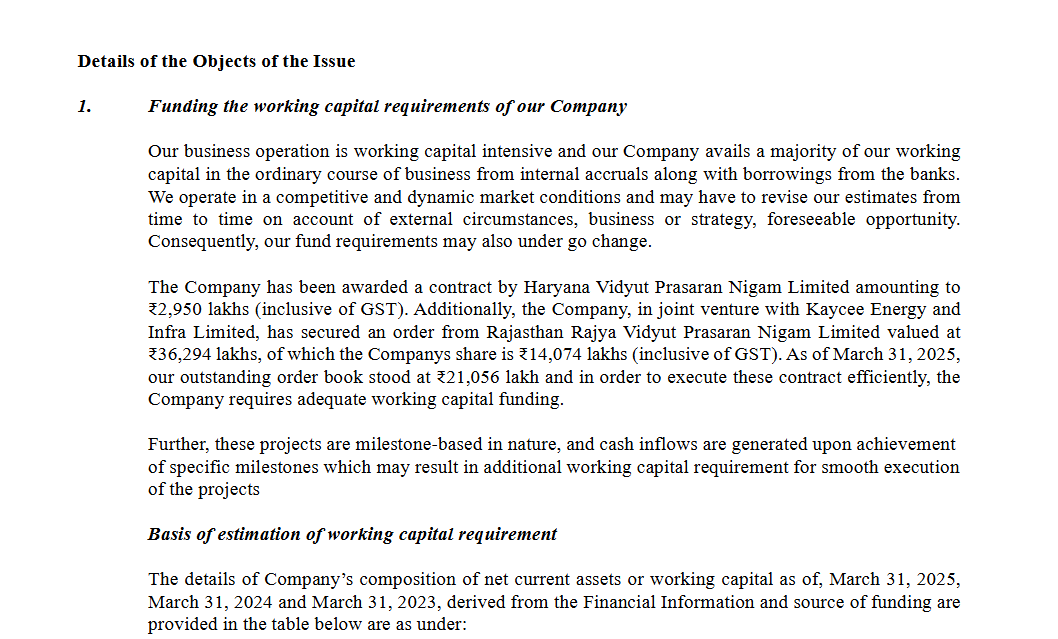

- In Dec-23, company raised Rs 12cr (at Rs 253 Rs per share, have adjusted for stock split that happened later) - Purpose was to expand the MHE vertical. They have started (trial production May 2024) new facility in Murbad for producing 2100 MHE annually (2x of current capacity) - Potential Revenue of Rs 300 cr overall.

AR 2024 - MDA Section extract

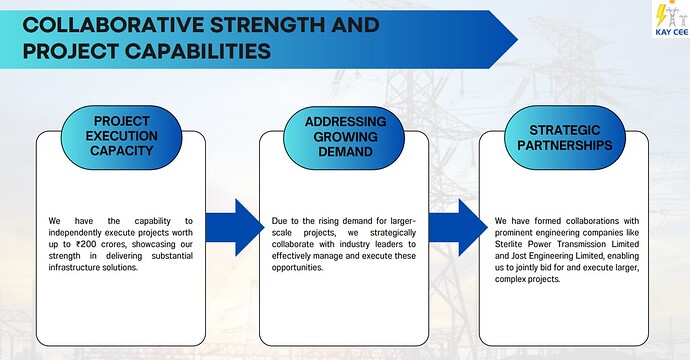

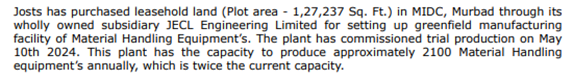

- 50-50 JV with Kay Cee Energy for executing transmission line construction, total order value of Rs 362cr (50% share for them is Rs 180cr).

AR 2024 - MDA Section extract

Kay Cee Energy PPT

Valuations -

-

At CMP (Rs 535), MCAP today is Rs 522cr (negligible debt on BS today). At 15cr trailing PAT, stock trades at 34x TTM PE.

-

There are tailwinds to both the segment they are present in. Material Handling Equipment growth is linked to general manufacturing growth, and are basic use cases of any logistic, warehousing activities, etc.). On the EPD vertical, their measurement devices for various manufacturing & scientific use cases looks to be steady growth business. However, their role in transmission projects (through new JV) needs to be understood better.

-

Growth rate and margins have improved in recent quarters, 2QFY25 annualized revenue run rate was 240+cr, and margins also improved to 13%, will need to track how that pans out in context that they will be capitalizing the newer capital expenditure (12cr CWIP as on Sep-24 book, on Net Block of Rs 22cr) which is for the MHE vertical new capacity expansion.

-

With capacity for now larger units in MHE & execution of the transmission line construction business from FY25, growth pick up is expected.

Key Risks -

-

Despite a long history (100+ years), scale of the company is not very high (just Rs 220 cr revenue), even though they look to be more active in expansion in last 5-6 years. However, vision of promoters needs to be understood.

-

What is their value add in JV they have done for setting up transmission lines with Kay Cee Energy needs to be understood. While it can be a new growth opportunity, but unit economics, receivable management, etc. will have to be evaluated.

-

Even though potential revenue from all their expansion plans look high (capacity in MHE vertical post expansion is of Rs 300cr per annum, EPD vertical is already doing Rs 90cr can grow well, Transmission line project can add 180 cr revenue over 2-3 years) - but sales & execution risks to be able to grow will need to be tested. Any disappointment on growth will be negative.

Disclosure - Evaluating as an idea, but still understanding more. Purpose of putting it on VP was to get feedback from broader group if someone has more idea on group & business. AR and website are only sources I have used to read on it, haven’t talked to company yet.

16 Likes

Wonderfully articulated about the company. Nice insights

Observed big volumes this whole week, any insights regarding this?

Hi harshit…good write up…would like to discuss this further with

There is an HNI Microcap investor named Sharad Kanhayalal Shah who has been invested since at least 2017 (screener only shows data until 2017), In last 2-3 quarters this guy has increased stake by about 3% approx which looks interesting…With such a huge stake and being a long term investor he looks as good as a promoter

One more point I would like to add is that over the last 5 years the company’s cash flows are excellent. Its actually using it own profits to grow. Debt levels are the same over the last few years…What this is doing is leading to increase ROCE…ROCE has gone from 10% in 2019 to 25% in 2024

do write back as I would like to discuss further…

Disc…I have taken a tracking position today, looking for some dips to buy into

2 Likes

2.13% shares of Jigna Knyal Sha have been transferred to Mr Sharad.

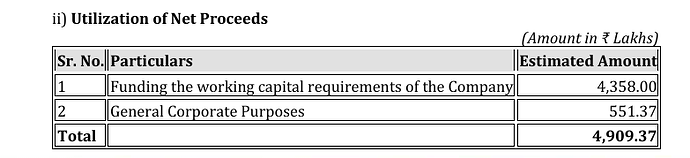

During the year under review, the Company made preferential issue of 2,25,000 equity shares to the persons belonging to the Non-Promoter Category at ₹506.50/- each (including premium of ₹504.50/- each) was approved by the Board of Directors in its meeting held on 9th November, 2023, as per the SEBI (ICDR) Regulations and other applicable provisions of the Companies Act, 2013. The same was approved by the shareholders of the Company in the Extra-ordinary General Meeting held on 7th December, 2023. The entire issue proceeds were utilized for meeting working capital requirements and expand the existing business of the Company and for general corporate purposes.

During the year under review the Board in its meeting held on 9th November, 2023 has approved to issue and allot upto 1,00,000 (One lakh only) Warrants, each convertible into, or exchangeable for, 1,00,000 (One Lakh only) fully paid-up equity share of face value of ₹ 2/- each at a price of ₹ 506.50 per share of the Company within the period of 18 (Eighteen Months) from the date of allotment of Warrants to the Promoter of the Company. The same was approved by the shareholders of the Company in the Extra-ordinary General Meeting held on 7th December, 2023.

2 Likes

Any views now? After 30% correction from top. Looks like the story is there but the flavour is not there. The pref. allotment was at 500 ish and currently 30% below that price.

I want to buy this business at dirt cheap valuations, Mcap to Sales of 0.7 - 0.8 and PB around 3.5. Am I reasonable understanding the correct value of this business?

Any suggestions?

3 Likes

anyone still tracking this ?

from march lows it went up 50% and now back to march levels.

what is causing these sharp movements ?

any clarity on revenue from this JV ?

Studying.

These kinds of movements are natural for such companies, as their stock is illiquid and listed only on BSE. Even one large investor exiting or entering the stock will move it quite a bit. Besides, the management seems to be having a penchant for frequent equity dilution - and the recent Rights Issue announcement doesn’t look good either. What is the need to go for a Rs.50 crore Rights Issue when the company is almost debt free and has no specific project for which funds are needed? Looks like an attempt to raise stake by stealth. Q1 results were also poor - sales down, margins down, profits down.

3 Likes

This is an article about Sharad Shah(HNI investor in Jost’s)

1 Like

Incidently Kay Cee Energy & Infra is facing allegations of using fake qualification certi to secure tenders of 8500Cr.. Kaycee has denied the charges and issued clarifications to NSE >> https://nsearchives.nseindia.com/corporate/KAYCEE_25082025215055_Kaycee_rumour_clarification_.pdf

Has this cast shadow on Jost’s Engineering Company Limited, which shares execution responsibilities on projects 363cr RRVPN order (Jost’s share: 141Cr) ?

These r not direct allegations against Jost’s, has market reacted to the allegation to Kay Cee ? — it has tumbled ~50%.

Anyone has studied wht companies have done after having Sharad kanaiyalal shah on board as investor, since he is known permabear & he is known to market. What does josts gain having him as investor ?

Studying.

1 Like

Mr. Shah although is a permabear but these sort of people create fear to take advantage of lower prices. What point is being permanently bearish if you are unable to make money,this person has made his money so he is using that to his advantage. He has recently sold 50,000 share of JOST’s at around 330 level, he can use that money to apply for righat at 270/- ,his holding would entitle him to atleast that much allotment. He is doing fine as a bear. Also one more thing no company choses its investors unless it is a preferential allotment. Also always bear in mind…birds of a feather flock together. Check Gensol engineering and its liaison with refex industries before it went down. Also when you see sudden rise in share price check social media posts on that…See the image below:

there is a pattern in social media posts and stock peaking. You need someone to buy your quantity.. It is well orchestrated, the stock hit its peak on that day. I am not insinuating that this handle Mr. Asan is involved in some way but I do remain wary of social media highlights about thinly traded BSE companies.

3 Likes