INTRODUCTION

-

JNK India Limited was incorporated in 2010 and is engaged in designing, manufacturing, supplying, installing, and commissioning process-fired heaters, reformers, and cracking furnaces (HEATING EQUIPMENTS).

-

The company has a diversified product portfolio that caters to varied industries such as oil and gas refineries, petrochemical, steel, fertilizer, etc.

-

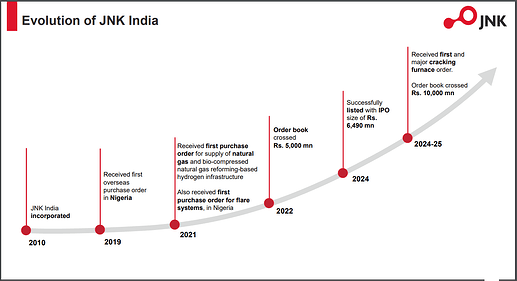

Evolution of the company

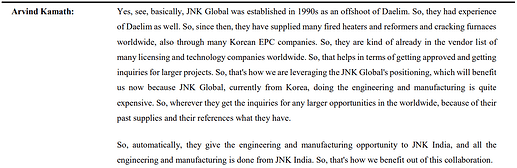

Strategic Collaboration with JNK Global

- Company has strategic collaboration with JNK Global, the renowned industrial-use Process Fired Heater producer in Korea, and it is one of the promoters of JNK India.

- This provides access to extensive knowledge and resources, fostering innovation and efficiency in JNK India projects.

- JNK India acts as a global joint engineering and implementing

partner for JNK Global

This snippet explaines it well

PROMOTERS

-

Arvind Kamath

Arvind Kamath is major promoter of the company and holds 32.65% stack via MASCOT CAPITAL AND MARKETING PRIVATE LIMITED -

Goutam Rampelli

Gautam Rampelli holds 8.34% stack in the company -

Dipak Bharuka

Dipak Bharuka holds 8.92% stack in the company

INDUSTRY OVERVIEW

-

Established business line for the company is in the segment of heating equiments. (Process fired heaters, Steam reformers, Cracking furnaces)

NOTE: For more technical understanding and product applications, please refer company DRHP here. JNK INDIA LTD-DRHP -

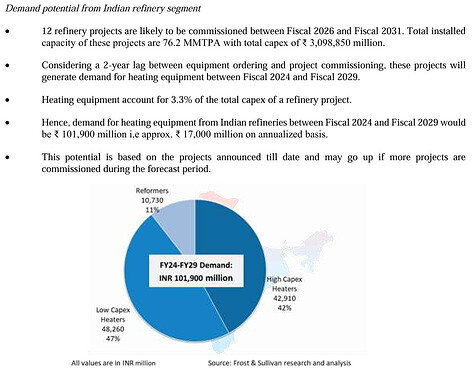

Demand potential for Indian refinery segment

-

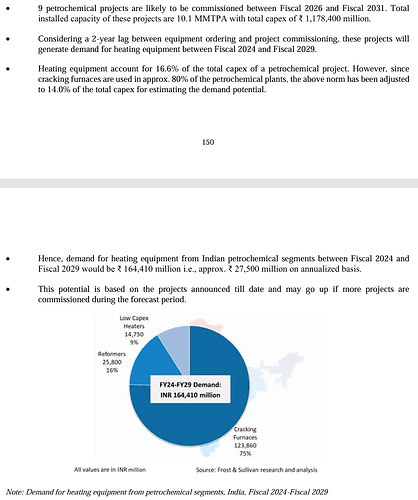

Demand potential from Indian petrochemical segment

-

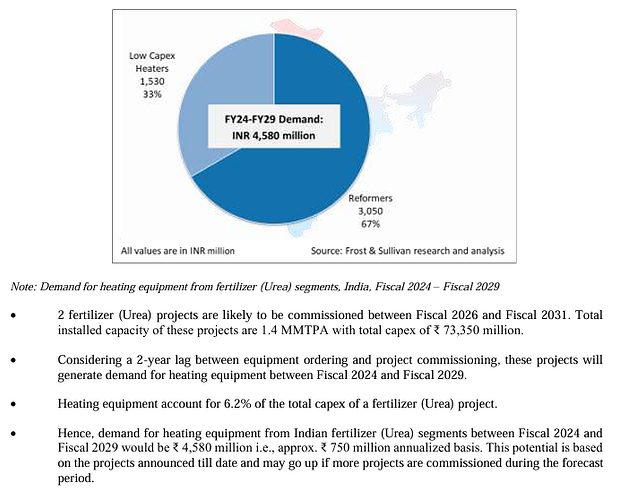

Demand potential from fertilizer (Urea) segment

So, total demand for heating equipment from Indian refineries, petrochemicals and fertilizer (Urea) segments between Fiscal 2024 and Fiscal 2029 is estimated at ₹ 27,089 crore i.e., approx. ₹ 4500 crore on an annualized basis. 61% of this demand would come from petrochemicals followed by 37% from refineries and 2% from fetilizers (Urea).

Same way, demand for heating equipment from the refineries in the countries of interest between calendar year 2024 and calendar year 2028 would be ₹49,045 crore i.e., approx. ₹ 7256 crore on annualized basis.

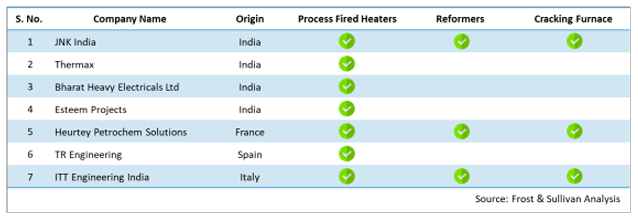

COMPETITIVE LANDSCAPE

- The process fired heaters market has high barriers to entry and there are only a handful of suppliers, despite surge in demand.

- If the operation of a process fired heater is interrupted for even one day, users could incur significant losses, which is why suppliers undergo a thorough selection process.

- The Indian heating equipment market is closely competed among seven companies with JNK India and Thermax being the most prominent and comparable players. Bharat Heavy Electricals Limited is also a participant however, its revenue from heating equipment is comparatively lower compared to its other flagship businesses.

- In terms of revenue from heating equipment, JNK India is the largest company in India with a revenue of more than ₹ 4,000 million in Fiscal 2023.

- In terms of volume, the company is currently installing 25 units, which is higher than any of its competitors currently executing in the Indian market.

- Based on discussion held with the leading heating equipment suppliers, approximately ₹ 22,000 million of heating equipment have been ordered in Fiscal 2023.

- As per Fiscal 2023 orders, company commands 27% market share in heating equipment space in India.

- At global level, JNK India commands 2% market share and JNK Korea commands 14% market share.

FINANCIALS AND FUTURE GROWTH

- From FY21 to FY24, revenue has grown at CAGR of 50%+ with OPM margins in the range of 18%-20%.

- Company has generated positive operating cash flow in 3 out of last 4 years, though cumulative OCF/PAT conversion rate for last 4 years is 39% which seems little low.

- Company’s current orderbook stands at Rs. 1246 crore as of Q1 FY25.

- Company’s orderbook was at Rs. 620 crore at the end of FY24, and after getting significant order of close to Rs. 700 crore from Reliance Industries for cracking furnace, orderbook strengthen significantly.

- Company plans to execute opening orderbook fully plus some portion of new orderbook, so revenue for FY25 will be close to 700 crore with 18% OPM.

- There is healthy bid pipeline of Rs. 4000 crore and company’s conversion rate stand at 20-25% historically. So there is good visibility for future orders.

RISK FACTORS

- Company is proxy to Oil and Gas sector growth, so if there is slowdown in capex plans or delay in new projects in this sector, it can affect the orderbook and future visibility of the business.

- Company has derived majority of revenues from their Corporate Promoter, JNK Global and use their experience and technology support for select projects. Any kind of dissociation with JNK Global may have an adverse impact on their business, results of operations and cash flows.

OTHER NOTES

- Company recently entered into Flares, Incinerators segment which is 4% of total revenue which I have not covered here in detail. I will add in subsequent comments.

- Company is also building capabilities in renewable sector with green hydrogen as well through subsidiary JNK Renewable Energy Private Limited, which we need to track going forward.

Disclaimer : Tracking