JKIL posted impressive results

9 Month’s EPS over Rs 20

Yearly EPS may be in range of 28-30

Available at PE of 5

Have Strong Balance Sheet

Quality Order Book of around 15000 Crs

Past hangovers of SEBI matters over now.

Looking very Interesting bet for 1-2 Years perspective.

What could be the reason for such subdued price action despite good rally in mid cap space and absorption of selling by Small cap fund? There were concerns that metro work was disrupted in Mumbai post change of government?

No Ayush Bhai, No party can afford to stall ongoing Metro Projects. JKIL having most of the Projects in MMR region and Co successfully worked with all the regimes in last 15-20 Years.

Timing the Market is very difficult, but Risk Reward seems highly favorable.

Only the work of Metro 3 car shed is stuck. Rest all are going on as planned. J Kumar is not contractor in Metro 3 car shed.

J Kumar Infra - CMP-169 / Current Mcap 1278cr - Trading in Deep Value

P/B - 0.7

I expect a PAT of 250cr by FY22 - implying a PE of 4 at current market price.

(Note: PAT projection based on fully ramped up business operations next year to pre-covid levels and growing at the natural growth rate for the company).

Valuation:

Annual growth rate 10% or higher (management guidance)

At my expected rate of return of 15% from the market, this implies a DCF based EV of 5000cr. Since net debt is zero, the implied equity valuation is 5000cr.

(Note: I have assumed growth rate of 10% to persist on a long enough horizon, which is realistic given the small base revenue & potential of infra spending in India in coming 2 decades)

This means the stock price should be 4 times current market price of 169, i.e., Target Price Rs 675 today. (In next 10 months, FY23 projects will come into play and I expect a PAT of 300cr, implying a valuation of 6000cr or ~4.7x of CMP, i.e., Target Price - 800)

Some other aspect to note are:

- News overhang, from 2-3 years ago, got removed last year when the company got all clear from SEBI/MoCA.

- Norwegian Pension Fund (which has long term investment horizon) entered the stock in March 2020.

- Company owns most of the construction equipment, whereas other companies rent it. That puts pressure on return ratios in the short term, but aids in timely execution of projects by providing more control over planning thereby increasing operational efficiency. In JKIL’s case, a lot of its equipment such as TBM (tunnel boring machines) used for underground projects, is fully depreciated & written off in books but is still in use. This will result in improved margins going forward.

- Recently won the Surat metro project in Gujarat., shows good relation with authorities.

So, in summary, JKIL is a multi bagger from here (CMP 169).

Excellent commentary by management in the Q3 concall.

Operations to be fully ramped up Q4 onwards. Guided for ~3500cr topline, implying my projection of 250cr PAT in FY22 will be easily met.

Mangement guided for ~15% YoY growth, which is more than my earlier projections of ~10% used to derive the valuations above. Therefore, my target price at fair valuation gets revised upwards to Rs 750 today, and Rs 875 by Dec 2021.

(Note: This is based on a conservative estimate of 15% growth rate only for a few years <10yrs, post which growth rate of 10% is assumed).

Management sounded extremely bullish on future prospects, given government’s strong infra push & company’s strong balance sheet, execution record and capabilities.

Positive move - Promoters have increased their stake from 45.32% to 46.51% (Shareholding pattern for period ending Mar 2021) by buying from the open market.

On another note, technically there is a support band between 177-180. This used to be the resistance line for over 2 years that finally got broken in Feb 2021 and has turned into new support zone. The resistance band above this is between 210-216 and the one above is at 275.

Disc: Invested

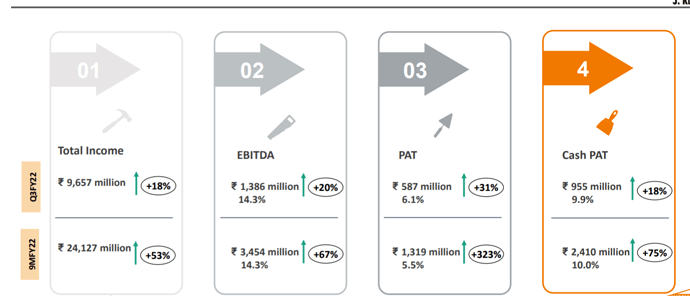

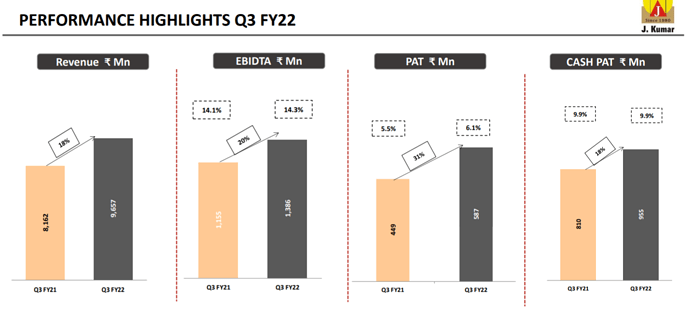

Q2FY22 Results.

Topline and bottomline improvement QoQ and YoY in a traditionally weak Q2. Augurs well for company’s guidance for 3000cr topline for FY22 since management mentioned that Q3 & Q4 performance will be similar to FY21.

Sales: 772cr (Q2Fy22) vs 675cr (Q1Fy22) vs 477 (Q2FY21)

EPS: 5.43(Q2FY22) vs 4.24 (Q1FY22) vs 0.94 (Q2FY21)

Disc: invested

JKIL improves earnings QoQ & YoY

Order book is at 10,636 cr. Revenues for FY22 is well on its way to score beyond 3000cr revenue projected earlier by management

9 months revenue is at Rs 2412cr.

Disc:invested

• Company appointed Mr. Praveen Kumar Bhandari as CFO of company who has 28 years of experience and among them 16 years was at ABG shipyard. Is it questionable?

• Company targeting a revenue of 5000 Crs by FY25 and plans to reduce gross debt every year.

• Order book stands at 10636 Crs.

• Company has bid for projects in Gujarat, Kanpur and Agra worth a total of 3500-4000 crs. Now the company is looking to take projects PAN india.

• Company is in the process of bidding for projects worth 28000 crs in a short span of time and have sighted that order book should not be an issue for the company going fwd.

• Company’s focus areas - Agra, Nagpur, Chennai. Kanpur, MMR, Surat and focus is also on bullet train projects, waterline and institution bld.

• Company expecting good order inflow in Q1 of FY22-23.

• Company has hired KPMG to improve the efficiency as well as the speed of work within the company.

Bottomline -

The company is shifting its focus to become a Pan india player then a regional player.

It is targeting 5000 Crs + revenue with 14-15% gross margins and with hiring of KPMG chances of margins improving are there.

The company received only 1800 crs. Of orders this year but that is set to improve next year.

Disclosure - invested at these levels with 5%

Fresh filing - JKIL bags orders totaling Rs. 2000cr+ !

In concall they had indicated that more order flows were likely to happen in Q1 FY23 than in Q4 FY22 due to election model code of conduct restrictions n multiple states.

Disc: Invested

Good that they have started to receive orders…orders were lagging in this FY…it could be one of the reasons for depressed stock price inspite of good results.

J KUMAR INFRA CONCALL NOTES

• Order book at 11936 Crs. and expecting order award to intensify in FY 23.

• Targeting 5000 Crs. of revenue by FY 25. Guidance to grow by 12-15%.

• Company very selective in choosing projects so that bottomline stays intact. It has been doing so for the past many years and so is able to manage a healthy balance sheet.

• Capex of 100-115 crs.

• Even with 37% increase in revenue in last FY the company was able to reduce debt.

• Process of bidding going on for projects Metro - 6000crs, STPs and water projects - 3000crs., Flyovers and roads - 5000-6000 crs, Buildings and hospitals - 5000 to 5500 crs.

• 55-60% of orderbook revenue is in the form of metro projects which the govt. has been focusing in a big way.

• With the present infrastructure the company will be in a comfortable spot with even 15-20000 crs of orders in hand but company will not take projects in which they are not able to maintain margins.

• Highly unlikely for going for a BOT or a HAM project.

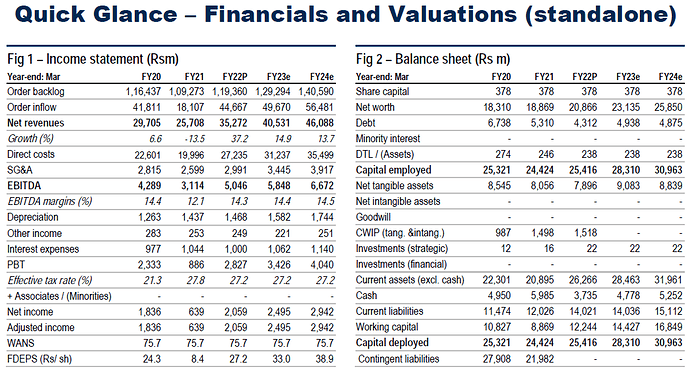

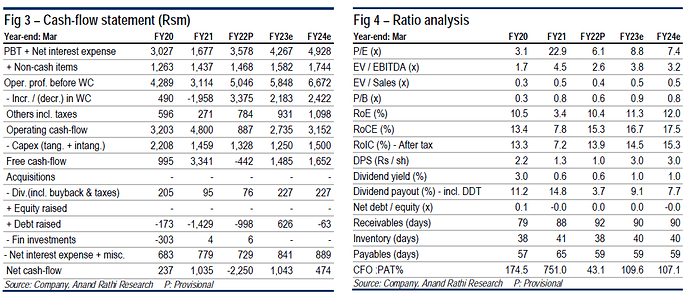

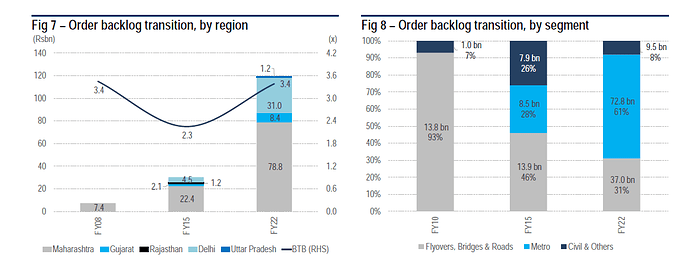

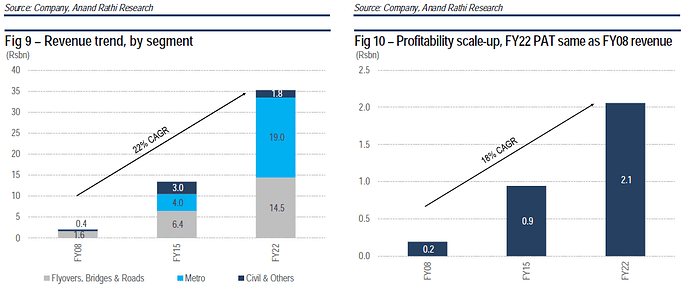

Notes from anand rathi research report

-

Company envisions revenue to become $1bn company by FY27 implying a revenue CAGR of 15-16%.

-

Capital, equipment and manpower are the key growth requisites which will not pose a problem according to the company.

-

For achieving the revenue target the company targets to have an order book of 200bn by 2027 and this they would target without compromising on margin front.

-

Company sees labour availability as a challenge and thus is focusing more on mechanism.

-

On equipment front company finds comfort from the fact that it has 7 TBMs and one more adding (the most by any company in India) two straddle carriers and much more equipment.

-

It has roped in KPMG to streamline the SOPs.

Wave 3 running, (iii of 3)

Looks like a good base, Stage 2 here

Not marking the count of sub waves and minor waves just so not to confuse and keep it clean

Company is one of the best performing infra companies with good execution trach record.

They have huge order book with good margins. one of the few companies which did not venture into owning projects (esp. road projects) but stuck to EPC model and made good money. Have started giving high dividend from FY 22 and expect dividends to to go to Rs 15 to 20 p.a. going forward.

They have good asset base (depreciated) including largest number of TBMs (needed for metro and other tunneling projects).

With infra spending to continue in india for next 20 to 30 years this company will be a multi bagger.

Price has corrected due to IT raid. it is an opportunity to accumulate and wait for good results and dividend,

I agree with you about the business. However, last time when there was an IT raid, stock corrected sharply (similar to current period) and stayed low for months.

So I guess we should wait for some time till the clarity emerge on the raid and see when the stock start rising again…

Disc.: sold sometime back at good profit. Looking to enter again after careful tracking

Like i had mentioned few days back it was good price to accumulate. Jumped up today.

It may come down a bit, but it will cross 350 after Q2 results.

my suggestion to promoters is they should give dividend at least twice a year as their cash flows have improved significantly.