It sounds too much of a work and continuous tracking. In small cap segment, personally i prefer small cap mutual funds like sbi small cap and nippon small cap. While in case of midcap, i prefer Midcap 150 index fund.

Author seems to be mining for nothing. Started with universe of 600+, applied 5 filters and reduced the list to 10 names. At the end, provided list of items under ‘Qualitative Checks’ that one should consider. If applied these as well, I am sure that ‘nothing’ will be left to consider for investment.

IMO, sub-standard write-up and that too under premium membership.

Investing in small caps without the knowledge of technical analysis is very lethal in low liquidity market like this. Irrespective of good fundamentals if your timing of purchase is wrong you can be in deep loss for 2-3 years. Many good small caps started their downway path from 2018 only to end in covid crash and then started to go up only to top at 2018 price top. If u have the knowledge of stage analysis you can save yourself from this.

We are all learning. At least I am. We will be grateful if you expand on your comments to show us which criterion/criteria the author has ignored.

To me, the small caps appear to have the most scope of benefiting the investors.

Because I have not really mastered the art of investing, I have upto now relied on two filters mainly- low PE and high ROE/ROCE.

I admit that this is simplistic. Thats why I urge more experienced investors to give their views here. As you have rightly observed, too stringent a criterion may leave us with no shares to invest. But sticking to some well-defined criteria may well instill discipline in us.

I have recently started investment in Patel Engineering because of the infrastructure play and because it is getting orders after orders. But today I have discovered that its debt is more than its market cap!

On the contrary, he applied too-many.

A simple approach could be:

- Start with any name

- Identify the mispricing to bet upon so that odds to win are 1:1

- Bet only if potential payout is 3 : 1

I have edited my comments.

But I have one question. If the criteria he has applied are too strict, shouldn’t it make the investment in the selected stocks safer?

For example, I have always found Godawari Power and Ispat attractive because of its low PE and high ROE. Caplin Point is also in the author’s list. Its on 52 week low, so it should pave for a rather safe investment?

You are right, but isn’t that the crux?

My two cents on Small caps investing based on last 2 years of experience :

- String Industry tailwind - mostly India structural story based tailwinds

- If possible , look for monopoly / oligopoly sectors

- Good track of Business scale up in last 10 years from micro to small cap journey

- Capex lined up in next 2-3 years

- Low debt preferable

6.Valuaation cap at 20 PE . Exceptional cases can be looked for 35-40 PE maximum. - Weekly Chart should not be too discouraging

- Last but the most important point - a portfolio of atleast 25 to 30 stocks to diversify company’s specific risk

Here I am posing a question with reference to two companies as to whether the stocks become worthwhile if the companies start receiving orders.

Here is the first. Patel Engineering. As per the website of the company, it is into, “all sectors of the Infrastructure industry from dams, tunnels, micro-runnels, hydroelectric projects, irrigation projects, highways, roads, bridges, railways, refineries to real estates and townships.”

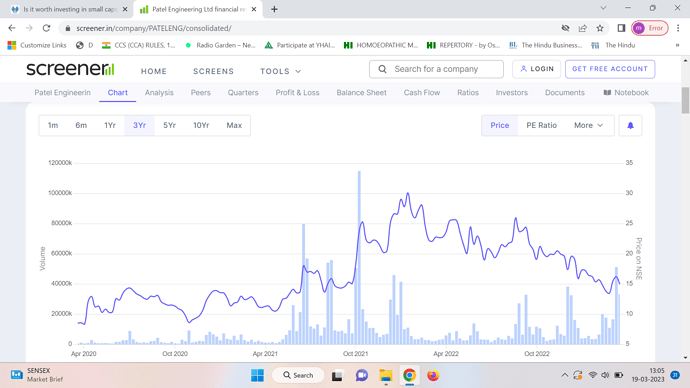

The price graph of the company does not makes for an appetising viewing.

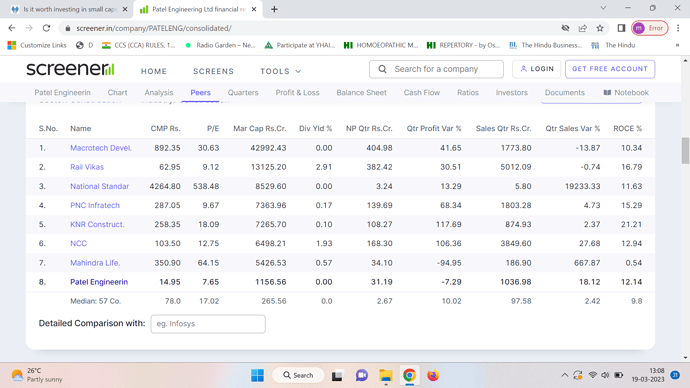

Even the past financials are not exactly inspiring.

The PE is rather low. This is what, alongwith the spate of orders it has received, and the fact that it is really trading at a rock-bottom price arouses interest.

What is however not palatable is the fact that it has a debt of ₹ 2,221 Cr, which is more than its market cap of ₹ 1,157 Cr.

This makes it practically a basket case.

As for the orders I have mentioned earlier, in the recent times it has received multiple orders. ‘Rupen Patel, Chairman and Managing Director of Patel Engineering Limited says, “In the recent past, we have declared L1 for four other irrigation projects located in Maharashtra, Madhya Pradesh and Karnataka. Further, these two new projects will help strategically deploy and utilise resources more efficiently. With these two new L1 projects, our share of order wins including L1 in this financial year is around 5,900 crores.”’ (March 16, 2023)

See also

The interest outgo for '22 was ₹420 cr, whereas the net profit was only ₹72 cr.

Book value of the stock is ₹32, which is more than double of its current price.

So, should we in the light of the recent orders ignore its debt?

The other company under consideration is Vintage Coffee and Beverages. Vintage Coffee is into the manufacturing of Instant Coffee. They are primarily supplying to domestic markets and majorly exporting to various countries.

The Co. was acquired by Chin Corp Holding Pvt Ltd and its owners in June 2021. The acquirer bought around a 50% stake in the company at an offer price of Rs. 20 from the public shareholders. [2] Post acquisition, the name of the Co. was changed from Spaceage Products to Vintage Coffee and Beverages Ltd.

https://www.screener.in/company/538920/consolidated/

Over the last 4 years, Vintage coffee has established itself as a supplier to several companies in key markets such as Russia, Latvia, Turkmenistan in East Europe and Central Asia, Nouakchott, Mali, and Nigeria in West Africa, Myanmar, Malaysia, and China in S.E. Asia and Australia in the far east, UK and Spain in Europe and now getting ready to enter markets in India.

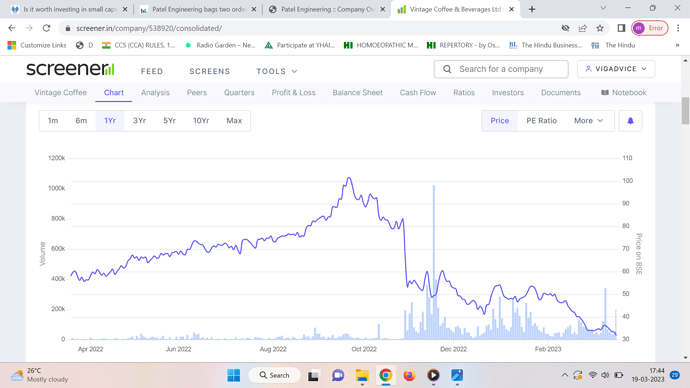

Again, the price of the share is at rock bottom. The trend looks like waterfall.

The book value in this case is half the current price of the stock ₹15.2 to ₹ 31.8.

The screen does not give any of the ratios, PE, ROCE or ROE. It made a net profit of ₹1.28 cr in the previous quarter. Last year its net profit was -12.27 cr.

Here, three things are of interest. The rock bottom price (Ben Graham would have recommended it?) and the orders it is receiving now.

Also, please see Vintage Coffee And Beverages Ltd bags order from South East Asia | EquityBulls

So, despite the low, almost negligible profits, are these two stocks worth a look?

Disclaimer: I have invested in them recently.

Time to bring Long-Term Investing Back! - Part 2

In my last post, I had mentioned Mutual Funds as a route to bring Long-term Investing Back. Another route that I had mentioned was through Direct Equity. Even under Direct Equity, there are various stocks that you can invest in. The investment universe under equity stocks is around 5000 listed stocks on BSE itself. How do you figure out which ones to invest in and which ones to not. Well, for that I had given an extensive Equity Checklist in my old blog posts. (They are only specific to Midcap/Small cap/Microcap Stocks and not applicable to Large cap stocks as they’re sure shot fundamental bets and that’s why they are Large caps :P).

Expanding more on the Equity Checklist (Qualitatively), I recently attended a webinar on Surviving & Thriving in the Small Cap Space organized by Smart Sync Services (Ankit Kanodia) with the Guest as Ayush Mittal. Very useful insights were given by Ayush Sir in the webinar.

Ayush Sir suggests that Small Cap Investing requires a lot of patience and the conviction to hold the stocks for a good period of time which maybe 5-10-15 years (As the heading suggests, long-term investing works best in small cap companies). In order to hold them for a long period of time, your conviction in the stock should be high which can be established through extensive research. A thorough Fundamental Analysis with the help of the Equity Checklist can help you build that conviction. A small cap company with an economic moat and strong competitive advantages should be preferred for investing.

Small Cap Investing does have its own challenges. As these companies are small (under researched as well), there might be limited information available in the public domain. This can be overcomed by either sending mails to the investor relations contact of the company and asking for relevant information or visiting the business premises physically to get more information. This will help build a better conviction and also help you understand the future prospects of the company. This might help you identify a good opportunity in the space.

Reviewing is an important activity that should be done on a quarterly basis (usually around the results season because management also provides some kind of guidance on the future) and rebalance is necessary.

I would like to give my own example in this context. I had identified a stock named BLS international on which I had written a Blog Post “A stock that gave me 150% return”. This is my story on Thriving and Surviving the Small Cap Space.

Hope this Blog helps you in creating your own Wealth in the Small Cap space!!!

Happy Investing!!!

Fantastic article. Thanks for sharing!

THat means now if you hold BLS still, you have around 800 pc return. Nice bog and thanks for sharing.

Hello Sir,

I went through your post regarding Vintage Coffee. All seems good but does not Coffee Day Enterprises Ltd seems more promising to you ?, considering:

- Better price discovery

- Better price to sales ratio

3.Better price to book ratio - Brand value

IMHO, Coffee Day Enterprises Ltd seems more promising, however Debt is major issue.

Regards

Frankly, I would have never invested in saner moments in any share whose PE is more than ROCE. ![]() So, it goes for both Vintage Coffee and CCL.

So, it goes for both Vintage Coffee and CCL.

But then, every investor dreams of stumbling upon a turnaround company. First time I bought it at 48 It went down to 22 too (52 weeks low is 17.35), but then I should not have sold my original holding when I got rights at 12. Shortage of funds was the reason.

So, my holding is up 18% now for my pains. As per the Screener* “Debtor days have improved from 84.7 to 60.4 days.”

But I still have hopes of this share. I have just checked and it is at 52 high. The CCL has not done so well.

But honestly, I have never compared Vintage and CCL.