i think this is a big news for IRCTC

Just wondering, if the government’s move attracted interest of two dozen firms, including global majors Alstom Transport, Bombardier, Siemens AG and Macquarie and domestic companies such as Adani Ports and Special Economic Zone, Indian Railway Catering and Tourism Corp. (IRCTC), then how it is a good news for IRCTC ? Is it not the case that the new players will enter the business and IRCTC’s monopoly would be lost ? Am i missing something in my thought ??

Govt intention to go for 150 trains is to those private players including global majors Alstom Transport, Bombardier, Siemens AG and Macquarie and domestic companies such as Adani Ports and Special Economic Zone. who would be investing into the train engines, and bogies. This way, govt will save about 25000 Cr. So that is the broad picture.

So far as IRCTC is concerned, train running is a diversification, it is not their monopoly. And they don’t have that kind of deep pockets. they might end up owning about 20-25 more trains. In IRCTC case, the railway’s own the engine and bogies, these are leased to IRCTC, being their own subsidiary. who pay them the lease charges. This leasing model will not be extended to other global and private entities.

It is worth noting that these private entities don’t have experience of managing trains in India. so many of them might assign that role to IRCTC on mutually agreed terms. It is too early to comment on that scenario,

It is quite an interesting model and analysis provided by you towards estimating the net profit due to Tejas Trains. I observe that you have not factored in costs items like (1) lease charges to be paid to railways. (2) staffing cost (3) amenities costs to be paid to various subcontractors (4) depreciation.

You may like to update the net profit taking these cost elements

Also the maintenance of the Rolling Stock is also with IRCTC to add in the above.

After anchor investor reservation whatever float was left Nippon bought around 15% of it If i remember correctly at 626 in preopen. this price was unexpectedly more then the GMP prevailing.I too had bought heavily in preopen.

IRCTC is an asset light mass B2C high dividend paying monopoly and internet based platform company with many optionalities like E catering , Static catering ,Data monetization etc unlike IRCON ,RVNL,etc which are asset heavy B2B PSUs.

hi!!

- Rs 14 lakh per day, which i had mentioned for Lucknow New Delhi Tejas express is inclusive of all annual charges/rent/lease, haulage etc.

2&3. Staff and Amenities costs are covered under catering charges taken by IRCTC from passengers. Further, these works are sublet by IRCTC to a vendor who pays a fixed licensee fees/commission on sales to IRCTC and look after amenities and staff. Remaining catering charges after deduction of IRCTC commission goes to that vendor.

03-05 IRCTC staff work in the train to supervise the operations. Their cost is about 50k to 01 lakh per month for 01 person.

- Since, catering/house keeping vendor is purchasing the crockery, cutlery, etc, no depreciation of these items are borne by IRCTC.

Regards,

Disc: I am invested in this stock, have contacts/friends in railways and IRCTC and through them i got to know how such businesses are run.

Please refer link,

IRCTC declined to provide information on profit ( operating or otherwise) on the newly run Tejas trains, citing trade secret. I remember in the con call, MD mentioned that they are just break even on the lucknow Delhi route of Tejas, while the response/ occupancy is better on the Mumbai ahmedabad Tejas. Also,. pertinent to note here is that IRCTC has been clubbing the numbers pertaining to these private train ops under rail teerth ( don’t recall exact category) and not showing them seperately

What could be the reason ? Is it due to fear of trade union, or is it that they are not making as much profit as would probably attract other foreign private players ? Or is it a genuine trade secret

Thoughts appreciated

Disclosure : invested with approx 30% of portfolio value

Although above news item has no direct relation with IRCTC, it shows government’s thinking of allowing competition in erstwhile monopoly sectors. This in my opinion is the biggest risk for IRCTC.

As per my understanding, the trade secrets can not be sought under RTI.

A good article on IRCTC with several strengths highlighted. BESIDES ET PRO Moneycontrol PRO also covers IRCTC today

https://economictimes.indiatimes.com/markets/stocks/news/why-irctc-is-the-virat-kohli-of-dalal-street/consistent-performers/slideshow/74173371.cms

Some more information

Does any one see a challenge that govt will reduce the share holding and include this stock into CPSE or ETF. Coal india moil and many more psu has got monopoly business but went down

With so much emphasis and noise around BPCL divestment which is at 100K cr mkt cap and handsome 8K cr/ yr profit.

30K cr mkt cap and less than 500 cr profit - IRCTC likely looks ripe for divestment.

That’s low hanging fruit for govt looking at all possible resources for managing CAD.we will know soon.

Presenting Notes on IRCTC Catering Policy 2017 - dated Feb 2019

-

The Committee have been informed that the system of train based contracts prevailing in earlier Catering Policy, 2010 has now been done away with in new Catering Policy, 2017 and instead IRCTC run state-of-the-art kitchens of various sizes would be provided at locations across the country.

-

IRCTC would be responsible for catering services through mobile catering units, Base Kitchens, Cell Kitchens, Refreshment Rooms at A1 and A category stations, Food Plazas, Food Courts, Train Side Vending, Jan Ahaars as defined in the Policy.

-

All mobile units will be handed over to IRCTC along with existing con1tracts. The contracts which were awarded in 2013-14 and still continuing, will gradually be short terminated or continued till expiry and re-allotted afresh after expiry of term.

-

Further, Mega Base Kitchens will be constructed by IRCTC and the existing four Mega Base Kitchens of Ahmedabad, Howrah, Mumbai and Delhi will be upgraded by IRCTC on PPP mode.

-

The Committee are unhappy to note that out of 80 number of Mega Kitchens proposed to be constructed, only 16 have been planned to be constructed in 2017. Further, to their dismay, only 5 Mega Kitchens have been completed so far.

-

IRCTC has already been advised by Railway Board to take necessary action for rationalisation and standardisation of the existing menu and number of services undertaken for catering in trains. In addition Railway Board has also directed that while undertaking the said review exercise, IRCTC shall ensure that the hygiene and quality of catering services is maintained to the highest level within the framework of tariff notified. IRCTC accordingly has revised and implemented new meals based on menu rationalization on 35 pairs of Shatabdi, Rajdhani and Duronto Trains.”

-

The contracts awarded by zonal railways for kitchen units viz. Refreshment Rooms at A1 and A category stations, Jan Ahaar, Cell Kitchens shall be reassigned to IRCTC on the same terms and conditions with sharing of license fee between IR and IRCTC in the ratio of 40:60 in all cases other than departmentally managed units by IRCTC wherein revenue shall be shared in the ratio of 15:85

-

The allotment of Refreshment Room (at B and below category stations), a stall or a trolley is deemed as one unit and shall be awarded through a single license. No new license for khomcha/Dallah/Chhabba/Wheel Barrow/Hand Barrow/Tray/Table/Tea Balta (or any other similar unit by a different name) shall be awarded by Zonal Railways

-

The Committee fail to understand as to how it was decided to frequently change the responsibility of such an 11 important service of catering of a vast organization like Indian Railways from IRCTC, which was incorporated on a decision of the Cabinet, as an extended arm of Indian Railways. Frequent changes in policies not only affect the efficiency of the system due to time slag in dealing with teething problem of implementation but also hits the morale of the employees of the organization. The Committee hope that the new Catering Policy, 2017 has been designed in a more scientific manner.

Disclosure : No positions as of date

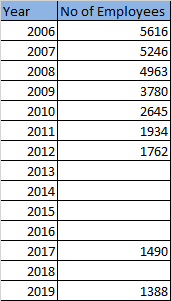

Some Unique data points

The normal issue with Govt companies is that they are overstaffed and do less work ![]()

Mapping employee strength of , IRCTC Since inception (some data missing)

-

IRCTC has been the foremost Ecom Co of India and they hardly (not nil) did Cash On Delivery even way back in 2002

-

They keep innovating and have a decent mindset. Some samples

Disclosure : No positions as of writing this post

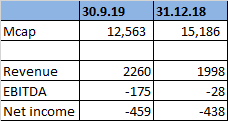

Problem is how to value this co.

-

It may earn a steady state 750-800 Crore PAT going forward

-

Despite all hoopla, Private trains are not coming in a big way. Govt has announced intention to run 100 Pvt trains across 7 clusters. Only people who have earlier worked with Indian Railways in some capacity can bid for trains. Max someone will get 3 clusters. Based on permutation combination, IRCTC can at best get 25-30 routes. That too bidding will start in June 2020.

-

I compared valuations with Event Brite - a Global Ticketing Co. Their revenue is very similar compared to IRCTC - but they are loss making and yet command a market cap of 15000 Crores

-

NSE (though very different) is a similar kind of monopoly and today unlisted deals are happening for it at 37 times FY19 earnings

-

Finally there is always overhang of Govt Stake sale (though this might not happen in next 6 months)

Old post but good one