After going through Financials of IRCTC, I can see that, there was Dip in revenues and PAT both in FY2018. Operating Profit dropped from 314 to 274, and Net Profit dropped from 229 to 221 (negligible). Dividend payout was also less in that year.

My understanding was that, Railway passengers in India generally goes up every year, and in 2018, there was no Pandemic, so what was the reason for this drop? Was it due to Fuel price rise or high inflation or any other specific reason?

(Note: There were massive lay offs in IT industry in FY 2018, which reduced IT workforce by large amount, which I can remember being part of IT industry at that time).

This looks Cyclic business to me, though it is PSU Monopoly, sustainability of PAT growth may not be there.

Valuations seems to be still on higher side though stock price has corrected a lot after October 2021. Initial enthusiasm about the stock is over but still consistency in PAT looks concern to me. I give more importance to consistent Sales and PAT growth for identifying secular growth stories.

Government policies can also have impact on margins in future.

Stock is on my watch list for some time.

govt had reduced the service fees.

railway passenger in india is growing at 2% yoy.

IRCTC enjoyed movment of 2S class booking to online as a mandatory to make their online booking share reach 83%.

ticketing business volume wont grow more than 2-3%.

ticketing revenue can only go up if services fees is increased.

“IRCTC Eyes Major Expansion in Non-Railway Catering Business Pan India

IRCTC is expanding its business beyond just managing catering services for trains. Currently, it is providing catering services to different government departments, ministries, autonomous bodies, and universities. They have even set up outlets in places like the Department of Telecommunications in New Delhi and the Calcutta High Court.

IRCTC is planning to grow its catering business even further. They have signed agreements with various government and autonomous bodies, including defense establishments like the Border Security Force and educational institutions like the Indian Maritime University and Cotton University. The company is also in the process of establishing 15 more catering units across the country soon.

The ultimate goal of IRCTC is to become a top brand in hospitality and catering throughout the country. They are in talks with other government organizations and businesses to set up more catering units and provide comprehensive catering solutions. The idea is to bring their expertise and quality service beyond just the railway system and make a mark in the broader hospitality industry.

Why IRCTC share price rising ? A blog written by Tanushree of equitymasters

An article that covers IRCTC story based on latest developments. This blog contains Ad’s intermittently on different stock stories

While this blog must have been prepared 3-4 days back , but what I find FII’s have bought on cash delivery basis this stock yesterday which made it to rise 14% in a single day.

Discl : This is one of my my “buy and hold stock” invested from lower level in this stock since Covid lock down days of 2020, I had partially booked profit earlier to recover my capital. However still holding a major portion.

This is not a buy or sell recommendation.

Please do your own assesment before investing. PSU stocks have their own set of advantages and disadvantages

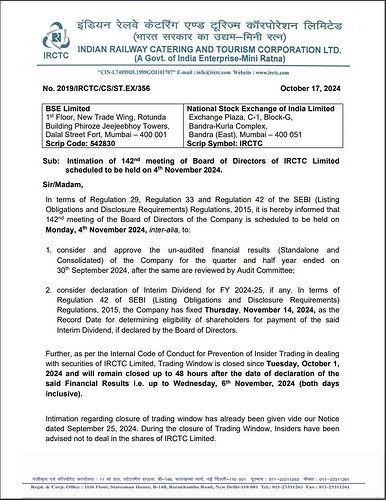

Indian Railway Catering and Tourism Corporation Q3 FY24 Earnings Conference February 14, 2024

Catering segment:

The catering segment reported a 29.1% year-on-year growth in revenue, reaching Rs.507.76 crores and a 17.6% increase on a quarter-on-quarter basis.

It may also be noted that the Q3 and nine months’ revenue in FY’24 is the highest ever recorded in the catering segment. The EBITDA margin continued to show substantial improvement reaching 15.44% compared to 10.73% year-on-year. However, there was a slight decrease compared to the 17.21% quarter-on-quarter margin, mainly due to changes in the product mix within the catering vertical as the prepaid trains revenue having low EBITDA, has increased Q3 to Rs.59.76 crores from Q2 Rs.207 crores.

Internet Ticketing:

- This segment continues to demonstrate resilience amid the conversion of the reserve to tickets back to the early reserve tickets during the pre-pandemic period. The revenue for the quarter was Rs.335.31 crores growing by 11.4% year-on-year and 2.39% quarter-on-quarter. The EBITDA margin for the quarter came at 83.02% versus 83.7% quarter-on-quarter and 84.15% year-on-year.

Tourism and state distance:

- That segment saw strong growth in revenue for the quarter at Rs.195.47 crores, implying a growth of 32.28% year-on-year and 21.11% quarter-on-quarter. Given the revenue growth, the segment reported a positive EBITDA margin of 12.10% versus 3.6% on a quarter-on-quarter and 10.79% year-on-year basis.

Rail Neer:

- Q3 FY’24, reported a value of Rs.83.76 crores marking a sequential growth quarter-on-quarter of 7.39% and a year-on-year increase of 6.05%. The reported EBITDA margin stood at 13.43% representing an improvement compared to both the year-on-year figures of 11.20% and the quarter-on-quarter figure of 12.43%. However, the segment’s quarterly profit showed a negative return of minus 3.3 crores contrasting with the previous quarter’s profit of 8.8 crores. This decline was primarily attributed to an adjustment of an exceptional item amounting to Rs.14.51 crores in this quarter.

- For Q3 FY’24, the cash and bank balances and the net worth of the Company at the end of the quarter is Rs.2,258 crores and Rs.2,946 crores respectively

IRCTC LIMITED Concall Summary Date: 29 May 2024

FINANCIAL HIGHLIGHTS

In Q4 FY24, the revenue from operations grew by 3.3% on a QoQ basis.

The YoY and QoQ growth in revenue was led by the catering segment during the quarter.

In FY24, the EBITDA grew by 14.9% YoY to ₹1,466 crore and EBITDA margin stood at 34.3% (v/s 36% in FY23).

Profit before exceptional items grew by 19.6% YoY to ₹1,170 crore in FY24 as compared to ₹978 crore in FY23.

As on 31st March 2024, the cash & bank balance stood at ₹2,263 crore.

The net worth of the company was ₹3,230 crore as on 31st March 2024.

In Q4 FY24, the company incurred capital expenditure of ₹55 crore. For FY24, it was at ~₹240 crore.

BUSINESS HIGHLIGHTS

CATERING

During the quarter, the catering business reported revenue of ₹530.8 crore, i.e., a growth of 34.1% YoY and 4.5% QoQ.

The EBIT margin moderated to 8.7% as compared to 15.4% in Q3 FY24 and 12.1% in Q4 FY23.

The company has a presence in over 120 prepaid trains, 440 mail, and express trains, and 702 trains under Train side vending (TSV). The margins in the prepaid trains are higher.

The recent tie-up with Swiggy and Zomato is progressing well. The company had started this year with ~60,000 orders booking per day. This has crossed 1,00,000 orders booked per day during this month. The company is booking revenue of ~₹1.5 crores per day and the margin is ~15%.

The company is providing e-catering services in 407 stations.

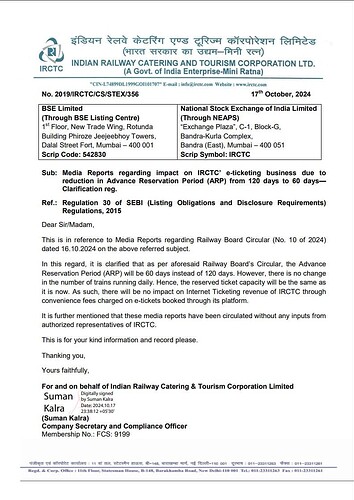

INTERNET TICKETING

The internet ticketing revenue grew by 16% YoY and 2.1% QoQ to ₹342.4 crore.

The EBIT margin for the business stood at 80.3% as against 83% in Q3 FY24 and 88.1% in Q4 FY23. The margin contracted due to government policy on the Unified Payments Interface (UPI).

The payment from UPI increased to 39% from 33% in Q4 FY23.

In Q4 FY24, the company booked 11.74 crore tickets.

During the quarter, the convenience fee revenue stood at ₹224 crore and non-convenience fee ₹118.3 crore.

During the quarter, I-pay revenue stood at ₹22.35 crore.

In FY24, the company booked 12.38 lakh tickets per day as compared to 11.82 lakh tickets in FY23.

IRCTC has applied for a payment aggregator license with the Reserve Bank of India (RBI).

TOURISM

The tourism business (including state teertha) revenue stood at ₹201.7 crore, i.e., a growth of 3.2% QoQ, however on a YoY basis, it declined by 1.1%.

During the quarter, the segment reported an EBIT margin of 9.4% v/s 12.1% in Q3 FY24 and 13.5% in Q4 FY23.

The state teertha business was impacted during the quarter.

RAIL NEER

Rail Neer segment revenue grew by 13.1% on a YoY basis, however on a QoQ basis it declined by 1% to ₹83 crore.

During the quarter, the EBIT margin improved to 13.3%.

In FY24, the company supplied ~12 lakh bottles per day as compared to ~11 lakh bottles per day in FY23.

The company is currently supplying ~14.5 lakh bottles per day.

FUTURE OUTLOOK

The management expects EBIT margin of ~8%-9% in tourism business and ~15% in catering business in FY25.

The company envisages adding more Vande Bharat trains to its portfolio in the catering business.

Modi-3 cabinet with old set of ministers signals policy continuance-Railway, Infrastructure, Defence,

I would tend to agree with you. Stock Price seems to be factoring in all good things at current CMP of 930 and P/E of 60+.

If GOI imposes any new policy restrictions in terms of convenience fee reduction, private players to participate in Online ticketing etc. then whether this premium valuation remains is the key concern.

Stock is on my watch list.

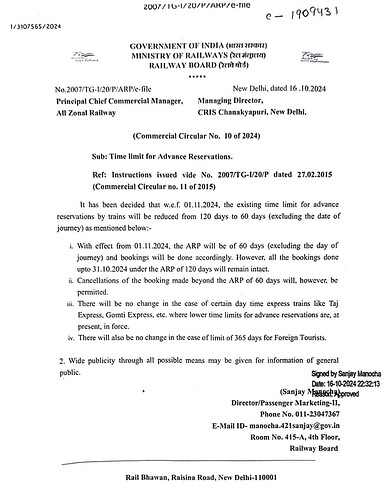

Will this be a pro for IRCTC (tktng revenue) or disadvantage?

Adani One’s, an online train ticket booking platform, is not expected to have a significant impact on the Indian Railway Catering and Tourism Corporation (IRCTC)

Integration with IRCTC

Trainman is an authorized agent of IRCTC and is integrated with its platform. This means that online train ticket bookings made through Trainman are powered by IRCTC’s API.

Contribution to total ticketing

Trainman is a business-to-consumer (B2C) partner of IRCTC, contributing only 0.13% of the total reserved ticketing.

No competition

IRCTC and its agents, including Trainman, are not competitors. IRCTC makes money from all online train ticket bookings, whether made through IRCTC itself or through aggregators like Paytm and MakeMyTrip.

Benefits for customers

The integration of Trainman with IRCTC provides a seamless ticketing process for customers.

I think irctc ticketing business almost on saturation level approx 84% tickets are booked online and main revenue is from ticketing business. Hence irctc must increase its catering business to grow it’s profit