Please correct me, but bond and int rates are inversely proportionat.

If you have a CDSL account and hold the shares before the cut off date, you can attend the AGM even if it is hosted by NSDL or any other platform. You don’t need a separate NSDL account. You are probably trying it the wrong way. The detailed instructions on the login procedure is given in the Notice to the AGM in the Annual Report, just follow it.

Briefly, do the following:

Register for the CDSL Easi / Easiest facility. Login and click on the e-voting menu.

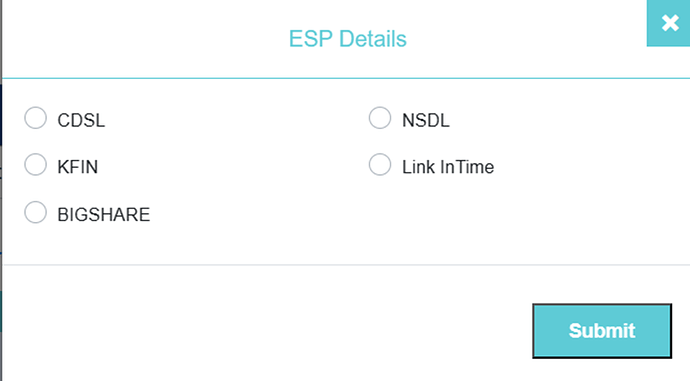

You will see a pop up where you can select the entity who is hosting the AGM (NSDL, in this case) and click Submit, it will take you to NSDL directly in a logged-in state i.e. you don’t have to have a separate NSDL account or create a NSDL login. This is a single sign-on (SSO) to go to NSDL via CDSL login and not from outside.

Alternatively, after clicking on the e-voting menu, you can see the below panel on the bottom of the screen where you can click and select NSDL and the same thing as above will happen.

After you are into NSDL website, click on Active evoting Cycles and you will see the name of your company and a hyperlink to launch the AGM interface.

A second option is to access though the evoting website www.evotingindia.com/ . Detailed instructions for this are also there in the Notice to the AGM as well as the email you would have received from the depository before the evoting period begins.

Lastly, there is also a Helpdesk number where you can call up in case of login issues. They should help you sort out the login issues. Sometimes, they also give dedicated links which can be used for specific AGMs. Everything is there in the Notice to the AGM in the Annual Report, just follow it and it should work.

Valid point. Times have changed. Many promoter companies are well governed as promoters have understood the importance of good governance. Professional managers are chasing short term targets and want to maximize their ESOPs and bonuses. Promoters want to leave a legacy for their children and have a more long-term vision. I prefer promoter managed companies than professionally managed ones.

Hi, See this article if it helps:

Existing bond price and interest rate increase are inversely propotional.

But Increase in interest rate and the bond yield are directly related therefore existing bond rates fall to match the current increase in yield.

From google

When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant, and yields go up

Thank you so much everyone for support.

@Chandragupta Sir - Thanks for sharing the approach, i indeed was following the wrong path. With the steps you listed out, i was able to get into the NSDL portal with my cdsl login.

I have a fundamental question about when a NBFC will get money when they do Direct assignments and securitization. My understanding, so far, is that NBFC will sell the pool to any other financial institutions and get the entire amount as bulletin payment and the buyer of the pool will get money as a monthly payment(as and when the customer pays). Am I getting this correct?

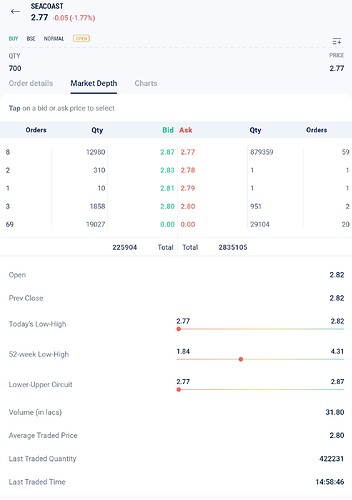

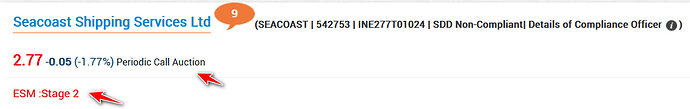

Enhanced Surveillance Measure (ESM)

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20230602-44

What are the advantages and disadvantage of companies demarger?

Bcz many companies demarge there business.

thanks a lot sir @ royatirek

How to make sense of valuation of a stock? Few things I encountered are

- PE and its comparison with historical PE of the company. Also with its Peers in the industry.

- Then we have DCF valuation

- Another one is Graham’s formula for calculating IV. Screener is also using this one.

My questions are :

-

How much weight one should give to these approaches and to valuations overall.? Analysing a company have plethora of factor? Lets say IV of a company is less than CMP but PE is higher than historical PE , does it make that stock undervalued or overvalued ? I totally understand that these are parameters to gauge a range of price but how do I make sense of these values when put together?

-

Is there any book or blog which compares different types of valuations? Just finished my first book “Five rule of successful stock investing” ?

-

Since both DCF and Graham’s formula are giving an approximate values , would it be safe to use Graham’s formula always just because its easier to calculate? Ofcourse , I will be using all the other factors (ROE,ROCE, P/B, EV/EBTIDA) along with it.

Thank you in advance.

calculating Intrinsic value or using DCF value is not helpful. Most of these calculations consider so many assumptions that two people with different assumption values can reach to exactly opposite conclusions.

Even comparing past average PE is not helpful as there might be drastic change in the business model as well as product portfolio of the company and hence current PE can be very different, and rightly so , compared to PE 5 years ago.

Even in case of Peers , its very challenging to compare. No two companies are same. Their moats can be very different. Their managment style can be very different and their geographical market can be very different. For example, in Paints industry, Asian Paints can be valued differently than Nerolac etc.

Thanks for the reply. Then How should one analyze price of a stock whether certain stock is relatively cheap or overvalued?

You can use all the above 3 methods, being very much aware that what you are actually doing can be very much wrong. .Sometimes it may give near approx or rough idea…but nothing above that…Also by spending more time in market and following that company for long time, during both bull as well as bear market, you may start getting a gut feeling when its over-valued or under-valued…but this is again subjective and only depends on how “sensitive” you become wit respect to that particular company in terms of its business and its all financials.

Thank you so much for your kind response. Really helps a lot.

Imho, Ben Graham captures the essence of valuation beautifully when he says.“It is quite possible to know that a woman is old enough to vote without knowing her age or that a man is fat without knowing his exact weight.”

I have been reading about goodluck india and the impact of warrants.

As per investopedia - Warrants represents rights to purchase a company stock at a specific price and at a specific date.

Here in this case goodluck promoters are also getting warrants at 600(near cmp).

I have heard that when a company issues warrant to promoters, then it is a positive sign.

I have few doubts here -

It feels that this settlement is very promoter friendly as when the price increases they get the profit ortherwise they don’t need to excercise it. Considering my understanding is correct, what is stopping the promoter to get warrants every year regularly(and exercise it based on profit) instead of only when business will do good in near future? It seems there is no negatives.

hi

How to know the value of work contracts/ Future order book of a company through NSE or any other valid resource. Please discuss.

Thanks and Regards

I feel that I got the answer.

They have to pay 25 percent upfront.

Link