hi guys just now i recd research report from value2wealth blogs.i personally feels very intresting story .u pl.read report and share your view

As per new regulations of SEBI, it seems that only SEBI qualified research analyst can express buy , sell , hold , accumulate etc. recommendation about a stock through any public media. SEBI has given six months time(May2015) to comply with it for existing research analyst .I am not SEBI qualified research analyst but I am aspire to become research analyst in next 3-5 years .So , purpose of this blog learn and put analysis of company with whatever I know and get input from SEBI qualified research analysts . I am sure this learning method will help me to become SEBI qualified research analyst one day.I think this rule is quite appropriate since how can person like me who is still learning give any opinion of buy , sell particular stock.

Today, I would like to get input on “Intrasoft Technologies Ltd” . Since you are experience research analyst you will say what is special here . They have www.123greetings.com which offer greeting services free of cost, generate revenue from add services and as per current market cap trading fairly .

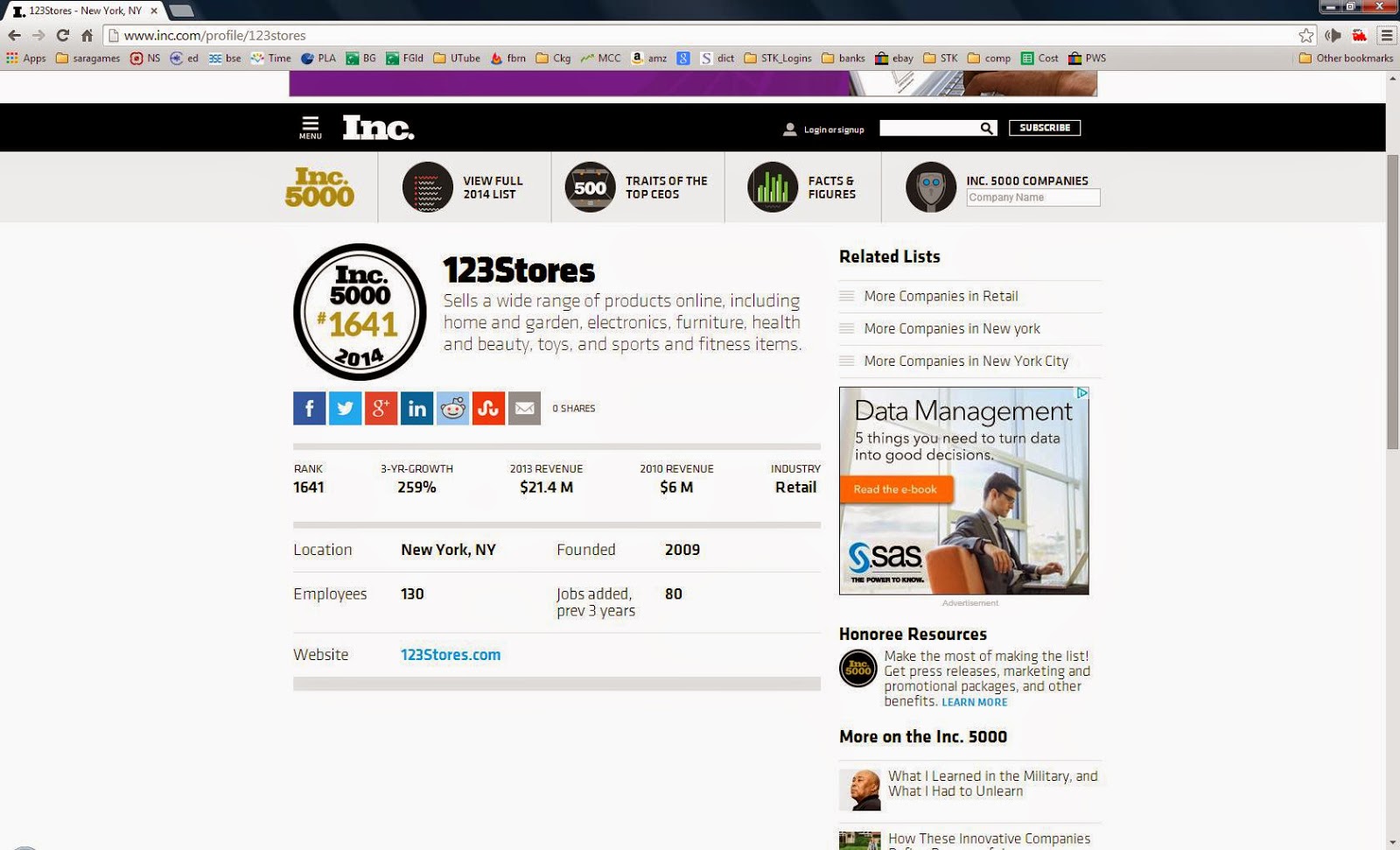

My interest in this counter is not generated because of www.123greetings.com but something else . Look at the following screen shot and let me know if a e-commerce company in USA growing with these figures wouldn’t attract your interest . How much will you pay for this company ?

Source :http://www.inc.com/profile/123stores

This is nothing but http://123stores.com/ e-commerce division of 123greetings.com

USA which is wholly own subsidiary of “Intrasoft Technologies Ltd” .

Please look into following links for highlight of last quarter . We cannot compare data directly with Snapdeal and Flipkart . It is growing fast with small base , same time present tremendous opportunity for me to participate in growth of e-commerce since very few e-commerce companies are listed like Info Edge , Just Dial etc. Those are available at high valuations and already discovered by market .

During the quarter they entered the US Internet Retailer Top 500 list at 499 from last years more than 650.

I still need to analysis business model but as per my initial analysis it generate revenue by two ways .

- Partnership with other top USA marketplaces (ashop in a shopa format) like Amazon, Ebay .We can describe in another words as marketplaces inside marketplaces .If it get commission from register vendors and not hold actual inventory . I do see quite low inventory in balance sheet .

2). Direct sale from http://123stores.com/

. I believe this is small portion at the moment since as per Alexa only around 3000 unique visitor visit daily this site but that count is also growing fast .

http://123stores.com.alexaview.com/

Open question to management .

- What is mix of above mention channels ?

- You mentioned “Our growth in the E-commerce business can be directly attributable to the strength of our proprietary enterprise software” . What are these strengths ?

I do also see good growth potential in http://www.123invitations.com/

but they need to make UI impressive and add few more value added features.

123Stores, Inc, reported record sales over the long holiday weekend from Thanksgiving Day through Cyber Monday of over $2 million, a 243% percent increase over last year. The Company sold one item every 7 seconds on Cyber Monday.

Please refer http://www.webwire.com/ViewPressRel.asp?aId=193500#.VIhzAdKUf3Q

Shareholdingpattern:

Kotak Mahindra Investments Ltd was holding around 6% share but recently they have release around 3% share . Not sure who has pledge those share since no promoter shareholding was pledge may be some HUF . As you can see retail investor holding is not even 10% in this stock . All the shares are in strong hands .

“Intel Capital (Mauritius) Limited” also hold around 12% of “Intrasoft Technologies Ltd” which gives confidence but I believe it is may be just strategic investment by Intel .

Corporate Governance :

I am still learning to scan corporate Governance level . I have not found any red flag as such . Just need to dig more on Kotak Mahindra Investments Ltd’s release of shares . I saw around 465 crores of cash in balance sheet of 2009-10 but next year was reduce to just 3 crores . I was at my wits end to figure out where they have spent so much money or spinned off but when I check annual report of 2010 and 2011 then I realized it was IPO money company had received(before financial year ending) due to over subscription and returned it next month(year) . So no issues on this front .

“Intrasoft Technologies Ltd” also put audited annual reports of it subsidiaries on their website that is good move .http://www.itlindia.com/investors/financials.html

Future Plan :

They are going start using platform of Alibaba similar to Amazon .“Intrasoft Technologies Ltd” is also planning to launch same platform in Canada which will again help top line to grow and obliviously they will target India as well . If that happen then top line growth will again get some boost . Management has also indicated that “We continue to focus on growing the business and re-invest the cash surplusas back into the business. As a result, in the short term, the bottom line may not correspond to the topline growth but we are confident that once economies have reached, it will yield even greater financial results.” They can easily leverage huge database of customer base of www.123greetings.com

to promote new e-commerce website.

Conclusion :

It is not Flipkart or snapdeal , business model may not be same but for me it is Flikart or Snapdeal of poor man. If it achieves even 3-4% of flipkart in next 4-5 years then that will sufficient to create some wealth.I am sure If I dig more then I will get few more positive and negative but at current market price of 52 market cap of company is only around 75 crores , growing fast, it holds cash around 8.33 crores and dividend yield is around 2% . I believe at this price I am not going to loss much but if not all the things but most things click for this company then sky is the limit who knows. I would like to get input from qualified research analyst on my analysis made for myself .

…

…