We have heard many times about all these investing aka behavioural biases.

Say Loss aversion / herd mentality / anchoring biases etc etc. We roughly know their meanings and understand many of them. But it’s not easy to APPLY them in our investing thesis.

Here I am trying to understand my mistakes / learnings through these Investing Biases.

These are my mistakes and my personal views.

I am avoiding to take the names of the stocks for obvious reasons, but most people will be able to guess them.

So here is my story.

As it always happens with us retail investors ( mind you, it’s nearly IMPOSSIBLE for us to come up with original ideas ), I came across a stock on social media (SM).

The stock was hitting upper circuits ( UC ) so was in the buzz. Here the Recency Bias kicked in. As we remember recent events better, we think those are important.

With so many people trying to catch this UC stock, the Herd Mentality kicks in. If it’s POPULAR, it HAS to be good.

You try to do the initial study about the business and you find that it’s a small cap so potentially a “multi-bagger” ( We Retailers simply Drool over Multi-Baggers) and it’s in “recycling”. Its “low float” with 73% with promoters. FIIs are buying in. So it fits the “ESG” theme. Now you fall PREY to Confirmation Bias. You only see the positive side of things and simply ignore the negative side.

And now throw in some Authority Bias. One of the main person whom you follow on SM, mentions that stock name ( not his buying price or his allocation percentage). So that stock name just keeps on popping up in your subconscious mind.

Now the FEAR OF MISSING OUT (FOMO) is so strong that you give up and simply jump in. You feel happy that even though the stock was hitting UC, you were able to grab it.

Now after a few UCs , the stock goes on for 2 / 3 consecutive Lower Circuits (LC). So you start worrying. But now the Endowment Bias has set in. You own it,so it’s your precioussss…… So you keep on holding onto your precioussss……, even when the SM Authority person tells you that he has already sold that stock. This ENDOWMENT BIAS makes you think that you are smarter than the market.

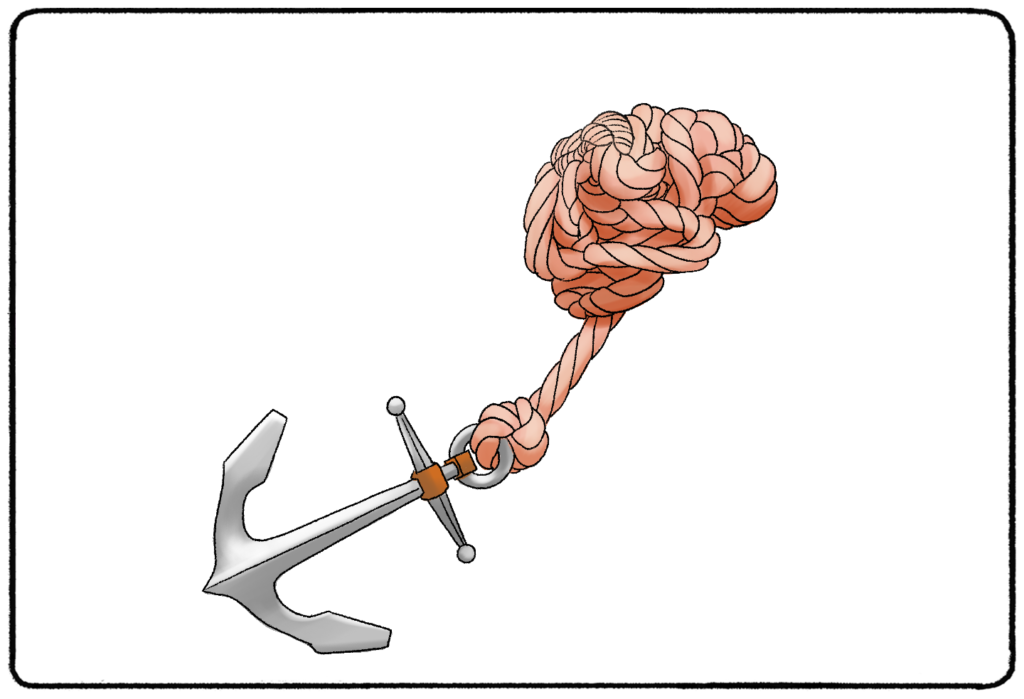

So now with 20/30 % loss, you are taken over by the Loss Aversion. You are not willing to book that loss ( as Loss hurts 3 times more than Profit) and keep on telling yourself that it will again hit a few UCs and when it comes to my price, I will sell.

When both Endowment bias and Loss aversion are strong, you fall prey to Sunk Cost Fallacy. And you keep on averaging the stock down. You start putting Good Money after Bad Money. It’s kind of a feedback loop from which it’s not easy to get out.

With time the SM buzz of the stock is gone. Slowly you start realising your mistake and at last you book your loss. And BLAME the market for your loss.

The sequence of such Biases may be different in different stocks, but these biases affect our Rational Thinking in many ways. They work on System 1 and won’t let System 2 come into play.

So how to overcome such Biases?

Well. It’s not easy for sure. But few points I can think of.

Back to BASICS again.

Invest in the business that you understand. COC - Circle Of Competence.

This particular business was out of my COC. And I failed to realise that it’s in the Rubber industry which is a commodity.

It’s difficult to avoid the SM buzzing stocks. But what one can do is - instead of immediately jumping in, keep them on watch-list. Or if you have too much FOMO, buy only a few quantities for the start. Once the FOMO dies APPLY some Checklist for the stock,whichever checklist you prefer.

With such CHECKLIST, you will avoid buying on intuition. It will force you to convert the “Narratives to the Numbers” and Think Rationally. Such a checklist will force you to apply the System 2 and keep in check the System 1.

Hope you liked this story. Please share your opinions.

Also please do share your such interesting stories.

Thanks,

dr.vikas