This is first full consolidate quarter result of Infobeans after acquisition of US based Philosophie group. Thus it’s showing hike in other expenses. It’s current market cap is around 200 crore so current PE is around 7. Now onwards It should show bottomline growth and expecting 10 crore + quarterly profit. However it is undervalued IT stock with consistent growth and consolidated in 60-70 rs range since long time. Now it has broken the range and keep it upside momentum.

Offices in India – Indore, Pune and Bangalore, in USA – Santa Monica and Manhattan, in Germany & Dubai each having above ~900 professionals across these locations. Now opening office in Chennai

Awarded for Best Exporting Company from Business Today conferred by Chief Minister of Madhya Pradesh, Mr. Kamalnath at a business conclave in Bhopal

Investory Presentation:

https://archives.nseindia.com/corporate/INFOBEAN_29012020170103_NSEINVESTORSPPT.pdf

Thoughts on the q4 results?

45cr vs 26cr topline

2cr flat profits for this quarter compared against march 2019.

Full year revenues: 157cr vs 116cr

profits: 22cr vs 17 cr

You could listen to this video - https://www.youtube.com/watch?v=fJ0c05AbD2Y

A little late but thought could value add to the thread. Here are some AR 20 notes -

- InfoBeans at present caters to a total of 11 Fortune 500 clients as compared to

just 3 at the time of IPO in 2017.

- Presently, InfoBeans is a CMMI Level 3 certified enterprise software development

company providing Product Engineering, Digital Transformation & Automation

and DevOps services

- IB has offices in Indore, Chennai, Pune, Bengaluru ~ 825 employees

- Segments including distributed storage systems, multi- platform content delivery

- and eCommerce & web mobile platforms

- Product Engineering - most prevalent service offering, also known as outsourced product development. It is the process of innovating, designing, developing, testing, and deploying a software product. The intellectual property so created in the process is owned and further monetized by our clients.

- Digital Transformation - Automate manual process from invoicing to complex processes in mid to large sized companies - Automation & DevOps

- 90% of businesses are repeat businesses

- Presently it takes us anywhere between 6 to 24 months to reach the $1 million benchmark

- Low-balling price is not our strategy, we always go for the premium pricing model and focus on the quality of delivery of our services

- There are a lot of niche areas that are completely ignored by our larger peers, due to the sheer size of business it can generate. Such uncrowded niche service areas work well for us. In fact, some of our business practices, such as ServiceNow and SalesForce, have been built on the same principle. Larger players also have a certain friction in terms of adopting newer practices, adapting their team as per project needs.

- 75% of team being in Indore helps in cost efficiences. Will continue to do this so maintain the cost advantage

- So far, we have been able to grow our non-USA business to ~10% vis-a-vis ~0% three years ago.

- In the German market, almost all the business is generated on the back of ServiceNow offerings. Whereas in the UAE, it is mostly digital transformation services. The USA market on the other hand is ripe for all our offerings.

- We have also observed that it is relatively tougher to gain trust of a traditional business in Europe and Middle-East

- The financial results expected to arise out of the Philosophie acquisition will also appear a little late on our books.

On Philosophie

-

Philosophie is a niche, high-end consulting company known for its rapid prototyping and innovation consulting capabilities. It was founded a decade ago by Skot Carruth and Emerson Taymor, based in the USA. At present, Philosophie has a total team of ~50 people based in New York and Los Angeles. Philosophie works with organizations such as Google, Amazon and American Express

-

The recent acquisition Philosophie is more design centric - The CEO exhibits such characteristics from youtube videos, his LinkedIn Profile etc.

-

Philosophie has done certain prototypes with PricewaterCooper (pwc) and thus indirectly for Google and other companies. They seem to be a relatively small studio shop

-

Philosophie provides a complementary range of service offerings to InfoBeans’ portfolio. Design and UX consultation are the primary stages of software development, while we at InfoBeans offer software development & product engineering services. It is adequate to say that this is a backward integration for InfoBeans. A broad set of admirable clientele on both ends provides great opportunities to offer end-to-end solutions. This acquisition also provides Philosophie’s customers an offshore presence and hence the ability to offer software development at competitive rates.

-

Philosophie clocked a sales turnover of $10.5 million in the year 2019, which was

above our initial estimates of $8.6 million during the signing of the term sheet.

The company reported an EBITDA and PAT of $0.91 million and $0.64 million respectively. Philosophie is also debt-free. After the acquisition, we have undertaken a lot of cost-optimization initiatives,

-

In the longer run, hope to make Philosophie’s PAT margin in line with IB so as not to dent the consolidated PAT margins.

-

The transaction has been structured into 4 tranches of cash payments. The first payment, 50% of the total consideration, was paid immediately after the deal in September 2019. While the subsequent payments are scheduled to be paid in 3 equal parts i.e. March 2020, March 2021 and March 2022. .

-

Founders of Philosophie will be responsible for running the business till December 2021

-

The Group has acquired 100% stake in Philosophie Group Inc through its wholly owned subsidiary InfoBeans Inc. wide share purchase agreement dtd 24/09/2019. The purchase consideration of the acquisition is in the range of USD 7.84 to 9.4 million, based on the performance achieved in the subsequent years. - ~60 - 70 cr

-

Inorganic growth has been a concrete, well-defined strategy at InfoBeans. we’ve been looking for companies that specialize in niche IT space or are in a domain we aspire to grow into.

-

InfoBeans did not have any domain expertise in high-end innovation consulting that has design and UX as core components. That is how Philosophie ticked the first box

-

Through Philosophie, InfoBeans will be able to expand its competencies into ideation, design, and prototyping software development.

-

Both run like sister concerns and not merged into one entity. Decision will be made post 2021

-

Constant inorganic growth efforts & developments are something that would be a part of this organization perpetually.In future, we will be looking at acquisitions in the range of $10-$15 million. At present we are looking at inorganic growth opportunities only in the USA.

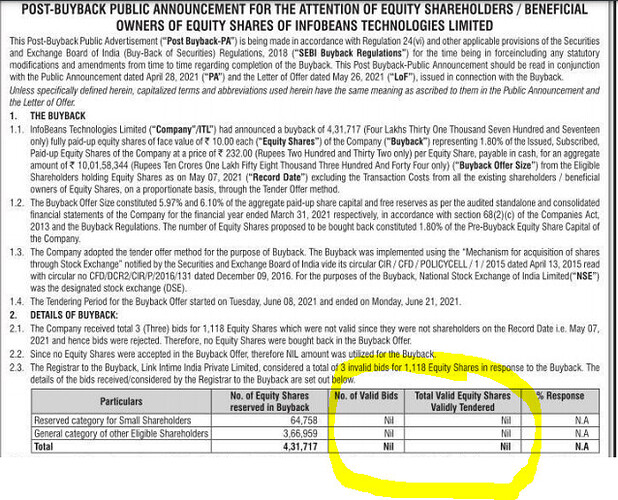

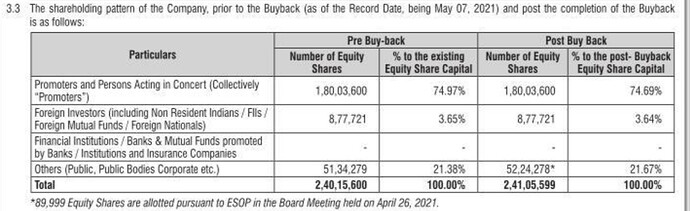

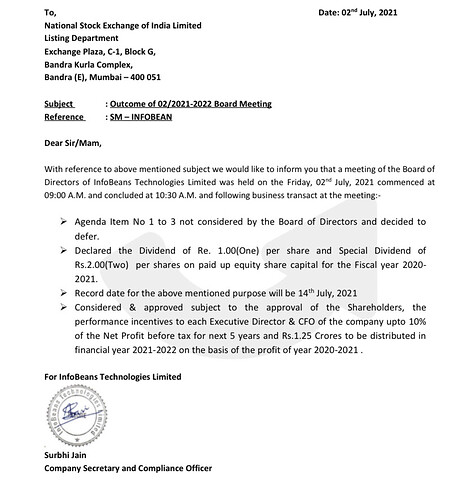

The Board of Directors has approved the buyback up to 4,31,717 (Four lacs thirty one thousand seven hundred and seventeen) fully paid-up equity Shares of the Face Value of Rs. 10/-(Rupees Ten Each) eachof the company (Equity Shares ) representing up to 1.80 % of the total issued and paid up capital of the company as per the Audited Financial statement for the period ended on 31stMarch, 2021 at a price Rs. 232/-(Rupees Two Hundred and Thirty Two) per equity share (Buy Back Price)

Q4 concall notes-

- Buyback - 12.3cr inclusive of buyback tax @23%. Feel that stock is undervalued with the kind of growth in the last 4 years. Have grown 4 times in 4 years.

- Revenue split - USA - 94%, Europe 3.3%, Middle East - remaining

- Total revenue 196 cr YoY 19% up.

- 14 new clients in last quarter

- Opened a 100 seater office in chennai. DHL → client → they want the team to work in the same campus as they do. No tax benefit from SEZ. Continue to get Import duty waiver

- Pat Margin → 20% for the year, 21% for Q4.

- Expenses increased - October appraisal. Expect more increase in expenses as they have done a generous hike recently.

- Have recruited 100 fresh graduates from Jan - March. Plan to hire 10% freshers. 400 professionals recruited in the last fiscal (9 months). Currently have 200 open positions across all roles

- 20% attrition rate - very high. Trying to retain by providing better incentives + hike.

- Three active leads in ServiceNow and Salesforce.

- Philosophie - sales pipeline is strong, actively hiring, broke even in last quarter, focusing on longer term contracts. Residual payment is 1.3 mn$ if they achieve something. 300K from $2mn revenue. ~15%

- Focus is always on growth - Buyback is a signal to the market that the company is undervalued.

- Current cash position (inc receivables ) - 147 cr

- On guidance & 5 year plans - Try and aim to double revenues every 2 years. 24% EBITDA - 15% PAT is the aim always

Thanks for starting such an informative thread @anandsharp . I have recently started researching this company and I see a lot of positives in this company. I also find the stock undervalued at the current price and with the growth that Infobeans has shown in past. One of the best thing about the company is that promoters are very honest. Search for their founders on youtube and you will find a lot of videos of them. They even have their own channels.

I have compiled my research in the below video which others may find useful. Do provide me feedback on the same ![]()

Hey, can u pls share the concall

I attended the concall as they usually do a Google Meet. Unfortunately, I cannot find any link to the original meeting on the internet.

Can you pls share the highlights of the concall . thanks

No investor tendered shares in buy back. I think investors feel value of this company is more. I think its a good sign.

I don’t think that’s true. That table in the newspaper ad groups together NRI holding and FII holding into one group “Foreign investors”. If you look at the public shareholding from March end, NRIs already held 3.32%. i.e. Foreign shareholding at the end of March was already about 3.5%-3.6%. It may have changed since May 7th(the date of the newspaper ad data), but that ad data isn’t telling us anything we didn’t already know in March.

My mistake that I didn’t notice that they have also considered NRI in FII holdings. Thanks

Why there is no Break ups in Cash Flow Statements? If anyone has their opinion please explain…Thanks…

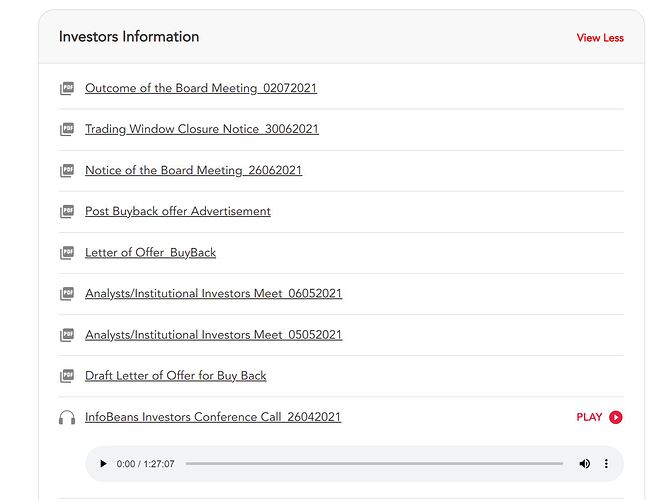

Conference call recordings are available at [(Investors - InfoBeans)

Infobeans looks like an interesting small-cap which demands further study. Here is my quick and dirty thesis!

Positive traits:

(1) Co-founders seem to honest, hardworking with decent educational backgrounds. My IIM Indore circle only has good things to say about them.

(2) The longevity of the core-team members is something unique. Most of the core-team has been working in the company for 10+ years. IT services is a people’s business and this point highlights talent nurturing as their strength.

(3) Quality of the on-shore consulting/sales team is really good. One of the Founder is based out US and drives most of the sales.

(4) The focus on design and UI/UX is unique which I have not seen in most listed IT players. The acquisition of Philosophie therefore is a great strategic step. Design thinking is very important in today’s world and this will give them an edge in winning new business.

Not so positive traits:

(1) Investors should take the growth numbers with a pinch of salt. PAT margins for FY21 look super inflated. This is due to three factors: (a) No office and travel expenses (b) High other income © Low tax rates. All these numbers should revert back to mean. Normalisation of these numbers should bring back PAT margins to around 13-14%. (Even the mgmt has said that long term goal is to reach 15% PAT). There will be further increase in costs due to sector-wide hike in salaries which will further bring down the margins.

(2) A quick calculation of the PE ratio using normalised PAT numbers shows the stock is trading at almost 35-40x PE multiple. Given that the stock has already run up a lot, these numbers look unsustainable.

(3) Although the design angle is interesting, I am finding it difficult to see any other competitive advantage from a offering perspective. I realise that IT companies can keep growing for years even with simple service offerings but investing thesis would be much stronger if we can understand their strengths better. Would really be helpful if other members with more understanding can throw some light.

I would be interested to take a position but at much much lower levels.

Yes, you are right in saying that the adjusted PE will come around 35-40. The management has guided for doubling revenue every 2 years. If they can achieve this, does current PE look high? EV/EBIDTA is a better ratio which doesn’t take other income and tax into consideration. It is around 18 for InfoBeans. Most other IT companies trade at EV/EBIDTA of 30.

Infobeans management has told that they have clients that are working with them for 10+ years. Most IT companies has got this advantage. Its tough for a client to switch. Bigger IT companies can crack big deals. Small companies like Infobeans cannot do that at this stage. Also, do you thing there is any competitive advantage with Happiest minds?

To me, the management looks transparent and honest. Let’s see if they are able to walk the talk.