Results of TRIL below. Just shows the underlying trends in transformer industry and the possibilities in Indo Tech

Brilliant set of numbers. I really like the story being built here.

Disclaimer took some position today.

Transmission Sector Tailwinds

- 7.4mn of transmission lines globally till CY50

- National grid plan locally.

- Integration of renewable energy Sources.

- Grid Modernization and upgrades.

- Power grid for Europe is the oldest globally 35-40 Years old and US is 20-25 Years old. So, Countries themselves have been lagging in capex in transmission sector. Whereas different sources have come into being since 2020 too.

- From thermal to natural gas then nuclear then renewable sources. Mega capex cycle globally coz of this.

- Modernization grid is super important at this time.

- Power grid capex guidance has increased from their concall too.

- PLI to boost domestic manufacturing and reduce imports.

- ADD 1st sep by US on China. ADD 55% on conductors similar for wires too.

- HVDC orders being awarded.

Multiple orders LOI/LOA Indotech

-

Supply of 13 Nos of 150 MVA transformers. The aggregate value of the order under the said LOI/ PO is INR 117.17 Crores plus applicable taxes.

-

Supply of 3 Nos of 192 MVA transformers. The aggregate value of the order under the said LOA is INR 32.32 Crores plus applicable taxes

Capex of 75 crs annouced to be completed by max March 2027 to increase capacity from 9.5 GWA to 16GWA

https://www.bseindia.com/xml-data/corpfiling/AttachLive/a00da431-10fa-42eb-9f64-8eec351672b4.pdf

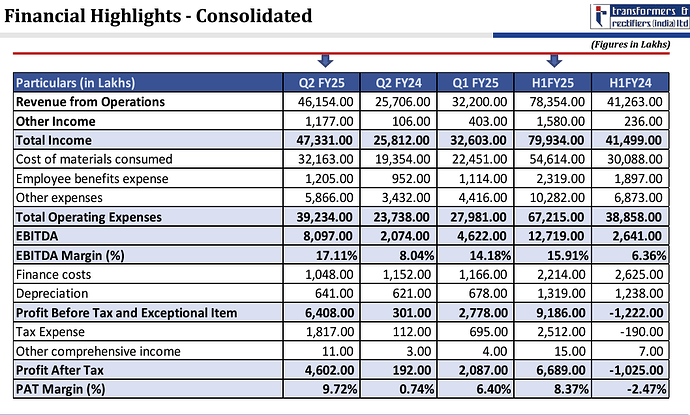

Transformers and Rectifier Blockbuster Q3FY25 bodes well for Indo Tech

Highest ever revenue, EBITDA, PBT and PAT in comps history

Solid QoQ uptick

Exponential YoY growth

Rev at 559cr vs 369cr

Q2 at 461cr

PAT at 55cr vs 15cr

Q2 at 45cr

Another superb results. Usually 4q is the largest quarter.

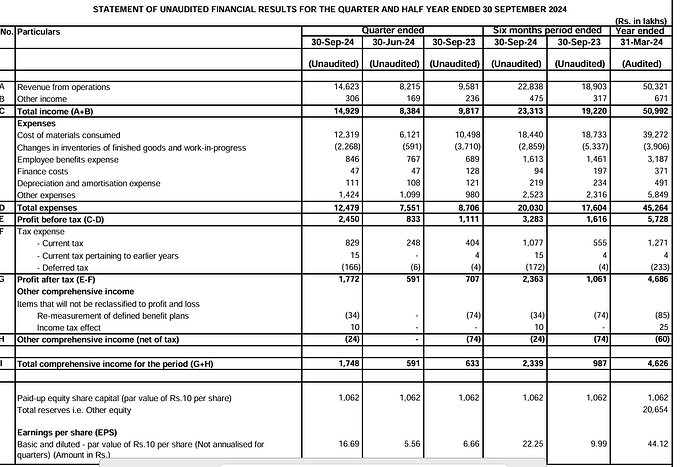

![]() Revenue - 184 cr vs 139 cr YoY vs 149 cr QOQ

Revenue - 184 cr vs 139 cr YoY vs 149 cr QOQ

![]() PBT - 29 cr vs 14 cr YoY vs 24.50 cr QoQ

PBT - 29 cr vs 14 cr YoY vs 24.50 cr QoQ

![]() Net Profit - 19.27 cr vs 10.68 c YOY vs 17.72 cr QOQ

Net Profit - 19.27 cr vs 10.68 c YOY vs 17.72 cr QOQ

![]() EPS - 18.15 vs 10.6

EPS - 18.15 vs 10.6

9M EPS at 40 v/s 20 last year 100% growth

FY25 EPS could be between Rs60 (if there is capacity constraint) to Rs70 (if there is no capacity constraint) with great growth ahead

Earlier the board had approved an INR 75 Cr capital expenditure to expand the plant’s capacity from 9,500 MVA to 16,000 MVA.

But don’t you think the performance could have been better? especially considering what TRIL was able to achieve in Q3.

Can anyone explain me the other income component of 6cr ? Like what exactly are they doing in that part? I read footnotes but nothing mentioned over there.

Also if anyone is in touch with mgmt lets request them for concall ?

Can’t compair, both the companies are in to different capacity of transformers

This might mean that Indotech is missing out on better opportunities…I see some gap now maybe the Market considers the same and so values TRIL much higher than Indotech. It’s a good time for the management to start Con-Calls and clear the haze.

Disclosure - Invested

Parent company working towards Inverter Duty and Power transformers albeit lower capacities (higher margin products), which indicates Indotech too would gradually foray into it.

Disc - Invested and may be biased

Also anyone knows why the Margin has taken a slight hit on gross level

The Company has done a revenue of Rs.405 crores in 9MFY25 out of the same-year executable order book of over Rs.700 Crores. Margins were already expected to be around 14%, what will be interesting to see is if they can execute the remaining Rs.295 Crores worth of orders in this FY, and if it does the Q4 will be like no other, the last couple of years show that Q4 is their strongest quarter from an execution point of view.

P.S. The Company lacks Investor relations big time and should start doing Con-calls soon. The last I was able to talk to a few people at Indotech was a year ago.

On TTM level, their Q2 revenues were hit by a strike. Hence the p/e seems optically higher and forward p/e is even lower.

Considering the demand and how transformer companies are booked for multiple years, it feels astounding, how much they have fallen. Unless we are missing something that only big players know.

Just a lack of investments into renewables shouldn’t impact transformer demand this much.

‘Lack of investment in Renewables’ Assuming I got the context, the parent company has already tested Inverter Duty transformers (capacity almost equal to Danish Power). This gives confidence that Indotech too isn’t far away from it.

Yes, If we normalize the EPS adjusted to the loss of revenue due to strike the PE is/would be around 25 right now.