Indian Railway Industry- A quick glimpse

Railways Industry in India is one of the largest ones in the world. For over 170+ years, the sector has been catering to millions of passengers every single day. From daily commutes to freight transfers, the widespread network of railways has been contributing significantly to the Indian economy’s growth.

India’s railway network has a long history. It dates back to the British colonial era, wherein the first passenger train ran from Mumbai to Thane in 1853. Since this period, the Indian Railways has grown exponentially. It is a state-owned enterprise comprising millions of miles of tracks, numerous stations, and a vast fleet of trains.

Railways in India operate passenger services, suburban trains, and luxury trains, too, connecting remote villages to major cities. Apart from passenger services, this sector plays a key role in transporting freight across the country.

Despite the growth and significance of the railway sector, often this industry has faced numerous challenges, that include funding constraints, safety concerns, ageing infrastructure, etc. However, the future looks promising for this sector, given the ambitious plans to create high-speed rail corridors, expansion of Vande Bharat Express network, modernization of existing infrastructure, enhancing passenger amenities, etc.

Due to these factors, many investors have been turning to this sector for investment. Nevertheless, it is better to stay updated with factors such as the latest developments, financial health, growth prospects, etc, before investing in railway stocks in India.

The Indian travel and tourism sector has seen a robust demand in 2023-24, and the future looks even brighter.

The national transporter aims to ferry seven billion passengers annually, projecting an increase to 10 billion by 2030.

To meet this and to eliminate waiting lists, the number of daily trains needs to increase substantially.

In a bid to meet the surging demand in passenger travel, the Indian Railways is gearing up for a massive investment of 10-12 trillions (tn) of Rupees in acquiring new trains/Augmenting Railway infrastructure over the coming years.

The Indian Railways plans to procure 7,000-8,000 new train sets over the next 10 years.

This move aligns with the broader plans of enhancing passenger and domestic goods transportation capabilities.

Currently, the railways are operating 10,754 trips daily,. To enhance this capacity , the railways expect to close 5,500 to 6,000 kilometres of new tracks, equivalent to 16 kilometres per day, by the end of the ongoing financial year.

These initiatives aim to free up tracks, facilitating faster movement of both passengers and goods.

Railway witness highest ever capex utilisation 100% during 2023-24 for Rs 2.4 Lakh crore.This expenditure resulted in acceleration of rail electrification, laying of new lines and tracks, doubling and gauge conversion.

The Indian Railways is set to receive a capex push of Rs 2.52 lakh crore for the financial year 2024-25, as announced in interim budget 2024-an increase of 5 percent from Rs 2.4 lakh crore allocated a year ago.

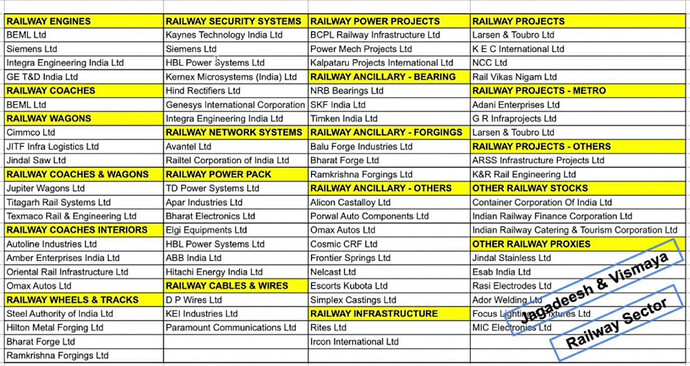

So which are the railway stocks to keep under watch list?

Top 5 Railway stocks as per market cap: IRFC, IRCTC, RVNL, Container corporation, IRCON

State owned Monopolies: IRFC, IRCTC, Railtel, Container corporation

Railway EPC companies : RITES, RVNL, IRCON , K&R Rail engineering

Locomotive & Wagon manufacturer: Titagarh Rail, Texmaco Rail, Jupiter wagons , BHEL, Siemens (Locomotives)

Railway Ancillary Companies: Oriental Rail, Ramakrishna forgings , Concord control systems, Apar industries, Elgi Equipment, HBL Power, TD Power, Escorts Kubota

Profile of these companies along with the products and /or services they supply to Indian railway and Last 5 years financial data is given below in a link of equity.masters com

we might often get tempted to invest in Railway stocks but before investing, it is necessary to consider the factors mentioned below

Government Policies and Regulations

Since the Indian railways is a state-owned enterprise, it is significantly influenced by the policies and regulations stipulated by the government. Therefore, make sure you stay updated with the infrastructure developments, tariffs, privatisation, budget allocation, etc.

Financial Performance

Before investing any sum in railway stocks, it is necessary to evaluate the financial performance of railway companies. Run a thorough check around the revenue growth, debt levels, profitability, etc, to understand the track record of companies.

Technological Advancements

To understand the growth potential of the railway industry, make sure to monitor the technological advancements in the sector. Since growth potential indicates healthy balance sheets, therefore, keep an eye on innovation, automation, digitalization, and electrification in the industry.

Embracing such technologies helps improve safety, efficiency, and cost-efficiency, directly impacting growth. The utilisation of such tech-backed factors signifies that the railway industry is stepping up the growth ladder.

Risk Factors

The Indian Railway industry is highly prone to regulatory risks, operational risks, geopolitical risks, etc. Therefore, we should conduct a thorough risk assessment to overcome possible setbacks.

Demand Trends

The Indian railway sector is largely dependent on passenger and freight transportation. Therefore, you should check factors such as population growth, industrial activities, trade volumes, etc, to assess the demand for services offered by railways.

Should You Invest in Railway Stocks?

The railway industry has always been a popular choice for investment. Given its scale, government support, consistent growth, technological advancements, and diverse services, it has been evolving since its inception. These lucrative factors have often attracted investment from people around the country.

However, we must not forget that this sector is also often influenced by stringent government regulations, geopolitical factors, labour disputes, etc. This has frequently affected its market performance as a whole.

Thus, we should weigh all the possible factors before investing any sum in railway related stocks, along with considering our nvestment horizon.

.Top Railway Shares in India 2024: Railway Companies to Add to Your Watchlist