simple screener not yet updated the balance sheet, pls check

Does anyone have the Jeffries report after they initiated coverage? VV himself lauded the quality of the report, would be great to read

Dont have the report but came across this article

Does anyone has any idea, why the provisions have gone up in this quarter? Did Mr.VV give any commentary on that?

As per management credit cost will be 1.65 going forward. So, its normal. Expect it at this level.

Number seems high because:

- you are looking at absolute number, not as percent of loan book

- earlier credit cost was bit lower due to covid. 1.65% is new normal and well within suggested guidance

There is a video on youtube showing jeferries report if you do not want to create scribd account and download: https://www.youtube.com/watch?v=Kgo541gBcr4

I’ll agree with @RaghuG on this one. One has to understand how PE works.

The money in private equity usually comes in tranches which is then allotted to specific product (a closed illiquid fund) with a maturity date in 5/8/10/12 years. So when the fund reaches maturity they will have to sell all of its holding whether they are publicly listed or privately held and return the money back to the investors (the investor has to pay tax on the gains he or she has made at the end of the). Just before they liquidate the fund, PE firms will open new products (funds) for subscription. The idea being the investor who is about to receive his money from liquidation will once again subscribe to the new fund if he or she made a decent profit. Shall the investor decide to stay with the same PE and subscribe to a new product, the manager of the product (fund) might end up buying even the same stock few months later!

Understand the incentives over here: The PE makes a handsome 2% over the duration of the fund as management fees (on the AUM) and another 20% when assets are liquidated as performance fees. If the investor is lucky enough to make a profit he/she/it will have to pay capital gains tax and the after tax capital is once again reinvested into the new product for another 5-12 years! If the investor suffers a loss at the end of the duration the PE still ends up making 2% every year for the entire duration of the fund! So your sell decision should not depend on what PE firms do (my opinion).

If you want more insights on what I just said there is a podcast which interviewed the CEO/Chairman of Danaher Corp. (It’s a 2 hour interview with Patrick O’shaughnessy titled the art of compounding).

My valuation for IDFCFB is as under as of today (I just happened to look at their financials today):

Over the next five years I expect the funded assets to be around 315,000 crores (assuming a 14% CAGR in loan book). I expect PAT margin in the range of 1.7% - 2.4% percent (I am assuming VV is as good as Uday Kotak and he’s trying to build another Kotak bank and that he is successful in doing so). This translates to a PAT of 5300 Cr to 7500 Cr. Giving it a generous multiple of 18, Mcap could be around 94,400 Cr - 136,000 Cr (115,000 Cr at the midpoint). Assuming no equity dilution and the outstanding shares at about 700 crores (after reduction in OS from merger plus addition from stock options), the share price comes to around Rs. 164 (a 2x in about 5 years). I know my valuation technique is debatable!

Good luck and have a nice weekend!

On the contrary…I am expecting share price to be 4x-5x in 5 years…am I being over optimistic here…??

I would still like to believe management guidance of 13000 crores of profit in 5th year from now…

I expect number of shares to reach 900 crores by then…

So with 14.5 rs of EPS and a P/E of 25 (that valuation is easily possible for a bank growing it’s profits at 35%), share price can reach 350-360 level.

.

It is my kind of ‘conservative estimate’ xD

I think the latest results were very disappointing.

The bank is trying to do too many things at once.

So even though the bank will make 20% profit growth their EPS growth will be way lower.

Eg last year their Profit growth was 28% and EPS growth was approximately just 11%.

I dont see valuation of 18-19x with EPS growth of 12%-14% justifies that.

The equity capital has increased by around 7% in the finance year. The growth in EPS seems very low considering the dilution and net profit growth. Are we missing something ?

Hi!

I have few anti-thesis points regarding IDFCFIRSTBK. Would love to understand the other POVs which could counter it. (I am new to the bank and NBFC space and still trying to learn and understand things in more depth, so please bear with me)

1.) IDFCFIRSTBK doesn’t have a granular CASA unlike that of HDFC or ICICI. Folks have put in money here only for higher interest rate. And they would move out the day the bank decreases the savings interest rate or someone with better interest rate comes up. IDFCFIRSTBK hasn’t really done well in acquiring salaried accounts, which are sticky and promises a higher customer LTV.

2.) Since the cost of funds are on the higher side, they are only able to loan out to more riskier segment( less to the salaried segment), and during the cycle downturn the chance of NPA’s ballooning up is much much higher. Not sure though what % of the retail book is secured vs unsecured?

3.) Also since the book is relatively new and unseasoned it also poses a higher risk on again NPA increasing in the near future maybe after 12-18 months.

What would the counter thesis points here?

Note :- Bullish on the stock, and invested in it from lower level.

I second that analysis.

They’ve been working on the retailization of their deposit base as a key imperative for a while now. Its gone from ~13k Cr of retail CASATD in 2019 to 1.5L Cr in 2024. Wholesale deposits have moved from 27k Cr to 42k Cr in the same period so the nature of their deposit base has completely changed. Can’t comment on how these are split by balance buckets as banks don’t give that info out.

They’ve been garnering deposit market share despite the war that’s out there so clearly doing something right there. While it started as an interest rate play, it’s no longer the primary driver I think especially since they cut the rate to 3% in the <1L bucket. Mgmt says they didn’t see outflows despite the drop. Over a certain balance threshold (different for different people), you start competing with FD rates anyway so if you can pull SA balance at 6% that’d have otherwise gone into a FD in some other bank, it’s a win anyway. The true granular SA (<1L) is at 3% for them so no rate play there.

As far as salary accounts go, it’s about quality of these A/Cs more than the quantity and HDFC is in a league of it’s own there. Number of other banks manage to get these A/Cs but getting the desired balance there is difficult. If you fail there, these A/Cs barely remain profitable on a cost to service POV, let alone result in good CLTV. So yeah, they have a fight there but it’s the same for most banks. Getting good salary accounts is tough.

On the NPA front, their NPAs are good and VV has been very vocal about keeping them that way. I remember him mentioning their NPAs even on the unsecured book is low but don’t recall if he mentioned a number. Future’s uncertain but VV has delivered on the promises so far and given the confidence with which he mentions keeping NPAs in check, I’m willing to go with him unless proven otherwise. He’s the main reason I invested in the stock anyway once they demonstrated they’d turned a corner.

Disc - I’ve tracked IDFC for a while now and took a position at around the 45-50 mark so I may be biased. I’m strongly considering adding to the position so there’s that as well.

I agree with the views and would like to add.

The most important criteria for deposits appear to be 1. safety factor followed by 2. interest level and then 3. service levels. This is strongly indicated by the fact that PSBs continue to have major share of deposits despite low savings interest rate and indifferent service levels. If the govt were to withdraw their safety guarantee, I am sure the deposits will tend to evaporate.

Therefore as long as the bank meets the criteria of a particular class of customers, the deposits will remain sticky. In my opinion Customers/deposits are sticky due to the characteristics of the glue( composite offering by the bank) and not the other way round. Every Customer needs a bank for his deposits without any other option and will shift to another bank only if he gets a distinctly superior package of safety+ interest rate+service.

HDFC is popular because everybody you transact with, also has an HDFC a/c and transfers are smooth and instant. It has a Large network of branches and ATMs and service levels are good. They charge you a premium through lower interest on deposits. IDFC is however doing well in building credibility and trust, which is the most important factor. But they have a long way to go to achieve the status of “too big to fail”. They seem to have already achieved “too important to fail”. Their service levels are the best in my experience and a 7% interest in savings a/c is a powerful magnet. If they do not deviate and continue to keep customer first, they have a bright future.

I’ve been tracking this stock for the last few months. I see a huge potential in the bank as per my understanding. The numbers are fantastic and so is the management. They are candid about their guidance and have almost achieved what they said 5 years ago. I don’t see any problem in the bank as of now. I think the stock price will be 5-6x in the next 5 years(because of the Guidance 2.0). Am I missing something? I am a newbie (Started my journey 3 years ago). This is my fifth company.

Disc:- I’ve invested in the stock around 81-82 levels

I agree with management guidance of 13000 Cr Profit after 5 yrs. I think this is conversative forcast in my assesement Profit can be 20-25% higher than what management suggested if they are able to control or manage Cost to income ratio. I think last 5 years dedicated to restructuring the bank and next 5 yrs will be focused on optimising and improve efficiency.

I belive there is not major macro issue after 5 yrs conservatively profit will be 13-K14K Crs and optimistcally it will be in the range of 17-20 K Crs

Note: I have done my calculation based on various bank’s historical(HDFC, Kotak, Indusind) performance. I am not sebi registered advisor and my views can be biased.

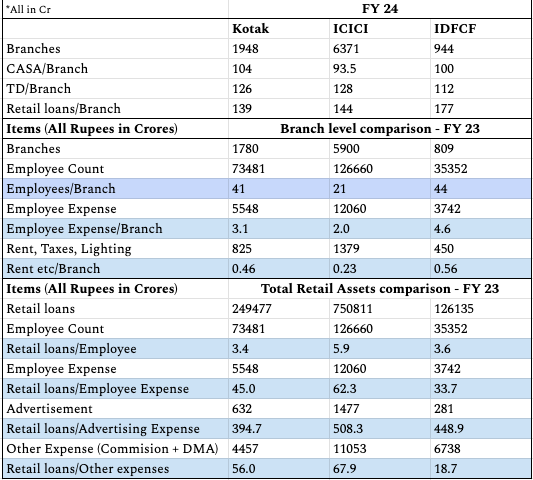

I looked at the operational performance of IDFC bank at branch level and compared it with Kotak and ICICI Bank. Please have a look and share your thoughts.

Branch level highlights of IDFCF:

-

IDFCF branches have similar or more average CASA than ICICI & Kotak. It will be interesting to understand the reason since almost 40% of branches are <3 yrs old.

-

IDFCF is distributing ~20% more retail loans/branch than Kotak/ICICI - although at much higher commission ratio (see point 7 for details).

Insights into higher Opex of IDFCF:

-

IDFCF has similar employees/branch as Kotak - but its average employee is paid almost ~40% more than Kotak’s. This difference can be slightly off as banks deploy employees differently but the general idea is fairly accurate.

-

IDFCF has ~20% higher rental etc expense per branch compared to Kotak and almost 2.5x that of ICICI - probably because most of its branches are in urban areas at good locales.

-

It is also interesting that IDFC’s per employee retail loan is similar to Kotak, but almost ~40% less than ICICI. Retail loans/Employee expense is a drag in Opex for IDFCF - it is almost ~30% lower, which should improve over time as the branches mature.

-

Advertisement expense is actually fairly similar to Kotak and slightly more than ICICI, relative to its retail asset and liabilities size.

-

Other expense - which mostly includes commissions is the biggest drag on Opex - IDFCF spends 3x more than Kotak and ~3.6x more than ICICI to generate same amount of retail loans.

Asking people with experience in banking, please help understand why IDFCF is spending so much more on commissions?

-

Other Expenses should continue to be a major watchout for the investors as the commission expense per loan may not come down with scale. The bank will need to work hard and innovate in its distribution strategy to reduce this expense. Other expenses can also include different items for different banks, I have tried to make the comparison as fair as possible.

** Overall comparison with Kotak is more fair since its retail:corporate split is similar to IDFCF.

Very well studied indeed!

I think per branch comparisons are not very relevant in some cases as IDFC/Kotak are more focused on online market. I believe large portion of IDFC’s CASA is from accounts opened online.

Not sure about loans whether they are coming from online(personal loans) or physical branches.