Reposted as some garble in prior one

He could have got a Bank license for Capital First directly instead of getting a bank licence by merging with IDFC Bank. CF was posting 15% ROE and increasing continuously since 5 years.

If he had to acquire a Bank at all, he could have waited 3 years to acquire IDFC Bank. Let me paint a fair scenario of what might have happened of IDFC Bank stock in 3 years. With all bad news of infra tumbling out in March 18, June 18 and September 18, and with no ROE, this stock could have probably quoted 0.5 X B, which is 0.5X 38.44 (then BVPS), say Rs.19. Then the Dewan, Reliance Capital, Vodafone, Cox and Kings, Café Coffee Day, PC Jewellers, Future Group exposure, Entry Point of Mumbai Toll road all well known market issues, and other infrastructure loans would have arrived. BVPS would have eroded further. IDFC Bank stock would have gone down to say Rs. 10 (guessing). And probably sold out to some bank in and around this price. So, for an IDFC Bank shareholder, VV takeover has been great.

But from a Capital First shareholder point of view, the return has not been as great as a startup should make. It was at 120-140 in 2012-2014 when he took it over. For all talk of 9X, (adjusted for merger ratio of 13.9), at today’s price of 75 it is 1042 (75*13.9), it has delivered only about 17% CAGR, its ok.

I think RL was smart and good for his shareholders. He realised the problem and looked for a merger to deal with issues before they arrived (not saying sarcastically, I mean it). Finding a VV to merge with and hand over the Bank was his masterstroke.

On equity raise, they could have raised 4000 cr this year and 4000 next year at a higher price. Why raise it all upfront. Why pay dividends even while raising equity on one side?

By his own admission in AR and in AGM, he was sitting on personal leverage of having acquired Capital FIRST, while transferring stock worth Rs. 100 crores for social trust philanthropy etc. This forced him to sell stock during COVID at Rs. 20. Why gift to philanthropy when you have personal leverage? Any sane person will close the personal debt first.

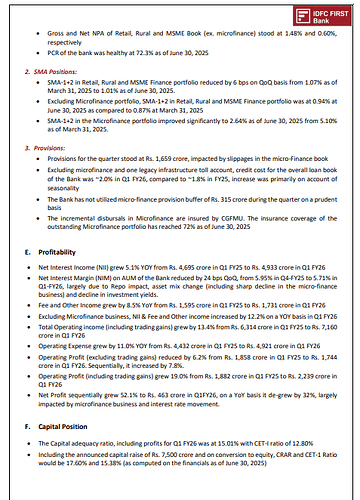

By the way, it’s not that they are “choosing” to make low 7% ROE. That’s all they can make today, Excepting credit cards, none of the investments were discretionary… branches, ATM, tech etc. these were all essential things to fix this bank.

I agree is a tough job to move the ROE needle from 0 to 7, but the market has other options. God knows if it will reach 15% ROE. Right now despite a good management, the bank as such is a dodo that cannot fly.

Only good thing they have done is good customer experience and positioning the bank as a good ethical institution people can trust. We can’t tell what it is worth, and whether it is worth this amount of premium for a low ROE Bank.

Btw, their own commentary for upcoming few quarters are real bad… MFI, repo rate.. everything. Wonder why stock is strong.