I have taken the BSE SmallCap as my stock empire. Thereupon, considered following criterion:

- Momentum, i.e., CMP within 5% of 52-week high + > 2x of 52 week low

- Return in last 1, 3, 5, 10 years must be very high, e.g., 75, 50, 25, 20 (indicative) respectively

- Revenue Growth & EPS Growth in 1, 3, 5 years must be high, say 20% (indicative) each

- OPM & ROE must be high, say 20% (indicative) each

- Debt/Equity < 0.1 (indicative)

- Price/Sales must not be very high, say 2-3 (indicative)

The figures above were varied to return sufficient no. of stocks while screening against each of the criterion so that final pick-up is done from a large pool of stock.

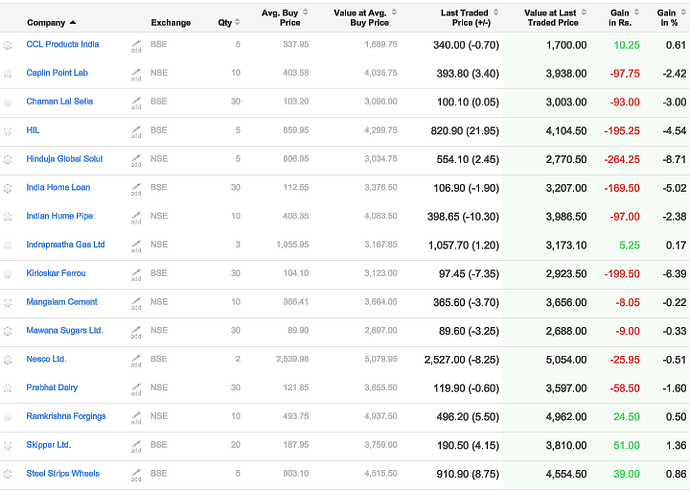

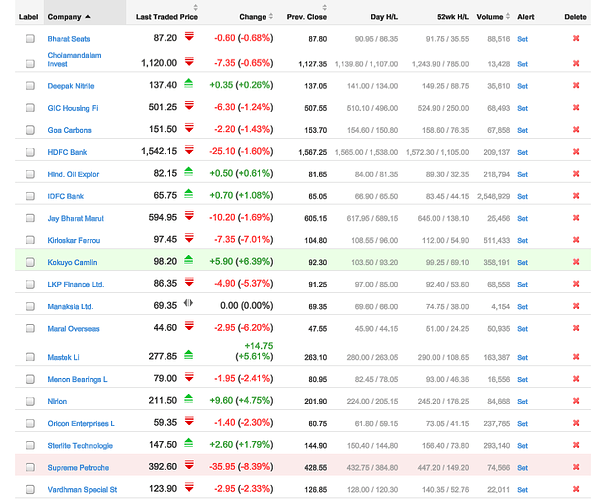

Stocks returned from screening against each of of the criterion was appended & sorted for sector & then for alphabetical name.

Stocks with Bold & Red, Green, Blue color (randomly with no additional meaning attached to them, just to make clearly visible in the list) are representing the stocks which qualified more than one screening criterion.

Stocks with Bold & Black color are my choice (arbitrary).

Then, studying about each stocks, what they do & who are their promoters, mainly from the company’s web-sites. I have a fairly decent knowledge of management pedigree of companies (of course through published informations)

Then, considering the macro-economic situations (domestic & global) & also the geo-politicals around the world, try to understand the growth & other business prospects of each of the screened companies.

Finally, the shareholding pattern of the companies, watching the price action for few days & then buying it.

Yeah, b4 buying, I also look for any other exciting company from the peer group (which I am aware of for some other reasons). What are these reasons, I will discuss in some other post.

The things that I lack are finding any hidden financial stuff in company’s a/c book & any development before being reported in media.

123.pdf (500.6 KB)

Comments please.

I have some more stock empires, based on some other screening criteria. I will share them if this one excites fellow boarders.

Thanks in advance for being patient while reading my long post & long list.