What about the good ol’ Annual Reports! Investor presentations also contain many such points.

How to diversify in pharma? Let me try…the list is not exhaustive list of course

API - Divis, Granules

Complex generics - Natco, Dr Reddys

Generics (me too businesses) - majority of Indian pharma companies are in this category and you get all sorts in this group - domestic, export and mixture of both. Sun pharmac, Lupin, Ajanta, Aurobindo, laurus, ipca, alembic.

Biosimilars - Biocon is the clear leader by some distance (Lupin, Dr Reddys also have a few)

CRAMS/Research services - Syngene, Divis - their business model is very attractive, they get long term contracts (discl - not invested yet)

Acute segment - Alkem (antibiotics)

Chronic diseases - long list here - Cipla (respiratory, HIV), Natco (blood cancers), Dr Reddys (cancers), biocon (insulin), sun pharma …

Hopefully, in the near future, some new blockbuster drugs will originate from India. No Indian company has achieved this status. Indian pharma companies are just copy-cats at this stage…For the above to happen, investing in R&D is a must or the other way to achieve is to acquire a company with significant portfolio of innovative/new/orphan drugs undergoing clinical trials… My suggestion is to focus on companies with more R&D expenses!!

Discl - own Biocon, Natco

Thanks for the detailed breakdown. It is very helpful. Where do you see company like Jubilant life science, Granules, Alembic falling in your list?

I was reading Alembic thread and one of the research report and found that it is very old company and spending 15% of its sales on R&D.

It is strange that market is not giving any value to Covid vaccine trial by Cadila

Below news from Times Of India

"Ahmedabad-based pharma giant, Zydus Cadila announced the start of phase I of its testing process of its novel vaccine candidate earmarked ZyCOV-D last week. Extensive research for the same was done in coordination with medical laboratories in the USA and Europe for the same.

The company is testing two versions of its vaccine, one which makes use of molecular DNA to elicit an immune response, while the other uses a live measles viral strain to provide protection. Development of the vaccine was accelerated after authorities saw a positive response in pre-clinical research and animal studies.

While human clinical trials are currently going on, Zydus CEO Pankaj Patel said"

Dr Reddy’s Lab starts Home Delivery of Covid19 Drug Avigan ( Favipiravir 200 mg) in 42 Citis in India.

To launch another COVID-19 treatment drug, Remdesivir in the first week of September.

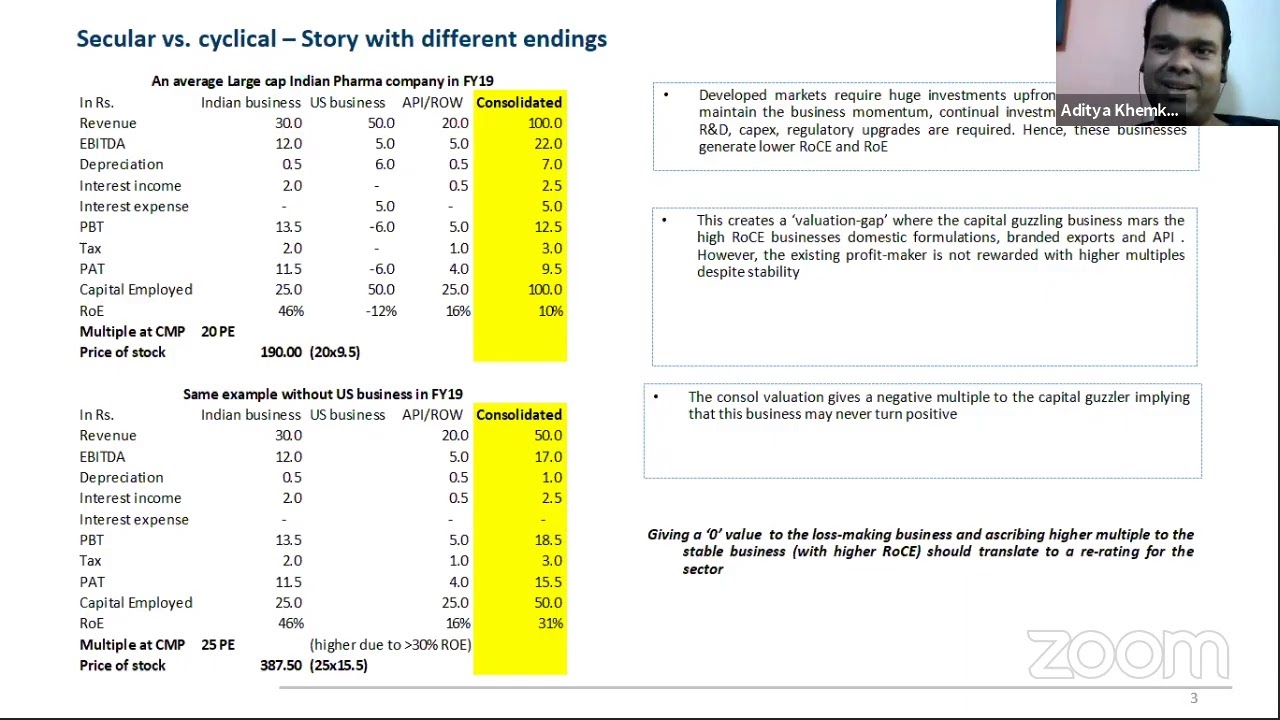

I think Aditya Khemka of DSP is having good circle of competence in healthcare. I am investing in his fund since Jan19, people may find this video helpful in understanding this sector:

Good Analysis…

I was going through the portfolio of DSP healthcare, which has returned 73% during last one year…it has not only outperformed the Pharma index , but it has outperformed all its peers…

I find It has select stocks such as IPCA, Dr Reddy’s Lab, Divi, Aarti, Jubilant among its top holdings which seem to have contributed to the performance…it also has other stocks such as Alembic, Alkem, Abbott in its portfolio.

It is definitely a good fund for those who can not keep track of so many stocks.

And around 10% International exposure in pharma equipment etc which are not available in India

@Rakesh_Aggarwal do you think it is still a good time to enter this fund?

I think international exposure is only 5.3% as per the holdings as of 31st July 2020 as found out from Morningstar website. Abiomed Inc & Intuitive surgicals Inc both are Nasdaq listed…

Was surprised to see that our popular stocks such as Granules and Laurus did not find a place in this portfolio! May be the fund manager may add it in future…

If you want to enter any Mutual fund , any day is a good day… it is advisable not to put all the money at a time.

Considering that pharma sector is expected to do well, one can think of deploying 25% of funds a

to start with, then the rest by SIP…

Abbott Lab is also listed on NYSE.

Sector specific funds are not recommended. They are bit risky in nature returns are lumpy and may under perform long periods of time.

I think Aditya Khemka is very knowledgeable guy in Pharma so just listen and learn what he is trying to say will help retailers.

Agree with your views. Any Sectoral or thematic fund is Risky. If one wants to enter any sectoral fund, (1) one should not put all the money in a Sectoral fund. It should only be a part of the overall portfolio… (2) one should know when one should enter and when to exit.

Having said that now with the tail wind , most of the Direct equity investors are Pharma Heavy…and if the pharma prospects changes tomorrow, if the direct equity investor exits his pharma position, the Sectoral pharma MF holder can also redeem his holdings as well when he wants…

But going by what Mr Aditya Khemka says is Pharma tailwinds are here to stay for quite some time…

Not as risky as investing directly in stocks ![]() . Unlike direct investing where one invests in a smaller number of stocks in a sector, sectoral mutual fund is more diversified. It is also highly liquid compared to some of the smaller cap stocks.

. Unlike direct investing where one invests in a smaller number of stocks in a sector, sectoral mutual fund is more diversified. It is also highly liquid compared to some of the smaller cap stocks.

Agree. The same disclosures are valid for direct equity investing also. ![]()

My point is that, Valuepickr being a forum for direct equity investors we expect the members to be aware of the basic risk factors. Direct equity investors should go for such sectoral funds only when he feels that the sector is out of his area of competence or he needs a greater exposure to a sector than he is comfortable with in his direct equity portfolio. I have investments in a Pharma fund for the second reason.

Agree…

I had invested in Reliance pharma (Now Nippon) in 2012-16 in SIP… my return was excellent and I was enjoying the Ride … I thought pharma is a secular growth story…But thereafter gradually my portfolio value eroded due to sectoral headwinds faced due to US Regulatory norms, which I could not track…by the time I realised , I had lost most of the gains I had made …though I finally redeemed all with some profit…

Now with Covid19, all secular growth stories of all sectors seems to have disappeared… again Pharma seems to have very good future…only time would say…

I agree stock investing is risky and there is nothing called a secular growth story… the success remains in the knowledge and skill both fundamental and technical to decide as to when to enter and when to exit to book a profit…

First part was really good, speaker Vineet Gala from Monarch

Another good one from the Pharma investment specialist Dr Amit Varma