Yeah , an exit framework is important . But analyzing and tweaking the exit framework based on experience in the market is doubly important and in my view should be done atleast yearly on average. Like for example you thought a stock was overvalued and you exited but later on it went 200% up because you may have misanalysed the value (less info or wrong interpretation ) . And thus using this experience to add to the missing piece or tweaking the exit framework so that you don’t miss the next rally in the future. Just my few thoughts on why exit frameworks should have this flexibility

Exiting is the most difficult part of the stock investment.

Let us take an example of Large Cap ITC.

Before implementation of GST in 2017, ITC was trading close to 200 for few months in 2014-15-16, and before GST tax rate was finalized, it was mis priced at close to 340 (In July or August 2017). At that time, Mr. Market got GST rate completely wrong for Cigarette business and by the end of 2017, ITC corrected to 240.

In and After Feb 2020, it was available below 200 or 160 as well.

The investor who sold in July 2017 at 340 and re-entered again in Feb-Mar 2020, would have made more money than the Investor who kept on holding from 2015 to 2023.

Some times, it makes sense to exit Overvalued stock and Re-invest after few years and again sell after few years.

Alternatively, in many cases, like Small and Mid Caps, selling could be difficult because some times after selling it may go further up 2-3 times as well, due to mis pricing by Mr. Market.

Hence, an investor has to decide his/her expectations from the stock, and Build Sell framework accordingly.

If you are satisfied with 20% CAGR returns at the Portfolio level, then you can decide your Sell framework accordingly rather than taking the risk of holding the stock beyond your comfort level. Eventually CAGR returns at the portfolio level are more important than individual stock level in the long term.

Exits are always the most difficult part of investing. Few people get it right all the time.

For hardcore value investors, its often very difficult to keep holding on companies that run up fast that they have bought on very cheap vauations. I will share a few examples to illustrate this .

Very early on in 2009, in earliest part of my serious investing, I had bought TTK Prestige at the then price of 120. And in the subsequent rally it went up to 180-190… Now I had never seen big returns before with decent positions. So thinking that 50% returns in 6 months were too good to miss and I sold off. I was a newly educated investor, and markets were coming out of a big drubbing in 2009-2010. So the mindset at that time was that whatever rally was there in the market was just a pullback and we were again headed down. And the stock price went up to hit a high of 6500 in quick time. That was the first lesson for me.

I bought ajanta at 5-7 PE and had only newly learned to hold stocks for longer than 6-12 months. Results kept coming through and stock price kept going up, but serious re rating took about 3-4 quarters of consistent results. By that time stock had already gone up nearly 3-4 times and I had never had such returns on a decent allocation before. So seeing the stock quote at 15 PE I got scared and sold off my whole position at around 6 X kind of returns. But then it kept going up and that got me thinking, and I realised my mistake. I got a lucky break when there was some tax query related issue with Ajanta back then, and stock price corrected for a few weeks. I ended up buying whatever I sold and some more at only around 10% higher than my sell price. By that time a lot of other learned investor friends including some at VP were gung ho about the company and it was an easy decision for me. But it helped me in two ways… First is that when re rating happens, it often goes to the other pendulum of pessimism and often leads to froth and frolic. I made another 3.5 X from there and sold off, and stock went up from there another 50%, but I was satisfied with my returns and did not want to keep whipping a tired horse.

This helped in my future winners like Mayur, Canfin etc which I was able to hold in a better way, and got good returns.

Other important thing it did was get rid of anchoring bias for me. Subsequently, buying a stock which I had sold earlier even if it was at a higher price came naturally to me…

Most of the time this type of conundrums happen when a stock is bought as a value stock at cheap valuations and it then turns out into a growth stock later on. The valuations can go up from say 5-6 PE to 30-40 PE within a period of 2-3 years. This is the formula that leads to big multibaggers.

With experience and analysis of previous mistakes these types of conundrums will be gradually sorted. As long as the company keeps delivering growth numbers that beat market expectations, even lofty valuations will sustain. But many a times stock prices run up so fast that they will need to go into consolidation for a few weeks to a few months, or often a year or two, so that earnings catch up. This often leads to opportunity costs and in a very concentrated portfolio it can lead to diminshed returns. And these kind of run ups also skew the portfolio balance towards only one position and hence it needs to be trimmed to some extent.

Hi @hitesh2710 sir, Thank you for sharing such a valuable information. same happened to me recently in RKFORGE trimmed 1/3 Qty immediately another 2x happened.

Hitesh bhai has covered this with good examples. Let me add few points from my side -

-

In many companies, when high growth is coming and company is a small/mid cap - valuations can touch the sky because everybody wants a slice of that growth. So what I have done over the years is to do staggered selling instead of selling at one go. (e.g. Shilchar is in this mode currently)

-

One thing to remember is that business environments change (macro/geopolitics etc.). It is very difficult to grow at high rates for multiple yeas consecutively. So when businesses are trading at 40-50x PE or more, one should start looking for signs of change in business environment. If one can spot those changes, selling becomes an easy decision. (e.g. EV sector is facing slowdown due to reduced subsidies and higher auto loan interest rates. One could have spotted these things and sold out on stories like SBCL etc.)

Growth slowdown when company reached 40-50x or more has happened so many times in my observation that it is almost always a good idea to start trimming once these valuations are reached. -

Watching companies go up 50-100% once you have sold out has happened many times with me and I have felt stupid for selling out

. I think this is all part of emotion management and one has to believe in the process. One has to believe that we will find another undervalued story where one will make decent money and not let emotions take over you and make undisciplined decisions. Being disciplined this way has far more benefits over longer term rather than short term pain of missing out last bits of rally.

. I think this is all part of emotion management and one has to believe in the process. One has to believe that we will find another undervalued story where one will make decent money and not let emotions take over you and make undisciplined decisions. Being disciplined this way has far more benefits over longer term rather than short term pain of missing out last bits of rally. -

Finally the best decision of whether to sell or not sell despite slowdown comes to the amount of work someone has done fundamentally.

e.g. Selling agrochemical companies few quarters back was fairly obvious choice once it was realized that fast growth was due to inventory build up.

Selling out PVC pipe companies post stellar run around COVID was obvious choice once it was clear that PVC prices were falling and there will be inventory losses and wait-and-watch mode adopted by dealers/consumers.

If one looks at SBCL, the kind of margins and ROCE it is reporting and if one can see how it is going to be part of high growth sunrise sectors, not selling is also probably right decision if you are okay to stay put for few years of consolidation.

HBL Power broke down several technical parameters and was a sell based on that around 90. But if one had worked on fundamentals, it was clearly a candidate to not sell as best growth was in future quarters and these corrections should have been taken in stride. -

There are also few other things that result in forced selling for me - e.g. I am a concentrated investor with 80-90% of portfolio in 6-7 companies. So whenever I find a better quality, undervalued, fast growing business - I end up selling my tail or bottom ones.

Over a shorter duration, it has happened that the tail business that I have sold has gone up more and high allocation business has gone nowhere. But over medium term, these things have worked out pretty well.

This constant comparison and competition amongst businesses to be able to find place in top 6-7 means one has to consider a lot of things (BQ/MQ/Business Environment/Valuations/Differential Insights etc.) and somehow this has resulted in improved decision making.

Hope this helps.

Disc - I may buy or sell some of the companies mentioned in this post without mentioning at this forum. I am not SEBI registered analyst. Please do your own due diligence.

@hitesh2710 sir thank you so much for running this institution of a thread for everyone’s learning.

I was reading about the recent developments and potential trends in India from macro point of view and one theme which caught my attention was Data centers. What would be the better way to play this theme? The REITs who give the space on lease or the Companies who run them or companies which make instruments for use in these centers?

As of now, I am not able to find companies which are engaged in any of the above I mentioned above! Though some names which keep propping up in the discussions are Aurion Pro, Anant Raj etc.

Would be great to know your view!

Paraphrasing for a speech given by Charlie Munger

" Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns."

Let’s suppose one has Rs 100 to invest and the options that exist are investing in a single large cap company and the other option is that of momentum investing/techno funda (moving across multiple stocks)

Over the span of 10 years:

When one is sticking to a large cap - One is investing on the fundamentals of the company (let’s suppose a sales growth of roughly 11%)

When one is investing on multiple momentum stocks - One is is investing on his/her ability to find multiple momentum opportunities over the span of 10 years

While momentum investing offers better returns, the fundamentals of these businesses cannot deliver 11% sales growth over 10 years

So it becomes important to continuously find opportunities and not get off the carousel if one has to sustain momentum investing for 10 years. Honing technical skills and finding opportunities is the key to sustenance in this path

Is my thinking directionally correct?

Hitesh Sir… Your views on Mold Tek Packaging : Having strong tailwinds in the sector, company growth is also decent and analysts have also been bullish since long but stock’s price is not moving at all since more than a year…

Siddharth, you have nailed it. Just to add, finding out the opportunities is an ongoing process and there are tools and techniques to identify those in an early phase.

Having entry and exit criteria based on technicals, makes it icing on the cake. The entry and exit criteria on the technicals will help to ride the journey, keeping the noise aside as long as fundamentals are not changing in a big way.

@hitesh2710 Sir- At any point of time, how many stocks you have in your portfolio? Also do you give more weightage to technical indicators while exiting a stock? or fundamental analysis?

Also do you track Genus Power Infrastructures technically and fundamentally?

Regards

Rahul Shah

After reading Nalanda Capital fame Pulak Prasad’s recent book, I have sort of adopted permanent Owner type of approach, where, if I have selected a good company which has a long trajectory, then I dont want to sell it, no matter what its PE turn out to be. If company is good and price moves ahead of earnings, then maximum bad that will happen is few years of consolidation and I am OK with this lost opportunity. Who knows, may be after selling this , And buying something else, i may be wrong in both decisions, or wrong in one of the decision. Rather I would stay put and bear the consolidation phase. If I have selected a good company , it will come on track again, and I can be a permanent owner of a good company. Offcourse such companies are very few. But I just need 15-20 companies, so I am sorted. Why take unnecessary hassles of jumping here and there?

So based on this book have you made changes in your portfolio too.

Dear hiteshbhai, I am always on the lookout for sectors who have lost all the interest of market. However, in the current bull run, all the sectors seem to be “not undervalued”. Any sectors come to your mind which are ignored at the time for whatever reasons?

@vikrantmehta888 apologies for chipping in but have you looked at chemical sector? In my view Chem sector is out of fancy for sometime.

chemicals? like aarti, srf etc?

Unfortunately being a specialty chemicals manufacturer being myself, always invested in chemicals sector. Have lowered the PF returns by not exiting a year back! Also, the sector is actually suffering from lack of demand and too much capacity expansion! China is dumping the products again! So next upmove in the sector needs some strong triggers!

Any other?

Hitesh Bhai. Any views on GAIL? the results have been positive and the stock since then is in an uptrend and is around life time high. Where do you see resistance on charts?

Also how do you see the PSUs going forward from here. Results have been good in many companies.

Thanks.

Usually a rising tide lifts all boats. In the kind of bull markets we are in, most sectors will fare well.

Very few sectors are there which are still lagging in this market. That is more to do with the kind of headwinds these sectors face. And there we are not too sure how long these headwinds are going to last and when the good times going to come back.

Personally my philosophy is exactly opposite to what you mentioned in the first statement. I am always interested in what is in fancy or what is going to catch fancy in the markets. That’s where I feel most money is made. So I don’t bother myself with sectors which are not market favorites.

Stocks and sectors that are languishing at 52 weeks lows or lower during a raging bull market are there because of a reason. And many a times when markets correct they fall even more. So even though on first glance these kind of names appear to have fallen a lot from their peaks, valuations may not have become too cheap.

@Shakti_Srivastava I don’t track Mold Tek.

@rjs391 Portfolio construction strategy has been discussed in the past in this very thread. I usually hold between 6-10 stocks in my portfolio, sometimes based on opportunities stretch this to 15 stocks. While exiting a stock it’s an allround decision based on technicals, fundamentals, froth, stop loss, whatever applies. I don’t track Genus power.

@ram1984 GAIL is in a strong uptrend, though being a large cap PSU stock, upmoves are slow as of now. Resistance is at 130 and slightly above. Fundamentally I find it difficult to analyse this kind of business. PSU fever is strong in the markets. Idea should be to ride this sector till there are signs of exhaustion or reversal

Hello Hitesh ji,

Would appreciate your views on Maruti as a medium term bet (3-4 years) with moderate return (~20% CAGR) expectation. Below is a summary of my analysis and estimates:

• In Q2 FY 2024, company reported highest ever quarterly volume, sales and profit. Sales volume went up 6.7%, revenue up 25% and profit up 80% on YoY basis. As per concall comments, there is no one off, although some factors (commodity, forex) seems to have benefitted the company. Management is cautiously optimistic about growth and margins.

• Company is outpacing industry growth, even when its traditional bastion of small car portfolio sales is muted.

• Maruti is now at leadership position in SUV segment with 23% market share.

• Maruti’s plan of betting on CNG & hybrids in medium term also seems to be working. CNG is 21% of volume in latest quarter.

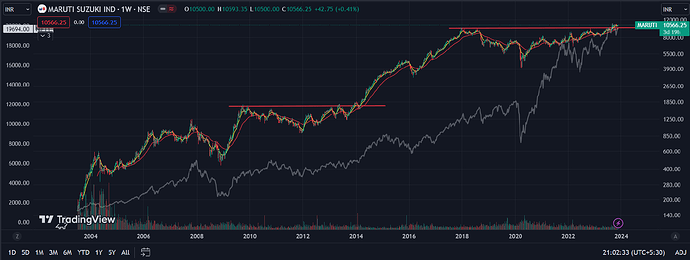

• Share price crossed 10,000 after coming out of almost 6 year rounding bottom.

In my opinion, with factors like good GDP growth, increased premiumization and growth returning in small car segment, revenue can grow at 15-20%, and profits can grow at 20-25%+ over next few years. Current valuation is also not too demanding considering the latest quarterly result.

Similar situation happened in 2014-2018 period when stock price consolidated for 5+ years and then went up 5X in next 4 years when growth was good.

Maruti Suzuki is a large cap company and a fairly big large cap at that. Its market cap as of now is 3.19 lac crores… The company has done exceedingly well in the crossover car segment like the Brezza, and its colloboration with Toyota with the launch of Grand Vitara ( and to some extent Invicto) is paying it rich dividends. If it continues this kind of momentum for next 2-3 years, it can provide returns that you expect of around 20 % CAGR.

However autos are inherently a cyclical business and while the cycle once it turns tends to run for a few years, one has to consider possible disruptions that are happening in the space and how well equipped the company is to deal with these kind of situations.

The advantage Maruti has over its competitors is its distribution reach and service network all across the country. But companies like Hyundai have been very nimble in launching new versions of cars every 3-6 months and have been increasing their reach and distribution very fast. Competition in the form of Volkswagen,Toyota and Honda are also coming up with a slew of new product launches. Domestic players like M&M and Tata Motors are also showing good intent and growth.

So while Maruti seems well placed as of now to generate decent returns, one eye has to be kept on the competition and the company’s growth rate going ahead.

Personally I invest in small and midcaps and find much more lucrative options in these segments. So I don’t have a definite view on Maruti, even though the charts show a good breakout after a long period of time.