Over the last few days there has been a lot of nervousness and speculation about election results outcome. Markets have been on tenterhooks. Cat on hot bricks is an apt analogy to current markets.

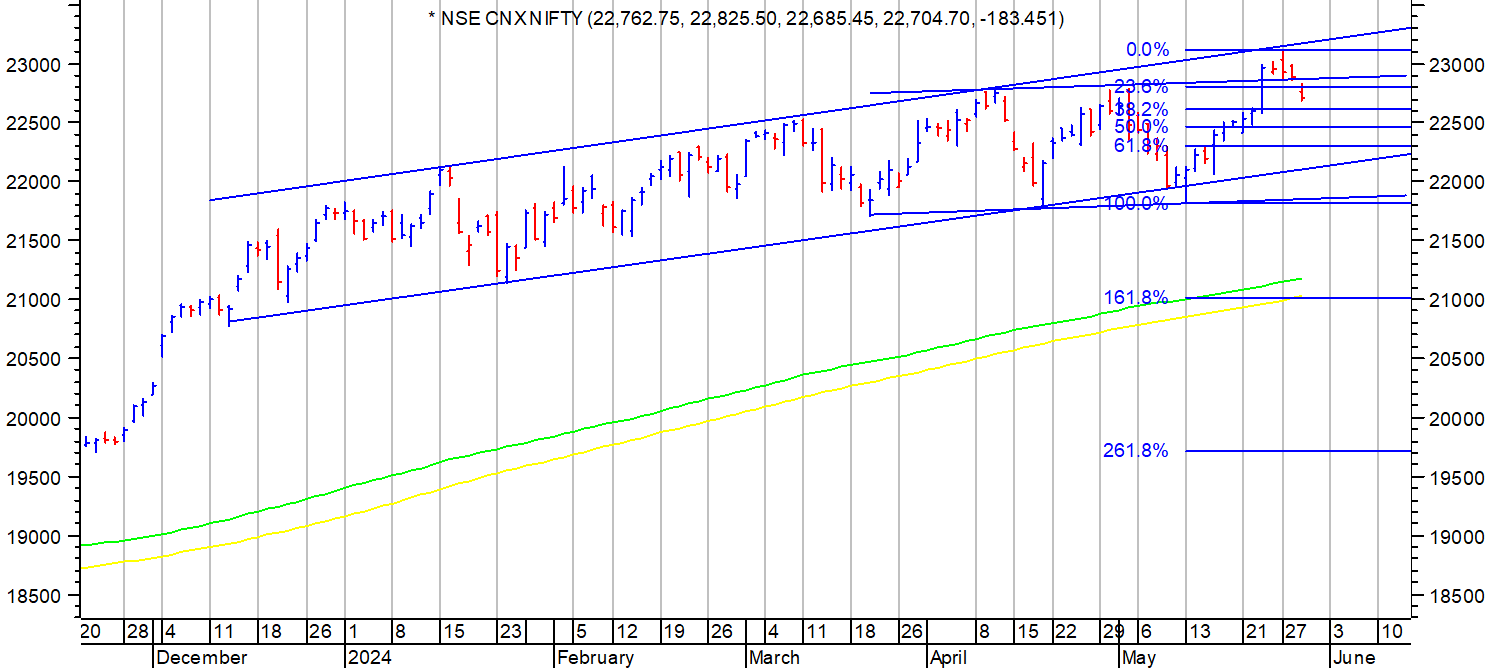

To take away the noise, attached chart shows a rising channel within which Nifty has traded since Dec 2023. And in recent past we have had a triple bottom formation in range of 21700-800 with breakout and confirmation on clearing 22700-22800. Index made a swing high of 23110 on 27th May and has been in a corrective mode. Recent correction can be a retest after a breakout, or a failed breakout.

In either case, if double bottom plays out, we can be looking at potential target of 23700-23800 on Nifty depending upon election results However if we continue with correction, then levels of 22200-300 is rising channel support. Below that the previous triple bottom range support is at 21700-800. 22200-22600 is zone of retracement support wherein the 38.1%, 50% and 61.8% retracement levels of the previous rally are located.

If results are totally unexpected on either side, things can go wild on either side.

This is a totally objective chart of Nifty with well defined patterns, channels and levels. No recommendations, views. Just observing how things pan out. Hope for best and prepare for the worst.