@Naman_Gupta1 By the virtue of having learnt a lot from Hitesh bhai, I think he means getting into a trend early on. And the story can come in different sizes, shapes and forms.

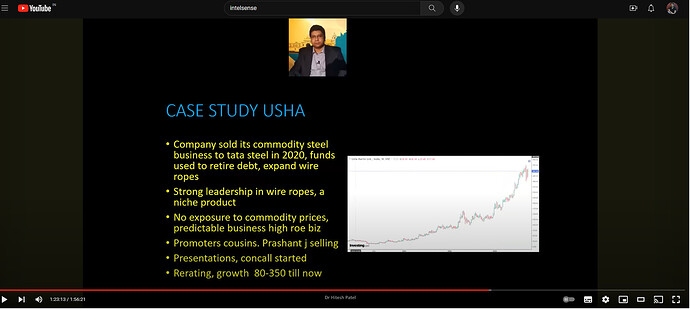

For example, I believe the first time he wrote about Usha Martin was in Nov 2021 (Stock price then was in the range of 65-95)

A behind the scenes look at what was happening at UM, prior to this was that one set of promoters were starting to run the company and the other promoter was backing off after an internal feud, starting 2017.

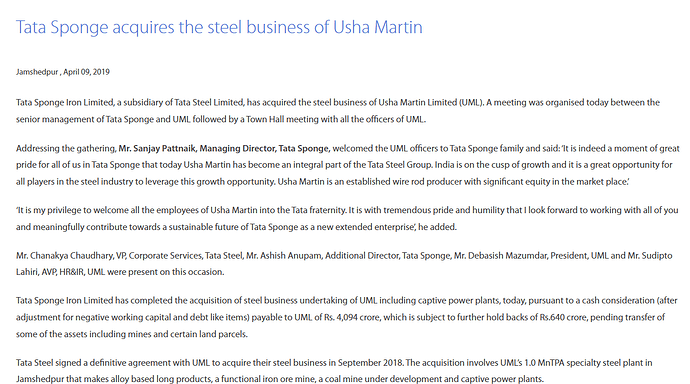

Subsequently, the new promoters (the Rajeev Jhawar faction) started to work on turning around the co. and got rid of debt by selling off their commodity steel business in April 2019.

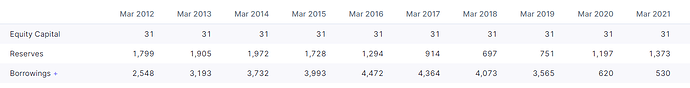

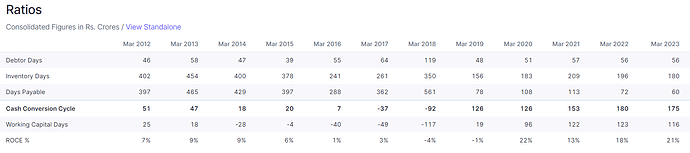

And boy! look at their balance sheet after that. Debt reduced to a fraction of what it was, before the steel business was hived off and the new promoters took control.

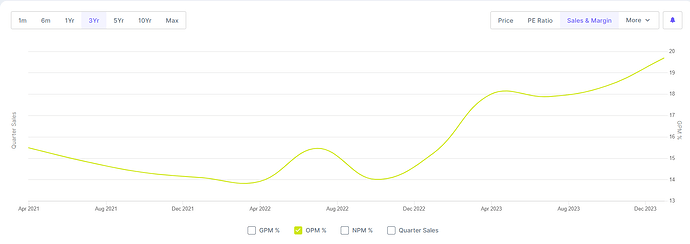

Subsequently margins started to improve because UM started to focus more and more on wire ropes which was unlike their commodity steel business.

And single digit return ratios went to double digits, starting in 2020-2021

The end result was a stock that went up 3-4x in less than 3 years, which happened through a process of catching a stock early on + using technicals + doing the work on the fundamental side + understanding the story behind a rising stock.

You may want to revisit this talk by Hitesh bhai. It is a masterclass in investing and covers many other mental models and case studies which one can use in the pursuit of getting into the right stocks early.

PS: It takes several iterations to grasp many of the concepts he’s talked about in the video because what a teacher has learnt over many years can’t be learnt by a student in 2 hours.

Over to Hitesh bhai ![]()