One of my relative is looking to take up dairy farming by the end of the year with the aim to expand into dairy business eventually. So I decided to dig out about the sector. Following are some notes from research with major focus on Heritage Foods.

INDUSTRY

Milk and milk products form a major part of diet of Indian populace unlike a lot of other countries. Most of the milk consumption is in the form of liquid milk but consumption of milk products like curd, butter, ghee, cheese, Paneer is also growing. Indians prefer buffalo milk over cow milk due to higher butterfat content in the former.

If someone thinks about whether this industry will be around for 10 years from now and whether it would still be growing, the answer comes to a resounding yes. That is one of the strengths of the dairy businesses i.e. forever and repetitive market.

The dairy industry can be sliced into three categories - Co-operative, Private and Unorganized.

The prominent examples of co-operatives are -

- Gujarat Co-operative Milk Marketing Federation (GCMMF, brands - Amul, Sagar),

- Karnataka Milk Federation (KMF, brands - Nandini),

- National Dairy Development Board (NDDB, brand - Mother Dairy).

The major private players are as follows -

- Hatsun Agro Products Ltd.

- Heritage Foods Ltd.

- Parag Milk Foods Ltd.

- Prabhat Dairy Ltd.

- Kwality Ltd.

In unorganized sector, the milk is produced/procured locally and then sold locally.

As per some reports, Co-operatives and Private players constitute 50% of the total industry size while rest is controlled by unorganized players.

MILK PRODUCTION

In India, milk is produced by lakhs of small and marginal dairy farmers. This is unlike developed countries where large corporate dairy farms are present. In India, due to high land cost, large corporate farms have not been developed. Also average animals per farmer is less than 10 in India whereas that number is quite high in other countries. This creates an interesting entry barrier where a company has to develop large network of farmers and have to gain their trust. The building of such network takes years and gaining trust is even harder.

On productivity front, there is usual nonperformance by India. The average milk per day per animal is 6-8 liters whereas average in US/NZ/UK is almost three times. This is also due to usual suspects like - cows/buffaloes are fed low quality/leftover food, lack of quality grazing lands, lack of proper veterinary care, inefficient cross-breeding etc.

Since Indians prefer buffalo milk, there is another intricacy with that. Buffaloes produce twice as much milk in winter compared to in summer. But demand for milk products (ice cream, flavored milk etc.) is more in summer. This creates supply-demand imbalance. This seasonality further complicates relationship with farmer. Farmer expects that entire surplus milk will be procured during winter even though company might not be able to sell that milk.

MILK PROCUREMENT

To develop relationship and gain trust of the farmer, procurer has to provide payment on time, payment has to be as per the quality of the milk. It is also nice if procurer can help in cattle feed, provide guidance on veterinary practices and also help to get small loans from the banks.

The issues faced in milk procurement are usually - inability to grow outside home state, home district, political interference and policy interference.

Parag has been unable to grow its supply outside of Pune, Prabhat has been unable to grow outside of Ahmednagar. Most of the local co-operatives in Maharashtra are dominated by politicians and hence it gets difficult for private players to compete. In Karnataka, farmers get subsidy for supplying milk to KMF.

MILK CONSUMPTION AND DISTRIBUTION

90% of the milk in India is consumed in liquid form and this product has very low margins. Due to this, milk produced have to be sold within 200-300kms of radius as costs of storage/transportation make it nonviable after that distance.

Due to above, milk business is very competitive in regional pockets. There is virtually no entry barrier in packaging and selling liquid milk. Also regional player or co-operative can always hit private player with lower selling cost to consumers or higher remunerative cost to farmer.

So having a strong distribution network, well recognized brand and efficient operations is only insurance from this potential disruption.

MILK PRODUCTS

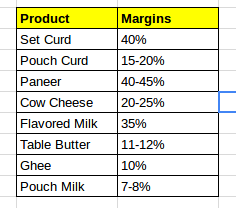

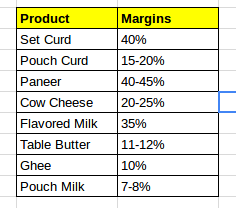

Milk products can be categorized into two categories viz. Fresh Products and Value Added Dairy Products (VADP). The Fresh products are set curd, pouch curd, Paneer, flavord milk etc. The VADPs are mainly Cheese, Butter, ghee etc. The consumption of these products is growing faster than liquid milk and they have higher margin than liquid milk. A company with increasing proportion of Fresh Products will see bottom line grow faster.

Following table provides the margins of various products →

COMPANY

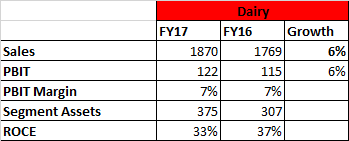

Now coming to company, Heritage Foods was founded by N Chandrababu Naidu in year 1992. The company has six business verticals - Dairy, Retail, Agri, Bakery, Renewable Energy and Vetca. My primary focus of analysis is dairy business.

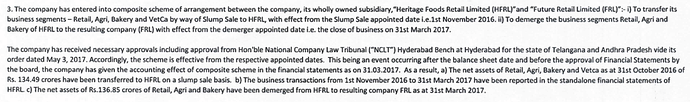

The recent relevant announcements are as follows -

- Decided to acquire dairy business of Reliance - 2.25 LLPD procurement (Big positive if farmers stick)

- De-merger of retail/agri/bakery undertakings to Future Retail Limited (Big positive as bottomline will have predictability)

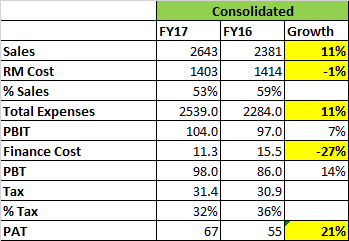

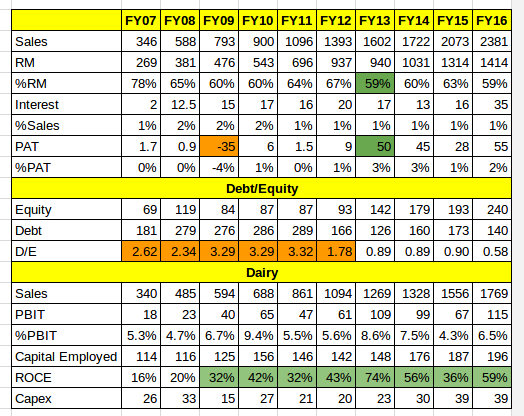

NUMBERS

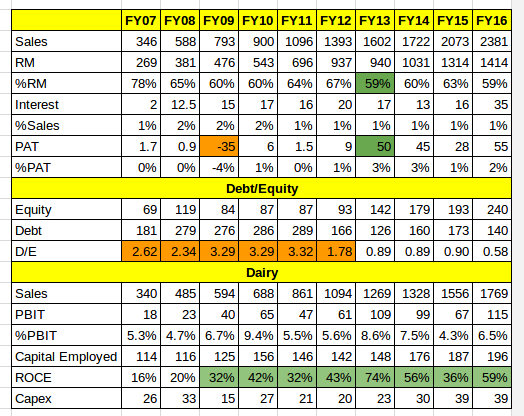

- The retail business did take byte out of bottom line every year and made the performance of the company look inconsistent.

- But the dairy business has been growing with very good consistency. Topline growth, Asset Turns, ROCE, Negative WC cycle everything checks out. The dairy business actually fits the bill of Warren Buffet’s ideal business - “The business that has high return on capital employed and requires very little additional capital to grow”.

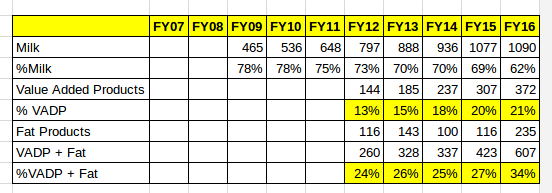

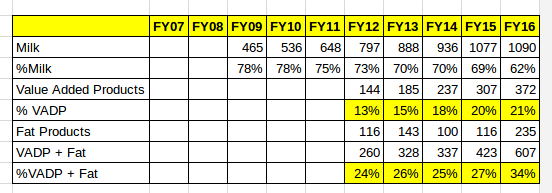

- The % of milk in dairy business has consistently gone down i.e. VADP + Fat products consistently contribute more to dairy business.

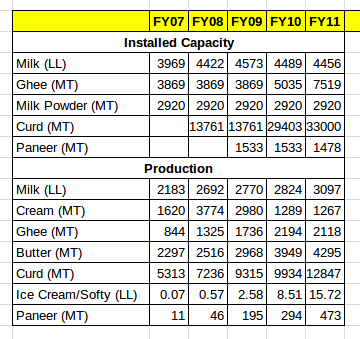

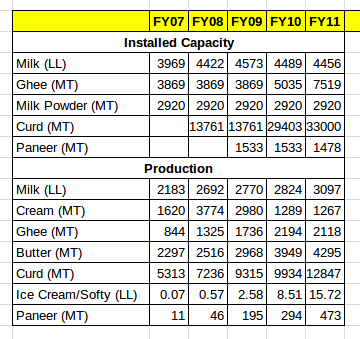

The company used to give installed capacity and production numbers earlier. Newer ARs do not have those.

LESSONS LEARNED

-

The stock has been amazing wealth creator. In FY12, the stock was trading around 100 odd. FY13 the stock was trading around 200 and today stock price is around 1200. The company issued bonus shares in ratio 1:1 in July 2013. So in last 5 years, stock has been amazing 10+ bagger.

-

The above performance is despite blunders. The company did a classic case of “Peter Lynch Diworsification” by entering into Retail business and losing money consistently. Also the D/E > 1 till FY13. Also the promoters of the company are politicians (N Chandrababu Naidu Family). Based on above three, my checklists would have ruled the stock out as an investment candidate.

-

To rationalize the point 2, we will use HM. As he says, just because an investment worked out does not mean it was not risky and just because investment did not work out does not mean it was not good call. So maybe it is still okay to miss out on this story. BUT I think our checklist filters can not be absolute. They have to be relaxed from time to time if one finds some good insight into story.

-

The company was trying to hive off retail business for almost 3-4 years without much success. they did so finally in Q3FY17. The lesson here is that - one can not be a hawk and track and question company on quarterly basis. Business is combination of several variables and sometimes it can take a long time to achieve something. The patience is virtue if one has done proper research.

OTHER INFO

MANAGEMENT

N Bhuvaneswari, Vice Chairman and MD

- WIfe of N Chandrababu Naidu

N Lokesh, Executive Director

- Son of N Chandababu Naidu

- Resigned as ED in FY13, continues to be non executive director

- Chairman of Nirvana Holdings which holds 11% stake in company

N Brahmani, Executive Director

Ashok George, COO, Dairy

- Formerly employed with Mother Dairy, Salary seems less at 12L

- Left company in Aug 2008

M Sambasiva Rao, M. Sc., PhD

- Previously joint secretary, Ministry of commerce, retired IAS

K Durga Prasad Rao

J Samba Murthy

AR FY08

- Decided to setup own Fresh Outlets in South India so farmers can get better price.

- 70 stores operating in Hyderabad, Bangalore and Chennai

- Plan to open 30 more stores

- Two pack houses - Mattam (Chittoor), Mulugu (Medak)

- Convertible Warrants issued to N Bhuvaneshwari - 8L, N Lokesh - 10L, Kotak India Focus fund - 10L

AR FY09

- Created 400 heritage parlors, plan to setup 1000 in next year

- Appointed 400 milk distributors

- 14% milk share in AP, 7.4% in KA, 6% in South India

- Floods in AP where company has substantial operations

AR FY10

- Convertible warrants issued to following were forfeited due to nonpayment, N Bhuvaneshwari - 2.6L, N Lokesh - 8L

- Retail - following steps were taken

Restricting roll out of new stores

cost reduction initiatives like closure of nonviable stores, manpower reduction, rent reduction etc.

- Started bakery division

AR FY11

- setup 1000 franchise outlets

- Threats mentioned

Excessive grazing on small and marginal community land resulting in degradation of land

Extinction of indigenous breeds due to excessive cross breeding

AR FY12

Exported 25MT butter to Bahrain

AR FY13

- 15L customers

- Only packaging partner for curd for Nestle in South India

- 1176 Heritage Parlors and 67 Heritage Fresh Stores

- Milk

9LL procured every day from 3L farmers

14LLPD chilling capacity (123 chilling units)

12.50 LLPD packing capacity (13 packing units)

Increased milk procurement capacity by 0.72 LLPD

AR FY14

- 1:1 bonus share issued in July 2013.

- Expansion into MH, Odisha and Delhi

- Focus on ice-creams emphasized ahead of curd, paneer, ghee etc.

- AP, TA, TN, KA contribute 93% of revenue

- Commissioned 2.34 MW solar plant at Medak

This will generate 10,000 KWH of power per day

- India has 200Mn cows and 170Mn buffaloes

- Plan to double the share of value-added products from 15% to 30% over next 5 years

- Dairy business needs 65,000 KWH power per day.

- Acquired plant in Sangavi, MH for processing of milk

- Around 4Cr paid as commission to N Bhuvaneshwari, N Brahmini, N Lokesh

AR FY15

- Aim to achieve 6000 cr revenue by 2020

Dairy to contribute 4500 cr

- Engaged external consultant for business rationalization, restructuring etc.

- Value Added Dairy Products (VADP) has twice EBITDA margins compared to raw milk

- Aim to grow share of VADP to 40% in next 5 years

- The bottomline was hit despite 32% growth in VADP. Reason was that the price of Skimmed Milk Powder had gone up from 153/kg to 232/kg.

- Number of retail stores - 92

AR FY16

- Retail vertical was affected by Chennai floods

- Commissioned wind plant at Ananthpur, AP - expected to produce 50L units per annum.

- Number of retail stores - 110, Number of Heritage Parlors - 1455

- Plan to spend 100Cr capex in next 2 years, 80 cr in dairy

- Co-operatives have advantage of subsidies in terms of milk procurement

- Compensation of N Bhuvaneshwari and N Brahmani is around 9Cr

- Milk procurement at 11L LPD

FY16 Investor Presentation

Average procurement cost - 30.90/L, selling price - 36.55/L

REFERENCES

[1] Milk, Dairy Products Manufacturer & Supplier | Heritage Foods

I find above Ambit report excellent and a must read. A lot of industry data has been taken from this report and credit goes to Ambit for providing this data.

Disc - Never Invested into Heritage so far, this may change in future. This is not a buy/sell recommendation. Please do your own due diligence before investing. I am not SEBI registered analyst.