I wish to buy hercules hoist .please comment.

@Chintan, please make an attempt to sound reasonable to other users of the forum. Don’t assume we know what’s on your mind.

@Admin, please take note.

If the user wasn’t new, i think suspending him would be an option.

I am totally new to this forum and i am no expert as others . I like to read and imbibe what the experts have written. If this is only for expert comments then i prefer to read only. Thanks

Hi Chintan.Looks like you got it wrong here.For queries like this,i.e.,concerning your portfolio,etc. post in the section ‘Portfolio Q&A’.You can check the other posts to get an idea about it.

Hi Chintan,

Sorry, it wasn’t meant to discourage you from asking questions.

In fact questions are most welcome on valuepickr and seniors here are very considerate to answer them.

I would advise you to go through the link

http://www.valuepickr.com/forum/site-navigation-some-pointers

Basically, there are thousand’s of companies in the market, if you want other’s opinion on a specific company, first let us know your thoughts on it. Why you are asking about this one ? any reason you think this is a good investment ? Then others can help with their thoughts.

As I surf about the company on website , I found company is in a business of chain pully and engineered products related to weight lifting.

Recently promoter has bought some shares from market.

It is virtually a debt free company.

Hercules Hoists Limited

BSE: 505720 | NSE: Hercules

Sector: Capital Goods-Non Electrical Equipment | Industry: Engineering

Share Price as of 23/10/19: Rs. 84.15 | Market Cap: Rs. 269 cr

- Part of the Bajaj group. Incorporated in 1962 as a JV with technical and financial collaboration from Heinrich de Fries GmbH, Germany, which continues to hold a 5% stake. About 69% is held by the promoters. The company and its products, are more known by the industry brand name, INDEF (India + Hadef, brand name of Heinrich de Fries).

- HH has integrated design & manufacturing capabilities for in-plant overhead material handling equipment for lifting, moving and storing. Product range includes chain pulley blocks, electric hoists, cranes, etc. Mechanical and electrical propelled products include: chain pulley blocks, ratchet lever hoists, pulling – lifting machines, pull push or geared trolleys and electrical solutions like electrical chain and wire stackers for storage & retrieval, manipulators etc.

- These capital equipment products are applied in industrial verticals like automotive and auto-ancillary, energy & power generation (hydro / thermal / nuclear) , metal and metal processing, cement and infrastructure, food processing, logistics, textiles, oil, gas & petro chemicals, chemicals, fertilizers and pharmaceuticals etc. The usage is across the entire industry spectrum: private or public sector, large scale to tiny scale and even contractors.

- Clientele includes Tata Group (Tata Motors, Tata Steel, TRF), L&T, Aditya Birla Group, Reliance Ind, Mahindra Group, Eicher Motors, Jindal Steel (JSPL, JSW), ThyssenKrupp India, ABB, Ashok Leyland, Thermax, NTPC, NPCIL, SAIL, F L Smidth, McNally Bharat Engineering, BHEL, BEML, Department of Defence etc.

- ISO 9001:2008 quality systems certified. ISI & CE certification (for mechanical hoists). As a brand, if anybody would like to buy established products like chain pulley block, electric hoist and a wire rope hoist where safety is very critical, the buyer doesn’t bother if anybody gives it to them 2-5% cheaper. It could be very risky and dangerous if the chain breaks or quality is not up to the mark, which is why, people do not like to try new brands. This is the reason why they can get high margins and required growth. When the market is down, people like to go for established brands rather than taking chance with new brands.

- HH is the market leader in India for its core product lines: Manual Hoists (~33% market share), Electric Chain Hoists (~44%), Electric Rope Hoists (~30%). Main competitors are Reva, Swift, Brady & Morris, Safex, Demag, Coolie, Speed, Kepro, Tractel Tirfor, MM Engineers etc.

- Faces competition from the cheaper products of the unorganized sector and Chinese imports. Also faces competition from foreign manufacturers, who have set-up Indian operations. In the past, HH has had to take measures to check sales of fake Indef products in the market.

- Margin pressure is driven by increased competition (global, Chinese, unorganized players), expansion into cranes business (which have structurally lower margins), aggressive marketing efforts including targeting exports, etc.

- Sluggish order book: Gets majority of the orders as repeat orders from existing clients. Business is directly linked to investments in new projects, expansion of existing capacities and positive sentiments in industrial production.

- HH is constantly exploring the possibility of tie-up with foreign firms for improving sales and new products/designs:

- Launched a new product group: Manipulators, by bringing the “Indef-Zasche” Manipulators made from Carbon Fibre for the first time in India, in association with ZascheSitec Handling, Germany.

- Launched high quality mechanical handling equipment – Chain Pulley Blocks, Ratchet Lever Hoists and Pulling & Lifting machines in association with Planeta Hebetechnik, Germany.

- Also, launched a new series of modern and ultra-compact electric chain hoists, wire rope hoists and jib cranes in cooperation with Varese Handling Technology, Italy.

- Team size: 120+. Direct sales network of 4 regional offices (Delhi, Pune, Kolkata & Chennai). Dealer network of 44 authorized marketing associates (stock & sell distributors), supported by >100 sub-dealers. Also exports to customers in Central & Middle East Asia, South & South East Asia, Africa and South America.

- 2009 - GOI had reduced the excise duty from 14% to 8% in its economic revival package, which was fully passed onto the customers.

Production Facilities

- 2 facilities in Maharashtra – Khopoli (Raigad) and Chakan (Pune).

- June ’09 - Closed its Mulund (Mumbai) factory and shifted its entire facility, including the machine house and shop-floor, to a new factory in Khopoli, located at the outskirts of Mumbai. All the Mulund workmen accepted the VRS.

- There used to be an order backlog of ~4 months and delivery was given after a 4 month waiting period. To cope with the rising demand, HH invested Rs. 5 cr in new factory, in 2006. Land of 6 acres was purchased in Khopoli (Raigad). The construction of the building for the new factory commenced in 2007 with a scheduled production start by Mar ‘08. The actual production started in Dec ’08.

- The Khopoli plant is more modernized; HH used to operate with 79 workers in Mulund, but can do the same work with 41 employees in Khopoli. HH employed ITI workmen in Khopoli at half the wages of Mulund workers, while also getting higher productivity.

- Furthermore Khopoli plant is large enough to take care of turnover of upto Rs. 300 cr, which is more than the current market size for India. Given the current sales of <Rs. 100 cr, ~2/3rd of the capacity is unutilized. There are no Octroi in Khopoli as compared to 5.5% in Mulund.

- Dealers now know that HH has capacity and hence they don’t order in advance like they did it in the past. Plus the dealers, with rising interest rates are playing more safely rather than holding the stock in advance.

- To utilize the full capacity of the Khopoli plant, HH ventured into exports in regions like Middle East, US and some parts of Africa.

Labor Relations

- Apr/May ’13 - There was a disruption of production at the Khopoli factory due to agitation by the workmen wef April 17, 2013. The management entered into a dialogue with the workmen for the resolution of the issue. The Khopoli factory normal production resumed from May 27, 2013 after the agitation ended.

- Oct ‘14 - Concluded a settlement agreement with Navi Mumbai General Kamgar Sanghatana, Panvel representing the workers at the Khopoli factory. The 4 year settlement was valid from Jan ‘14 up to Dec ‘17.

- Oct ‘14 - Started commercial operations at a new manufacturing unit, at Hinjewadi, Pune to manufacture, assemble, test, maintain and repair material handling equipment including electrical & non electrical hoists, trolleys, cranes etc. The introduction of this unit served to partly de-risk the operations and contribute to growth of overall business.

- July ’18 – Upon the expiry of the previous settlement agreement in Dec ’17, a new settlement agreement was concluded with Jai Bharatiya General Kamgar Sanghatana, Panvel representing the workers at the Khopoli factory. The current 4 year settlement is valid from Jan ‘18 up to Dec ‘21.

- June ’19 - Shifted its manufacturing activities carried out at Hinjewadi (Pune) to a manufacturing unit on lease rental basis, at Chakan (Pune). The production capacity will remain the same.

Corporate governance risks / Capital allocation policy with respect to excess cash and hidden assets

- HH has invested surplus cash in group firms (Hind Lamps, Bajaj Holdings & Investment, Bajaj Auto, Bajaj Finserv, Bajaj Electricals) via either equity or inter-corporate deposits. Moreover, in the past, HH has also advanced loans to Advance Appliances Pvt. Ltd. and Emkay Appliances Pvt. Ltd. These entities seem to be suppliers to Bajaj Electricals. The deployment of FCF into group entity equity shares (unrelated businesses from non-promoter shareholders POV) is a concern from governance perspective.

- Per 2019 AR, the fair value of the 2 acre Mulund factory land is highly likely to lie between Rs. 85-100 cr. There have been rumors in the past that the land would be sold / planning to build a mini township and also commercial facilities. Shekhar Bajaj: “Our Mulund land is completely empty. We have locked it up and have not applied our mind on what to do with it. We do not need funds. We would keep our spare land as it is than converting it and paying taxes on that. HH is a very cash-rich company. If we sell it, we would get further surplus cash. There has been a continuous appreciation of this land. Unless we have some good acquisition opportunity where we need funds, we won’t look at developing this land.” HH had also earlier stated in 2010/11 (right after the factory was shifted to Khopoli), that if octroi was not an issue, then Mulund may be restarted as it is better located.

- 2010 - Acquired 2 lac shares of Bajaj Holding & Invt. through Arrow Capital, a broking firm of Gaurav Nevatia (Ind. Director). But the transaction was cancelled since it attracted provisions of Sec. 297 of the Companies Act.

Valuation

- The intrinsic value of HH is possibly a matter of conjecture since the non-core investments are more valuable than the core business. As such, the assumed discount factor (50-60%) applied to group entity equities (Rs. 259 cr MTM, as of 23/10/19), unused land (Rs. 90 cr) and fixed income & cash (Rs. 74 cr) provides a wide valuation range.

- The MTM of non-core investments is Rs. 423 cr, giving a discounted value of Rs. 169-211 cr (50-60% discount).

- HH earns ~Rs. 6-7 cr of net income from dividends and interest from these investments, yielding a paltry ~1.5%. This is largely due to the prime Mulund land which is lying unused & low dividend yields from equities.

- I’m not sure if this discount factor is conservative enough, since there seems to be no catalyst which will unlock their divestment. It’s been a decade since HH has been sitting on them, although one might argue that buying and sitting on Bajaj Group equities (Bajaj Holdings & Investment, Bajaj Finserv, Bajaj Auto, Bajaj Electricals) has been a genius move during this bull run.

- The real issue from an investor POV remains the unwillingness of management to return FCF to shareholders. HH is (i) already the market leader in India, (ii) has >3x the installed capacity that it needs, (iii) does not seem to have expanded aggressively into newer geographies, and, (iv) there doesn’t seem to be any M&A initiative to acquire other competitors that could provide market access/technology in the globally battered capital goods space.

- FYE Mar ’19 operating results, after excluding other income (attributable to non-core investments)

- Sales of Rs. 102 cr.

- EBITDA of Rs. 9.4cr. Valuation range of Rs. 56-75 cr using EV/Ebitda multiple of 6-8x.

- EBIT of Rs. 6.4 cr. Valuation range of Rs. 51-64 cr using EV/Ebit multiple of 8-10x.

- Net Income of Rs. 5.0 cr. Valuation range of Rs. 40-61 cr using P/E multiple of 8-12x.

- The above multiples may seem to be on the lower side, but my reasoning is purely based on the suppressed capex cycle. In the absence of meaningful positive catalysts in the underlying industry conditions, it is preferable to play it safe on the valuation assumptions and minimize downside risk.

- As such, the intrinsic value range is Rs. 209-286 cr based on non-core (Rs. 169-211 cr) + core biz (Rs. 40-75 cr).

- Note that given current sentiment in the engineering / cap goods space, this valuation process is currently based on a Graham net-net basis. If positive events materialize and the financials start reflecting operating leverage through earnings surprises, then the situation may turn into one where the larger crowd will start valuing HH on a P/E basis.

Majority of Market Cap Value still comes from Non Core Investments:

Anyone tracking this? How will demerger impact on it?

The demerger will help in finding the value of the crane & hoist business. I have checked the Balance sheet. The investment value in Bajaj Finserv, Bajaj Auto, Bajaj Electric and Bajel projects as of March around 680 crores, and investments in MFS and equity makes upto 900 crores. However, the value of these investments can’t be realised as they are not going to sell anything. One can expect a regular dividend based on the cash flows from investments. The cranes and hoist business valuation can be made based on the revenue. I think there’s no moat for the business.

I believe, all the upside is captured in the current share price.

Disc: I don’t have any holdings.

Thanks for your reply

Demerger happened in 1:1 ratio; for every 1 share of HHL 1 share of IML would have been allotted. However, I couldn’t find IML being listed.

Can someone please clarify this.

Listing generally takes 2-3 months time, there are some cases, where the listing has taken more than 5-6 months. There’s a regulatory procedure, Even though shares are allotted, those will be listed after the approvals from exchange.

Here is my analysis of the company:

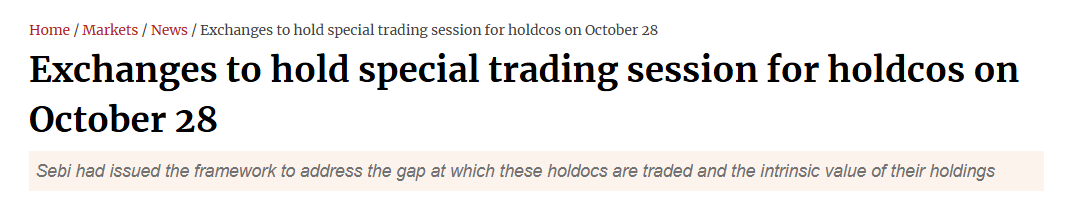

In June 2024, the Securities and Exchange Board of India (SEBI) introduced a special call auction mechanism for holding companies, which took effect on October 28, 2024. This initiative was aimed at addressing the gap between the market price at which these holding companies were traded and the intrinsic value of their underlying holdings.

Key Points:

-

Purpose: The primary objective of this move was to ensure that the market price of holding companies better reflects the actual value of the assets they hold. Historically, shares of holding companies were often traded at significant discounts or premiums to their intrinsic value due to factors like liquidity, market sentiment, or lack of investor understanding of the company’s holdings.

-

Mechanism: The special call auction allows for a more structured and transparent way of trading these companies, especially in situations where there are significant gaps between the market price and intrinsic value. The auction mechanism is designed to provide a fairer price discovery process for investors and enhance market efficiency.

-

Impact: By implementing this auction system, SEBI aimed to enhance liquidity, reduce volatility, and ensure that holding companies’ shares are traded closer to their true value, ultimately benefiting investors. The move was also intended to encourage greater investor participation and confidence in such companies.

Source - Business standard (link)

Thanks for reading Smart Fundamentals - by Scoop Investment! Subscribe for free to receive new posts and support my work.

Subscribed

Brief -

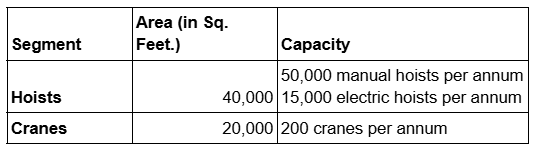

Hercules Hoists currently operates with two distinct divisions, with plans for a demerger that would further separate these divisions into independent entities. Below is the structure of these divisions:

1. Holding Company for Multiple Companies:

- This division will remain under the Hercules Hoists entity following the demerger.

- It holds and manages various subsidiaries and investments in different businesses.

- After the demerger, this division will continue to operate under the Hercules Hoists brand, focusing on the strategic management and oversight of the group’s investments and holdings.

2. INDEF Limited:

- Current Business : INDEF Limited currently manufactures mechanical hoists and cranes.

- Demerger Plan : The mechanical hoists and cranes business will be demerged from Hercules Hoists and transferred to a newly created entity, INDEF Limited , which will be listed as a separate company.

- The demerger will enable INDEF Limited to focus on its core manufacturing business and operate as an independent entity in the market.

Post-Demerger Structure:

- Hercules Hoists will continue to operate as a holding company, overseeing its investments and subsidiaries.

- INDEF Limited , as a newly listed company, will concentrate on the production and sale of mechanical hoists and cranes, benefiting from a more focused operational structure.

This restructuring will allow each division to pursue its business objectives independently, enhancing operational focus and possibly unlocking shareholder value through the listing of INDEF Limited.

Source - Company (Link)

Hercules Hoists Limited -

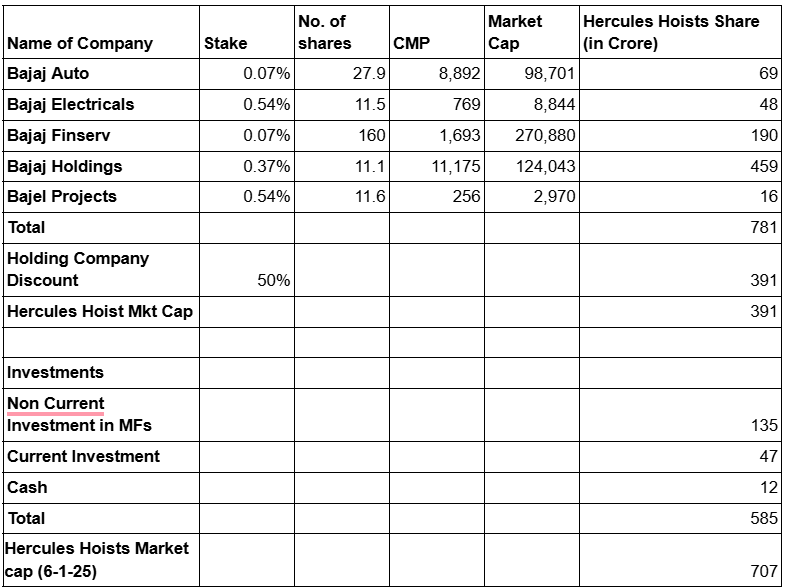

The holdings of Hercules Hoists primarily consist of shares in Bajaj Group companies, listed below. Additionally, there are other investments, which are detailed separately beneath the listed companies.

Note - Market cap - As on 6 Jan, 2025 & Investment Value are based on FY2024 Annual Report

After applying a 50% holding company discount to Hercules Hoists and adding the value of its investments, the implied value of INDEF Limited is estimated at ₹110 crore.

INDEF Limited -

The company started as a JV with HEINRICH DE FRIES GMBH, a German company & to this day, they hold 5% of the company.

Capacity Data-

Source - Company (link)

Note - 4 wind turbines of 1.25 MW generation capacity each were sold to HUL in 2022.

Don’t keep this to yourself—share it and spark a conversation

Revenue Mix

- Chain Pulley and hoists (79% of revenue) -

Under this segment, the company manufactures a variety of hoisting and lifting equipment, including:

- Chain Pulley Blocks

- Ratchet Lever Hoists

- Pulling & Lifting Machines

- Electric Chain Hoists

- Wire Rope Hoists

.

Source - Company (link)

- Cranes (15% of revenue) -

The company manufactures cranes that find applications across various industries, including:

- Power Generation

- Automobile

- Infrastructure

- Steel & Metals

These cranes are essential for handling heavy loads and are widely used in sectors requiring robust lifting solutions.

Source - Company (link)

- Spares & services (6% of revenue) -

Spares, Services, and Annual Maintenance Contracts (AMCs)

The company provides comprehensive support for its products, including:

- Spares and Services: Offering replacement parts and maintenance services for the products sold.

- Annual Maintenance Contracts (AMCs): Providing long-term maintenance solutions to ensure the optimal performance and longevity of the equipment.

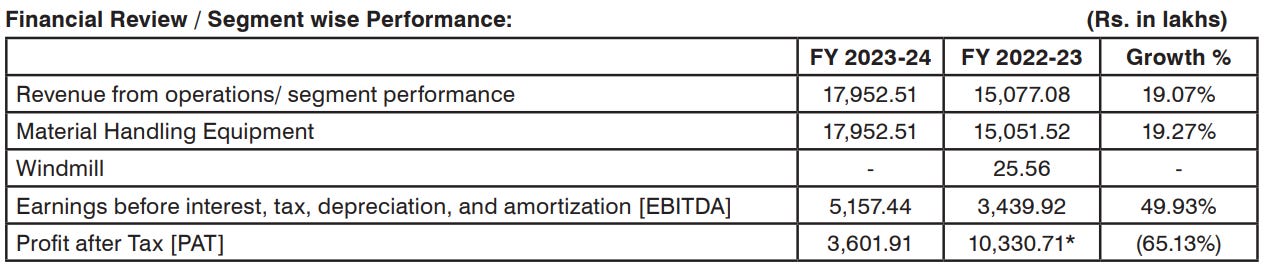

Financials of INDEF -

Source - Annual report FY 24 (link)

- EBITDA : The EBITDA includes ₹22 crore from the Investment Division .

- Core INDEF Business :

- Revenue : ₹180 crore

- EBITDA : ₹30 crore

- EBITDA Margin : 16.67% (excluding the contribution from the Investment Division)

- Other Income : In FY24, Other Income primarily consists of:

- Interest from Inter-Corporate Deposits (ICDs)

- Gains from the sale of investments, which Hercules Hoists will retain post-demerger.

This breakdown highlights the strong performance of the core INDEF business and the significant contribution from the Investment Division and other income sources.

Management Of INDEF -

- Amit Bhalla, Managing Director -

He holds a B.Tech in Chemical Engineering and a Post Graduate degree in Management with specializations in Strategic Marketing and Analytical Finance. He was appointed as President and CEO on January 1, 2021. Prior to joining Hercules Hoists Limited, he was associated with Bajaj Electricals Limited.

Demerger

Timeline -

The Board of Directors approved the scheme of demerger on September 23, 2022, and on August 2, 2024, the NCLT granted approval for the demerger.

Hercules Hoists Limited is now classified as an Unregistered Core Investment Company (CIC), which is expected to reduce its holding company discount and enable the company to trade closer to its fair value.

The company has received BSE approval for the listing of INDEF, though NSE approval is still pending. Shares of INDEF have already been allotted to eligible shareholders.

Scheme

After the demerger, INDEF will have the same shareholding structure as Hercules Hoists, as shares have been allotted in a 1:1 ratio. Trading is expected to begin post-listing approval from the NSE.

Risks -

- Slowdown in INDEF Business

- Dependence on Capex : The performance of the INDEF business is closely tied to India’s capital expenditure (Capex). If there is a slowdown in Capex, it could lead to a decline in both revenue and margins for the company.

- Valuation at Which INDEF Trades

- Shares Allotment and Market Trading : Since the shares of INDEF have already been allotted to existing shareholders in a 1:1 ratio, new investors will not receive new shares immediately. Instead, they will need to purchase the shares from the market.

- Potential Impact of Listing Valuation : If INDEF gets listed at a higher valuation, it could impact the attractiveness of the demerger, as the arbitrage opportunity may not be as favorable for investors, potentially diminishing the positive impact of the demerger.

Concluding thoughts -

Hercules Hoists operates with two key divisions: a holding company for investments and INDEF Limited, which manufactures hoists and cranes. Following a demerger, INDEF will focus on its core manufacturing business, while Hercules Hoists will manage its investments. The company holds stakes in Bajaj Group companies, with an implied valuation of ₹110 crore for INDEF. The demerger, approved by the Board and NCLT, aims to unlock shareholder value. The INDEF business is reliant on India’s Capex and its future valuation will be crucial for investor interest. Trading is expected to begin after NSE approval.

The company’s hoists and cranes business appears to be well-positioned for growth. Additionally, as the merger has not gained significant attention, there is potential for a re-rating of the stock as the market begins to recognize its true value.

.

good analysis @Chirag.jain48 but the demerger is done only the listing part is remaining record date was October 11th and the listing takes time 2-3 months when I checked the market cap before 11th Oct it was around >2000 cr if not wrong

This has been written here. @Omkar11 Do check it.

For any feedback let me know

Sorry I couldn’t explain well @Chirag.jain48 I was referring to about statement.

On the day of the demerger, Hercules Hoists shares were trading at approximately ₹800, with the post-demerger shares of Hercules Hoists trading around ₹200. The market capitalization on the day of the demerger was approximately ₹2,000 crores.

Based on this, I estimate that Indef Manufacturing shares should list at around ₹600 per share.

I would appreciate any guidance or insights on this matter. Additionally, if anyone has updates on when Indef Manufacturing shares will be credited to our Demat accounts, please share.

Disclaimer: I have been invested in Hercules Hoists for about three years.

I think they are credited in demat account but since not listed so not showing on trading platform

Is anyone still tracking Indef Manufacturing and can provide some insights?