Delighted to present to VP Community HBL Power Systems Stock Story.

Kudos to @YachnaBhatia for doing a super (dedicated) job in meticulously compiling another very interesting VP Business story. A business that many might characterise as having a chequered-past, especially those invested for long.

She has succinctly brought forward what has “changed” in the business/product mix, huge “Optionalities” that the business now exhibits - that can make for an exciting future for another high-tech, import substitutive, Atmanirbhar (primarily B2G) business. Others like @Anant @Rokrdude @dd1474 @Donald have collaborated with her actively.

Despite some easily identifiable missing “Investor wishlist” parts (like high Re-Investment requirements and lack of an intrinsically scalable business model) this is a business thats NOT easy to ignore, B2B or Not. Might even be positioned uniquely for a disproportionate “atmanirbhar” future should government policies/budgets remain stable and encourage sustainable progress.

Hope you enjoy the story as much as we did the process in bringing this to publishable shape.

Noted from PIB release on Kavach - Interesting Facts

- Kavach has so far been deployed on 1465 Route km (Rkm) and 121 locomotives.

- Kavach tenders have been awarded for Delhi – Mumbai & Delhi – Howrah corridors (approximately 3000 Route km).

- Indian Railways is preparing Detailed Project Report (DPR) and detailed estimate for another 6000 RKm.

- The Cost for provision of Track side including Station equipment of Kavach is approximately ₹ 50 Lakhs/Km and cost for provision of Kavach equipment on loco is approximately ₹ 70 lakh/ loco.

Kavach.pdf (456.7 KB)

Disc: - Invested. Not an Advisor and Not an recommendation.

KAVACH is bigger than Vande Bharat It replaces the worlds best system at 1/4th the cost Mr. Mani - founder of #Vande Bharat

(1161) Indian Railways में कवच का करिश्मा, भारतीय इंजीनियरिंग का कमाल | News Station - YouTube

RATING HBL202308120820_HBL_Power_Systems_Limited.pdf (167.8 KB)

HBL RATING

It is a good news- this news had also appeared in another article in Feb 2023. link given below.

However, i could not see any official statement from HBL power.

Any views/ confirmation from the company in this news which is floating around since last 6 months

Discl: invested in HBL as a part of my Railway / defence basket.

While Q1 numbers were good, the surprise element was in Industrial battery segment which mgmt. had categorized as slow growth traditional business. Mgmt. gave a guidance of 1060 cr. from this segment in FY24 with a growth rate of ~10% and then a growth of 4% for FY25.

However, Industrial battery segment did a 50% YoY and 9% QoQ growth. That’s super duper. Nearly 30% of annual target done in Q1. So is there a case for revising the guidance in industrial battery segment ?

At collaborator’s corner, VP team has already indicated this possibility

- Telecom batteries (Lead Acid) - This segment has seen many years of decline and is now making a comeback due to the improving demand in telecom space fuelled by 5G adoption and higher O&M replacement. Higher volumes in this segment can lead to better absorption of overheads and thereby higher margins from c. 8% to c. 10% – within the existing setup with no incremental investment.

October 2022 Credit report highlighted some of HBL’s top customers in the industrial battery segment, namely Indus Towers and Cummins India in the listed space.

Indus Towers Q1 call has some very positive insights on the telecom industry.

From Collaborators Corner: “The Company has been supplying its PLT batteries to Cummins for its DG sets under white label program – an association that has grown each year for over a decade.”

Snippet from Cummins India Q1 call confirms fabulous growth happening in this segment.

The new credit report released in Aug’23 also highlighted the growth in order book of nearly ~2.6x YoY basis, backed by demand from telecom sector. So even we deduct the kavach order of 600 cr from this 1600 cr. order book, that still leaves a sizable growth in order book from ~600 cr to ~1000 cr.

There is a chance that HBL has got itself into lollapalooza kind of situation where not only it’s new growth segment is firing, but it’s supposedly “low growth” largest contributor, industrial battery segment is also doing superb. Company is now raising 150 cr. to meet it’s working capital needs, which is in line with what mgmt. has been guiding.

Disc: Hold from ~100 levels. Have added more after Q1 results.

Now some good news on TMS.

One thing noteworthy in this is, earlier they indicated about the possibility of ‘at least’ one TMS system per zone. Now the implementation has come for first division. Has the recent events sensitized the railways to implement this per division ? The no. of division is ~5x that of zones. So the TAM changes accordingly.

HBL AR 23 OUT

HBL AR FY23.pdf (3.9 MB)

Some of the interesting points from annual report:

New areas for revenue growth:

#1

Our PLT batteries are fast catching the attention of Data Centre consultants and entities, aided by their performance, total cost of ownership, and safety over conventional VRLA and lithium options. We hope to make deeper inroads into this large and rapidly growing business space

#2

we are working with the Ministry of Aviation and the Director General of Civil Aviation (DGCA) to deploy NCSP batteries in all civil aircraft flying in India under the Atmanirbhar Bharat initiatives. When this happens, maybe a few years into the future, it will open an interesting growth window for the

HBL. → This will be huge opportunity, how to calculate the opportunity size ?

#3

We are also working on products for new generation aircraft and helicopters, recently acquired by the Indian Air Force and currently under development in India.

#4

We made considerable progress in this area. We undertook road trials of our electric drive train (EDT) solution on a 7.5T truck, demonstrating encouraging results with our solution’s performance and energy efficiency. → New area of opportunity for the company ?

#5

The fruits of our transformation journey have only started to show. Our high-value business segments, namely Electronics and Defence, where we enjoy an oligopolistic position, have come under the spotlight as our products and solutions secure approvals from user sectors

→ Not observed such bullish statements earlier.

All these things did not happen overnight, it’s a result of decades of R&D, sweat and toil: The battery division was started in 1977 which is the bedrock of the company and In 2002, the Industrial Electronics and Railway Signalling domains developments were started and in 2007 the Kavach development began and Kavach became a commercial business only in 2022.

Change in the group Composition:

HBL Tonbo Private Limited (HTPL) was incorporated by HBL Power Systems Limited and Tonbo Imaging India Private Limited on September 12, 2022 with a sharing ratio of 51:49. There were no commercial operations since inception of HTPL. Subsequently, it was decided to explore other opportunities to carry on the intended business. The Board of Directors of HTPL in their meeting

held on March 08, 2023, resolved to apply for voluntary striking off the name of the Company from the register of the Registrar of Companies under Section 248(2) of the Companies Act, 2013 read with rules made thereunder. In view of the decision of the Board of Directors HTPL, a provision for diminution of 100% value of investment in equity shares of HTPL of Rs.51,000 (being 51%) has been made during the reporting period.

There is no mention of Electro Optics products/Tonbo products in the table for business segment, which was present in the Q1 presentation under Rapid growth vertical.

Following is from Investor presentation in Feb2023.

=============================================================================

Summery of HBL Types of batteries and usage ![]()

ANNUAL REPORT SUMMARY 2023

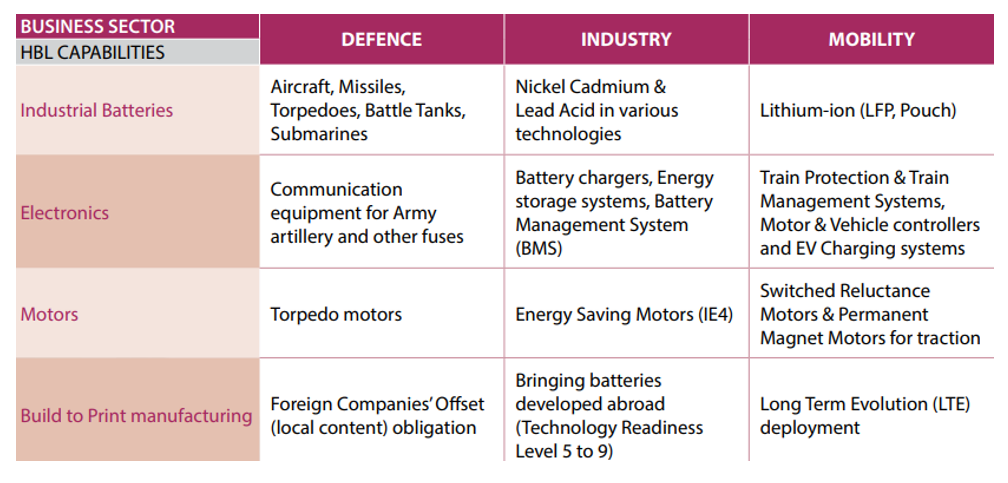

About the Company and its Business Segments:

HBL Power Systems is a technology-driven engineering enterprise that develops niche solutions for demanding applications.

Business Highlights FY2022-23:

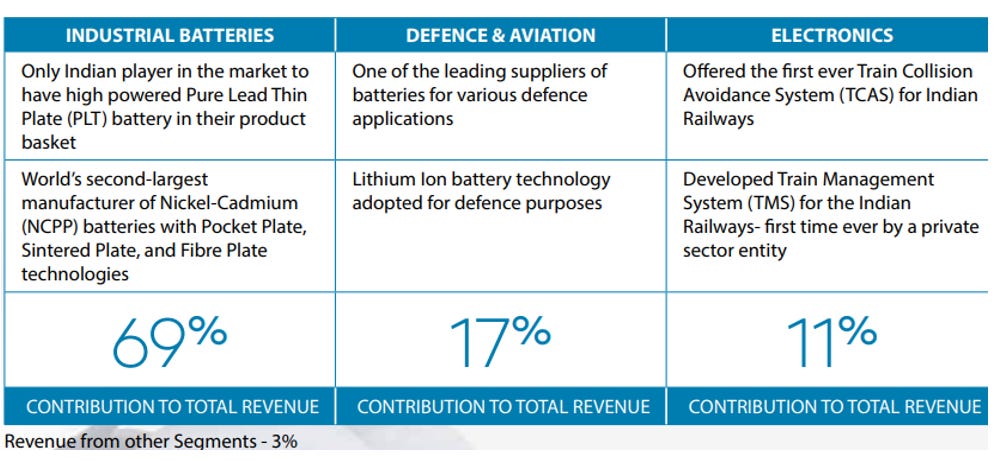

Industrial Batteries

- Witnessed strong demand from the telecom sector due to 5G Rollouts.

- Executed large orders for the supply of 12V-VRLA batteries for Wi-Fi electrification projects as a part of the Bharat Net project.

- Bagged single largest order of 31 crs for Ni-Cd batteries for IGGL (Indradhanush Gas Grid Limited) pipeline project in Northeast.

- Bagged export orders for supplies to New York City Transit (NYCT) & Siemens Via Rail, Canada.

Defence

- Completed type approval process for Type-II batteries meant for use in HDW German (Shishumar) class submarines, and secured manufacturing clearance.

- Developed and supplied thermal batteries to the Advanced Systems Lab (ASL) of DRDO, for Agni Prime Strategic Missile and received a production order.

Electronics

- Won four contracts for deployment of Kavach TCAS in Delhi-Howrah and Delhi-Mumbai routes worth 807 crore.

- Won a contract for the supply of 46 Kavach TCAS systems to Integral Coach Factory, to be installed in 23 Vande Bharat trainsets.

- Completed deployment of Kavach TCAS in Milestone I of Eastern Railway, West Central Railway and Western Railway.

- Deployment of Train Management System (TMS) in progress in Sealdah Division of Eastern Railway.

- Type testing and field trial of Electronic Interlocking System in progress

Medium-Term opportunities:

Batteries Segment

The Indian Lead acid battery is expected to register a CAGR of more than 9% during 2023-28. COVID-19 moderately impacted the market size in 2020, and currently, the market has reached pre-pandemic levels.

Estimates suggest that telecom players will add 4.5 lakh towers to improve latency and quality 5G coverage. 5G consumes more power than 4G. Hence, the connected battery capacity will be higher for a given backup requirement. Moreover, the replacement opportunity is also expected to be promising.

The UPS battery market is enormous (3000+ crore) and is growing consistently. These realities should sustain the demand for lead-acid batteries.

India is a data-guzzling market and the world’s largest consumer of data. This data needs to be stored in India. As a result, India will add a data centre capacity of over 4000 MW in the next five to six years. The company’s PLT batteries are gaining attention from Data Centre consultants and entities, aided by their performance, total cost of ownership, and safety over conventional VRLA and lithium options .

The management believes that the demand for Nickel Cadmium Pocket Plate (NCPP) will remain robust over the next couple of years.

Defence

The company has partnered with HAL Kanpur to develop batteries for civil aircraft Hindustan D0-228 and with HAL, Bangalore for Light Compact Aircraft - Tejas, and Advanced Light Helicopters, as part of the Atmanirbhar Bharat and Make in India initiatives.

They are working with the Ministry of Aviation and the Director General of Civil Aviation (DGCA) to deploy NCSP batteries in all civil aircraft flying in India under the Atmanirbhar Bharat initiatives.

They are engaging with defence authorities in other nations with Russian-made aircraft and helicopters to promote their batteries.

Having successfully developed batteries for Light Weight (LW) and Heavy Weight (HW) torpedoes, they embarked on creating new variants to expand the market.

Electronics

In the Union Budget 2023-24, an allocation of 2.40 lakh crore has been provided to the railway sector for accelerating the growth of the Indian Railways by improving infrastructure and introducing high-speed trains, which would call for increased TCAS deployment.

Considering these factors, Kavach TCAS garners the greatest attention in the directional focus for FY24 . So far, 20 Kavach systems have been delivered, and eight have been installed in 4 Vande Bharat train sets.

The company will focus on getting its Train Management System (TMS) certified to Safety Integrity Level II, according to CENELEC standards. Following this certification, the deployment in the Eastern Dedicated Freight Corridor will be commercially operational.

Business Model:

- Enter only Niche markets, which are (at that time) too small for big companies and too difficult for small companies.

- Avoid capital-intensive products and B2C businesses. Search for Engineering Intensive businesses to invest in.

- Technology should be the basis of sustained competitive advantage; avoid products where technology is easily available.

- Develop the technology needed, appropriate to the size of the Indian market, by R&D in-house.

- The goal is to be #1 or #2 in a market of reasonable size, or #3 in a large market. If this is not possible, do not enter, or exit.

- This business model has proved to be successful; HBL’s market position in India is #1 or #2 in all its products, except telecom tower batteries where it initially was #2, then #1, and currently #3.

Railway Signalling Electronics

TMS

One of the biggest issues in the operation of trains on the Indian Railways network is congestion on the available track infrastructure. Legacy systems for signalling and operations management are not able to keep pace with the need for running more trains. This, together with delays in the running of trains, affects the country’s economic progress.

Addressing this problem has become a compelling need for Indian Railways. HBL’s Train Management System (TMS), together with automatic signalling, addresses this problem.

A TMS is a central control centre, from where the operations of running trains in a large section of the railway network can be controlled centrally, avoiding delays in signalling. TMS, with its centralised traffic control capability and faster emergency response time, increases track capacity utilization.

The Company had deployed this solution in the Eastern Dedicated Freight Corridor. TMS installation in the Sealdah Division of Eastern Railway is in progress and will be completed in the current year

Defence Electronics- Electronics Fuzes for ammunition

Electronic Fuzes are essential for reliability and safety. HBL is the only Indian supplier for the Electronic Fuzes , and can also supply to other firms making the rest of the grenades.

Grenade fuzes made by HBL have been approved by the Ministry of Home Affairs for use by the paramilitary forces under a “Development cum Production Partner” contract with ARDE/ DRDO. Sales to MHA are expected to begin in FY24.

Dear Raj- What is the size of the opportunity for TMS?

Am not sure, because of the confusion that I cited here. Plus will there be a need for a separate TMS for Dedicated Freight Corridor and normal routes in same zone ? TMS cost per installation data is available but the total no. of installation required is still hazy. Hence we can only guess the opportunity size for TMS or go by the guidance mgmt. has given the presentation.

They come up with another presentation on today:

https://www.bseindia.com/xml-data/corpfiling/AttachLive/769685c8-5512-465a-bfa8-433645e26f17.pdf