A memorable set of quotes.

Ruchir Sharma always delivers. this time as well. Audience consist some well known investors… Liked hence posting.

Source: Trendlyne

The $100 predictions for oil prices are back. Crude oil prices touched their 10-month highs on Tuesday, as OPEC+ extended production cuts till the end of the year.

But this did not stop the Nifty 50 from hitting its all-time highs in the past week and gaining 2.5% in September, despite falling 1.2% on Wednesday. Crude oil prices increased by 6.9% over that same period – which should be a major concern for India, a net oil importer.

Investors however, are overlooking rising oil and food prices and focusing instead on India’s long-term growth. According to the World Bank, India will be the fastest-growing economy in FY24 with a 6.3% growth rate. In Q1FY24, India’s GDP [accelerated](India Q1 GDP Growth Highlights: India’s Q1 GDP growth rises to one-year high of 7.8%; RBI to maintain FY24 projection | Mint to 7.8% YoY, beating analyst expectations.

To keep growth momentum going, the Centre earmarked Rs 10 lakh crore for capital expenditure in FY24. By June end, the Centre had already spent 27.8% of the budgeted capex. As 2024 is an election year, there are plans to use at least 60% of this allocation by October.

While the government has pushed spends in the past two years, the long-awaited ramp-up in corporate capex has not happened. The private sector is cautious, hesitant to invest. Companies are sitting on their hands – the question is why.

In this week’s Analyticks,

![]() Capex Imbalance: Government drives capex surge as private sector hits the brakes

Capex Imbalance: Government drives capex surge as private sector hits the brakes

![]() Screener: Companies with highest estimated forward capex growth for FY24, and rising cash flow from operations

Screener: Companies with highest estimated forward capex growth for FY24, and rising cash flow from operations

Is weak corporate spending hurting India’s growth trajectory?

Capital expenditure (capex) is crucial for economic growth, as it helps create and improve long-term assets like buildings, equipment and infrastructure. Such spending comes from the government, businesses and households. While government capex has surged in the past few years, business investments have been lagging.

In response to a question about business capex, Finance Minister Nirmala Sitharaman had said in December 2022, “Private capex is picking up, thanks to measures such as production-linked incentive (PLI) schemes…this will drive a virtuous investment cycle in the economy.”

Despite her optimism, the share of corporate investments in total capex fell to a 19-year low in FY23.

Despite efforts to stimulate corporate spending—such as tax cuts in September 2019, increased government capex to attract private investment, and the introduction of Production Linked Incentive (PLI) schemes—we have not seen the much-hoped for boom. And it isn’t debt that is holding businesses back, since the corporate sector’s debt-to-equity ratio is at a 15-year low.

Government capex has the lion’s share, as it rises sharply in Q1FY24

Corporate capex is estimated to have fallen for the second consecutive quarter, with a projected decrease of 6.2% YoY in Q1FY24. However, the government came to the rescue – total capex is still set to rise by 7.1% YoY, thanks to a 54.1% spike in government capex, which made up for the fall in private investments.

Corporate investments contract for the second consecutive quarter in Q1FY24

Corporate investments contract for the second consecutive quarter in Q1FY24

The decline in corporate investments for two consecutive quarters has resulted in its share in total capex dropping to a 19-year low of 41.2%, compared to a pre-Covid average of 51.2%.

The government’s focus on infrastructure has raised the sector’s share of total capex from 2.5% in Q1FY17 to 11.1% in Q1FY24. Investments from private players are concentrated in a few sectors. Hetal Gandhi, director of research at Crisil Market Research and Analytics, said, “Private investment is leaning towards cement, auto, oil & gas, green technologies, and areas driven by PLI schemes."

Roads and bridges gain larger share in banks’ sanctioned project costs

Roads and bridges gain larger share in banks’ sanctioned project costs

While infrastructure companies’ aggregate cost of sanctioned projects has risen sharply, the power and construction sectors’ capex has fallen.

In Q1FY24, newly announced projects hit a five-year high at Rs 5.96 lakh crore. However, 74% of these investments came from the airlines sector, which ordered new planes by the hundreds.

Other sectors like power (10%), chemicals (8%), machinery (3%) and auto (2%) contributed relatively lower shares.

Airlines sector leads new projects announcements with huge orders

Airlines sector leads new projects announcements with huge orders

Companies are worried about high interest rates, uncertain economy

Inflation and high interest rates have got India’s private companies worried. High inflation took a significant bite out of corporate margins in FY23.

In an effort to bring down inflation, the Reserve Bank of India (RBI) raised interest rates by 250 bps to 6.5%, and has since paused further hikes. Businesses are unwilling to take on debt at these higher interest rates, and are waiting for potential rate cuts. Commenting on this recently, Satish Pai, Managing Director of Hindalco Industries, said, “Interest rates are up, which makes borrowing less attractive. So, we will work with what we have in our internal accruals, because money costs more now.”

But the recent spike in inflation in July and August means that the RBI may have to wait longer before cutting rates.

India’s CPI inflation exceeds RBI’s upper limit of 6% in August

India’s CPI inflation exceeds RBI’s upper limit of 6% in August

While private companies have strong balance sheets, inflation, uncertain global economic conditions, and high interest rates are roadblocks to anything they see as non-essential spending. Ambitious projects are more likely to be postponed.

The upcoming election in 2024 is also influencing decisions in the C-suite. Companies are cautious about policy shifts that may occur with a change in government. They will wait for clarity before committing to significant investments.

Addressing the sluggish pace of private capex, former RBI Governor C Rangarajan said, “The government has done a lot at the macro level to crowd in private investment. The next step is to evaluate each sector to see what is holding them back, and resolve the issues."

With capacity utilisation rising, analysts believe private capex will take off

A recent, positive sign however, is the surge in India’s index of industrial production (IIP), which grew at the fastest rate in five months to 5.7% YoY in July. The mining, manufacturing and electricity sectors have shown growth compared to the same period last year.

India’s IIP tops estimates and rises 5.7% YoY in July

India’s IIP tops estimates and rises 5.7% YoY in July

The IIP rising for nine straight months indicates high demand, and increased capacity utilisation among companies.

Current capacity utilisation for Indian companies stands at 76-78%. Analysts believe that crossing the 80% threshold could trigger major capex from private companies to meet higher demand.

Any fall in inflation, followed by interest rate cuts, will also jumpstart spending and get companies back on track with their investments. ICRA estimates that the RBI may start to cut interest rates in the second half of 2024. But if corporate investments stay sluggish, it will put pressure on the government to keep capex high, increasing the fiscal deficit.

According to Chief Economic Advisor (CEA) V Anantha Nageswaran, government capital expenditure cannot continue to rise at the same pace. The private sector needs to take over as the primary driver of capital formation. India’s economy will fire up in earnest only when private firms join the capex party, and keep the growth momentum going.

"Most people perform best on tasks when doing the tasks in complete silence; the next best condition is instrumental music in the background; music with lyrics leads to poorer performance.

Surprisingly, listening to your favorite music is the worst condition for performance & learning – the semantic content of the song competes with what we’re trying to learn because there are too many dialogues in our head."

Interesting presentation from PPFAS. Many investor believes that small cap only gives high return. They reject large cap as mota hathi.

Study or research said that there is no size premium or to put it in simpler terms they did not find any evidence of small caps outperforming large caps over their period of study

When you look at market cap overall large caps are 72 percent of the overall market cap pool mid cap is about 18 today small cap is nine and a half percent so fairly similar from 2003 to 2023.

Many interesting points…

Analysing Nifty performance using Chatgpt’s Code Interpreter Plugin without any programming.

I think one can do this with the Excel sheet we export from Screener for individual companies, too.

Technology has boosted the productivity of sectors like manufacturing and agriculture, driving down the relative price of their outputs, like TVs and food, and raising average wages. Yet TVs and food are not good substitutes for labor-intensive services like healthcare and education. Such services have remained important, just like constructing buildings, but have proven hard to make more efficient. So their relative prices have grown, taking up a larger share of our income and weighing on growth. Acemoglu, Autor, and Patterson confirm using historical US economic data that uneven innovation across sectors has indeed slowed down aggregate productivity growth.[3]

Read the very interesting thread on Nvidia on ValueinvestorsClub by the handle " pcm983"

The person is short on Nvidia and gives the detailed reasoning for it.

Description

We are in the midst of the final innings of one of the largest financial bubbles in recent history, artificial intelligence.

Nvidia sits at the center of this bubble, seemingly poised to benefit from the boom in AI research and development.

Unfortunately, history suggests that this time is likely not different. Artificial intelligence tends to progress in waves of ebullience and doldrums. An advance is made and people extrapolate it into the future, assuming that Artificial General Intelligence is only several years away.

“In 1970 Marvin Minsky told Life Magazine, “from three to eight years we will have a machine with the general intelligence of an average human being.” However, while the basic proof of principle was there, there was still a long way to go before the end goals of natural language processing, abstract thinking, and self-recognition could be achieved.”

While some of the recent advancements in AI are no doubt exciting and represent great progress, we believe the market is currently wildly too optimistic about the future pace of progress in AI and that this cycle will be no different than past AI hype cycles.

ChatGPT is an exciting product, but internet searches suggest that its growth has stalled out. While OpenAI does not release any usage stats, we believe it’s likely that the retention data of ChatGPT’s users is bad, and growth/recurring usage are down considerably.

As a proxy for ChatGPT usage, we pulled the search trends for the term ChatGPT Login, which we believe represents people trying to login to the service - it shows that usage is well off the highs, suggesting some of the initial enthusiasm has worn off. While it’s a neat tool, as most have seen, its accuracy causes great concern given the high error rate, and the true value may be a lot less than many initially expected.

How does this all relate to Nvidia? While NVDA is up ~200% YTD, NVDA revenues actually declined 13% YoY in its most recent quarterly results. But why then is the stock performing so well? Expectations for massive future growth, driven largely AI orders of Nvidia chips specially designed for AI use cases.

Nvidia projected $11bn of revenues for the 2nd quarter of the FY 2024. This is in large part driven by a wave of capex from AI companies. We believe it’s likely much of these orders are one-time in nature given the companies putting them in are burning cash at astronomical rates. It seems the market has forgotten the lessons of the past few years. OpenAI reportedly lost $540mm in 2022

To help fund this capex by a range of nascent companies, Nvidia is investing its own capital in many of the same companies that are putting in orders of the chips.

6/8/2023:

June 8 (Reuters) - Cohere, an AI foundation model company that competes with Microsoft-backed OpenAI, said on Thursday it had raised $270 million in a funding round from investors including Nvidia (NVDA.O), Oracle (ORCL.N) and Salesforce (CRM.N) Ventures.

6/13/2023:

Artificial intelligence-based video generation platform Synthesia has raised $90 million from investors, the company told CNBC exclusively.

The round, which values the company at $1 billion, was led by venture capital firm Accel and backed by U.S. chipmaker Nvidia.

How does the funding mechanism work? Nvidia partners with leading VC firms to invest in AI startups which then take that capital and place orders with NVDA for chips. This helps boost NVDA’s stock price given NVDA currently trades at a Price to Sales Multiple of ~25x. So every $1 of Sales generated by startups buying NVDA’s chips generates $25 of value for NVDA stock.

Like most bubbles, we believe this is unsustainable. Eventually the AI startups need to generate cash flow or they cannot continue to massively invest in Nvidia chips. Past chip cycles like Crypto Mining have tended to peter out over time as they were fundamentally unsustainable. We believe the same will hold true this time.

Nvidia currently trades at a valuation not even matched by the excesses of the 2000 Internet Bubble. Even if AI ends up being as transformative as experts are predicting, it will take far longer than expected and involve numerous bumps in the road. There is also the possibility that there are technological advancements that displace Nvidia as the leading Chip solution. The first mover in a space is rarely the last mover as we have seen numerous times in the past. Check Excite and Yahoo! For some cautionary tales on the risks inherent in being first out of the gate in a hot new area with new entrants chomping at the bit.

As a reminder, this is far from the first time Nvidia has seen a short-term boost due to a temporary dynamic. Nvidia saw a revenue boost from crypto mining because its chips were the best suited to crypto mining. This ended up unwinding: Nvidia’s crypto-associated revenues went down ~80% from 3Q21 to 4Q21:

We believe the same dynamic likely will occur with AI.

Another interesting point which has gone largely unnoticed is Nvidia insiders have been selling large blocks of stock in recent weeks. Just since May 31, insiders have sold >$100mm of stock. We believe this is a very telling sign - these are not people who need to sell stock to buy a home or renovate their house - these are insiders selling substantial portions of their holdings likely because they recognize there is an AI bubble going on.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer’s securities.

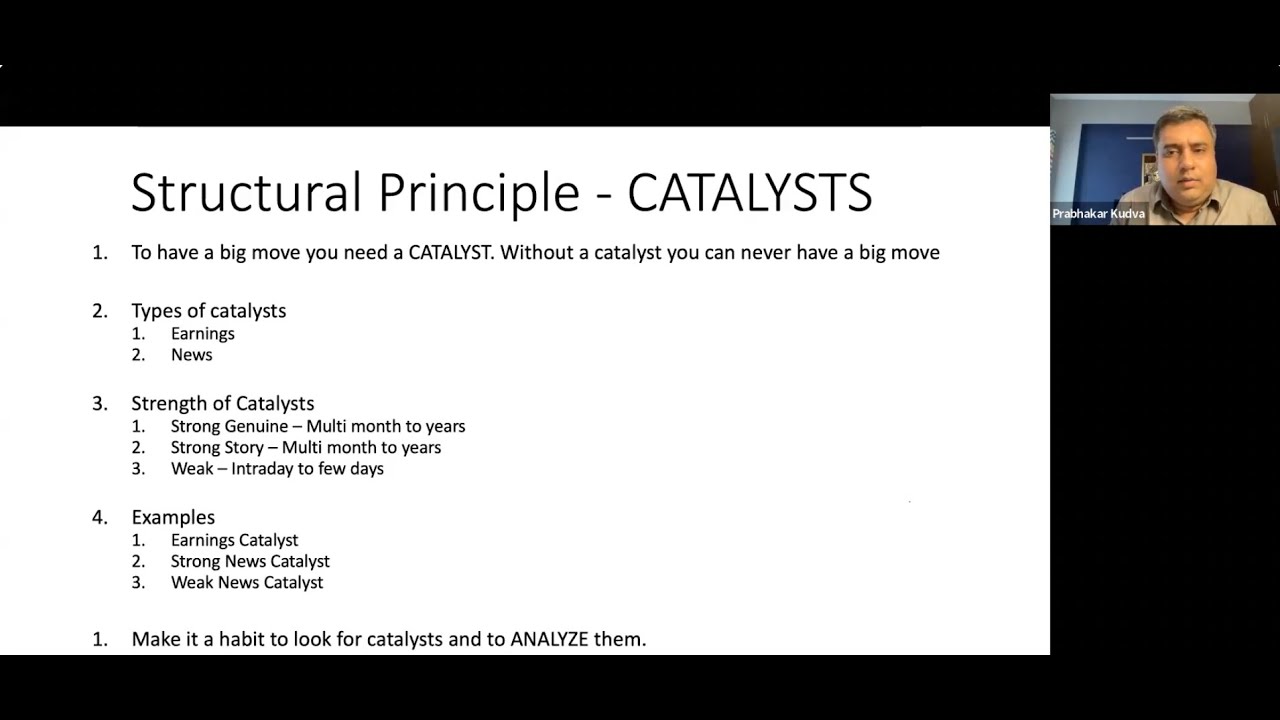

Catalyst

father time is undefeated

eventual capital raise

A massive bull market is taking place in front of our eyes (moneycontrol.com)

200% positive article on India, no negatives.

Double GDP in the next 10 years, which the author is saying, is approx 7% growth annually, which is the Indian historical average growth rate since opening up the economy. Now embellish with some pomp and show, and the ordinary become extraordinary. What is there to read?

Base rates exist for a reason!

A good ppt on ‘how to use Trading View for technical analysis’.

Good information on rare minerals and where India stands.

-

“One of the most common due diligence questions is, “when doesn’t this strategy work?” It’s an important question to ask for making sure you understand the nature any strategy.”

-

“Every portfolio, and every portfolio decision, can be decomposed into being long something and short something else.”

Making Sense of the Market Pt.2 | Colossus® (joincolossus.com)

Just like Aswath Damodaran’s previous appearance on IltB, this one’s very good, too.

Covers a wide range of topics from current state of the markets, inflation, interest rates, to AI & even Sports franchises.

Found this very educative. Especially for long term investors, what not to do. Has some Indian companies mentioned.

I think the article refers to mankind pharma IPO that listed in may, but its IPO price did not fall 50% instead it has increased by 50% since IPO. Kind of misleading.

-

“A year ago, Netflix was losing 1 million subscribers per quarter and had shed 75% of its market cap. It was the worst performing stock in the S&P 500. Fast-forward one circumnavigation of the Sun, and Wall Street is “gushing” over its “beautiful” results while the rest of the industry flounders.”

-

“In 2015, Netflix registered negative $840 million in free cash flow. By 2017, that number was negative $2 billion; two years later, negative $3 billion. Fearless spending was its differentiator. Capital as a weapon, if you will — specifically, cheap capital. Original content spending at Netflix grew faster than at any other streaming service, and by 2021 the company was investing $18 billion on content per annum, with free cash flow still in the red. Meanwhile, the legacy media players were beholden to a different investor base that wouldn’t tolerate the losses needed to go toe-to-toe with the streaming platform. Netflix is now firmly profitable in all aspects of the business. It is the only entertainment company with a profitable DTC streaming business, and the legacy players are playing catch up.”

-

“Netflix’s decision to increase subscription prices this quarter reflects the strength of the platform. It has reached utility status.”

-

“Research has found that introducing lower-quality products actually increases sales of your higher-margin premium products”

-

“The most valuable companies in the world all have one thing in common: They build a thick layer of innovation on top of investments made by the premier VC in history, the U.S. government.”

-

“Suits was the most streamed show across all platforms for three straight months this year, hitting the record for most-ever weeks at No. 1. This is the Netflix Effect in action: Take a solid series, reheat it, and make it the most consumed content on the planet.”

-

“Streaming was not the company’s only bold pivot. In 2011, despite its reputation as a “platform,” Netflix decided to foray into original content. At the time, it seemed absurd. The company was going up against Universal, Paramount, Warner Bros., Disney, and Sony — Hollywood titans known in the industry as the Big Five. Still, Netflix dove in headfirst, spending $2 billion on content in Year One. One of its first original series, House of Cards, went on to earn 33 Emmy and 8 Golden Globe nominations.”