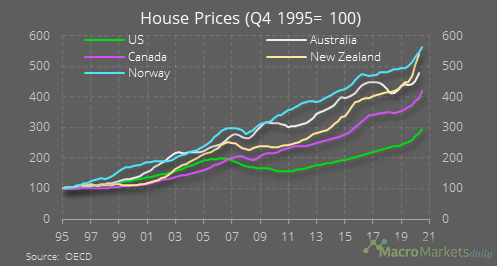

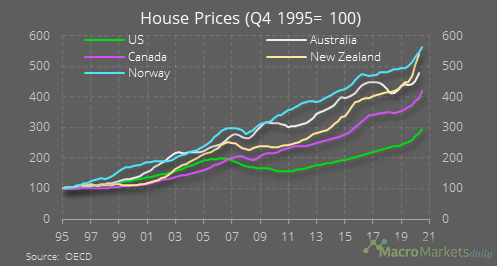

“As New Zealand’s average house price closes in on $1m, a generation says they’re being locked out of the market…the average property value has risen to nearly eight times the annual household income.”

“As New Zealand’s average house price closes in on $1m, a generation says they’re being locked out of the market…the average property value has risen to nearly eight times the annual household income.”

Bayes for days: What to do with signal

Article explaining how to use the simple Bayes’ Theorem for investing.

The Truth about Investing

Howard Marks, Chairman

Oaktree Capital Management

Howard+Marks_The+Truth+about+Investing.pdf (312.0 KB)

Adding a third article in the same thread.

David Einhorn and Reasons Why Widely Followed Stocks Get Mispriced

Had posted this regarding valuation debate on Dmart. Since it is relevant to other “high fliers” like IRCTC etc also, posting it here.

Good read on management/promotors covering a lot of aspects.

This post summarizes why being contraction is difficult and the evergreen nature of asset allocation irrespective of the market conditions

TLDR: The two client that had the best returns were of:

In essence people who did not constantly track the market or trade made the most returns.

Mohnish Pabrai Lecture at Boston College. Distinguished Speaker Series, October 14, 2021

Timeline of the video …

00:00:00 Introduction

00:01:55 Competition is For Losers, Peter Thiel

00:08:17 Rain Industries

00:12:30 Monopolistic business models, Amazon and Google

00:17:05 Redoing the Spaghetti code, AWS in business

00:19:00 A Whale only gets harpooned only when it surfaces,

Warren Buffett

00:19:52 AWS, cloning by Microsoft and Google

00:24:08 Monopolistic characteristics of giant Chinese tech

companies

00:28:10 Tencent (under)reporting style

00:30:15 Naspers business model, Koos Bekker

00:40:50 Better capital allocation by Amazon and Tencent

00:43:30 Tencent business model

00:50:15 The bazooka Model of Pony Ma

00:57:25 How I became a value investor

01:02:17 Chinese tech giants and political risk

01:03:17 Dakshana Foundation’s Education Model

01:08:53 Evolution of my investing style

01:12:50 Mohnish’s investing framework on start-ups

01:17:22 Ali Baba

01:23:12 Competence and edge

01:24:45 Change in Investment strategy due to Covid

01:37:44 Application of NLP(Natural Language Processing) in

investing

01:45:03 Up and comers in the investment sector

01:47:37 Quality of Management

01:50:25 Book recommendations

Good video on corporate cycles by Kenneth Andrade

Takeaway:

| Co Name | 1993 | 2000 |

|---|---|---|

| Infosys | 100 | 15013 |

| L& T | 100 | 93 |

| HUL | 100 | 563 |

| Sensex | 100 | 119 |

From 1993 to 2000; Infosys beats Sensex by a wide margin where HUL also beat it handsomely. However L&T underperformed.

| Co Name | 2000 | 2008 |

|---|---|---|

| Infosys | 100 | 169 |

| L& T | 100 | 931 |

| HUL | 100 | 120 |

| Sensex | 100 | 243 |

From 2000 to 2008; Infosys and HUL underperformed Sensex, whereas L&T beat it handsomely.

Besides that Comparisons of index components (in %):

| 2008 | 2020 | |

|---|---|---|

| Commodities | 17 | 4.2 |

| Telecom | 11 | 3.6 |

| Corp Bank | 9.6 | 1.6 |

| Utilities | 9.2 | 3.2 |

| Infra | 7.7 | 5.3 |

| IT | 9.3 | 14.5 |

| Pharma | 2.2 | 3.3 |

| Consumer | 4.4 | 13.8 |

| Consumer Bank & NBFC | 4.6 | 31.8 |

Ultratech 140 Million ton cement, USA consume 90 Million tons of cement.

Nick Sleep’s Costco investment thesis back in 2005.

Complexity Investing Whitepaper by NZS capital (46 pages)

Condensed version (5 pages)

One line summary by me: Complex systems are complex. ![]()

Abstract from the paper:

Investors and corporate management are in the same fundamental business: capital allocation – applying scarce resources toward the best long-term outcomes. Historically, stock market investing and corporate strategy have optimized around normally distributed future outcomes. However, we believe financial markets and companies operate in complex adaptive systems, and as such are better explained by the phenomena of power laws and ‘fat tail’ events. Investing and corporate strategy are often based on narrow predictions of the future, but complex systems dictate such predictions will ultimately prove very dangerous and loss making. We propose a new framework for capital allocation at companies and in portfolios that emphasizes adaptability, innovation, network effects (positive and negative feedback loops), management vigilance, long-term thinking, and duration of growth.

Combining these elements creates a new type of capital allocation model, which balances Resilience and Optionality. This framework helps avoid and protect against the common mistakes that come from the false belief in a normally distributed world. In order to apply a disciplined framework for optimizing capital allocation between Resilience and Optionality, we must be awake – paying attention to the world around us to recognize when the right situations arise to re-allocate capital.

In other words, we must be present to see when luck finds us. While focusing on Resilience and Optionality, we must also cut out the unproductive middle – investments or resources that are neither

Resilient nor Optional.

This paper begins with a brief overview of normal distributions compared to a power law or complexity framework. We then outline the key aspects of Resilience and Optionality that we look for in companies and investments. This new framework leads to a new understanding of competitive advantage in the Information Age and a better way to construct investment portfolios for superior long-term returns.

NZS in the company name stands for non-zero-sum.