Aditya Birla Group has, on 11-Aug-16, announced a composite scheme of arrangement between Grasim Industries Ltd. and Aditya Birla Nuvo Ltd. What caught my attention is probable spin-off of their FS business. This thread is created to discuss and understand opportunities/risk etc. this special situation offers and the best way to leverage upon this opportunity. Kindly pour in your views.

AB Nuvo’s CA on BSE

http://www.bseindia.com/corporates/anndet_new.aspx?newsid=43527dde-7462-48fe-8c6e-e9ac7085b154

Aditya Birla Nuvo Ltd has informed BSE that the Board of Directors of the Company at its meeting held on August 11, 2016, have considered and approved a Composite Scheme of Arrangement between the Company, Grasim Industries Limited and Aditya Birla Financial Services Limited and their respective shareholders and creditors u/s Sections 391 to 394 of the Companies Act, 1956 [“the Composite Scheme"].

The Scheme is subject to necessary statutory and regulatory approvals including the approvals of the respective High Courts, the Stock Exchanges, SEBl, the respective Shareholders and lenders/ creditors of each of the companies involved in the Composite Scheme.

In this regard, the Company has issued a Press Release dated August 11, 2016 titled “Creating a premier play on India’s growth”.

Grasim’s CA on BSE

http://www.bseindia.com/corporates/anndet_new.aspx?newsid=403d1e6c-8392-4860-a690-70cf6239c06f

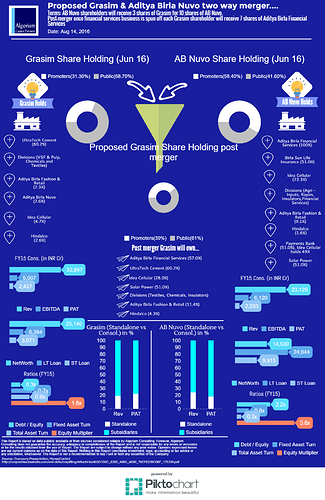

As per the proposed scheme, The two companies, Grasim and Aditya Birla Nuvo (AB Nuvo), have entered into a two-way merger. The first step involves merging the two companies and the second would be a spin-off of the financial division.

For every 10 shares held, the shareholders of AB Nuvo will receive 3 shares of Grasim. Post-merger when the financial services business is spun off, the shareholders of the merged Grasim will receive seven shares of Aditya Birla Financial Services – the arm which holds the insurance and asset management companies.

The Street clearly is unhappy with the way the Grasim–Aditya Birla Nuvo merger has been announced. Their unhappiness is reflected in the share price of Aditya Birla Nuvo which is down 17.5% to Rs 1,288.

more to chew on this…

Demystifying Grasim-Aditya Birla Nuvo merger

(Analysts have openly voiced their concern over the deal aimed at helping the group’s telecom venture ahead of Reliance Jio’s launch)

Merger will give capital to high-growth biz: Kumar Mangalam Birla

(Interview with Chairman, Aditya Birla group)

Aditya Birla to merge Nuvo, Grasim

(The combined entity will have revenue of Rs59,766 crore; Nuvo unit Aditya Birla Financial Services to be listed)

Financial services company has come of age: Kumar Mangalam Birla

(Aditya Birla chairman Kumar Mangalam Birla on the proposed Nuvo-Grasim merger and the spinning off and listing of Aditya Birla Financial Services)

The rise of Aditya Birla Financial Services

(Over the decades, Aditya Birla Financial Services has grown into a Rs9,300 crore business, with a potential valuation upwards of Rs25,000 crore)

News in numbers | Aditya Birla Nuvo, Grasim merger to create Rs59,766 crore revenue firm

(Post merger, Grasim will become a more diversified firm)

Aditya Birla Nuvo, Grasim fall most in 8 years after merger announcement

(Aditya Birla Nuvo and Grasim shares saw their steepest single-day fall in 8 years in intraday trade as analysts, minority investors disapproved of the proposed merger)

Kindly share your views.

Disc: No Investments in any of these companies