Garuda Construction and Engineering Ltd.

> “All About WHAT WE KNOW and WHAT WE DON’T”

CMP: 170

Market Cap: 1600 Cr

Garuda Construction Ltd. was incorporated in 2010 primarily to serve as an intra-group construction company.

Garuda Construction specializes in civil construction services that include project planning, resource mobilization, detailed engineering, and the complete execution of construction projects. Their service offerings include operations and maintenance (O&M), Mechanical, Electrical, and Plumbing (MEP) services, and finishing works.

The Promoter and Group companies typically secure orders by winning tenders or by acting as real estate developers. These companies then outsource the construction (referred to as EPC - Engineering, Procurement, and Construction) component of the order or real estate project to Garuda.

The main benefit for Garuda is that it is not involved in project planning, land acquisition, or related activities. Garuda’s primary responsibility is construction, while all other aspects are managed by the Promoter and Group companies.

Business Model:

How they work?

- Procure the Projects from Clients (Related / Unrelated)

- Undertake Site Visit & Local market survey to check the availability of Construction material, labour or sub-contractor

- Work Agreement finalized once with the client

- Client provides basic plan, scope and specifications of the project

- Project execution starts:

- In-house engineering team (Create a design as per client requirement)

- Procure Material

- Procure Equipment (Largely they source all kind of fleet require for construction locally from the project location)

- Appoint local Sub-contractor (Less headache to deal with local labour)

Asset Light in Nature:

Over the years, Company have procured a fleet of construction equipment to ensure high quality and timely execution of our projects. However, keeping in mind our objective of being an asset light company, for most of our construction equipment, the deployment of construction equipment is done vide third party vendors, which keeps their asset model light for project execution, thereby allowing them to maintain cost control and minimize disruptions due to non-availability or machinery breakdown.

Raw Material Procurement:

(This procurement of RM part is bit unclear – Above image reference from RHP)

LOCK AND KEY PROJECT:

This refers to a comprehensive construction contract where the company is involved in all stages of building development - from the foundation and structural work through to the finishing touches such as Mechanical, Electrical, and Plumbing (MEP) systems, interiors, and final finishes.

Example of Niche Infra and How they work:

In February 2016, the Concessionaire (Eternal Building Assets Private Limited – One of the related party) appointed our Company for the construction part of the project. The construction of the Delhi Police Headquarters involved seventeen (17) storey twin towers at Jai Singh Road, New Delhi. Pursuant to this we entered into an EPC contract with Eternal dated April 15, 2021 For a turnkey completion of the contract of the value of 448 Crore.

The scope of work involved shore piling, site development, structural steel, civil and finishing, external glass façade and an additional scope of work involving HVAC installation including air conditioning of the entire building, electricals, interior, furniture and furnishings, security apparatus and building automation system.

Our Company has entered into an agreement with the Concessionaire to maintain the building and we will receive ₹ 7.2 Cr per year for a period of thirteen years (13) for maintenance of the Delhi Police Headquarters.

Sense of Future business model shift:

Garuda is neither a developer nor a main concessionaire under government contracts or private construction projects. Their contracts are with the principal developers and concessionaires, and we are engaged exclusively for the completion of construction works. We focus specifically on building construction, without involvement in activities such as land development or broader infrastructure development.

"Further, our promoters are already procuring projects as developers and contracting the construction activities. We have been working on various projects with our promoters which has given us exposure to the roles and responsibilities of a developer and hence, utilising the same, we are keen to grow ourselves as the developer.”

Important to Note:

Assuming the role of a developer brings significant changes to the existing business model, including:

- Higher Capital Requirements due to involvement in the entire development lifecycle, from land acquisition to project completion and sales.

- Shift from B2B to B2C Operations, as the company will now sell real estate projects directly to end users, demanding a new approach to marketing, customer engagement, and after-sales service.

- Impact on the Balance Sheet, with factors such as increased inventory levels and land acquisition affecting financial structure and working capital management, which will differ substantially from the current construction-focused model.

Group companies from where Garuda source the Construction work:

- Artemis Electricals and Projects Ltd.

- Eternal Building Assets Private Ltd.

- Shree Umiya Builder & Developers

- PKH Ventures Ltd.

- Electro force (India) Private Ltd.

- Golden Chariot Hospitality Services Private Ltd.

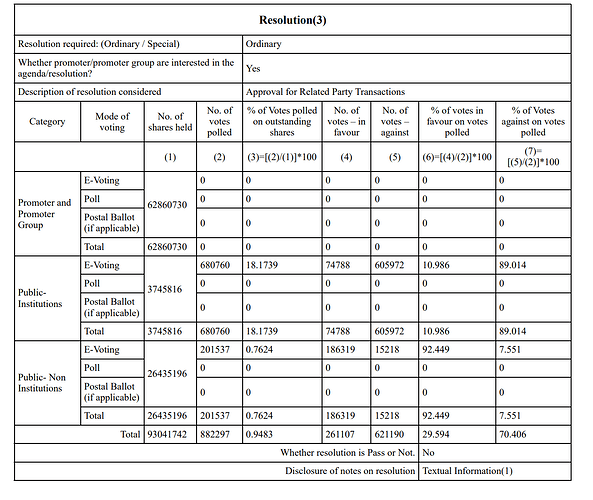

High RPT (Related Party Transactions):

In several of the Company’s projects, there is significant reliance on the Promoter and Promoter group companies, who competitively bid for government and private sector contracts, either individually or as part of a consortium with other entities. When the Promoter is selected as the concessionaire or main contractor for these projects, the Company typically enters into construction contracts on an EPC basis with entities where the Promoters hold substantial shareholding or partnership roles as developers, often alongside third-party stakeholders.

Currently, the order book, valued at approximately ₹3,000 crore, comprises over 50% of orders from related parties.

Mind you again, the Company was incorporated in 2010 solely to fulfil the construction service requirements of its Promoter group entities, which primarily operate as full-scale developers

Reason for High Margin:

The difference of Operating Margin between Garuda and its peers are highly visible.

| Company | 5 years median EBITDA Margins % |

|---|---|

| Garuda Construction | 32% |

| PSP Projects Ltd. | 12% |

| Capacite Infra | 17% |

| Ahluwalia Contracts | 10% |

Here, the clear explanations from the management is missing but let’s try to incorporate reasons behind this wide gap:

1. Focus on Construction part of Full development business:

To better understand Garuda’s current scope of work within a typical ₹100 crore real estate development project, the major expenses can be broadly categorized as follows:

- Land Acquisition: ₹30 crore

- Material Procurement: ₹20 crore

- Designing Costs: ₹2–5 crore

- Construction Services: ₹15–20 crore (approximately 15–25% of the total project cost)

- MEP (Mechanical, Electrical, and Plumbing) Work: ₹15–20 crore

- Fleet, Equipment, and Other Overheads: ₹5–8 crore

“The portion highlighted in box - primarily the Construction Services segment - is characterized by relatively low working capital requirements and higher operating margins, and that’s where Garuda’s core business is involved.”

2. In one of the interviews - Management highlighted some points:

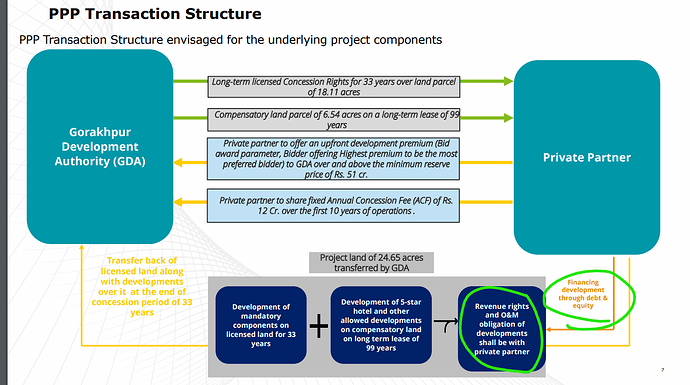

- Niche Infra project selection where the Competition is less & Specialisation is High.

(Few examples are Delhi Police Headquarters, Gorakhpur Convenience Center, World Trade Center, Sport City etc…)

“As per management: These are the segments where very few project implementers are available in the country who can deliver quality work on a timely basis. The opportunity size is increasing due to the government’s emphasis on ‘Infrastructure as the face of New India.’”

-

Bottom-line focused approach: Project selection based on How much margins they can earn

-

Procure the Asset on lease, keep the Asset base low, which also helps them to reduce maintenance, insurance, and idle-time costs.

-

Company’s asset-light and low working capital business model supports these high operating margins and profitability

Thesis/Conclusion:

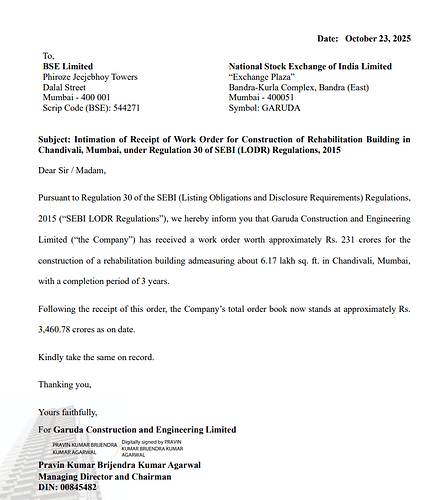

- Few questions are still unanswered (As No Management interaction, No Investor Presentation, No Concall, nothing…), but Topline growth visibility is multi-X.

FY 2025 Revenue: 225 Crore

Q1 FY26 Revenue: 125 Crore

Orderbook: 3,000 Crore + (App..), which needs to be executed within the next 3 years.

- Business model will change as the Company is going from related to unrelated Business transactions (Pure Construction to Real Estate developer as well…)

Margins and Return Ratios might not be the same as earlier once they start to execute higher-sized orders

(i.e. If I’m earning 30% EBITDA Margin on pure Construction service order size of 100 Crore, Same kind of margin might not be possible in the 500-1000 Crore size of order)

Well, As per the interview’s comment by Mr. Praveen Agarwal – Margins will be same or will improve further from here as well ----- Who knows, might this be continue

~ Working Capital need will be watchful from here as the execution size is becoming multi-X — The need of WC and debt ceiling will be key to watch.

(The thing is Management still staying confident on current Margin and debt levels to maintain, BUT – I Am bit sceptical on this)

Other Points to Note:

~ Less Communication by Management

~ A Question on Corporate Governance may emerge due to lack of Information and High RPRT

(It is worth noting that Mr. Utpal Sheth, both personally and through Trust Mutual Fund, has made a substantial investment in Garuda since its IPO, subsequently increasing his stake via the open market. It is possible that a thorough level of due diligence was carried out by him.)

~ In the event of a quarter with one-off execution challenges, it could lead to unanswered questions.

> One can give less weight on all Above (Watchful) point in their investment decision making on the face of High future Growth Prospects.

**

“With the evolving business - New Ratios will emerge.”

**

INFO WHICH WE DON’T HAVE:

-

Exact bifurcation of Margins they are earning on Related and Unrelated party contracts.

-

High Number of Debtors and Negative OCF in FY25 – Related Party revenue in FY25 is not available as AR of FY25 not published yet.

-

Few questions still on the Business model and the Group business structure

Any Further view are Most welcome…