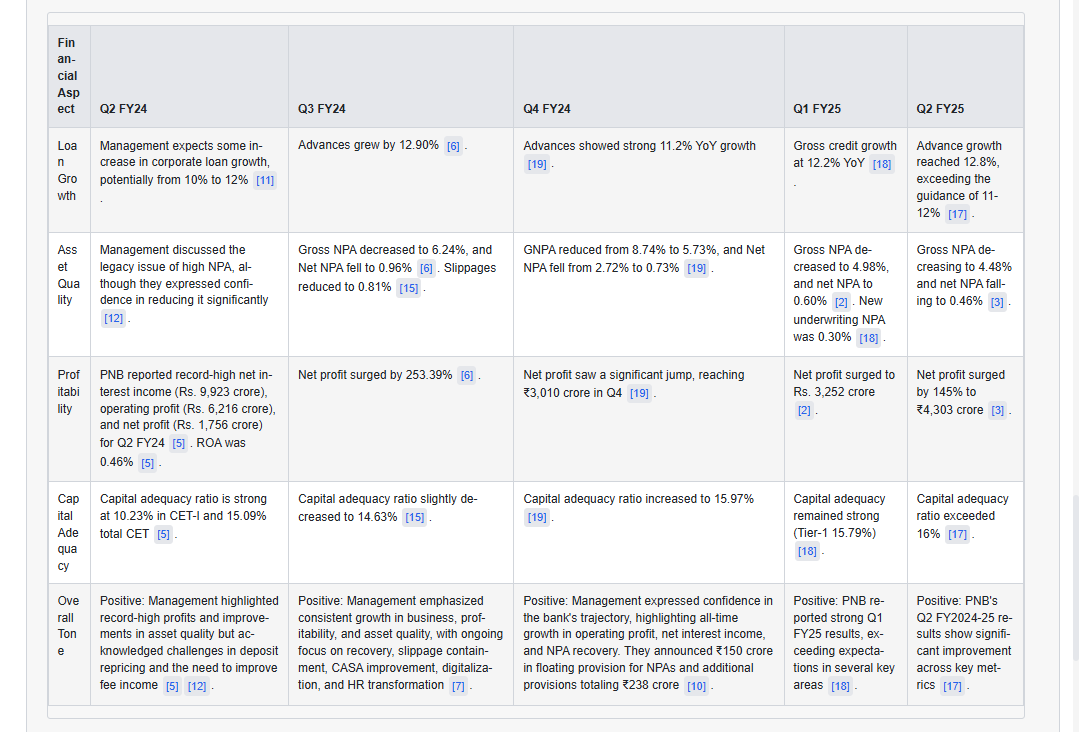

PNB’s narrative has evolved meaningfully over the last five quarters.

In Q2 FY24, the tone was cautious, focused on legacy NPA issues and capital rebuilding.

By Q3–Q4 FY24, performance improved with strong profit growth and better asset quality, shifting the tone to confident execution.

In Q1–Q2 FY25, the bank entered a growth phase with consistent profitability, sharp improvement in NPAs and credit costs, and capital adequacy exceeding 16%. Guidance became sharper, and management shifted focus from recovery to expansion, digital transformation, and returns.

The tone today is clear: from clean-up to compounding, with strategic intent and financial strength driving the next phase.

Narrative has evolved meaningfully over the last five quarters.

Here is a breakdown of how Punjab National Bank’s (PNB) performance has evolved and how that shift is reflected in the language, metrics, and narrative from Q2 FY24 to Q4 FY25:

Evolution of PNB’s Performance and Tone (Q2 FY24 to Q4 FY25)

1. Asset Quality

Then (Q2 FY24):

Management acknowledged legacy high NPA issues.

Gross NPA stood at 6.96%, Net NPA at 1.47%.

Credit cost was a high 1.31%, indicating ongoing stress.

Now (Q2 FY25):

Gross NPA reduced to 4.48%, Net NPA to 0.46%.

Credit cost dropped sharply to 0.08%, with new underwriting NPAs at just 0.30%.

PCR has improved from 94% in Q3 to 95.90%+, reflecting improved provisioning buffers.

Interpretation:

The bank has effectively contained slippages and cleaned up its book, turning asset quality from a problem statement into a proof point. The narrative moved from “confidence in reduction” to firm guidance on further improvements (targeting 3.5 - 3.75% GNPA by March 2025).

2. Profitability

Then:

Q2 FY24 net profit was ₹1,756 Cr.

Management celebrated it as a “record high” but sounded cautious about structural pressures.

Now:

Q4 FY25 net profit is ₹4,567 Cr (YoY growth of 51.7%).

ROA hit 1.02%, up 25 bps YoY.

Net Interest Income (NII) grew to ₹10,757 Cr (up 3.8%).

Interpretation:

Profit growth is now multi-quarter, consistent, and margin-supported. Earlier quarters highlighted profit spikes; now the tone reflects profit compounding with stable fundamentals (e.g., NIM guidance of 2.9–3% is sustained).

3. Capital Adequacy

Then:

CET-1 stood at 10.23% in Q2 FY24.

Commentary included “slight improvements” but concern over deposit repricing.

Now:

Capital adequacy exceeded 16%, CET-1 at 11.59%.

Management signaled readiness to raise more capital proactively if rates are favorable.

Capital now positioned as an enabler of shareholder returns.

Interpretation:

Earlier, capital was a compliance requirement; now it’s a strategic asset supporting growth and improving investor confidence. The tone moved from “meeting norms” to capitalizing on growth.

4. Business Growth

Q4 FY25 Metrics:

Global business up 14.03% YoY to ₹26.8 lakh Cr.

Deposits up 14.38%, Advances up 13.56%.

RAM advances (Retail, Agri, MSME) up 15.89%, led by MSME & current account additions.

Interpretation:

Earlier, growth commentary was tied to “recovery”; now the bank is using phrases like “successful expansion strategy” and highlighting digital journeys. The tone is transformational, not transactional.

5. Strategic Guidance

Then:

ROA guidance was vague (~0.8%), asset quality goals were qualitative.

Focus areas included HR transformation, CASA improvement, etc.

Now:

ROA guidance upgraded to 0.9–1%, Gross NPA guidance: 3.5–3.75% by March 2025.

Credit cost outlook revised from 1% → 0.5% → now 0.25–0.30%.

Strategic focus on digital MSME journeys, platform modernization, and account expansion.

Interpretation:

The guidance has evolved from aspirational to numerical and accountable. There’s a sense of target-driven execution, replacing the earlier narrative of system clean-up.

6. Risks and Competitive Context

Risks around asset quality and intense fee income competition are mentioned, but with a lighter touch.

The dominant message has shifted from risk management to opportunity capture.