Here I would be Sharing Updates and Learning on the Companies which likely to be Next Multibagger in Long Run and Also Companies Which will Run On Short Run Based on Techno+Fundamental Setup,Nothing Shall hold Buy and Sell Recommendation ,Purely To Understand Rationales and Learning

Will be tracking this thread actively.

will be tracking this thread sure

1- Prince Pipe : Capacity at lower Utilisation and likely to Ramp up due to Industry Demand

Company has been in consolidation for nearly 2 years and Above, But Why?

Company deals into pipe fitting products and Raw material such as PVC price were going through Volatility and Destocking result in Collapse of margin badly At The same time housing crises in China, Europe & us led dumping in India

One thing to Notice company OPM% For last 10Y average remains above 12% and this year reported 9% which is Outlier

Recent Q2FY24 Showed up Good numbers where OPM% Touched 14%

Greenfield Expansion in Bihar of About 35000 MT will be commercialized Q4FY25 with Nearly 150 Cr Capex and Current Capacity is around 328500 MT and De Bottlenecking may increase 20-30K MT So we can expect Touching 385000 MT Q1FY26

Currently Operating at 50-55% Utilization and Now Real-estate Performance, Jal Jeevan Mission will support the Growth Story of This Segment

Telangana Also at 40% Utilization and which likely to Improve based on Demand going Forward

CPVC where Company Accounts 10% Market share and now remains to be more Focused area due to Lubrizol Tie-up

At the Same time Company entered in Bath ware, Sanitary may further strengthen the Margin of the company

Key Trigger: Product Mix, CPVC Contribution, Operating Leverage & Volume Growth would be main Driver for the Company

Dis: No Buy/Sell Rico*

over valuation and other factor mentioned already but its for educational purpose

Business Number 3 - Welspun Corp

Diversification of Product Portfolio and Demand in the Sector for the Product will Take Company To Next Level

WCL is a welded pipe manufacturing company engaged in offering solutions in line pipes used for onshore and offshore oil, gas transmission and can produce 2.15 MTPA of steel pipes. Leaders in the oil and gas industry, including Shell, Saudi Aramco, TOTAL, and Chevron etc

Company has given top line Guidance of Rs 15,000 cr by FY24 & EBIDTA of Rs 1,500 crore

Sintex acquisition will help WCL to expand its presence in the B2C market and become a more diversified player such as Line Pipe,DI Pipe,Drums ,Buidling Material and Targeting Rs.1,700 cr of revenue & 20% EBITDA margin for Sintex by FY26

Acquisition of ABG Shipyard can give more than its acquisition cost by selling the half-constructed ships/ scraps. The land area could be utilized for multiple purposes which the management is evaluating, and the potential worth will be realized over the next 12-15 months.

And in next five quarters the profit on the scrap at the ABG shipyard, which will add about 100 cr to EBITDA in FY24

Capacity expansion by 100 KMTPA at Anjar to take total capacity to 500 KMTPA in Next 12 Months and will reach 100% Capacity Utilisation in next 2-3 Years

Company Already have future Ready Capacities which will increase the generation of free Cash Flow with lower debt

Dis: No Buy/Sell Rico*

Carysil

Carysil Nearly after 2 years of Consolidation and 50% Correction stock has Shot up 100% up from the Bottom What Happened?

Company was Badly Impacted because Export Contributes 75% of the Business from Europe, UK and USA region i.e Political Issue and Holding 200000 Capacity expansion of Quartz Sink

Company has Given Guideline of 1000 Cr Revenue BY FY25 But I am Expecting It May Touch in FY26, Since I have been tracking managements Con Call they have been Always over estimating and Delivering Lower

Sink Capacity Doubled That is from 90K To 180K and Quartz Sink Capacity At 10L P.a

Company Fully Utilized existing Capacity expansion, So Company Acquired 60000 Sq.Mt for Future expansion

Acquisition & Cross Selling has always been in Company Favor through Earlier decision like 100% Stake in Homestyle ,Tickford,Tap Factory in Europe ,Uk Resulting in Growth of the Company gradually

Expanding to New Geography from Existing 55+ To 70 in Next 3 Years, As 75% of the Business Comes from Export, so going forward it will help in Top Line

Quartz Sink Contributing 46% of the Business and Currently At 60% Utilization and Guiding for 80% End of FY24 on new Customer Acquisition As Quartz sink in demand in India likely to go up due to luxury lifestyle and Real Estate Performing Well now and Expecting Rs 200 Cr Sales From Domestic Region From Current 100-120 Cr Sales

Company Done Recently Acquisition of Granite LLC as its one the fastest Growing Segment in Home Improvement Space Across the Region and this will Result in 120-130 Cr Top line at 90% Capacity Utilization

Company is Sable to Grow Market share from Competitor due to Quality and Cost of the Product in Europe

Stainless Sink Supply to IKEA Will commence from Q4FY24 Which been Already delay so we need to check on these too.

Company Distribution Network Jump From 1500+ to 3200 Pan India

Next Business No.4 -Pyramid Technoplast

“Delevraging Balancesheet with Incremental Capex & Order Books to Boost Earnings”

Company Produce Industrial Packaging & Specialized in the Molding of Polymer Based Products such as Polymer Drums, Industrial Bulk Container, MS Drums.

Company Current Have 7 Mfg. Plants where 7th one is recently commissioned in FY23 now just at 30% Utilization level

Company Plant No 8,9 constructions begin which will be fully utilized by FY26 at Cost of Rs 40Cr -Rs 50Cr and Asset Turn over will be 5X

At Current Capacity Company is Doing Rs 480Cr Sales once capacity Comes Live it Earnings Might Jump By 50% as Demand for Handling Specialty chemical likely to Increase.

Company has 40% Market share in IBC, which is value added Product of the Company

Company Became Debt Free and Order Books Increasing Steadily

Company Currently at 75% Capacity Utilization and Management Projected Topline Growth in Few Years 20%-25%

Dis : No Buy/Sell Rico* Only Learning

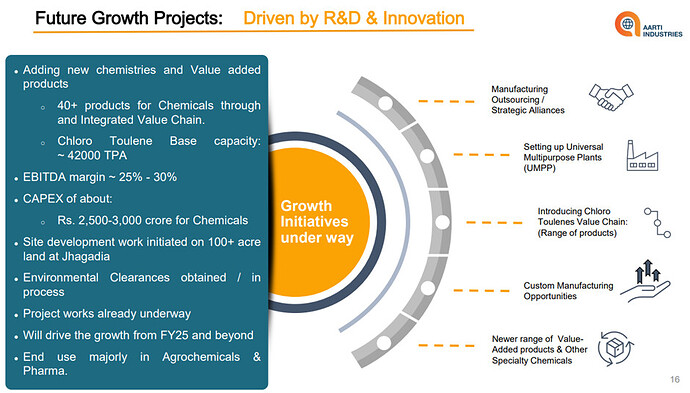

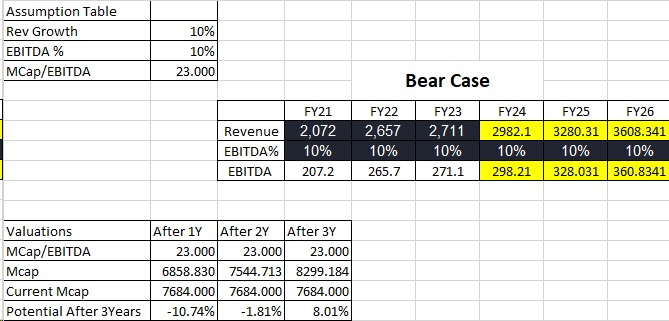

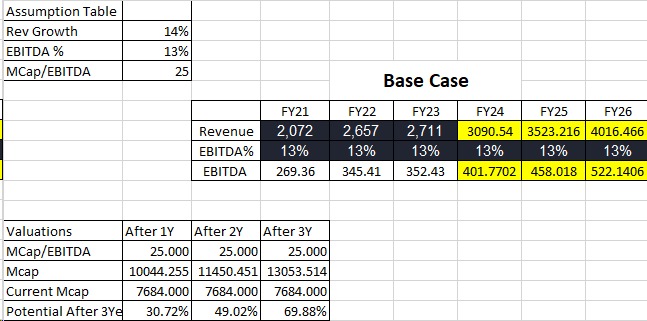

Next Business No 5 - Aarti Industries

“Sleeping Giant ,Will Come out with Flying Colours In FY26”

Company Corrected 50% Peak in last 2 years and now started forming Base

Largest producer of Nitro-Chlorobenzene, Benzene and Lowest cost producer of benzene in the world and have diverse portfolio of basic chemicals, agrochemicals, speciality chemicals and intermediates, which are extensively used in the manufacture of pharmaceuticals, agri-products, polymers, additives, pigments and dyes.

Multiple Long-Term Contract during FY17-FY19 Mfg Outsourcing, Product development and these contracts are under ramp up and can add 1000 Cr Sales and all contract are at less utilisation level

Agro chemical division business facing downturn nearly 30% Down overall

Benzene Price Volatility leads to inventory losses which is likely to cool off now.

Capex Guidelines Rs 3000 Cr for next 2 Years 50% for existing products and rest for the new product.

Chlorotoluene in Jaghadia India with Integrated Operation chain and will have 20% of the Global Capacity and whatever capacity they have built will be at 70%-90% Capacity Utilisation level by FY24 End.

Company Business into B2B and having Shallow Cyclical in nature leads to ups and down in the operating margin and overall growth in every 2-3 Years

Thesis

· Company has Given Guidance Earnings to 3X By FY27 on FY21 As Benchmark based on above expansion and product mix with higher value-added products

· Company have been maintaining CFO/EBITDA Above 75% despite B2B business Model

· Company has Big Marquie Clients recognised Globally

· Company has Strong management with Technical Know How >30 Years

· Company will be able to take benefit of operating Leverage in few years

Anti-Thesis

· From the current Outlook company seems to sleep more at least for next 1 Year

· Company debt will mount and Deprecation too may lead to poor earnings for next 1year Minimum

· How company able to pay such debt to be Noticed

· How Orderbook of the Company at Current stage and going forward

· Over Capacity and if China starts dumping company may suffer

Dis: No Buy/Sell Rico*

Feed and Shrimp Processing Industries: India

“What Went Wrong in the Feed Processing and Shrimp Industries”

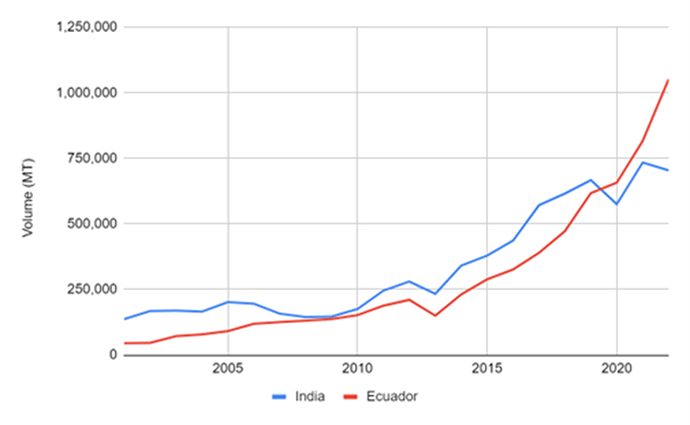

The world’s two major shrimp exporters—Ecuador and India

Increase in the capacity of Ecuador leads to oversupply and spiralling prices impacted Indian Shrimp Industry Badly Below chart shows how last 2-3 Years export of India Compared to Ecuador

How They able to Do This

Ecuador’s farmers have been increasing their output by using post-larvae that are tolerant to disease and grow increasingly fast; by using nursery ponds to shorten production cycles; by adding aeration systems and auto feeders to their grow-out ponds, which enable higher stocking densities

Ecuador supply at $7.42/kg where India Supply at $9.1/kg which leads to decrease the market share of India from 43% to 36% in 2-3 Years now again back to 36% in US

Ecuador has a lower cost of production of processed shrimp as processors there are large vertically integrated companies. Additionally, they have become the biggest producer of shrimp in past 2 years (from production of 600 mn to 1.5bn now).

Ecuador focuses on commodity products like headless shell on or head on, shell on shrimp

Raw Material Cost Increased for fishmeal, soyabean, wheat impacted the overall Indian shrimp Industries

Market expansion

Nearly 75% of China was made up of Ecuador shrimp market but covid restriction led to Aggressively focus product in US Market proximity to US coast reduced the Shipment transit time, faciliting Ecuador to dump its product in US Market leads to stiff competition to India where Shipment from India to US it takes Nearly 40 Days leads Further increase in fright and landing cost

What’s Happening Now

· Most of the Indian company under CAPEX and may commissioning of new plant will yield good topline growth and better ROCE

· US shrimp import market has seen improvement in past 3 months after 13 consecutive months of YOY decrease. However, realizations are lower by 10-15%

· In Indonesia and Ecuador, there might even be Antidumping Duty by US Countervailing Duty

· Company To Watch out: Avanti Feeds, Sharat Industries, Apex Frozen, Coastal Corporation

· Avanti a Market Leader Needs to closely monitor, company at bottom price, cyclical benefit may play out ,the PE at Lowest as compared to Mean PE of 5 Years