What about 2023 numbers and growth? 2023 numbers went in an overbought situation.

Was analyzing Fortnightly Sector Wise FPI Investment data and found something fascinating!

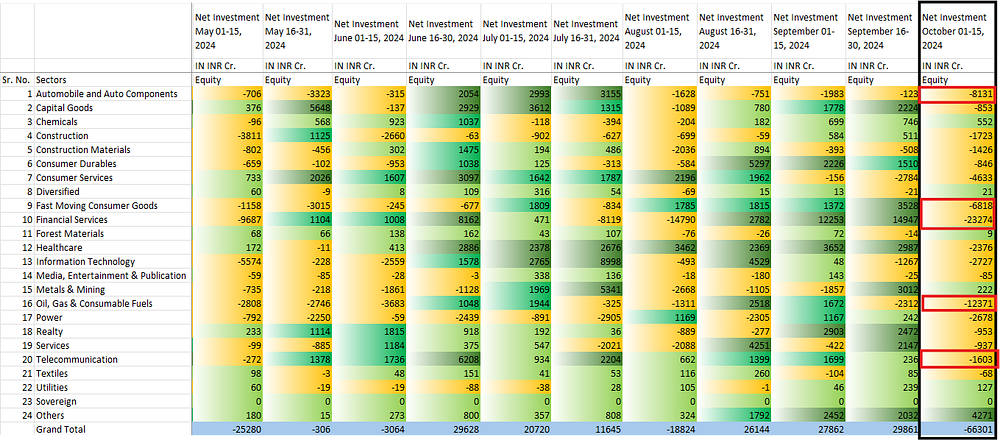

Here’s a broader picture to make you understand:

As you can see there is a massive surge in the Net Investments in the fortnightly data from 16-30 June 2024, of 29,628 crores.

The Oil, Gas and Consumable Fuels Sector has seen a positive Inflow of net Investments from FPI’s after three months of continuous outflow. This indicates a positive sign for this particular sector.

Huge Investment by the outsiders has also taken place in the Healthcare sector. There is an Increase in Inflows of staggering 598%.

Automobile Sector and Capital Goods sector, both has seen a massive jump in Net Investments in the second half of June month indicating a positive impact to their respective Industries.

However, Metal and Mining Sector along with Utilities Sector has seen negative Inflows during the last quarter.

Hope this data helps in analyzing the trend of FPI’s in our economy.

It would help, if you can give the sources for the data.

The source for the data:

https://www.fpi.nsdl.co.in/web/Reports/ReportsListing.aspx

From the latest data released by the NSDL for the first half of July month indicates Net inflows of 20,720 crores.

The sectors that have experienced net Investments greater than 2000 Crores are Automobile and Auto Components, Capital Goods, Healthcare and Information Technology, which constitutes to around 57% of total Net Investments.

The sector Metal and Mining have seen a positive net Investment from the FPI’s after nearly two months. This shift from negative to positive investment indicated a renewed interest in this sector.

Oil, Gas & Consumable Fuels, this sector for the consecutive second fortnight has seen a positive net investment increasing from 1,048 to 1,944 crores. This significant inflows for the second period indicates a good opportunity for investment.

The sectors which has seen continuous outflows for the past month are Construction, Power and Utilities.

Overall the Investments from the FII’s have been positive and is in the best interest of the economy.

The views are personal. Appreciating your thoughts on this.

Net Investment data for the month of July is out. The data shows the Net investments done by the Foreign Portfolio Investors (FPI) in the equity segment.

From July 16-31, the sectors which have seen massive Net inflows of more than 2,000 crores are Automobiles and Auto Components, Healthcare, Information Technology, Metals and Mining followed by Telecommunication. From these 5 sectors, the Net inflows in Automobiles and Auto Components sector has observed a gradual increase in its investments for the past three fortnights.

In the Information Technology sector, there is a massive jump in Net Investments. If you observe closely, FPI’s have significantly decreased their holdings in Financial services by 8,119 crores and on the other hand, they have increased their holding in the IT sector by 8,998 crores. Will there be a boom in the IT sector?

Metal and Mining sector have also experienced a good amount of Net inflows. Does this show a trend reversal in this sector?

The FPI’s are continuously decreasing their holdings in the Power sector from the past two months. However, the Government is very positive on the same sector.

The grand total increase in Net Investments made by the FPI’s for the month of July is 32,365 crores as compared to 26,564 crores for the month of June. An increase of 21.83% on monthly basis.

This shows the global confidence in the Indian markets.

Your thoughts and feedback are encouraged.

Hello Friends,

The data of net investments by FII’s are out from 1st October to 15 October.

This fortnight was one of the darkest fortnight for the Indian equities market. Due to Geopolitical tension around the globe between Israel-Iran and the China stimulus, we have experienced a huge chunk of net outflows from major 17 sectors out of 24 sectors.

The data provided in the image is for 11 fortnights starting 1st May to 15th October. In the 11 fortnights we have acquired a net inflow of 32,085 crores. However in the same duration, excluding the lates fortnight we had clinched net inflow of 98,386 crores. In just 15 days we almost lost 66,306 crores of Investments.

The most affected sectors for this fortnight are

- Financial Services: - 23,274 crores

- Oil Gas and Consumable fuels: -12,371 crores

- Automobile and Auto components: -8,131 crores

Collaboratively these three sectors have contributed to 66% of net outflows for this fortnight.

Chemical sector sees promising investments as this sector has been securing net inflows for the past 4 fortnights continuously. This shows a positive sign in the chemical sector.

Well… Its true that everyone is talking and panicking about sudden withdrawals but FII’s in recent times. in my opinion there are few questions we should ask for ourselves before panicking

1. what is the % of withdrawals to their total investment?

2. Is there any global uncertainty looming on?

3. Is it a special Month or a period of year of rebalancing global money?

I think its just around 1-1.8% of their investment is withdrawn, there can be many reasons out of which few key to my understanding are… Raising China Markets, Japan’s crumbling economy and most importantly US Elections, which is one of the key events globally.

View : with the way china markets are booming money may be shifting there and Indian markets may see another spurt of bull run post US Elections.

I am a very new bee to this forum and would appreciate other thoughts on this.

“October Sell-Off: Why FIIs Are Pulling Out of Indian Markets”

Unpacking the Factors Driving FIIs Away from Indian Markets.

October month was a turbulent month for Indian equities, experiencing significant volatility and rampant outflows across several key sectors. The above data shows pronounced decline in foreign investor sentiments as nearly all sectors experienced heavy investment withdrawals, reflecting heightened market uncertainty.

The above data shows sector wise net investments of FII’s from the month of July to October. Out of 24 sectors, ~60% of the sectors experienced outflows. In the second quarter of FY25 ie. from July to September, Indian equities saw a total inflows of 97,408 cr. Rupees , while in the alone month of October we experienced a massive outflow of 94,017 cr. Rupees.

This outflows show a period of market anxiety and if this sharp downturn trend continuous it could point to challenging economic environment ahead.

The most hit sectors in this period are:

- Automobile and Auto Components :In the July month it gained a net investment of 6,148 Cr. and by the end of October it suffered a net outflow of 10,440 Cr. From a positive inflow to a major outflow indicating a significant investor retreat.

- Capital Goods :In July it secured investments worth 4,927 Cr. and by October it suffered outflows worth 2,786 Cr. The investment swing is a -153% change , showing increasing volatility.

- Chemicals :This sector was a good bet for the FPI’s as in the month of October it saw net inflows of 583 cr. as compared to net outflow of 512 cr. in the month of July.

- Financial Services :This the most uncertain sector amongst all as it is the backbone of any economy and is very difficult to analyse. in the four month period the FII’s have withdrawn a staggering amount of 18,515cr. Alone in the month of October, the financial service sector have contributed 27.8% or one fourth of the total outflows of the net investments for the particular month, suffering the net decrease of 26,139 cr.

- Healthcare :In the second half of October month only the healthcare sector experienced net inflow of >2000 cr. Overall this sector has gained a total of 17,469 cr. This shows that the FII’s are still bullish on this sector.

- Oil, Gas & Consumable Fuels :This sector saw a stark contrast between early inflows and severe outflows in October. From 1,944 cr. in early July to -12,371 cr. in early October has affected all the companies in this sector severely. The main reason behind this can be contributed to the ongoing war between Israel and Iran which directly impacts the prices of the crude oil.

The reasons for the selloff in the month are given below

- US Presidential Elections Stirring Uncertainty.

Global investors are keeping a close watch on the outcome, which could shake up economic policies worldwide. As the outcome was in favour of India not many economist believe it. - China’s Stimulus TemptationOne of the big reasons for the FII exit is China stepping up with some pretty tempting stimulus measures. China wants to get global investors back, and with these new incentives, FIIs see potential for higher returns there.

- Premium Valuation of Indian MarketsHere’s where valuations come into play. The Indian market isn’t exactly cheap. The long-term median price-to-earnings (PE) ratio of the Indian market, since 2007, has been around 21.9. But before this recent market correction, the Nifty50 PE was over 24. In simple terms, the market was slightly overvalued compared to other emerging economies. FIIs are like seasoned bargain hunters, and when they spot better value elsewhere, they don’t hesitate to shift. With more attractive valuations popping up in global markets, India lost some of its appeal.

- Disappointing Q2 FY25 Earningsthe September quarter earnings were a real letdown. Indian companies posted net profit growth of only 3.6% in Q2 FY25, the slowest in 17 quarters. This sluggish growth came from weak revenue numbers and rising interest and depreciation costs. Even though expenses and other income crept up only a little, the market didn’t take this news lightly. There was panic amongst the retails investors.

Conclusion

The overall idea from analyzing the data is that market investments between July and October 2024 experienced significant fluctuations across different sectors, reflecting broader market volatility and changing investor sentiments due to various macro economic factors.

While things might be a bit shaky in the short run, India’s economy is actually pretty solid underneath all the drama. Don’t panic out and sell everything just because things get a little wild Just do your homework, spread your money around different investments and focus on sectors that seem to provide opportunity in the long run. Stay cool, stay smart, and keep your eyes on the bigger picture!

Indian equity market has seen worse. As @maruthi_srimanth mentioned, only 1.8% is removed by FIIs.