I have shared how to build a momentum screener here. If you have any more queries do ask. I have also shared a repository of research papers on factors in the blog post.

For books you may want to read,

- Following the trend, Andrew Clenow

- Quantitative Momentum, Wesley Gray, Jack Vogel

- Stocks on the Move, Andrew Clenow

- The many flavors of Trend following, Hari Krishnan

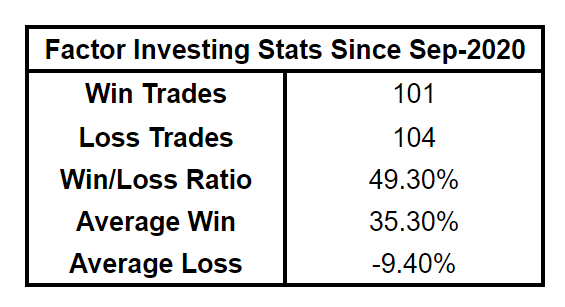

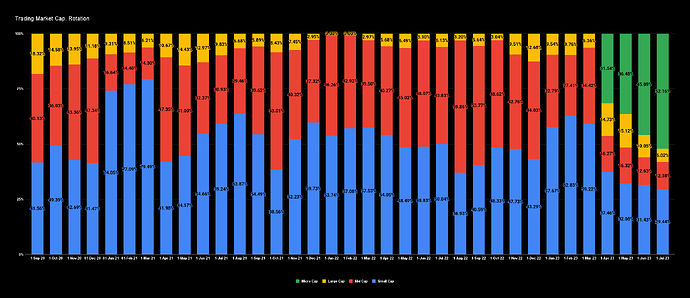

Below are some stats of the strategy I have been running.

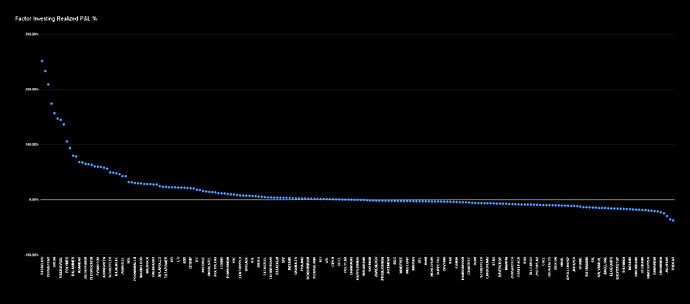

- Actual realized trades % P&L.

- Table sums ups whats seen in the chart. As in most trading (we like to call it factor investing) strategies, the win/loss is usually less than 50%. Meaning you have more losing trades. But what matters is, the quantum of win vs the loss. The strategy derives its profitability from winning less but winning big and losing more but losing lot less in each trade.

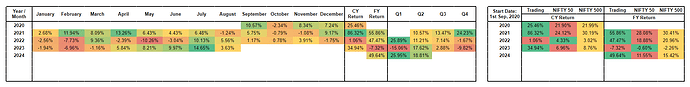

- The returns table shows the strats returns month by month. For comparison to indices, we do annual benchmark to N50 & N500.

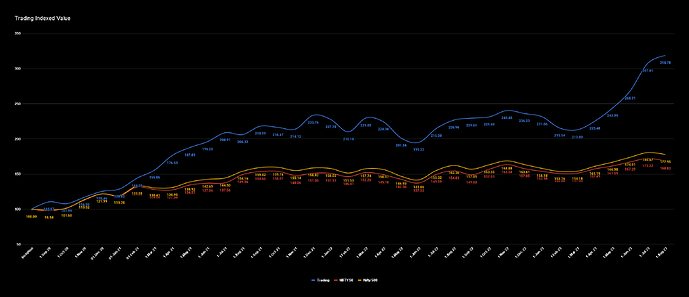

- The chart shows NAV of the factor investing strat vs its benchmark universe.